|

市場調查報告書

商品編碼

1773242

住宅電壓調節器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Residential Voltage Regulator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

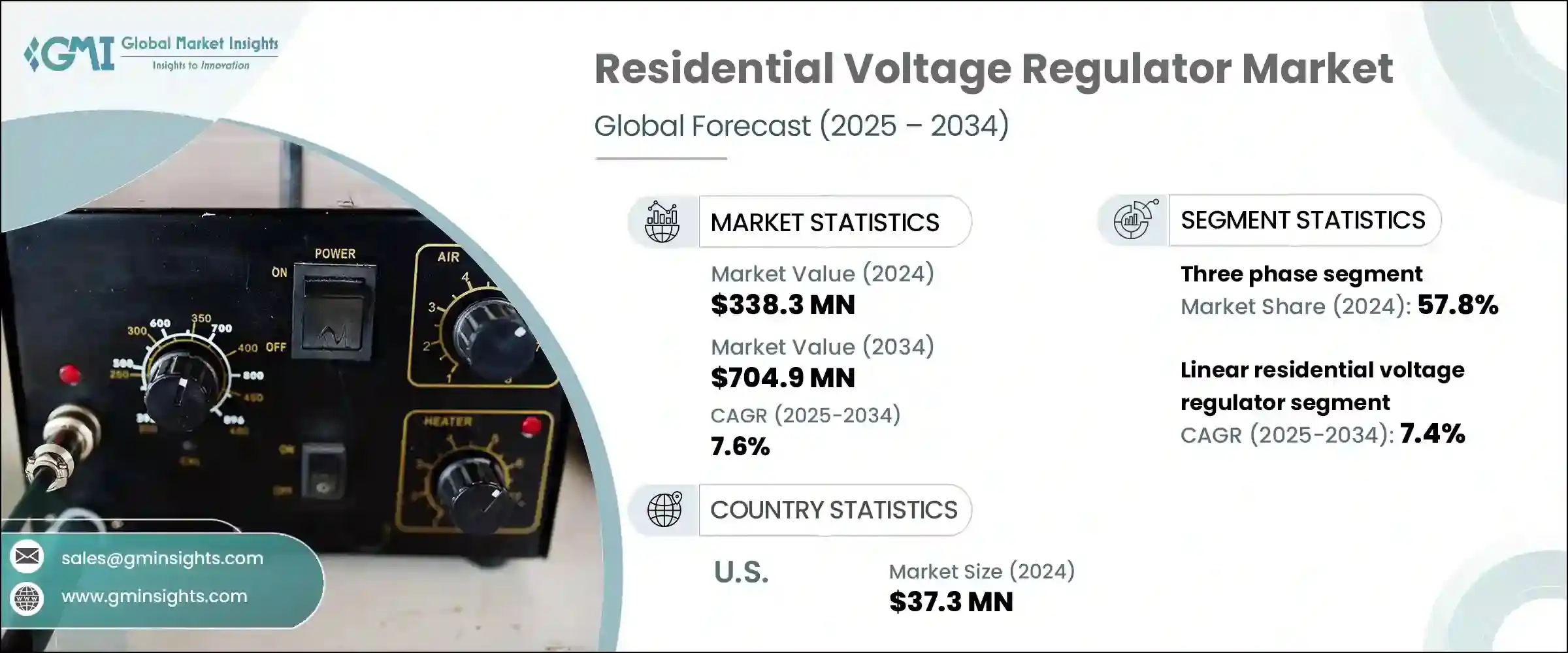

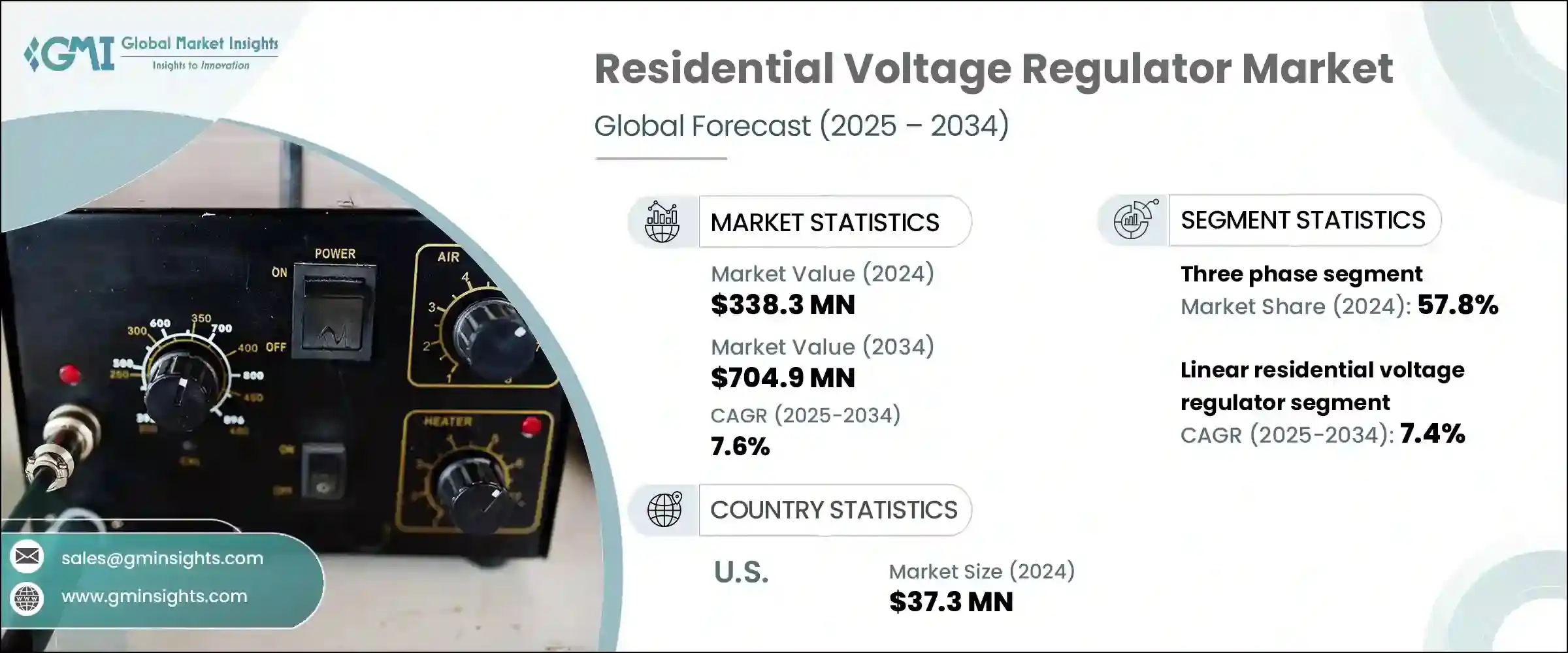

2024年,全球家用電壓調節器市場規模達3.383億美元,預計2034年將以7.6%的複合年成長率成長,達到7.049億美元。電網普遍不穩定、智慧家居整合度不斷提升,以及對保護家用設備免受不可預測電壓波動影響的需求日益成長,共同推動了這一快速成長。電力電子技術的進步,尤其是碳化矽 (SiC) 和氮化鎵 (GaN) 的應用,顯著提高了開關精度、改善了熱處理性能並增強了冷卻響應能力——這些因素正在推動市場需求的成長。這些材料效率的提升支持更智慧、更快速、更緊湊的電壓調節解決方案,使其成為當今不斷發展的住宅能源配置中不可或缺的一部分。

發展中國家公共和私人部門在數位電網現代化和能源普及項目上的投資激增,預計將擴大市場覆蓋範圍。太陽能光電、儲能裝置以及暖通空調系統、冰箱和智慧電視等連網電器的日益普及,正鼓勵屋主投資更智慧的穩壓器。消費者的偏好正轉向支援物聯網的系統,這些系統可以透過行動裝置進行即時監控和遠端控制。同時,永續生活的概念也促使家庭選擇能源效率更高、運作功耗更低、長期電力成本更低的穩壓器。隨著越來越多的地區電力供應不穩定、停電頻繁,製造商優先考慮專為家庭環境設計的經濟實惠且堅固耐用的穩壓器,這正在加速整個行業的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.383億美元 |

| 預測值 | 7.049億美元 |

| 複合年成長率 | 7.6% |

到2034年,線性穩壓器市場的複合年成長率預計將達到7.4%。該市場受益於小型機器人、精密醫療設備和消費性電子產品等家用應用對穩定電壓日益成長的需求。這些穩壓器設計簡潔、噪音低、反應速度快,非常適合在小型環境中需要高性能的住宅安裝。隨著這些應用在日常生活中越來越普遍,對可靠線性穩壓器的需求將持續成長。

