|

市場調查報告書

商品編碼

1773248

孕婦用品市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Maternity Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

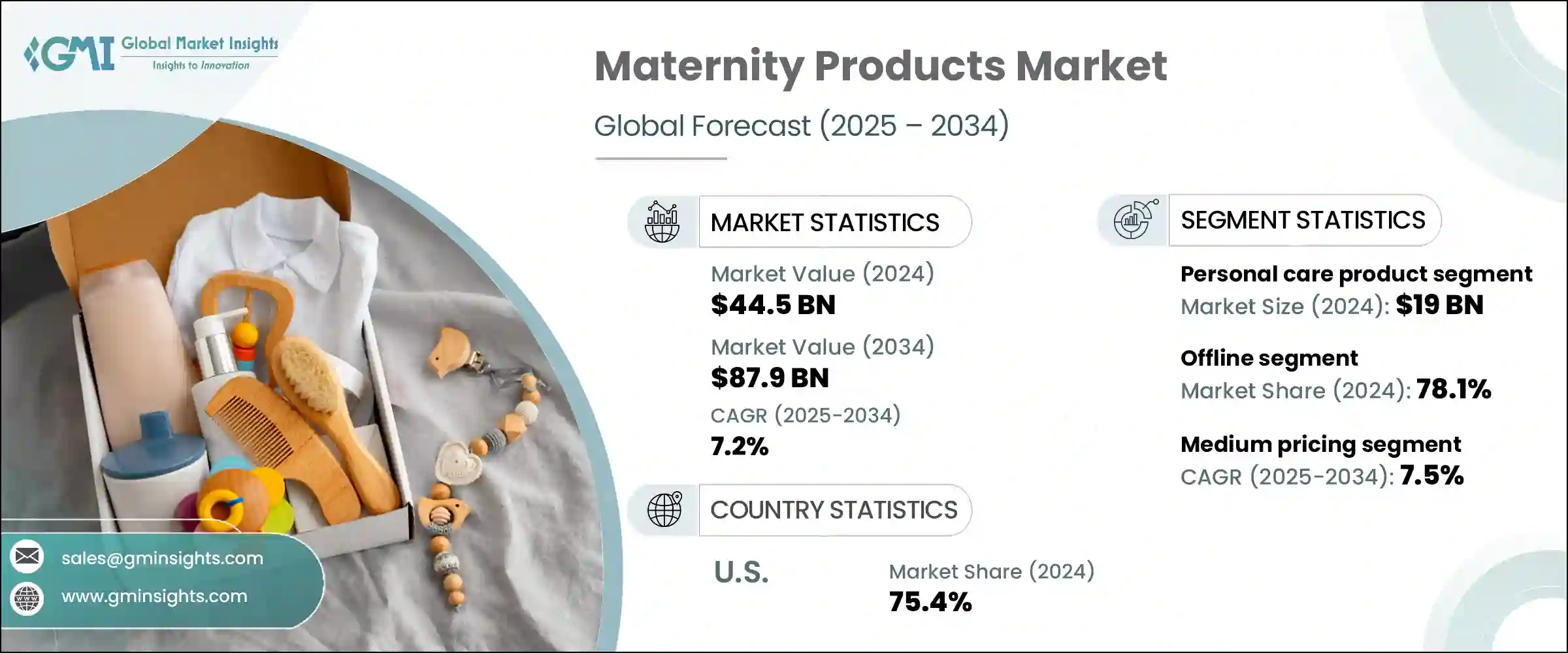

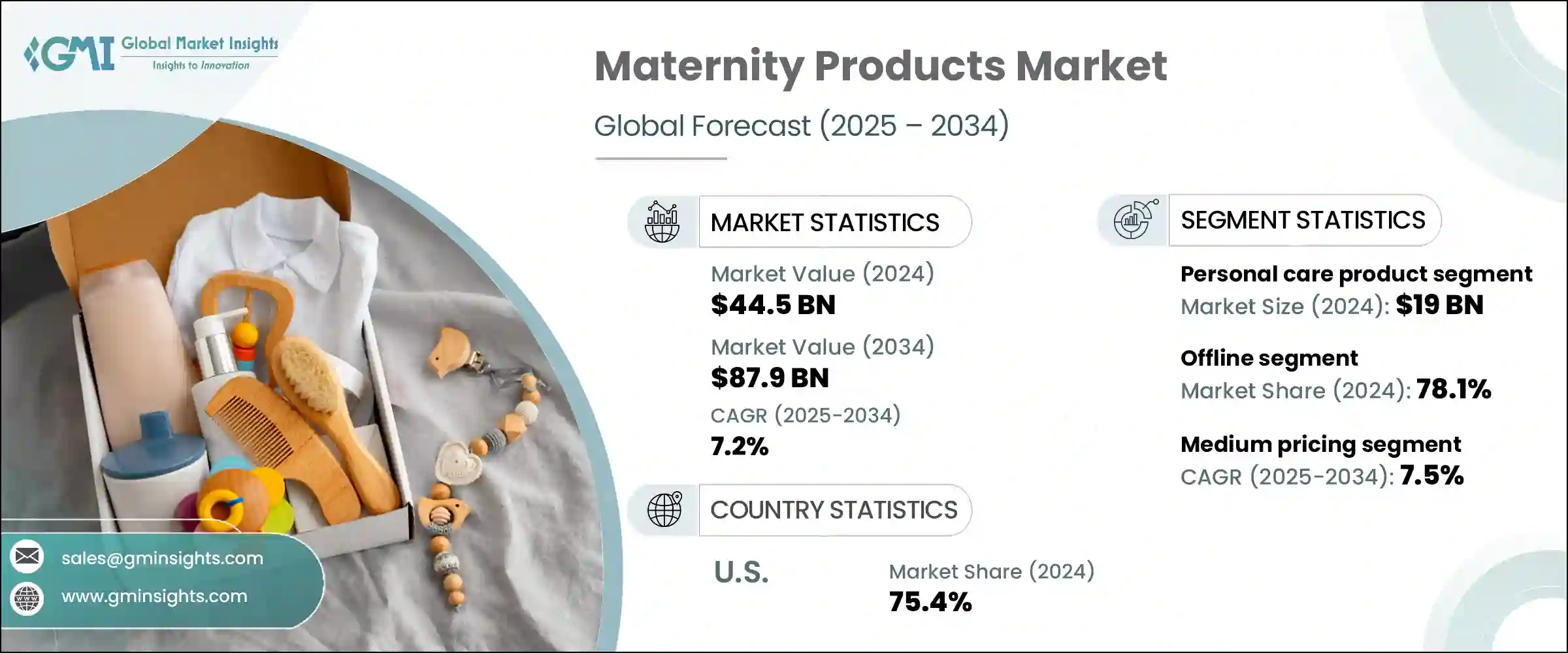

2024年,全球孕產婦用品市場規模達445億美元,預計到2034年將以7.2%的複合年成長率成長,達到879億美元。受家長對孕產婦健康意識不斷提升的推動,該市場正呈現強勁成長動能。受醫療保健服務覆蓋範圍的擴大、消費者期望的不斷變化以及政府扶持政策的影響,孕產婦保健方式正在發生顯著轉變。主要成長因素之一是消費者越來越關注懷孕及孕後身心健康。孕產婦護理領域的技術整合正在加速成長,數位工具可提供個人化的健康追蹤、飲食計劃和活動建議。

透過遠距醫療服務進行的遠距諮詢也提高了孕產婦護理的可近性。各國政府和衛生組織正在推廣數位化孕產婦解決方案,以彌補現有的護理缺口。隨著全球可支配收入的成長,父母更傾向於投資先進、舒適、安全的孕產婦用品。線上零售平台的激增也改變了孕產婦護理的可近性和便利性。憑藉更高的隱私性、更廣泛的產品選擇以及貨比三家的優勢,電子商務持續吸引那些精通科技的現代父母,他們正在尋找高品質的解決方案來支持孕產之旅。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 445億美元 |

| 預測值 | 879億美元 |

| 複合年成長率 | 7.2% |

2024年,個人護理產品產值達190億美元,預計到2034年複合年成長率將達到7.4%。這些產品在全球市場佔據主導地位,這主要得益於懷孕和產後女性對護膚和健康的意識日益增強。皮膚刺激、色素沉澱和妊娠紋等問題促使人們對各種解決方案的需求不斷成長,包括乳霜、凝膠和有機護膚品系列。女性勞動參與率的提高,以及對天然、安全和高性能產品的偏好,持續推動這一領域的成長。母親們更注重便利性和有效性,這促使消費者轉向值得信賴且注重環保的品牌。

