|

市場調查報告書

商品編碼

1773251

家庭辦公家具市場機會、成長動力、產業趨勢分析及2025-2034年預測Home Office Furniture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

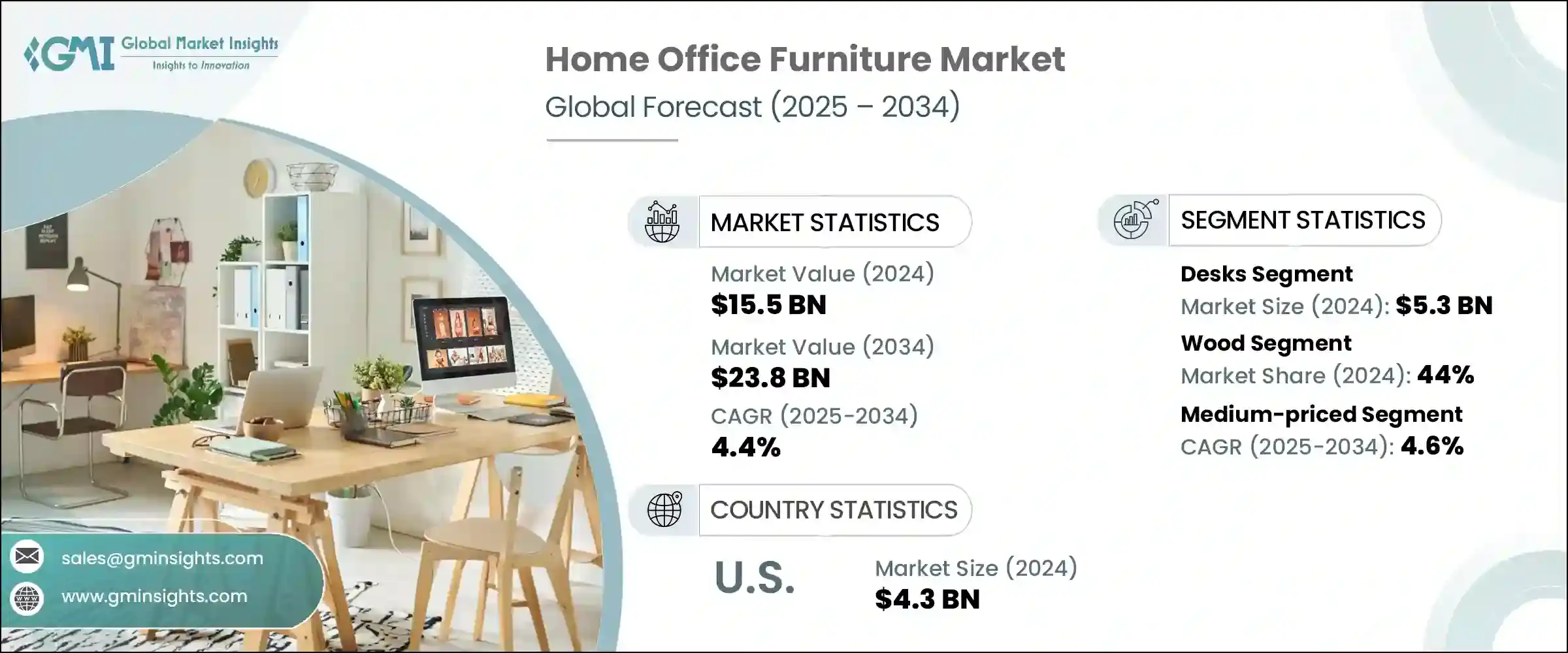

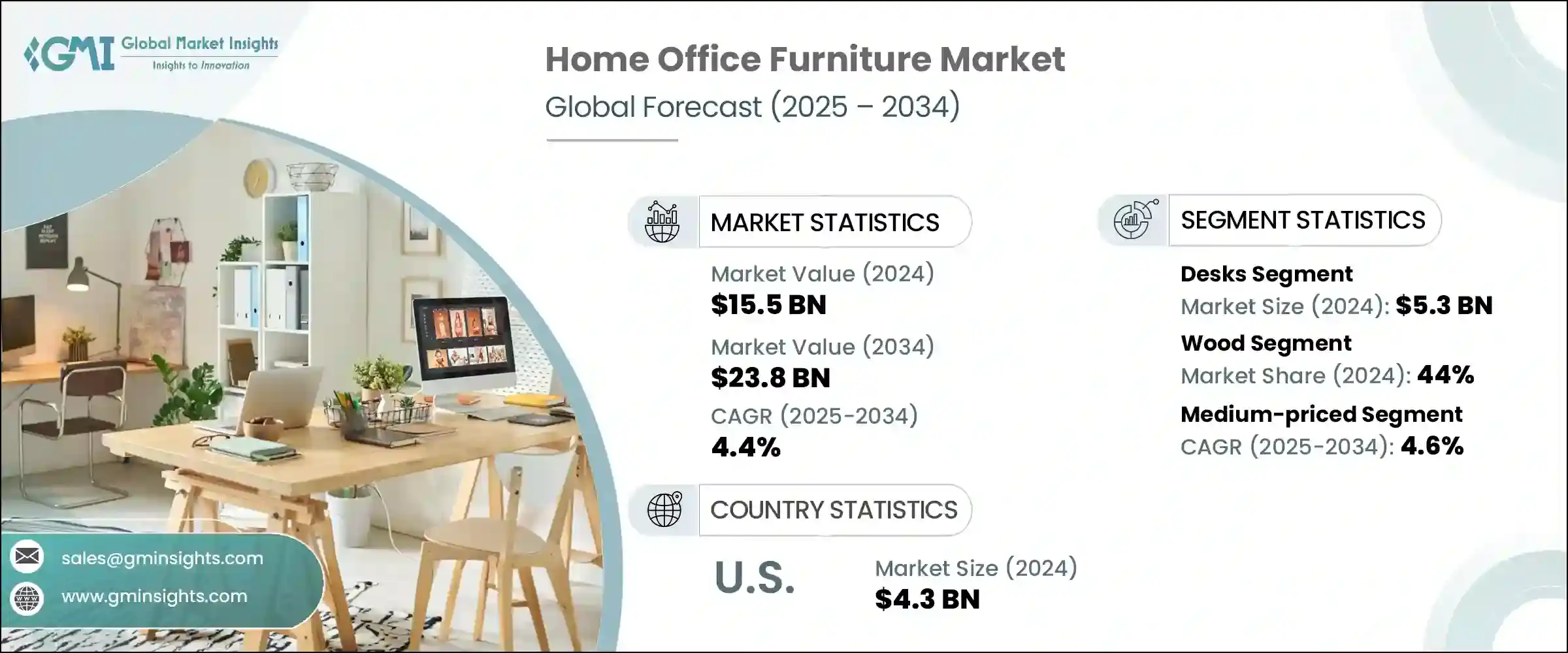

2024 年全球家庭辦公家具市場價值為 155 億美元,預計到 2034 年將以 4.4% 的複合年成長率成長至 238 億美元。主要成長催化劑包括向遠距辦公的廣泛轉變和持續的城市生活趨勢,這增加了對緊湊型多功能家庭辦公室設置的需求。隨著美國和德國等國家越來越多的專業人士轉向混合或完全遠端工作,對功能性、人體工學和時尚的辦公家具的需求持續成長。城市住房佔地面積的縮小進一步加速了對模組化和節省空間的辦公家具的需求。隨著設計不斷發展以滿足不斷變化的生活水準,消費者對兼具美觀與可用性的選擇的興趣日益濃厚。雖然這種趨勢支持市場擴張,但原料價格上漲和森林砍伐導致的木材短缺正在給利潤帶來壓力。