預計到2034年,單相穩壓器市場規模將達到2.5億美元。這類系統尤其受到使用230V或120V供電的家庭的青睞,這在許多地區都是標準電壓。它們廣泛應用於照明系統、家用電器和其他低負載住宅應用,使其成為城市和郊區家庭的經濟高效的解決方案。中型住宅(尤其是在電力需求適中的地區)對單相穩壓器的使用日益成長,進一步支撐了這一趨勢,有助於推動該領域的長期成長軌跡。

2024年,美國家用穩壓器市場規模達3,730萬美元。智慧家電生態系統的不斷擴張,使得高性能穩壓器的需求日益成長,這些穩壓器能夠保護敏感電子設備免受電源波動的影響。先進的電壓控制系統的整合不僅可以防止損壞,還能提高能源管理效率,從而促進更廣泛的應用和需求。隨著美國電網的現代化和家庭科技化的日益普及,穩壓器日益被視為維護可靠性和性能的必備硬體。

Maschinenfabrik Reinhausen、Vishay Intertechnology、SEMTECH、Selec Controls、瑞薩電子、Legrand、東芝美國能源系統公司、英飛凌科技、Vicor、Purevolt、意法半導體、羅姆、BTRAC、ABB、理光美國、Analog Devices、vonject、Mr.kalk、Molecro、Mild Vernova、西門子、特瑞仕半導體、巴斯勒電氣。領先的公司正專注於開發緊湊、高效且兼容物聯網的穩壓器,以滿足智慧住宅生態系統的需求。人們越來越重視使用氮化鎵 (GaN) 和碳化矽 (SiC) 等先進的半導體技術來提高能源效率並最大限度地減少熱量產生。為了鞏固市場地位,各公司也正在投資研發、建立策略聯盟並擴展產品客製化能力,以滿足不同地區的電壓需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 線性

- 交換

第6章:市場規模及預測:依階段,2021 - 2034

- 主要趨勢

- 單相

- 三相

第7章:市場規模及預測:按電壓,2021 - 2034

- 主要趨勢

- ≤5千伏安

- > 5 kVA 至 20 kVA

- > 20 千伏安至 40 千伏安

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 荷蘭

- 奧地利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 馬來西亞

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 科威特

- 阿曼

- 拉丁美洲

- 巴西

- 秘魯

- 阿根廷

第9章:公司簡介

- ABB

- Analog Devices

- Basler Electric

- BTRAC

- Eaton

- GE Vernova

- Infineon Technologies

- Legrand

- Maschinenfabrik Reinhausen

- Microchip Technologies

- NXP Semiconductors

- Purevolt

- Renesas Electronics

- Ricoh USA

- ROHM

- Selec Controls

- Selvon Instruments

- SEMTECH

- Siemens

- STMicroelectronics

- TOREX SEMICONDUCTOR

- Toshiba America Energy Systems Corporation

- Vicor

- Vishay Intertechnology

The Global Residential Voltage Regulator Market was valued at USD 338.3 million in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 704.9 million by 2034. This rapid growth is being fueled by widespread grid unreliability, expanding smart home integration, and an increased need to protect household devices from unpredictable voltage fluctuations. Advancements in power electronics, especially the use of silicon carbide (SiC) and gallium nitride (GaN), have significantly elevated the precision of switching, improved thermal handling, and enhanced cooling response-factors that are pushing demand higher. The increased efficiency of these materials supports smarter, faster, and more compact voltage regulation solutions, making them essential in today's evolving residential energy setups.

