|

市場調查報告書

商品編碼

1773246

透明質酸市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hyaluronic Acid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

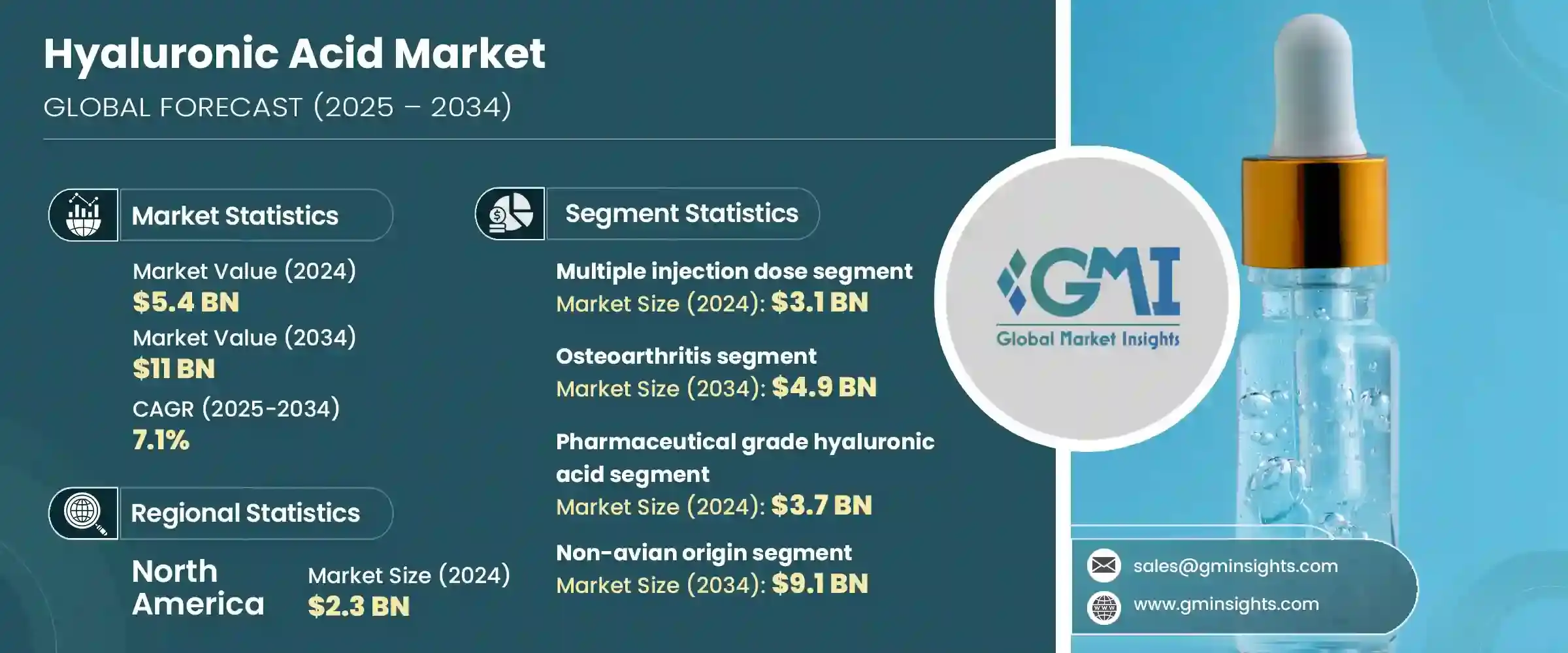

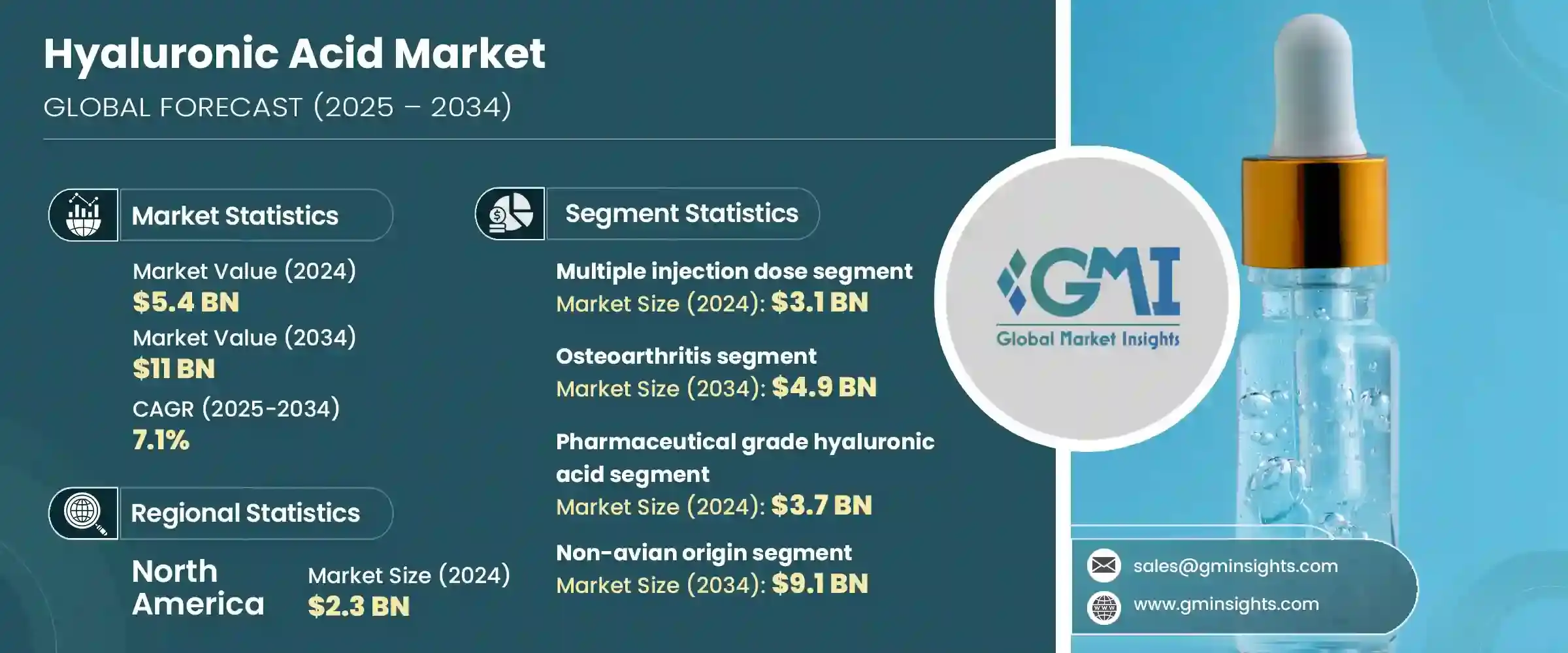

2024年,全球玻尿酸市場規模達54億美元,預計2034年將以7.1%的複合年成長率成長,達到110億美元。推動這一成長趨勢的核心因素之一是醫藥和化妝品領域透明質酸製劑的快速發展。人們對個人形象的日益關注、美容手術的普及以及對微創治療的需求不斷成長,為透明質酸產品創造了肥沃的市場空間。大眾也明顯傾向於那些見效更快、副作用更少的治療方法。受自我形象意識增強和數位文化的影響,年輕一代越來越關注美容整形。同時,全球人口老化加劇,對透明質酸在關節相關疾病治療的需求也日益成長。

在醫療領域,尤其是在骨科領域,透明質酸注射已成為一種廣泛接受的緩解關節僵硬和疼痛的方法。骨關節炎(尤其是在髖關節和膝關節)發病率的上升,使得越來越多的患者選擇黏彈性補充療法(一種將透明質酸直接注射到關節中的技術)。這種方法有助於恢復關節潤滑並減少摩擦,為關節置換手術提供了一種創傷性較小的替代方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 54億美元 |

