|

市場調查報告書

商品編碼

1773249

離心鼓風機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Centrifugal Blower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

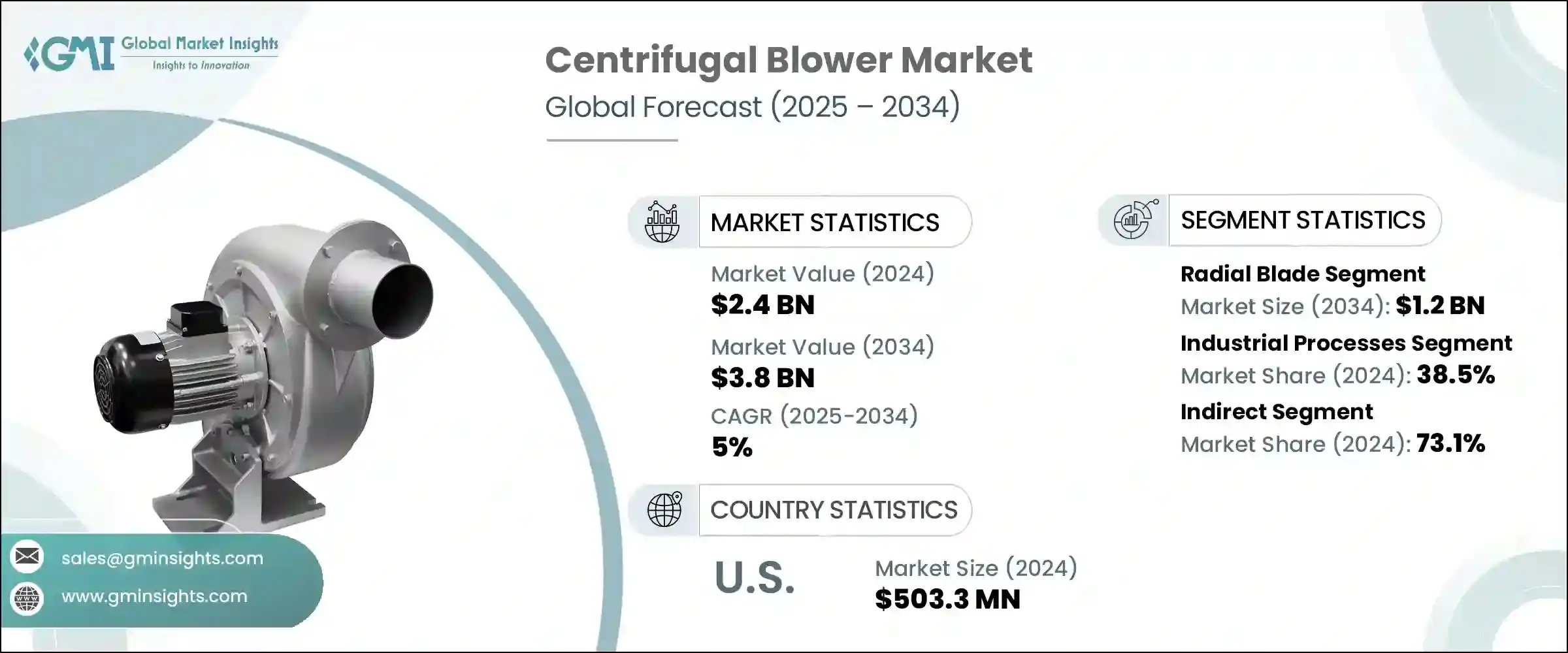

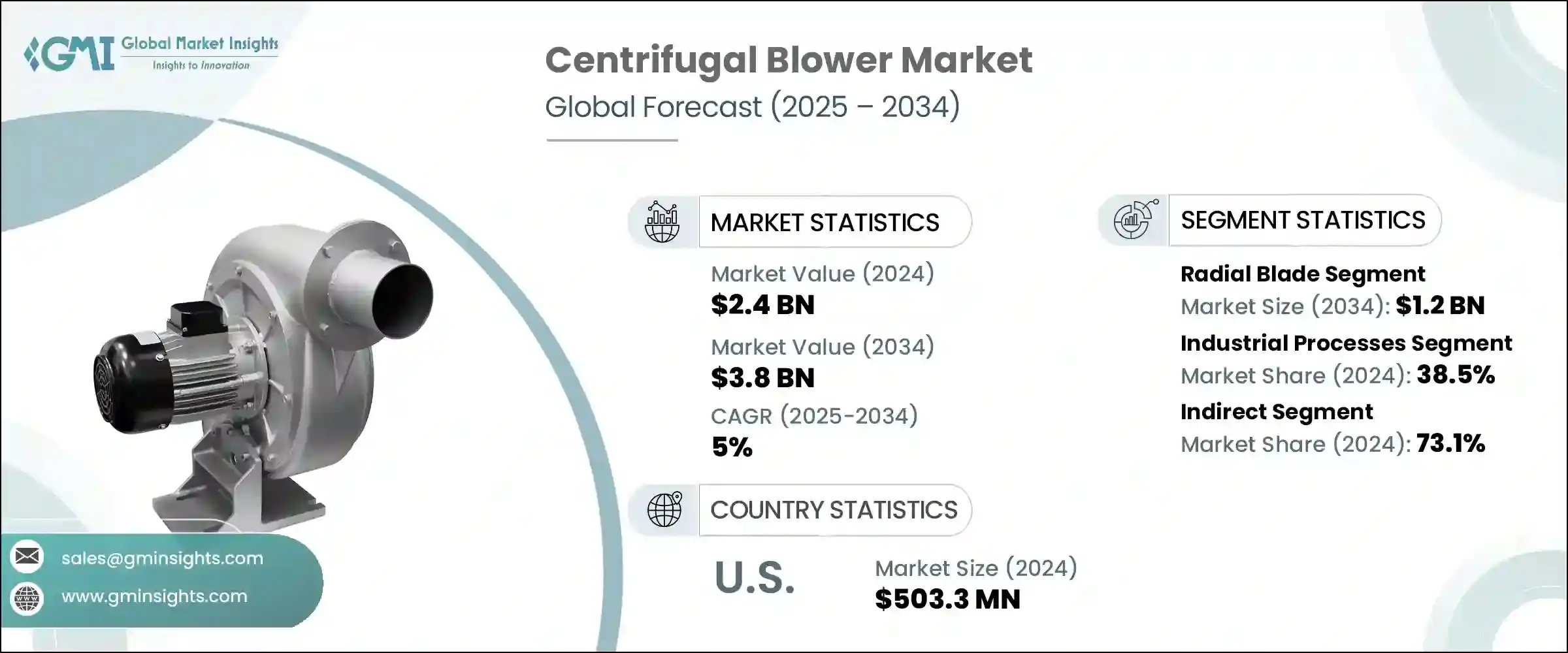

2024年,全球離心鼓風機市場規模達24億美元,預計2034年將以5%的複合年成長率成長,達到38億美元。該市場的成長軌跡與汽車、暖通空調、化學加工和發電等行業日益成長的需求密切相關。離心鼓風機是空氣和氣體輸送系統的關鍵部件,包括通風、冷卻和氣動輸送系統。

這些鼓風機的普及率激增,很大程度歸功於提升能源效率、減少環境影響和延長使用壽命的創新技術。採用智慧技術設計的先進鼓風機型號的推出,正在支持現代製造業,尤其是那些與工業4.0相契合的製造業,這些製造業強調自動化、生產力和數據驅動的效率。隨著各行各業積極尋求降低能源消耗和碳足跡的解決方案,節能鼓風機已成為營運策略的核心。這些鼓風機不僅支持工業永續發展目標,還有助於降低能源密集產業的公用事業費用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 38億美元 |

