|

市場調查報告書

商品編碼

1773238

獸醫皮膚病藥物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Veterinary Dermatology Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

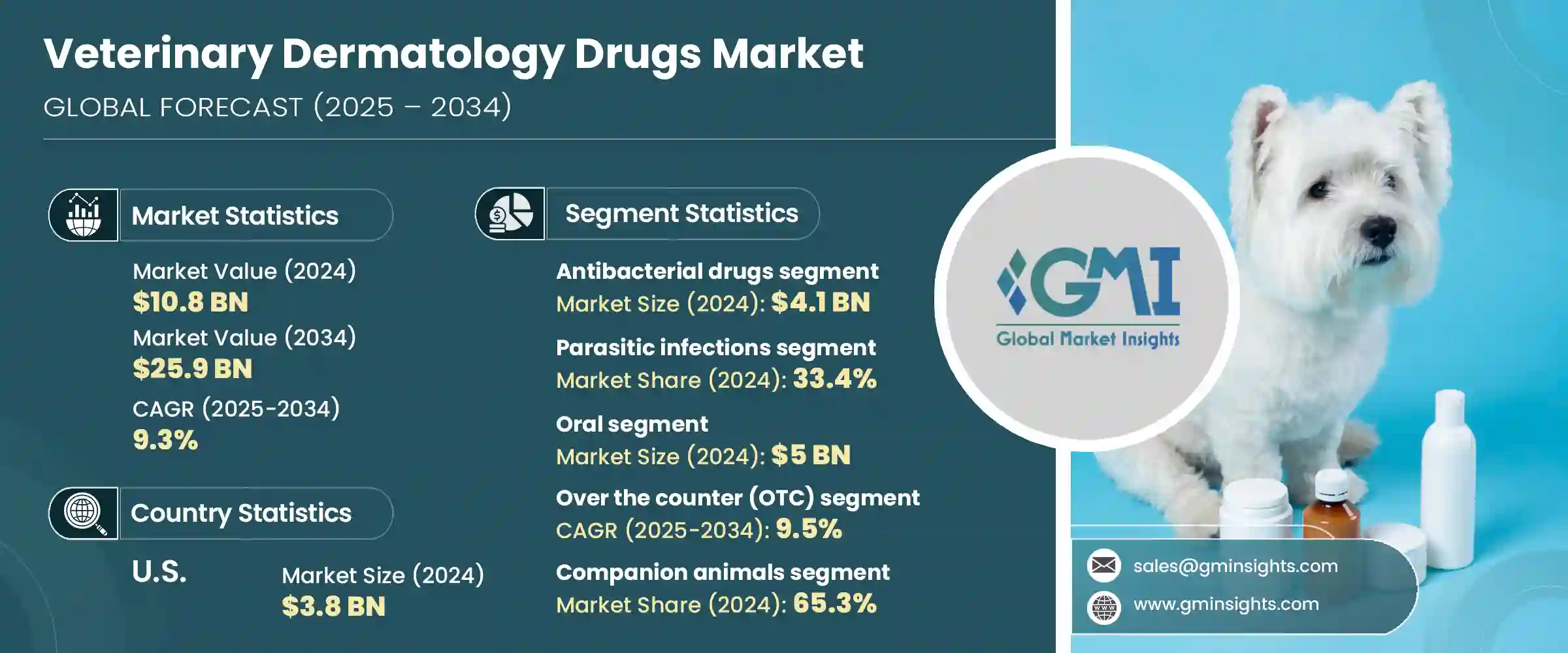

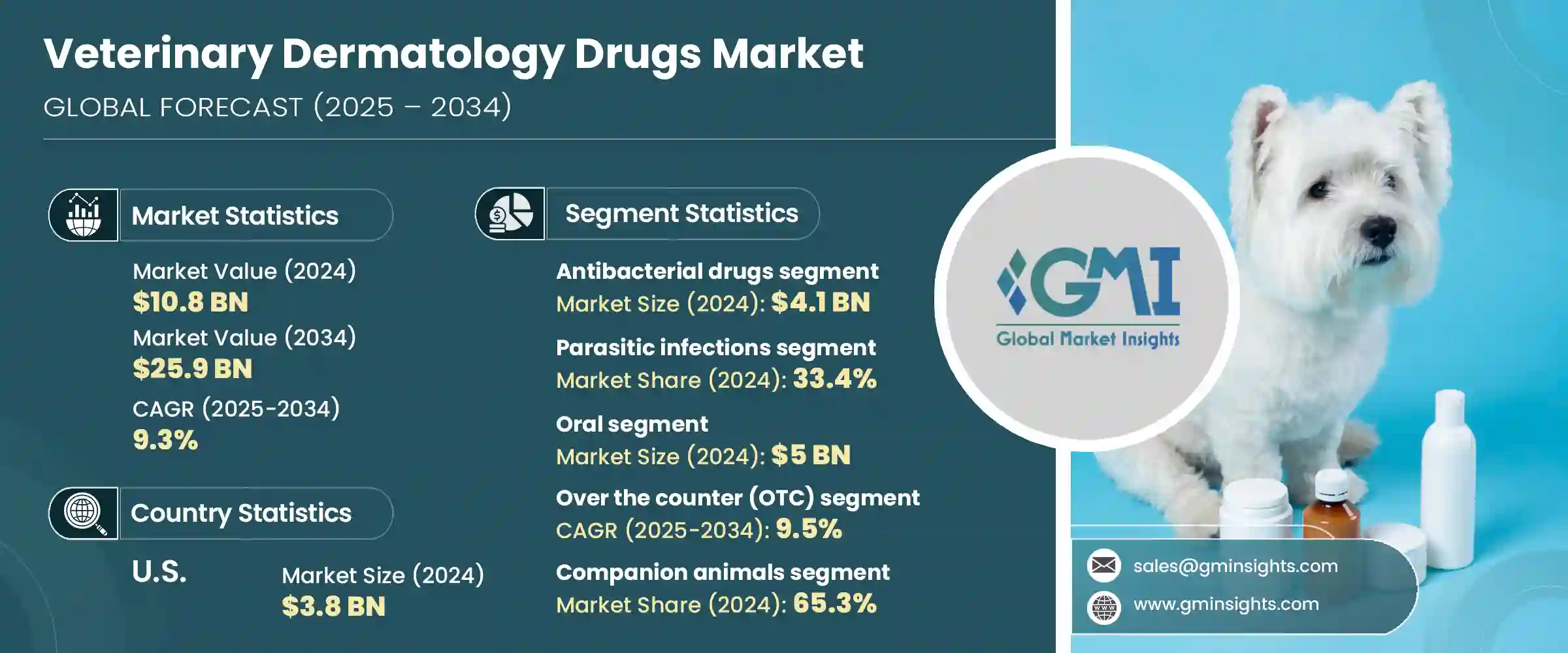

2024 年全球獸用皮膚病藥物市場規模為 108 億美元,預計到 2034 年將以 9.3% 的複合年成長率成長,達到 259 億美元。推動這一成長的主要因素是動物皮膚病發病率的急劇上升,以及人們對寵物健康保健意識的不斷提高。隨著全球寵物擁有量的持續成長,用於治療皮膚病的獸藥需求激增。動物保健支出的增加和醫療化率的提高進一步擴大了這一需求,尤其是在伴侶動物更為普遍的城市地區。新興經濟體,尤其是亞太和拉丁美洲等地區,對動物保健基礎設施的投資正在增強,這為市場擴張創造了有利條件。