| 預測值 | 110億美元 |

| 複合年成長率 | 7.1% |

隨著患者尋求延緩或避免手術的治療方案,對透明質酸注射劑的需求持續成長。玻尿酸作為結締組織和滑液中的天然物質,在醫療應用方面具有額外優勢,可作為避震器和潤滑劑,改善關節活動性和舒適度。此外,其特性也被用於傷口癒合產品和保養品等外部應用,進一步拓展了其商業應用範圍。

就產品細分而言,市場分為多次注射劑量和單次注射劑量兩種類型。 2024年,多次注射劑量佔據全球市場主導地位,規模達31億美元。由於其已證實能夠長期有效緩解關節不適,這種劑型在骨關節炎治療中仍受到臨床醫師和患者的青睞。通常,治療方案包括每週進行一系列注射,以提供持續緩解,特別適用於中度至重度關節退化的患者。這些產品擁有豐富的臨床資料支援,通常可享有保險,並因其安全性和有效性的良好記錄而備受青睞。

按應用分析,骨關節炎領域佔據市場領先地位,預計2034年將達到約49億美元。隨著老齡化人口中關節疼痛的持續增加,越來越多的人正在探索基於透明質酸的解決方案來控制症狀。在傳統止痛藥和口服藥物療效有限的情況下,玻尿酸尤其受到重視。這些注射劑的微創特性,加上其恢復關節功能和延緩手術介入需求的能力,使其成為越來越有吸引力的選擇。

