|

市場調查報告書

商品編碼

1773235

再生能源接觸器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Renewable Energy Contactor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

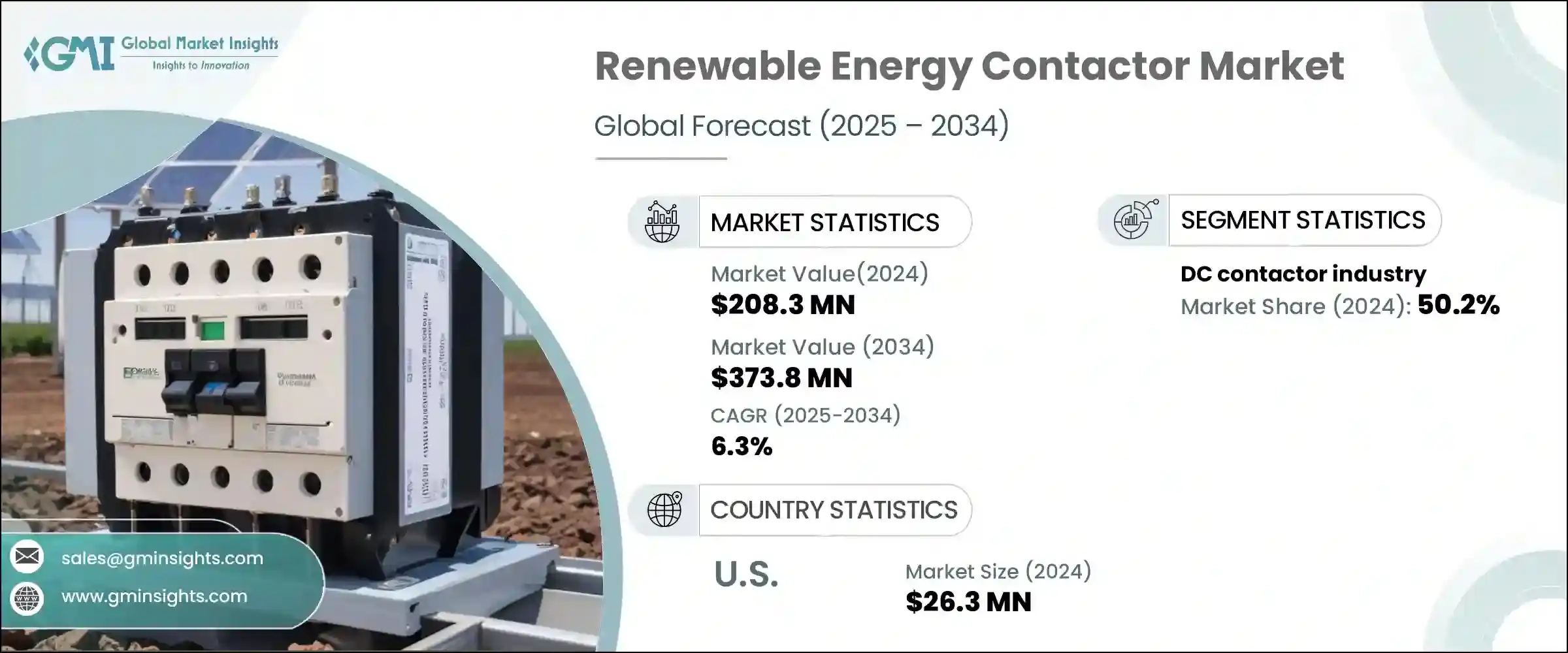

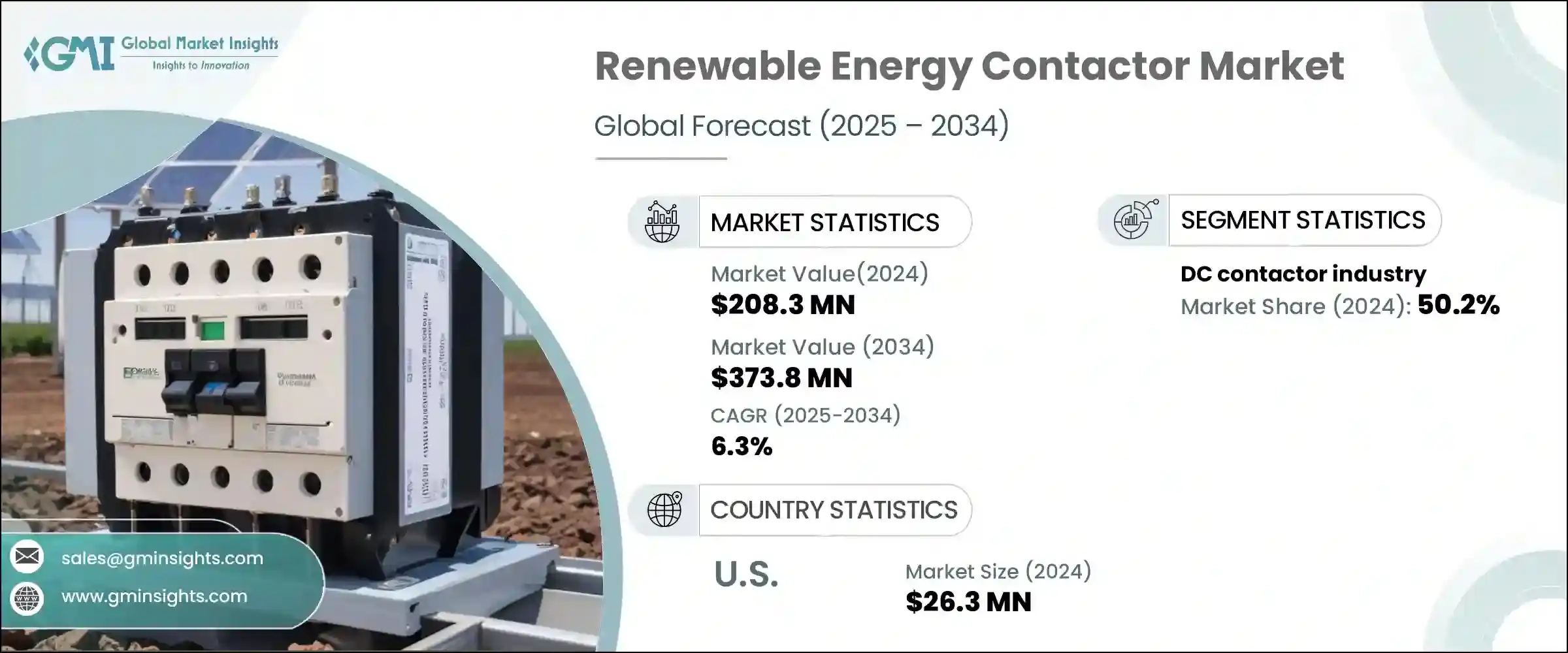

2024年,全球再生能源接觸器市場規模達2.083億美元,預計2034年將以6.3%的複合年成長率成長,達到3.738億美元。這一成長主要得益於旨在加速清潔能源轉型的支持性政策的持續實施。隨著太陽能和風能等再生能源在全球的普及,對能夠處理高電壓和高電流負載的電氣接觸器的需求持續成長。不斷擴張的再生能源基礎設施以及政府支持的投資,正在顯著影響再生能源承包商的需求前景。大規模清潔能源裝置的快速部署正推動製造商開發高性能、與電網相容的組件。