推動市場發展的另一個因素是先進皮膚科藥物的開發,這些藥物旨在最大限度地減少副作用,同時提高療效。製藥公司正專注於開發新的劑型,尤其是外用和口服藥物,以提高給藥的便利性和療效。隨著人們對皮膚病對動物健康影響的認知不斷提高,市場對皮膚科專用藥物的接受度也越來越高。此外,牲畜和伴侶動物皮膚感染的增加也推動了早期診斷和治療的需求,從而促進了皮膚科藥物在獸醫實踐中的廣泛使用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 108億美元 |

| 預測值 | 259億美元 |

| 複合年成長率 | 9.3% |

獸用皮膚科藥物涵蓋了用於治療動物皮膚疾病的廣泛領域,涵蓋從感染、發炎到自體免疫性皮膚病的各種疾病。這些藥物通常分為幾類,包括抗菌藥、抗真菌藥、抗寄生蟲藥和抗發炎藥物。這些藥物可透過多種途徑給藥,例如口服、外用和注射,這取決於動物的病情和對治療的反應。

就藥物類別而言,抗菌藥物佔據最大的市場佔有率,2024 年價值達到 41 億美元。細菌性皮膚感染(尤其是在伴侶動物中)的發生率不斷上升,這在很大程度上推動了對抗菌獸藥的需求。隨著這些感染日益普遍,獸醫開始尋求更先進的抗菌製劑和聯合療法,以獲得更有效的治療效果。抗藥性菌株的出現也加速了對更強效、更有針對性的抗菌產品的需求。此外,人們對這些疾病的認知不斷提高,診斷能力也不斷提升,使得早期發現成為可能,從而推動了抗菌獸藥領域持續佔據主導地位。

