|

市場調查報告書

商品編碼

1773250

網路流量分析市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Network Traffic Analytics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

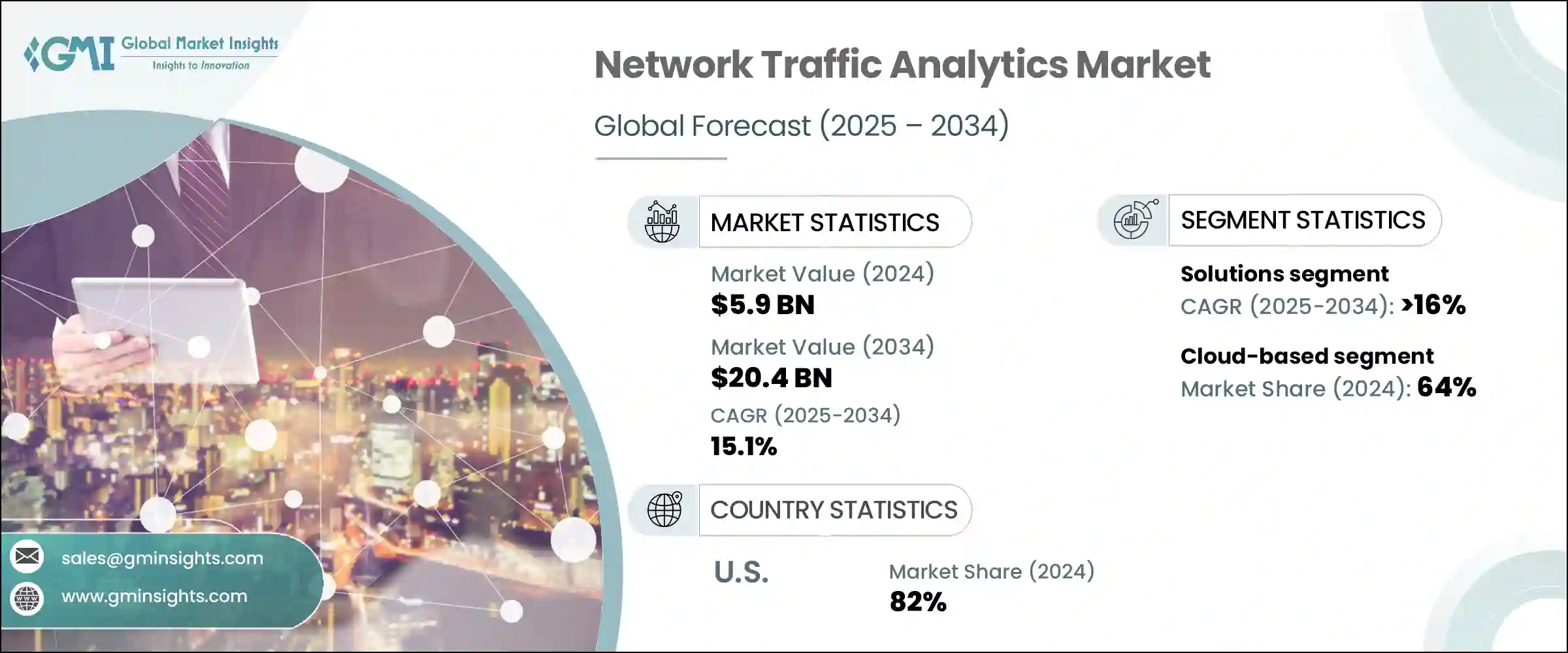

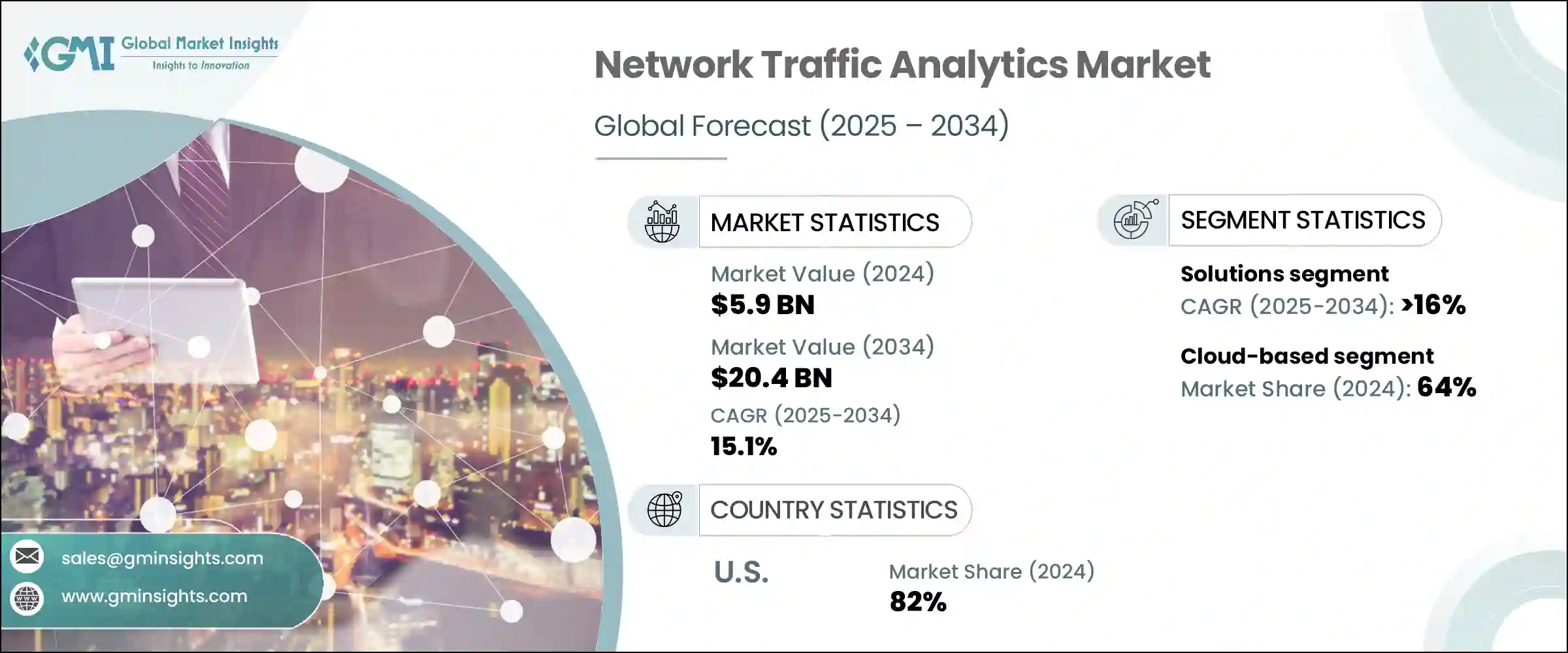

2024年,全球網路流量分析市場規模達59億美元,預計2034年將以15.1%的複合年成長率成長,達到204億美元。這一成長源於對複雜數位網路中即時營運情報、安全性和可視性日益成長的需求。隨著企業紛紛採用混合雲端環境並應對不斷演變的網路威脅,理解和管理資料流變得至關重要。隨著遠端辦公、物聯網設備和基於人工智慧的應用激增,可擴展的分析平台變得至關重要。這些解決方案能夠提供網路效能、威脅偵測和合規性的可行洞察,使企業能夠保持安全、高效且不間斷的連線。