The surge in public and private investments in digital grid modernization and energy access programs across developing nations is expected to elevate the market's reach. The rising deployment of solar PVs, energy storage units, and connected appliances like HVAC systems, refrigerators, and smart TVs is encouraging homeowners to invest in smarter regulators. Consumer preference is shifting toward IoT-enabled systems that allow real-time monitoring and remote control through mobile devices. Simultaneously, the push for sustainable living is prompting households to opt for voltage regulators with higher energy efficiency, lower operational power use, and reduced long-term utility costs. With more regions experiencing unstable electricity supplies and frequent power outages, manufacturers are prioritizing affordable and rugged voltage regulation units specifically designed for household environments, which is accelerating overall industry growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $338.3 Million |

| Forecast Value | $704.9 Million |

| CAGR | 7.6% |

The linear voltage regulator segment is set to register a CAGR of 7.4% through 2034. This segment is benefiting from a growing demand for stable voltage in home-based applications such as compact robotics, precision medical devices, and consumer electronics. These regulators offer simple design, low noise, and fast response, making them ideal for residential installations that require high performance in small-scale environments. As these applications become more common in daily life, the need for reliable linear regulators will continue to increase.

The single-phase voltage regulator segment is projected to reach USD 250 million by 2034. These systems are especially favored in homes operating on 230V or 120V supply, which are standard in many regions. Their widespread use in lighting systems, home appliances, and other low-load residential applications makes them a cost-effective solution for both urban and suburban households. The growing uptake in mid-sized homes-particularly in areas with moderate electrical demands-is further supporting this trend, helping to push the segment's long-term growth trajectory upward.

United States Residential Voltage Regulator Market generated USD 37.3 million in 2024. The expanding ecosystem of smart home appliances has increased the necessity for high-performance regulators capable of protecting sensitive electronics from fluctuating power conditions. The integration of advanced voltage control systems not only prevents damage but also enhances energy management efficiency, contributing to broader adoption and demand. As the U.S. power grid modernizes and homes become more tech-centric, voltage regulators are increasingly seen as essential hardware for maintaining reliability and performance.

Maschinenfabrik Reinhausen, Vishay Intertechnology, SEMTECH, Selec Controls, Renesas Electronics, Legrand, Toshiba America Energy Systems Corporation, Infineon Technologies, Vicor, Purevolt, STMicroelectronics, ROHM, BTRAC, ABB, Ricoh USA, Analog Devices, Microchip Technologies, NXP Semiconductors, Eaton, Selvon Instruments, GE Vernova, Siemens, TOREX SEMICONDUCTOR, Basler Electric. Leading companies are focusing on developing compact, high-efficiency, and IoT-compatible regulators that cater specifically to smart residential ecosystems. There's a growing emphasis on using advanced semiconductor technologies such as GaN and SiC to increase energy efficiency and minimize heat generation. To strengthen market position, firms are also investing in R&D, forming strategic alliances, and expanding product customization capabilities to address regional voltage requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Linear

- 5.3 Switching

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 ≤ 5 kVA

- 7.3 > 5 kVA to 20 kVA

- 7.4 > 20 kVA to 40 kVA

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Russia

- 8.3.4 UK

- 8.3.5 Italy

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.3.8 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 New Zealand

- 8.4.7 Malaysia

- 8.4.8 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Egypt

- 8.5.5 South Africa

- 8.5.6 Nigeria

- 8.5.7 Kuwait

- 8.5.8 Oman

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Analog Devices

- 9.3 Basler Electric

- 9.4 BTRAC

- 9.5 Eaton

- 9.6 GE Vernova

- 9.7 Infineon Technologies

- 9.8 Legrand

- 9.9 Maschinenfabrik Reinhausen

- 9.10 Microchip Technologies

- 9.11 NXP Semiconductors

- 9.12 Purevolt

- 9.13 Renesas Electronics

- 9.14 Ricoh USA

- 9.15 ROHM

- 9.16 Selec Controls

- 9.17 Selvon Instruments

- 9.18 SEMTECH

- 9.19 Siemens

- 9.20 STMicroelectronics

- 9.21 TOREX SEMICONDUCTOR

- 9.22 Toshiba America Energy Systems Corporation

- 9.23 Vicor

- 9.24 Vishay Intertechnology