以適應症分類,寄生蟲感染佔據最大市場佔有率,2024年佔總市場佔有率的33.4%。寄生蟲引起的皮膚病是動物最常見的皮膚病之一。環境和氣候條件的變化是導致寄生蟲疾病傳播加劇的原因之一,尤其是在熱帶地區。為此,製藥公司正在推出外用和口服兩種形式的長效抗寄生蟲藥物。這些新劑型著重簡化治療程序,同時提供持久保護。抗寄生蟲藥物研發領域的持續研究和創新,加上有利的監管條件,正在支持該領域的成長。透過擴大分銷網路來提升可及性,也促進了該領域的強勁表現。

在各種給藥途徑中,口服藥物在2024年佔據了50億美元的市場,預計到2034年將以9%的複合年成長率成長。口服給藥因其系統性給藥方式而廣受青睞,該方式允許藥物在血液中循環,從而解決皮膚問題的根本原因。由於動物通常更容易接受口服藥物,因此口服藥物也能確保更好的依從性。高依從性有助於獲得一致的治療效果,從而推動該領域的需求。

從區域來看,北美引領全球獸用皮膚病藥物市場,2024 年佔 38.6% 的佔有率。光是美國市場當年的規模就達到 38 億美元,高於 2023 年的 35 億美元。該地區的成長得益於其強大的研發能力和不斷改進的藥物配方。伴侶動物數量眾多以及對寵物照顧的文化重視是該地區主導的關鍵。隨著寵物主人不斷為他們的寵物投資高階醫療保健解決方案,對皮膚病藥物的需求也隨之成長。

市場競爭依然激烈,眾多參與者透過精準研發、藥物配方創新、地理擴張以及遵守不斷變化的監管標準等方式爭相搶佔市場佔有率。各公司越來越注重研發滿足動物獨特皮膚病學需求的專用產品,並在這個快速成長的領域中確立策略性定位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 皮膚病發生率上升

- 技術進步

- 獸醫皮膚科醫師數量不斷增加

- 增加動物保健支出

- 產業陷阱與挑戰

- 不良副作用和安全問題

- 治療費用高昂

- 市場機會

- 寵物擁有量和支出不斷增加

- 拓展電子商務與零售通路

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 定價分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

第5章:市場估計與預測:按藥物類別,2021 年至 2034 年

- 主要趨勢

- 抗菌藥物

- 抗真菌藥物

- 抗寄生蟲藥物

- 其他藥物類別

第6章:市場估計與預測:按適應症,2021 年至 2034 年

- 主要趨勢

- 寄生蟲感染

- 過敏性感染

- 自體免疫性皮膚病

- 皮膚癌

- 其他適應症

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 外用

- 注射劑

第8章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 處方

- 場外交易(OTC)

第9章:市場估計與預測:按動物類型,2021 年至 2034 年

- 主要趨勢

- 伴侶動物

- 狗

- 貓

- 馬匹

- 其他伴侶動物

- 牲畜

- 牛

- 豬

- 其他牲畜

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 獸醫院藥房

- 零售藥局

- 網路藥局

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Bimeda

- Bioiberica

- Boehringer Ingelheim

- Ceva Sante Animale

- Dechra Pharmaceuticals

- Elanco Animal Health

- Indian Immunologicals

- Merck & Co.

- Vee Remedies

- Virbac

- Vetoquinol

- Vivaldis

- Zoetis

The Global Veterinary Dermatology Drugs Market was valued at USD 10.8 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 25.9 billion by 2034. This growth is being driven by a sharp increase in the incidence of skin disorders among animals, coupled with rising awareness around pet health and wellness. As pet ownership continues to rise worldwide, demand for veterinary drugs designed to treat dermatological issues has surged. This demand is further amplified by an uptick in animal healthcare spending and an increasing medicalization rate, particularly in urban areas where companion animals are more prevalent. Investment in animal healthcare infrastructure is gaining momentum across emerging economies, especially in regions such as Asia-Pacific and Latin America, creating favorable conditions for market expansion.