從等級來看,藥用級玻尿酸佔據主導地位,2024 年估值約 37 億美元。此等級透明質酸因其嚴格的品質標準(包括可控的分子量和增強的生物相容性)而備受追捧。它廣泛用於關節注射、眼科手術和可控給藥系統等治療。其高純度和安全性使其可用於注射劑型,從而擴大了其在臨床領域的應用。

就終端用戶而言,醫院在2024年佔據最大佔有率,預計在預測期內將繼續保持強勁需求。這些機構在透明質酸療法的推廣中發揮關鍵作用,尤其是在骨科、眼科和整形外科病房。高技能醫療服務提供者的集中度、支持性報銷框架以及清晰的監管是推動醫院使用透明質酸產品的關鍵因素。隨著醫療實踐越來越傾向於非侵入性或微創干預,對醫藥級透明質酸的依賴也日益增強。

美國市場發展勢頭強勁。市場規模從2021年的16億美元成長至2022年的17億美元,預計2024年將達到21億美元。這一成長反映了骨關節炎的高發病率、美容手術的廣泛應用以及涵蓋黏彈性補充注射的優惠保險政策。在醫療需求和美容創新的共同推動下,美國仍然是透明質酸(HA)最成熟的市場之一。

市場參與者專注於提升產品性能和用戶便利性。包括艾爾建美學 (Allergan Aesthetics)、Anika Therapeutics、輝凌製藥 (Ferring Pharmaceuticals)、BLOOMAGE 和 Bioventus 在內的主要公司正在將投資投入到先進製劑研發中,包括旨在簡化治療方案的單劑量方案。這些公司合計佔據了全球超過 40% 的市場。一個突出的行業趨勢是,人們越來越傾向於使用透過細菌發酵生產的非禽類透明質酸 (HA),因為這種製劑具有更高的安全性、純度和患者相容性。保持競爭力需要公司遵守不斷變化的法規,產生真實世界的使用資料,並與醫療保健專業人士保持積極合作,以支持循證產品的採用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 骨關節炎盛行率不斷上升

- 美容手術數量增加

- 微創手術的需求不斷成長

- HA 基產品的技術進步

- 產業陷阱與挑戰

- 治療費用高昂

- 潛在的不良反應和副作用

- 機會

- 擴大醫療旅遊

- 電子商務與遠距皮膚病學整合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 按產品分類的價格趨勢

- 未來市場趨勢

- 報銷場景

- 消費者行為分析

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 世界其他地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 多次注射劑量

- 單次注射劑量

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 骨關節炎

- 真皮填充劑

- 眼科

- 膀胱輸尿管逆流

- 其他應用

第7章:市場估計與預測:依等級,2021 - 2034 年

- 主要趨勢

- 醫藥級玻尿酸

- 化妝品級玻尿酸

第8章:市場估計與預測:按原產地,2021 - 2034 年

- 主要趨勢

- 非禽類來源

- 禽類起源

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 皮膚科診所

- 門診手術中心

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Allergan Aesthetics

- altergon

- ANIKA

- bioventus

- BLOOMAGE

- FERRING PHARMACEUTICALS

- GALDERMA

- kewpie

- LG Chem

- Lifecore BIOMEDICAL

- Roche

- Sanofi

- SEIKAGAKU CORPORATION

- Teleflex (Deflux)

- TOPSCIENCE

The Global Hyaluronic Acid Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 11 billion by 2034. One of the core factors fueling this upward trend is the rapid development of hyaluronic acid-based formulations across both pharmaceutical and cosmetic domains. The increasing focus on personal appearance, growing uptake of aesthetic procedures, and rising demand for minimally invasive treatments have created a fertile landscape for HA products. There is also a visible shift in public preference towards treatments that offer faster results and fewer side effects. Younger populations are engaging more with cosmetic enhancements, largely influenced by greater self-image awareness and digital culture. At the same time, aging demographics globally are creating a growing need for HA in managing joint-related conditions.

In the medical sector, particularly in orthopedics, HA injections have become a widely accepted method for alleviating joint stiffness and pain. The rising incidence of osteoarthritis-particularly in hips and knees-has increased the number of patients opting for viscosupplementation, a technique where HA is injected directly into the joints. This approach helps restore joint lubrication and reduce friction, offering a less invasive alternative to joint replacement surgeries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $11 Billion |

| CAGR | 7.1% |

As patients seek treatments that delay or avoid surgery, demand for hyaluronic acid injections is seeing consistent growth. HA's role as a naturally occurring substance in connective tissues and synovial fluids gives it an added edge in medical applications, where it functions as a shock absorber and lubricant, improving joint mobility and comfort. Additionally, its properties are being harnessed in external applications like wound healing products and skincare, further diversifying its commercial reach.