透過持續分析資料包和串流資料,網路流量分析工具可以幫助 IT 團隊快速偵測異常,確保合規性,並最佳化資料路由,從而防止擁塞或中斷。對於適應現代數位化環境的企業而言,它們已成為不可或缺的工具。隨著企業規模的擴大和數位化環境的多樣化,這些工具能夠深入了解網路行為,從而實現主動威脅偵測和快速事件回應。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 59億美元 |

| 預測值 | 204億美元 |

| 複合年成長率 | 15.1% |

隨著雲端服務、虛擬化基礎架構和行動優先員工隊伍的日益普及,維護無縫且安全的網路效能變得比以往任何時候都更加複雜。網路流量分析解決方案使企業能夠監控即時流量模式,確定關鍵任務應用程式的優先級,並在可疑活動升級之前將其隔離。這些解決方案能夠將原始網路資料轉化為可操作的情報,從而使 IT 團隊能夠更敏捷地營運,改進服務交付,並增強整體網路安全韌性。

2024年,解決方案細分市場佔據了68%的市場佔有率,預計到2034年將成長16%。這種主導地位凸顯了先進的軟體平台對現代網路管理的重要性。企業正在投資先進的工具,提供合規性報告、行為分析和加密流量視覺化功能。從定期批量分析到持續即時串流的轉變標誌著現代網路分析的轉型。