| 複合年成長率 | 5% |

在採礦和發電等行業,離心式鼓風機的角色不僅限於氣流控制,還包括關鍵的安全功能。它們有助於在危險的工作環境中維持潔淨的空氣區域,並確保敏感設備的平穩運作。隨著監管壓力的不斷增加以及人們對工作場所安全和環境標準的認知不斷提高,對可靠耐用鼓風機的需求正在加速成長。隨著企業努力滿足合規要求並加強風險緩解策略,離心式鼓風機正擴大被整合到核心營運中。

食品飲料產業是離心式鼓風機應用的另一個關鍵促進因素。這些系統支持高水準的衛生條件,這在食品加工環境中至關重要。隨著全球對包裝和加工食品的需求持續成長,生產線對空氣過濾和氣味控制系統的需求也日益成長。離心式鼓風機提供精確的氣流控制,使其成為食品製造所需的無塵室環境和空氣淨化系統的理想選擇。食品生產領域自動化和可編程系統的持續擴展也推動了先進鼓風機配置市場的發展。

按類型分類,徑向葉片離心式鼓風機在2024年佔據市場主導地位,估值達7.885億美元,預計到2034年將達到12億美元。該細分市場憑藉其高效的氣流性能、跨行業的適應性以及持續最佳化能耗的設計改進,仍然是首選。隨著各行各業對兼具營運效能與節能效果的解決方案的需求日益成長,徑向葉片配置在各個應用領域持續受到青睞。