Another factor contributing to the market's progress is the development of advanced dermatological drugs aimed at minimizing side effects while enhancing therapeutic outcomes. Pharmaceutical companies are focusing on new formulations, particularly topical and oral options, that improve ease of administration and efficacy. As awareness continues to grow about the impact of skin diseases on animal health, the market is witnessing greater acceptance of dermatology-specific medications. Additionally, the rise in skin infections among livestock and companion animals is pushing the need for early diagnosis and treatment, encouraging the widespread use of dermatology drugs across veterinary practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.8 Billion |

| Forecast Value | $25.9 Billion |

| CAGR | 9.3% |

Veterinary dermatology drugs encompass a broad spectrum of treatments used to manage and cure skin disorders in animals, ranging from infections and inflammations to autoimmune skin conditions. These medications are typically categorized into several drug classes, including antibacterial, antifungal, antiparasitic, and anti-inflammatory drugs. These drugs are administered through multiple routes, such as oral, topical, and injectable, depending on the condition and the animal's response to treatment.

In terms of drug class, antibacterial medications held the largest market share, reaching a value of USD 4.1 billion in 2024. The demand for antibacterial veterinary drugs is largely fueled by the increasing frequency of bacterial skin infections, particularly among companion animals. As these infections become more common, veterinarians are turning to more advanced antibacterial formulations and combination therapies to deliver effective results. The emergence of drug-resistant strains has also accelerated the need for stronger and more targeted antibacterial products. Furthermore, the rising awareness of these conditions and improvements in diagnostic capabilities have enabled early detection, contributing to the consistent dominance of this segment.

By indication, parasitic infections accounted for the largest market share, capturing 33.4% of the total in 2024. Skin conditions caused by parasites are among the most common dermatological issues in animals. Changes in environmental and climatic conditions are playing a role in the increased spread of parasitic diseases, particularly in tropical climates. In response, pharmaceutical companies are introducing long-acting antiparasitic drugs in both topical and oral forms. These new formulations focus on simplifying treatment routines while delivering lasting protection. Ongoing research and innovation in antiparasitic drug development, combined with favorable regulatory conditions, are supporting segment growth. Enhanced access through expanded distribution networks has also contributed to the segment's strong performance.

Among the various routes of administration, oral drugs accounted for USD 5 billion in 2024 and are forecast to grow at a CAGR of 9% through 2034. Oral administration is widely preferred due to its systemic approach, which allows the drug to circulate through the bloodstream and tackle the root cause of skin issues. It also ensures better compliance, as animals tend to accept oral medications more readily than external applications. This high compliance rate contributes to consistent treatment results, which in turn drives demand in this segment.

Regionally, North America led the global veterinary dermatology drugs market, holding a 38.6% share in 2024. The market in the United States alone was valued at USD 3.8 billion that year, up from USD 3.5 billion in 2023. Growth in this region can be attributed to the presence of robust R&D capabilities and the steady introduction of improved drug formulations. The high volume of companion animals and the cultural emphasis on pet care are central to the region's dominant market position. As pet owners continue to invest in premium healthcare solutions for their animals, the demand for dermatology drugs has followed suit.

Competition within the market remains strong, with numerous players striving to gain market share through targeted R&D, innovation in drug formulations, geographic expansion, and compliance with evolving regulatory standards. Companies are increasingly focusing on creating specialized products that meet the unique dermatological needs of animals, positioning themselves strategically within this rapidly growing sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug class

- 2.2.3 Indication

- 2.2.4 Route of administration

- 2.2.5 Type

- 2.2.6 Animal type

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of dermatological diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing number of veterinary dermatology practitioners

- 3.2.1.4 Increased spending on animal healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse side effects and safety concerns

- 3.2.2.2 High cost of treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Rising pet ownership and spending

- 3.2.3.2 Expansion of e-commerce and retail channels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antibacterial drugs

- 5.3 Antifungal drugs

- 5.4 Antiparasitic drugs

- 5.5 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Parasitic infections

- 6.3 Allergic infections

- 6.4 Autoimmune skin diseases

- 6.5 Skin cancer

- 6.6 Other indications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Topical

- 7.4 Injectable

Chapter 8 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Prescription

- 8.3 Over the counter (OTC)

Chapter 9 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Companion animals

- 9.2.1 Dogs

- 9.2.2 Cats

- 9.2.3 Horses

- 9.2.4 Other companion animals

- 9.3 Livestock animals

- 9.3.1 Bovine

- 9.3.2 Swine

- 9.3.3 Other livestock animals

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Veterinary hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Bimeda

- 12.2 Bioiberica

- 12.3 Boehringer Ingelheim

- 12.4 Ceva Sante Animale

- 12.5 Dechra Pharmaceuticals

- 12.6 Elanco Animal Health

- 12.7 Indian Immunologicals

- 12.8 Merck & Co.

- 12.9 Vee Remedies

- 12.10 Virbac

- 12.11 Vetoquinol

- 12.12 Vivaldis

- 12.13 Zoetis