In terms of product segmentation, the market is split into multiple injection dose and single injection dose types. The multiple injection dose segment dominated the global market in 2024, accounting for USD 3.1 billion. This form remains popular among clinicians and patients managing osteoarthritis due to its proven efficacy in reducing joint discomfort over a longer duration. Typically, treatment protocols involve a series of weekly injections that offer sustained relief, especially for those experiencing moderate to severe joint degradation. These products are backed by a wealth of clinical data, are generally covered by insurance, and are favored for their track record of safety and effectiveness.

When analyzed by application, the osteoarthritis segment led the market and is projected to reach approximately USD 4.9 billion by 2034. As joint pain continues to rise among aging populations, more individuals are exploring HA-based solutions to manage symptoms. Hyaluronic acid is especially valued in cases where conventional pain relievers and oral medications provide limited results. The minimally invasive nature of these injections, along with their ability to restore joint function and delay the need for surgical intervention, makes them an increasingly attractive option.

On the basis of grade, pharmaceutical-grade hyaluronic acid emerged as the dominant category, with a valuation of around USD 3.7 billion in 2024. This grade is highly sought-after for its stringent quality standards, including controlled molecular weight and enhanced biocompatibility. It is extensively used in treatments such as joint injections, ocular surgeries, and controlled drug delivery systems. Its high purity and safety profile enable its use in injectable formats, expanding its adoption across clinical settings.

Regarding end users, hospitals accounted for the largest share in 2024 and are expected to continue seeing robust demand over the forecast period. These institutions play a pivotal role in the adoption of HA-based therapies, particularly in orthopedic departments, ophthalmology units, and cosmetic surgery wards. The concentration of skilled healthcare providers, supportive reimbursement frameworks, and regulatory clarity are key drivers for HA product use in hospitals. As medical practices increasingly favor non-invasive or minimally invasive interventions, the reliance on pharmaceutical-grade hyaluronic acid continues to strengthen.

In the United States, the market has shown strong momentum. From USD 1.6 billion in 2021, it rose to USD 1.7 billion in 2022, reaching USD 2.1 billion by 2024. This growth reflects the high prevalence of osteoarthritis, widespread adoption of aesthetic procedures, and favorable insurance policies that cover viscosupplementation injections. The country remains one of the most mature markets for HA, driven by a combination of medical demand and cosmetic innovation.

Market players are focused on improving product performance and user convenience. Key companies, including Allergan Aesthetics, Anika Therapeutics, Ferring Pharmaceuticals, BLOOMAGE, and Bioventus, are channeling investments into advanced formulations, including single-dose options aimed at simplifying treatment regimens. These firms collectively represent over 40% of the global market share. A prominent industry trend is the growing preference for non-avian HA produced via bacterial fermentation, which offers enhanced safety, purity, and patient compatibility. Staying competitive requires companies to align with evolving regulations, generate real-world usage data, and maintain active engagement with healthcare professionals to support evidence-based product adoption.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Grade

- 2.2.5 Source of origin

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of osteoarthritis

- 3.2.1.2 Rise in number of aesthetic procedures

- 3.2.1.3 Growing demand for minimally invasive procedures

- 3.2.1.4 Technological advancements in HA-based products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Potential adverse reactions and side effects

- 3.2.3 Opportunities

- 3.2.3.1 Expanding medical tourism

- 3.2.3.2 E-commerce and teledermatology integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends, by product

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.9 Consumer behaviour analysis

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Rest of the world

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Multiple injection dose

- 5.3 Single injection dose

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Osteoarthritis

- 6.3 Dermal fillers

- 6.4 Ophthalmic

- 6.5 Vesicoureteral reflux

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Grade, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pharmaceutical grade hyaluronic acid

- 7.3 Cosmetic grade hyaluronic acid

Chapter 8 Market Estimates and Forecast, By Source of Origin, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Non-Avian origin

- 8.3 Avian origin

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Dermatology clinics

- 9.4 Ambulatory surgical centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Allergan Aesthetics

- 11.2 altergon

- 11.3 ANIKA

- 11.4 bioventus

- 11.5 BLOOMAGE

- 11.6 FERRING PHARMACEUTICALS

- 11.7 GALDERMA

- 11.8 kewpie

- 11.9 LG Chem

- 11.10 Lifecore BIOMEDICAL

- 11.11 Roche

- 11.12 Sanofi

- 11.13 SEIKAGAKU CORPORATION

- 11.14 Teleflex (Deflux)

- 11.15 TOPSCIENCE