線下零售通路在2024年佔據了78.1%的市場佔有率,預計在2025-2034年期間將維持7.1%的複合年成長率。實體零售店佔據主導地位,因為它們提供親手操作的產品評估。孕婦消費者更喜歡在購買前觸摸、測試和評估商品,尤其是在舒適度、合身度、品質和尺寸方面。銷售人員根據顧客的個人需求進行引導,從而提升了價值,從而改善了購物體驗並建立了品牌信任。線下模式也支援更有針對性的產品比較,尤其是在購買穿戴式裝置、健康設備或護膚品時。

2024年,美國孕產婦用品市場佔據75.4%的市場佔有率,預計在2025-2034年期間將以7.1%的複合年成長率成長。美國消費者高度關注孕產婦健康,並將安全性和創新性放在首位。職業母親數量的增加和收入水準的提高,促使消費者在優質孕產婦用品上的支出增加。此外,專注於永續和科技驅動創新的產品開發正日益受到消費者的青睞。市場的成熟和健康增強技術的快速普及,使美國繼續在該領域保持領先地位。

全球孕婦用品市場的領先公司包括 Gap、Motherhood、H&M Mama、Seraphine、JoJo Maman Bebe、A Pea in the Pod、PinkBlush、HATCH、Old Navy、Cake、Frida、ASOS、Destination、Isabella Oliver 和 The Moms Co. 孕婦用品用品、行業的公司正專注於創新、產業品質和全企業戰略,擴大其行業的公司正專注於創新、行業的企業和全企業戰略,擴大其行業的公司正專注於創新、行業的企業和全企業戰略,擴大其行業的公司正專注於創新、行業的企業和全企業戰略,擴大其行業的公司正專注於創新、行業的企業和全企業戰略,擴大其行業的公司正專注於創新、行業的企業和全企業戰略,擴大其行業的公司正專注於創新、行業的企業和全企業戰略。許多品牌正在增強其數位店面並最佳化電子商務管道,以滿足對便利、謹慎購物體驗日益成長的需求。產品組合正在多樣化,包括有機、經皮膚病學測試和永續性認證的產品,以滿足注重健康的消費者群體。與醫療保健專業人士和有影響力人士的合作有助於提升品牌信譽和消費者參與。透過個人化諮詢服務和精心策劃的展示,店內體驗正在改善。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 孕婦服裝

- 個人護理產品

- 營養補充品

- 孕婦配件

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 懷孕

- 產後

第7章:市場估計與預測:依定價,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 網上銷售

- 電子商務

- 公司網站

- 線下銷售

- 批發/分銷商

- 大賣場/超市

- 專賣店

- 其他(多品牌店等)

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- A Pea in the Pod

- ASOS

- Cake

- Destination

- Frida

- Gap

- H&M Mama

- Hatch

- Isabella Oliver

- JoJo Maman Bebe

- Motherhood

- Old Navy

- Pink Blush

- Seraphine

- The Moms Co.

The Global Maternity Products Market was valued at USD 44.5 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 87.9 billion by 2034. The market is experiencing strong momentum, driven by rising awareness among parents regarding maternal wellness. There's a notable shift in how maternal health is approached, influenced by better healthcare access, evolving consumer expectations, and supportive government policies. One of the primary growth factors is increased consumer focus on both mental and physical health during and after pregnancy. Technology integration in maternal care is accelerating growth, with digital tools providing personalized health tracking, diet planning, and activity recommendations.