不斷變化的消費者品味也帶來了挑戰,他們的需求轉向適應性強、舒適且永續的家庭辦公室解決方案,以支持靈活的工作習慣。隨著遠距辦公和混合辦公成為日常生活的常態,使用者正在尋求能夠無縫融入生活空間且不影響表現的多功能家具。人們對符合人體工學的設計越來越感興趣,這些設計有利於身心健康,包括腰部支撐、可調節高度和整合技術增強等功能。美感偏好也發生了變化,人們更青睞簡約、模組化的風格,既能體現個人品味,又能兼顧功能性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 155億美元 |

| 預測值 | 238億美元 |

| 複合年成長率 | 4.4% |

2024年,辦公桌市場規模達53億美元,預計到2034年將以4.5%的複合年成長率成長。辦公桌的崛起源於全球居家辦公模式的普及以及人們對共享辦公環境日益成長的偏好。現代辦公桌具備可調節高度和模組化附加組件等功能,可提升舒適度和效率。此外,人工智慧辦公桌等新興創新技術也日益受到青睞。這些智慧型系統可以根據用戶活動調整辦公桌設置,連接多種設備,並整合無線充電板和智慧感測器等技術,可最佳化性能並即時追蹤人體工學。

2024年,木製家具市場佔據44%的市場佔有率,預計到2034年將以4.8%的複合年成長率成長。木材因其耐用性、美觀度以及與各種室內風格的相容性,仍然是人們青睞的材料。具有環保意識的消費者擴大選擇再生木材和再生金屬,其中約40%的人在購買決策中尋求永續材料。設計趨勢正在演變,融入柔和圓潤的元素,營造寧靜宜人的工作空間。靈活的家具可以重新佈置或實現多種功能(例如從辦公桌變成餐桌),因其在節省空間的同時又不影響風格或功能而越來越受歡迎。

美國家庭辦公家具市場佔77%的市場佔有率,2024年市場規模達43億美元。這一領先地位主要歸功於混合辦公和遠距辦公模式的興起、消費者對個人化家庭辦公室配置日益成長的興趣以及強勁的購買力。美國買家願意投資高品質、科技整合的家具解決方案,以滿足舒適性、性能和耐用性的需求。與許多其他地區價格敏感度會抑制創新不同,美國市場的需求促使製造商開發專門針對遠距辦公文化的先進產品。

家庭辦公家具市場的領導者包括 Knoll、Kokuyo、Product Depot International、Godrej Interio、HON、Williams-Sonoma、Sunon Furniture、La-Z-Boy、Steelcase、Vitra International、Haworth、Humanscale、Virco、Herman Miller 和 HNI Corporation。為了增強市場韌性並擴大影響力,家庭辦公家具公司正專注於多種策略。這些措施包括引入模組化和人體工學設計,以適應不同的工作方式和空間限制。許多公司正在將智慧技術融入其產品線,實現無線充電、坐站自動化和數位健康追蹤等功能。永續性仍然是一個主要關注點,公司採用再生材料並促進對環境負責的採購。此外,強大的全通路零售策略,包括沉浸式線上體驗和虛擬房間規劃器,正在幫助品牌更有效地吸引客戶。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 書桌

- 椅子

- 置物櫃和櫥櫃

- 表格

- 配件

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 木頭

- 金屬

- 玻璃

- 塑膠

- 其他(布料等)

第7章:市場估計與預測:按價格,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 專業零售店

- 其他(獨立零售商等)

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Godrej Interio

- Haworth

- Herman Miller

- HNI Corporation

- HON

- Humanscale

- Knoll

- Kokuyo

- La-Z-Boy

- Product Depot International

- Steelcase

- Sunon Furniture

- Virco

- Vitra International

- Williams-Sonoma

The Global Home Office Furniture Market was valued at USD 15.5 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 23.8 billion by 2034. Key growth catalysts include the widespread shift toward remote working and the ongoing trend of urban living, which increases demand for compact and versatile home office setups. As more professionals in countries like the United States and Germany transition to hybrid or fully remote roles, the demand for functional, ergonomic, and stylish workspace furniture continues to rise. Shrinking urban housing footprints further accelerate the demand for modular and space-saving office furniture. As designs evolve to meet changing living standards, consumer interest grows in options that blend aesthetics with usability. While this trend supports market expansion, rising raw material prices and deforestation-induced timber shortages are putting pressure on margins.