在應用方面,工業流程中使用的離心式鼓風機在2024年佔了全球約38.5%的市場佔有率,預計2025年至2034年的複合年成長率將達到5.4%。這些鼓風機對空氣燃燒、物料處理和排氣系統等多項關鍵功能至關重要。它們能夠承受惡劣環境並維持穩定的性能,使其成為製造、煉油和重工業運作中不可或缺的一部分。人們越來越重視提高流程效率和減少停機時間,這使得離心式鼓風機在工業系統中得到更廣泛的應用。

縱觀分銷格局,間接銷售通路在2024年佔據主導地位,佔有率接近73.1%。經銷商在市場擴張中發揮關鍵作用,幫助製造商接觸更廣泛的客戶群,並加快產品在各地區的供應速度。這些中間商通常提供售後支援、技術支援和產品服務,從而提升客戶滿意度並促進回頭客。製造商與分銷夥伴之間的策略合作持續塑造市場格局,增強了該領域間接銷售的實力。

從地區來看,美國在2024年的市值達到5.033億美元,預計預測期內的複合年成長率為4.5%。美國完善的工業生態系統,涵蓋製造業、石化產業和暖通空調產業,為離心鼓風機的需求提供了堅實的基礎。成熟的物流基礎設施和廣泛的配銷通路網路確保了先進的鼓風機系統在全國範圍內隨時可用,從而支持國內消費的穩步成長。

離心鼓風機市場匯集了許多全球知名製造商和區域性供應商。該領域的主要參與者包括Airmake Cooling Systems、Aerotech Equipment、Alfotech Fans、Atlas Copco、Atlantic Blowers LLC、Chuan-Fan Electric Co., Ltd.、Colfax Corporation、CLEANTEK、Elektror Airsystems、HIS Blower、Illinois Blower Company、山東華東鼓風機有限公司、The Spencer Turbine Company、Trimech India 和 Vishwakarma Air Systems。競爭格局仍然較為分散,這有利於持續創新和製定具有競爭力的定價策略。雖然由於技術要求和資本投入存在一些進入壁壘,但市場環境仍然有利於新進入者和專注於定製或區域特定解決方案的利基市場參與者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 徑向葉片

- 前彎

- 向後彎曲

- 混流

- 軸流

- 多級

- 其他

第6章:市場估計與預測:按驅動機制,2021 - 2034 年

- 主要趨勢

- 直接驅動

- 皮帶傳動

第7章:市場估計與預測:按壓力,2021 - 2034 年

- 主要趨勢

- 高的

- 中等的

- 低的

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 暖通空調系統

- 工業製程

- 發電

- 製藥

- 食品加工

- 礦業

- 農業

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Aerotech Equipments and Projects Pvt. Ltd

- Airmake Cooling Systems

- Alfotech Fans

- Atlantic Blowers LLC

- Atlas Copco

- Chuan-Fan Electric Co., Ltd.

- CLEANTEK

- Colfax Corporation

- Elektror Airsystems

- EVG Engicon Airtech Pvt. Ltd.

- HIS Blower

- Illinois Blower Inc.

- Kaeser kompressoren

- Shandong Huadong Blower Co., Ltd.

- The New York Blower Company

- The Spencer Turbine Company

- Trimech India

- Vishwakarma Air Systems

The Global Centrifugal Blower Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 3.8 billion by 2034. The market's growth trajectory is closely tied to rising demand from industries such as automotive, HVAC, chemical processing, and power generation. Centrifugal blowers are key components in systems that move air and gas, including ventilation, cooling, and pneumatic conveying systems.

The surge in the adoption of these blowers is largely attributed to innovations that enhance energy efficiency, reduce environmental impact, and extend operational life. The introduction of advanced blower models designed with smart technologies is supporting modern manufacturing initiatives, particularly those aligned with Industry 4.0, which emphasize automation, productivity, and data-driven efficiency. With industries actively seeking solutions to reduce their energy consumption and carbon footprint, energy-efficient blowers have become central to operational strategies. These blowers not only support industrial sustainability goals but also help lower utility expenses in energy-intensive sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 5% |

In sectors like mining and power generation, the role of centrifugal blowers extends beyond airflow control to include critical safety functions. They help maintain clean air zones in hazardous work environments and ensure the smooth operation of sensitive equipment. With increasing regulatory pressures and rising awareness about workplace safety and environmental standards, the demand for reliable and durable blowers is accelerating. Centrifugal blowers are being increasingly integrated into core operations as companies strive to meet compliance requirements and enhance risk mitigation strategies.