日益增強的環保意識是推動採用光伏技術的另一個重要催化劑。人們對全球氣溫上升、碳排放以及氣候相關災害頻繁的擔憂日益加劇,促使各行各業和政策制定者紛紛放棄化石燃料。現代電網系統正變得越來越智慧,互聯程度越來越高,這增加了對能夠安全高效地管理能源流動的先進接觸器解決方案的需求。這些智慧系統需要承包商能夠在動態電力環境中提供高精度、高耐用性和高能源效率的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.083億美元 |

| 預測值 | 3.738億美元 |

| 複合年成長率 | 6.3% |

2024年,直流接觸器市場佔有50.2%的佔有率,這得益於直流(DC)配置在再生能源系統中的廣泛整合。商用和民用太陽能光電系統通常都採用直流電。在這些應用中,直流接觸器發揮著至關重要的作用,包括面板斷開、組串隔離和逆變器介面管理。隨著儲能解決方案和分散式電網的日益普及,對強大的直流開關機制的需求正在迅速成長。政府對直流能源系統的支持也為該市場的成長增添了動力。

2024年,美國再生能源接觸器市場規模達2,630萬美元。北美地區(尤其是美國)嚴格的監管架構正在加強對綠色能源技術的推動。對永續性和低碳營運的重視為接觸器在公用事業規模和工業再生能源設施中的應用創造了有利的環境。