Evolving consumer tastes also present challenges, with demand shifting toward adaptable, comfortable, and sustainable home office solutions that support flexible work habits. As remote and hybrid work become permanent fixtures in daily life, users are seeking multifunctional furniture that blends seamlessly into living spaces without compromising on performance. There's growing interest in ergonomic designs that promote health and well-being, including features like lumbar support, adjustable heights, and integrated tech enhancements. Aesthetic preferences have also changed, favoring minimalistic, modular styles that reflect personal taste while offering functionality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $23.8 Billion |

| CAGR | 4.4% |

The desks segment generated USD 5.3 billion in 2024 and is expected to grow at a CAGR of 4.5% through 2034. Their prominence stems from the global adoption of work-from-home arrangements and the growing preference for co-working-style environments. Modern desks offer features like adjustable heights and modular add-ons, enhancing both comfort and efficiency. In addition, emerging innovations such as AI-enabled desks are gaining traction. These intelligent systems can adjust desk settings based on user activity, connect with multiple devices, and include integrated technology like wireless charging pads and smart sensors that optimize performance and track ergonomics in real time.

In 2024, the wood furniture segment held a 44% share and is anticipated to grow at a CAGR of 4.8% through 2034. Wood remains a preferred material due to its durability, aesthetic appeal, and adaptability across various interior styles. Eco-conscious customers are increasingly choosing reclaimed wood and recycled metals, with approximately 40% of them seeking sustainable materials in their purchasing decisions. Design trends are evolving to incorporate soft, rounded features that foster calm and inviting workspaces. Flexible furniture pieces that can be rearranged or serve multiple functions-such as transforming from a work desk into a dining table-are gaining popularity for their ability to conserve space without compromising style or functionality.

United States Home Office Furniture Market held a 77% share and generated USD 4.3 billion in 2024. This leadership position is largely attributed to the rise of hybrid and remote work models, growing consumer interest in personalized home office setups, and robust purchasing power. US buyers are willing to invest in high-quality, tech-integrated furniture solutions that cater to comfort, performance, and longevity. Unlike many other regions where price sensitivity can curb innovation, the US market demand has propelled manufacturers to develop advanced offerings tailored specifically to the remote work culture.

Leading players in the Home Office Furniture Market include Knoll, Kokuyo, Product Depot International, Godrej Interio, HON, Williams-Sonoma, Sunon Furniture, La-Z-Boy, Steelcase, Vitra International, Haworth, Humanscale, Virco, Herman Miller, and HNI Corporation. To build market resilience and expand their footprint, home office furniture companies are focusing on multiple strategies. These include introducing modular and ergonomic designs that accommodate diverse work styles and spatial constraints. Many firms are integrating smart technology into their product lines, enabling features such as wireless charging, sit-stand automation, and digital health tracking. Sustainability remains a major focus, with companies incorporating recycled materials and promoting environmentally responsible sourcing. In addition, strong omnichannel retail strategies, including immersive online experiences and virtual room planners, are helping brands engage customers more effectively.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Price

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Middle East and Africa

- 4.2.1.5 Latin America

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Desks

- 5.3 Chairs

- 5.4 Storage units & cabinets

- 5.5 Tables

- 5.6 Accessories

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Wood

- 6.3 Metal

- 6.4 Glass

- 6.5 Plastic

- 6.6 Others (fabrics etc.)

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company websites

- 8.3 Offline

- 8.3.1 Supermarkets/hypermarket

- 8.3.2 Specialty retail stores

- 8.3.3 Others (independent retailer etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Godrej Interio

- 10.2 Haworth

- 10.3 Herman Miller

- 10.4 HNI Corporation

- 10.5 HON

- 10.6 Humanscale

- 10.7 Knoll

- 10.8 Kokuyo

- 10.9 La-Z-Boy

- 10.10 Product Depot International

- 10.11 Steelcase

- 10.12 Sunon Furniture

- 10.13 Virco

- 10.14 Vitra International

- 10.15 Williams-Sonoma