2024年,基於雲端的細分市場佔據64%的佔有率,預計複合年成長率為16%。雲端平台能夠快速處理大量網路流量,消除前期硬體投資,並靈活應對不斷變化的工作負載,同時還能在全球站點提供集中式洞察。這些優勢使雲端部署成為尋求敏捷、可擴展分析的企業的首選。

美國網路流量分析市場佔了82%的市場佔有率,2024年市場規模達到17億美元。這一領先地位體現了美國先進的IT基礎設施以及對下一代網路安全解決方案的早期採用。金融、醫療保健、製造業和政府等產業越來越依賴分析工具來監控加密流量、實施人工智慧驅動的威脅偵測,並在分散的雲端環境中保持法規遵循。

引領該市場的全球公司包括思科系統、Cloudflare、博通、Zoho、IBM Corporation、Arista Networks、NEC Corporation、SolarWinds Worldwide、Fortra 和 Progress Software。主要參與者正在透過創新、策略合作夥伴關係和垂直擴展來鞏固其市場地位。他們正在大力投資人工智慧和機器學習增強技術,以改善異常檢測、預測性威脅預防和加密流量分析。

平台與雲端原生環境、端點安全和 SIEM 系統的整合是實現統一安全和效能管理的策略重點。企業也在擴展託管服務和訂閱模式,以提供滿足企業需求的可擴展產品。與雲端服務供應商和電信營運商結盟可以實現更廣泛的部署和市場覆蓋範圍。此外,供應商強調以合規性為重點的分析,以因應日益成長的監管要求。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 網路安全威脅不斷上升

- 物聯網和互聯設備的快速成長

- 採用雲端服務

- 5G網路的擴展

- 產業陷阱與挑戰

- 實施成本高

- 可擴展性和整合挑戰

- 市場機會

- 增加行業特定客製化

- 與 SOAR 和 SIEM 工具整合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 成本細分分析

- 軟體開發和授權成本

- 部署和整合成本

- 維護和支援成本

- 網路安全與合規成本

- 培訓和變更管理成本

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

- 最佳情況

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 解決方案

- 網路效能監控

- 網路安全監控

- 網路行為分析

- 網路流量可視化

- 服務

- 專業的

- 諮詢

- 部署與整合

- 支援與維護

- 託管

- 專業的

第6章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 安全和威脅偵測

- 入侵偵測與預防

- 進階持續性威脅 (APT) 偵測

- 內部威脅偵測

- 效能監控和最佳化

- 網路容量規劃

- 異常檢測

- 合規與審計

第8章:市場估計與預測:依企業規模,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型企業

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 金融服務業

- IT和電信

- 政府和國防

- 衛生保健

- 零售與電子商務

- 製造業

- 能源和公用事業

- 教育

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Arista Networks

- Broadcom

- Cisco Systems

- Cloudflare

- Dynatrace

- ExtraHop Networks

- Fortinet

- Fortra

- IBM Corporation

- Juniper Networks

- NEC Corporation

- NetScout Systems

- NTT

- Palo Alto Networks

- Progress Software Corporation

- Riverbed Technology

- SolarWinds Worldwide

- Splunk

- Viavi Solutions

- Zoho Corporation

The Global Network Traffic Analytics Market was valued at USD 5.9 billion in 2024 and is estimated to grow at a CAGR of 15.1% to reach USD 20.4 billion by 2034. This growth is driven by increasing demand for real-time operational intelligence, security, and visibility in complex digital networks. As organizations embrace hybrid cloud environments and contend with evolving cyber threats, understanding and managing data flow has become critical. With the surge in remote work, IoT devices, and AI-based applications, scalable analytics platforms have become essential. These solutions offer actionable insights into network performance, threat detection, and compliance, empowering businesses to maintain secure, efficient, and uninterrupted connectivity.