Remote consultations through telehealth services are also improving maternity care accessibility. Governments and health organizations are promoting digital maternal solutions to address existing care gaps. As disposable incomes rise globally, parents are more inclined to invest in advanced, comfortable, and safe maternity products. The surge in online retail platforms has also transformed accessibility and convenience. With greater privacy, wider product choices, and the ability to compare offerings, e-commerce continues to attract modern, tech-savvy parents who are looking for quality solutions to support the motherhood journey.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.5 Billion |

| Forecast Value | $87.9 Billion |

| CAGR | 7.2% |

In 2024, personal care products generated USD 19 billion and are forecasted to grow at a CAGR of 7.4% by 2034. These items dominate the global market, largely due to growing awareness of skincare and wellness among pregnant and postpartum women. Concerns such as skin irritation, pigmentation, and stretch marks are prompting demand for a broad spectrum of solutions, including creams, gels, and organic skincare lines. Increasing participation of women in the workforce, along with a preference for natural, safe, and high-performing products, continues to fuel growth in this segment. Mothers are prioritizing both convenience and effectiveness, supporting a shift toward trusted and eco-conscious brands.

The offline retail channels segment accounted for 78.1% share in 2024 and is projected to maintain a CAGR of 7.1% during 2025-2034. Physical retail stores hold a dominant position because they offer hands-on product assessment. Pregnant consumers prefer the opportunity to touch, test, and evaluate items before making a purchase-particularly when it comes to comfort, fit, quality, and size. Sales personnel add value by guiding customers based on their individual needs, which improves the shopping experience and builds brand trust. Offline formats also support a more curated product comparison, especially when purchasing wearables, health devices, or skin care solutions.

United States Maternity Products Market held 75.4% share in 2024 and is on track to grow at a CAGR of 7.1% during 2025-2034. Consumers in the US are highly attuned to maternal health and prioritize both safety and innovation. An increase in working mothers and rising income levels are contributing to greater spending on premium-quality maternity products. Additionally, product development focused on sustainable and tech-driven innovations is gaining strong consumer interest. The market's maturity and fast adoption of health-enhancing technologies continue to position the US as a leader in this space.

Leading companies in the Global Maternity Products Market include Gap, Motherhood, H&M Mama, Seraphine, JoJo Maman Bebe, A Pea in the Pod, PinkBlush, HATCH, Old Navy, Cake, Frida, ASOS, Destination, Isabella Oliver, and The Moms Co. Companies in the maternity products industry are focusing on innovation, quality, and omnichannel retail strategies to expand their presence. Many brands are enhancing their digital storefronts and optimizing e-commerce channels to meet rising demand for convenient, discreet shopping experiences. Product portfolios are being diversified with organic, dermatologically tested, and sustainability-certified offerings to cater to the health-conscious consumer base. Collaborations with healthcare professionals and influencers help boost brand credibility and consumer engagement. In-store experiences are being improved through personalized consultation services and curated displays.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Pricing

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behaviour analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behaviour

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion)(Thousand Units)

- 5.1 Key trends

- 5.2 Maternal apparel

- 5.3 Personal care products

- 5.4 Nutritional supplements

- 5.5 Maternity accessories

Chapter 6 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion)(Thousand Units)

- 6.1 Key trends

- 6.2 Pregnancy

- 6.3 Postnatal

Chapter 7 Market Estimates & Forecast, By Pricing, 2021 – 2034, (USD Billion)(Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion)(Thousand Units)

- 8.1 Key trends

- 8.2 Online sales

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline sales

- 8.3.1 Wholesales/distributors

- 8.3.2 Hypermarkets/supermarkets

- 8.3.3 Specialty stores

- 8.3.4 Others(multi-brand stores, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)(Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 A Pea in the Pod

- 10.2 ASOS

- 10.3 Cake

- 10.4 Destination

- 10.5 Frida

- 10.6 Gap

- 10.7 H&M Mama

- 10.8 Hatch

- 10.9 Isabella Oliver

- 10.10 JoJo Maman Bebe

- 10.11 Motherhood

- 10.12 Old Navy

- 10.13 Pink Blush

- 10.14 Seraphine

- 10.15 The Moms Co.