全球再生能源接觸器市場中的頂級公司包括 ABB、羅克韋爾自動化、LS ELECTRIC、L&T 和 TE Connectivity。為了擴大市場佔有率並鞏固市場地位,再生能源接觸器市場的領先公司正在大力投資產品創新,專注於效率、安全性和適用於再生能源應用的緊湊型設計。許多公司正在整合智慧診斷和數位通訊功能,以適應電網現代化和智慧能源系統。他們正在與太陽能和風能開發商建立策略合作夥伴關係,以確保簽訂長期供應合約。各公司也透過併購和建立本地製造中心來擴大其區域影響力,以提高回應能力和成本效益。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 直流接觸器

- 交流接觸器

第6章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- ABB

- Carlo Gavazzi

- Curtiss-Wright

- Eaton

- Fuji Electric FA Components & Systems Co., Ltd.

- GEYA Electrical Equipment Supply

- KA Schmersal GmbH & Co. KG

- L&T

- LOVATO Electric SpA

- LS ELECTRIC

- Mitsubishi Electric Corporation

- Rockwell Automation

- Schaltbau

- Schneider Electric

- Sensata Technologies, Inc.

- Siemens

- TE Connectivity

- Toshiba International Corporation

The Global Renewable Energy Contactor Market was valued at USD 208.3 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 373.8 million by 2034. This growth is largely being fueled by the increasing implementation of supportive policies designed to accelerate clean energy transitions. As renewable power sources such as solar and wind gain traction globally, the demand for electrical contactors capable of handling elevated voltage and current loads continues to rise. Expanding renewable infrastructure, along with government-backed investments, is significantly shaping the demand outlook for renewable energy contractors. Rapid deployment of large-scale clean power installations is pushing manufacturers to develop high-performance, grid-compatible components.

Growing environmental awareness is another major catalyst driving adoption. Heightened concern about rising global temperatures, carbon emissions, and more frequent climate-related disasters is prompting industries and policymakers to shift away from fossil fuels. Modern grid systems are becoming smarter and more interconnected, increasing the need for advanced contactor solutions that can safely and efficiently manage energy flows. These smart systems require contractors who deliver high precision, durability, and energy efficiency in dynamic power environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $208.3 Million |

| Forecast Value | $373.8 Million |

| CAGR | 6.3% |

The DC contactors segment held a 50.2% share in 2024, driven by the widespread integration of direct current (DC) configurations within renewable systems. Solar PV systems, both at the commercial and residential levels, naturally operate on DC power. In these applications, DC contactors serve vital roles, including panel disconnection, string isolation, and inverter interface management. As storage solutions and decentralized grids become more common, demand for robust DC switching mechanisms is scaling rapidly. Government support for DC-based energy systems is also adding momentum to this segment's growth.

United States Renewable Energy Contactor Market was valued at USD 26.3 million in 2024. Strict regulatory frameworks across North America, particularly in the U.S., are reinforcing the push for green energy technologies. Emphasis on sustainability and low-carbon operations has created a favorable environment for contactor adoption in utility-scale and industrial renewable energy setups.

The top companies operating in the Global Renewable Energy Contactor Market are ABB, Rockwell Automation, LS ELECTRIC, L&T, and TE Connectivity. To expand their market share and strengthen their positioning, leading companies in the renewable energy contactor market are investing heavily in product innovation focused on efficiency, safety, and compact designs suited for renewable applications. Many are integrating smart diagnostics and digital communication features to align with grid modernization and smart energy systems. Strategic partnerships with solar and wind energy developers are being used to secure long-term supply contracts. Firms are also expanding their regional footprints through mergers, acquisitions, and the establishment of local manufacturing hubs to improve responsiveness and cost efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 DC contactors

- 5.3 AC contactors

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 UK

- 6.3.4 Spain

- 6.3.5 Italy

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 South Africa

- 6.5.3 UAE

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 ABB

- 7.2 Carlo Gavazzi

- 7.3 Curtiss-Wright

- 7.4 Eaton

- 7.5 Fuji Electric FA Components & Systems Co., Ltd.

- 7.6 GEYA Electrical Equipment Supply

- 7.7 K.A. Schmersal GmbH & Co. KG

- 7.8 L&T

- 7.9 LOVATO Electric S.p.A.

- 7.10 LS ELECTRIC

- 7.11 Mitsubishi Electric Corporation

- 7.12 Rockwell Automation

- 7.13 Schaltbau

- 7.14 Schneider Electric

- 7.15 Sensata Technologies, Inc.

- 7.16 Siemens

- 7.17 TE Connectivity

- 7.18 Toshiba International Corporation