The food and beverage sector is another key contributor to centrifugal blower adoption. These systems support high levels of sanitation and hygiene, which are crucial in food processing environments. As global demand for packaged and processed foods continues to rise, the need for air filtration and odor control systems within processing lines is growing. Centrifugal blowers offer precise airflow control, making them ideal for supporting cleanroom environments and air purification systems required in food manufacturing. The continued expansion of automation and programmable systems within food production is also boosting the market for advanced blower configurations.

By type, radial blade centrifugal blowers dominated the market in 2024 with a valuation of USD 788.5 million and are estimated to reach USD 1.2 billion by 2034. This segment remains the top choice due to its effective airflow performance, adaptability across various sectors, and ongoing improvements in design that optimize energy consumption. As industries increasingly demand solutions that combine operational performance with energy savings, the radial blade configuration continues to gain traction across applications.

In terms of application, centrifugal blowers used in industrial processes accounted for approximately 38.5% of the global market share in 2024 and are projected to register a CAGR of 5.4% from 2025 to 2034. These blowers are vital to several key functions, such as air combustion, material handling, and exhaust systems. Their ability to withstand harsh environments and deliver consistent performance makes them indispensable in manufacturing, refining, and heavy industrial operations. The growing emphasis on improving process efficiency and reducing downtime has led to the wider adoption of centrifugal blowers in industrial systems.

Looking at the distribution landscape, the indirect sales channel held a dominant share of nearly 73.1% in 2024. Distributors play a pivotal role in market expansion, offering manufacturers access to a wider customer base and enabling faster product availability across regions. These intermediaries often provide post-sale support, technical assistance, and product servicing, which enhances customer satisfaction and fosters repeat business. Strategic collaborations between manufacturers and distribution partners continue to shape the market, reinforcing the strength of indirect sales in this sector.

Regionally, the United States recorded a market value of USD 503.3 million in 2024 and is expected to grow at a CAGR of 4.5% over the forecast period. The country's well-established industrial ecosystem, which includes manufacturing, petrochemical, and HVAC sectors, provides a solid foundation for centrifugal blower demand. Access to a mature logistics infrastructure and a broad network of distribution channels ensures that advanced blower systems are readily available nationwide, supporting a steady uptick in domestic consumption.

The centrifugal blower market features a mix of prominent global manufacturers and region-focused suppliers. Key players in the space include Airmake Cooling Systems, Aerotech Equipment, Alfotech Fans, Atlas Copco, Atlantic Blowers LLC, Chuan-Fan Electric Co., Ltd., Colfax Corporation, CLEANTEK, Elektror Airsystems, HIS Blower, Illinois Blower Inc., EVG Engicon Airtech Pvt. Ltd., Kaeser Kompressoren, The New York Blower Company, Shandong Huadong Blower Co., Ltd., The Spencer Turbine Company, Trimech India, and Vishwakarma Air Systems. The competitive landscape remains moderately fragmented, which encourages ongoing innovation and competitive pricing strategies. While some entry barriers exist due to technical requirements and capital investments, the environment remains conducive for new entrants and niche players focusing on custom or region-specific solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Driving mechanism

- 2.2.4 Pressure

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Radial blade

- 5.3 Forward-curved

- 5.4 Backwards curved

- 5.5 Mixed flow

- 5.6 Axial flow

- 5.7 Multi-stage

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Drive Mechanism, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Direct drive

- 6.3 Belt drive

Chapter 7 Market Estimates & Forecast, By Pressure, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 High

- 7.3 Medium

- 7.4 Low

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 HVAC

- 8.3 Industrial processes

- 8.4 Power generation

- 8.5 Pharmaceutical

- 8.6 Food processing

- 8.7 Mining

- 8.8 Agriculture

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Aerotech Equipments and Projects Pvt. Ltd

- 11.2 Airmake Cooling Systems

- 11.3 Alfotech Fans

- 11.4 Atlantic Blowers LLC

- 11.5 Atlas Copco

- 11.6 Chuan-Fan Electric Co., Ltd.

- 11.7 CLEANTEK

- 11.8 Colfax Corporation

- 11.9 Elektror Airsystems

- 11.10 EVG Engicon Airtech Pvt. Ltd.

- 11.11 HIS Blower

- 11.12 Illinois Blower Inc.

- 11.13 Kaeser kompressoren

- 11.14 Shandong Huadong Blower Co., Ltd.

- 11.15 The New York Blower Company

- 11.16 The Spencer Turbine Company

- 11.17 Trimech India

- 11.18 Vishwakarma Air Systems