By continually analyzing packet and flow data, network traffic analytics tools help IT teams quickly detect anomalies, ensure compliance, and optimize data routes to prevent congestion or outages. They have become indispensable for enterprises adapting to modern digital landscapes. As organizations scale and diversify their digital environments, these tools offer deep visibility into network behavior, enabling proactive threat detection and swift incident response.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.9 Billion |

| Forecast Value | $20.4 Billion |

| CAGR | 15.1% |

With the rising adoption of cloud services, virtualized infrastructure, and mobile-first workforces, maintaining seamless and secure network performance is more complex than ever. Network traffic analytics solutions empower businesses to monitor real-time traffic patterns, prioritize mission-critical applications, and isolate suspicious activities before they escalate. Their ability to turn raw network data into actionable intelligence allows IT teams to operate with greater agility, improve service delivery, and enhance overall cybersecurity resilience.

In 2024, the solutions segment held 68% share and is expected to grow at 16% through 2034. This dominance underscores how vital sophisticated software platforms are to modern network management. Companies are investing in advanced tools offering compliance reporting, behavioral analysis, and visibility into encrypted traffic. The shift from periodic batch analytics to continuous real-time streaming marks modern network analytics' transformation.

The cloud-based segment held a 64% share in 2024 and is projected to grow at a CAGR of 16%. Cloud platforms enable rapid processing of massive network volumes, eliminate upfront hardware investments, and offer flexibility to handle fluctuating workloads-all while providing centralized insight across global sites. These benefits make cloud deployment the preferred choice for businesses seeking agile, scalable analytics.

United States Network Traffic Analytics Market held an 82% share and generated USD 1.7 billion in 2024. This leadership reflects the country's advanced IT infrastructure and early adoption of next-gen network security solutions. Industries such as finance, healthcare, manufacturing, and government are increasingly relying on analytics tools to monitor encrypted traffic, implement AI-driven threat detection, and maintain regulatory compliance across dispersed cloud environments.

Global companies leading this market include Cisco Systems, Cloudflare, Broadcom, Zoho, IBM Corporation, Arista Networks, NEC Corporation, SolarWinds Worldwide, Fortra, and Progress Software. Key players are strengthening their market position through innovation, strategic partnerships, and vertical expansion. They are investing heavily in AI and machine learning enhancements to improve anomaly detection, predictive threat prevention, and encrypted traffic analysis.

Platform integration with cloud-native environments, endpoint security, and SIEM systems is a strategic focus to offer unified security and performance management. Companies are also expanding managed services and subscription models to provide scalable offerings that match enterprise needs. Forming alliances with cloud providers and telecom operators allows wider deployment and market reach. Additionally, vendors emphasize compliance-focused analytics to address rising regulatory demands.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Mode

- 2.2.4 Application

- 2.2.5 Enterprise Size

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising cybersecurity threats

- 3.2.1.2 Rapid growth in IoT and connected devices

- 3.2.1.3 Adoption of cloud services

- 3.2.1.4 Expansion of 5G networks

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs

- 3.2.2.2 Scalability and integration challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing industry-specific customization

- 3.2.3.2 Integration with SOAR and SIEM tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Network performance monitoring

- 5.2.2 Network security monitoring

- 5.2.3 Network behavior analytics

- 5.2.4 Network traffic visualization

- 5.3 Services

- 5.3.1 Professional

- 5.3.1.1 Consulting

- 5.3.1.2 Deployment & integration

- 5.3.1.3 Support & maintenance

- 5.3.2 Managed

- 5.3.1 Professional

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Security and threat detection

- 7.2.1 Intrusion detection and prevention

- 7.2.2 Advanced Persistent Threat (APT) detection

- 7.2.3 Insider threat detection

- 7.3 Performance monitoring and optimization

- 7.4 Network capacity planning

- 7.5 Anomaly detection

- 7.6 Compliance and audit

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 IT and telecom

- 9.4 Government and defense

- 9.5 Healthcare

- 9.6 Retail and e-commerce

- 9.7 Manufacturing

- 9.8 Energy and utilities

- 9.9 Education

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Arista Networks

- 11.2 Broadcom

- 11.3 Cisco Systems

- 11.4 Cloudflare

- 11.5 Dynatrace

- 11.6 ExtraHop Networks

- 11.7 Fortinet

- 11.8 Fortra

- 11.9 IBM Corporation

- 11.10 Juniper Networks

- 11.11 NEC Corporation

- 11.12 NetScout Systems

- 11.13 NTT

- 11.14 Palo Alto Networks

- 11.15 Progress Software Corporation

- 11.16 Riverbed Technology

- 11.17 SolarWinds Worldwide

- 11.18 Splunk

- 11.19 Viavi Solutions

- 11.20 Zoho Corporation