|

市場調查報告書

商品編碼

1773231

高強度聚焦超音波 (HIFU) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測High Intensity Focused Ultrasound (HIFU) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

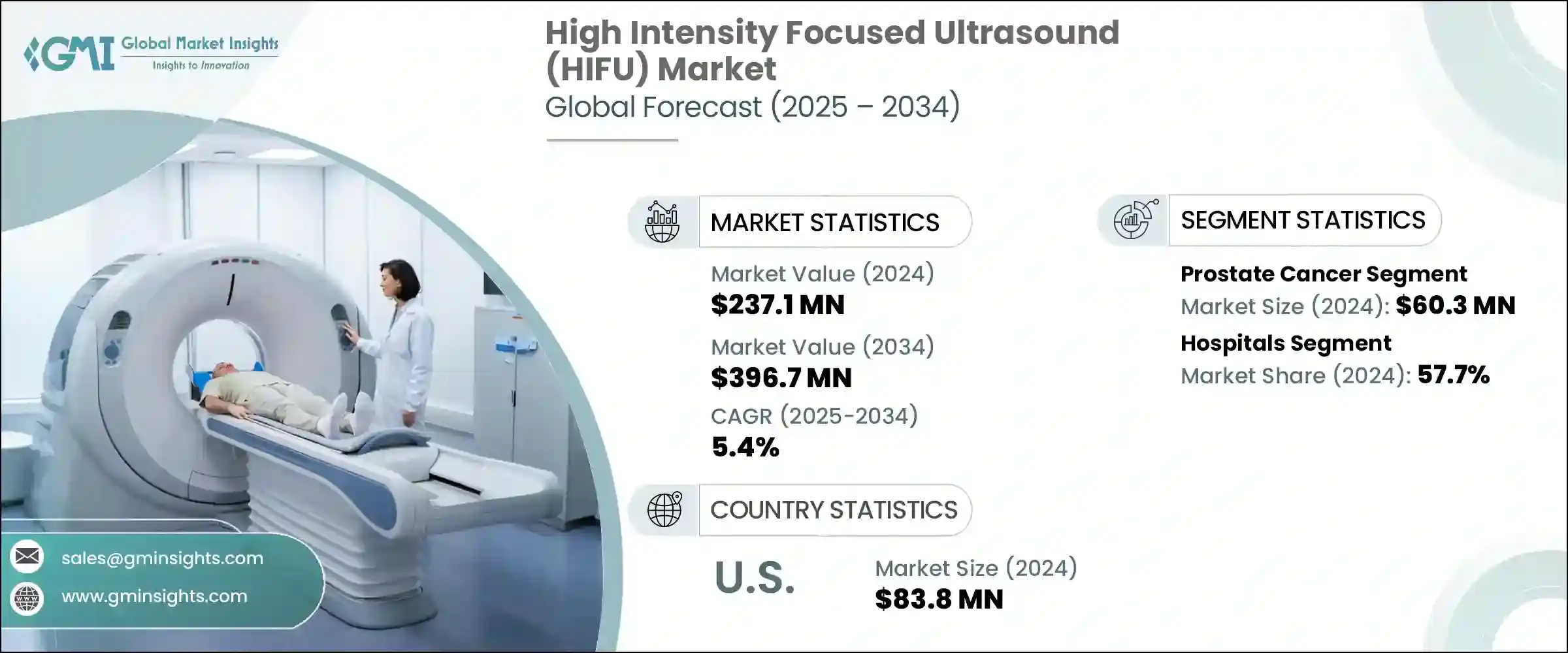

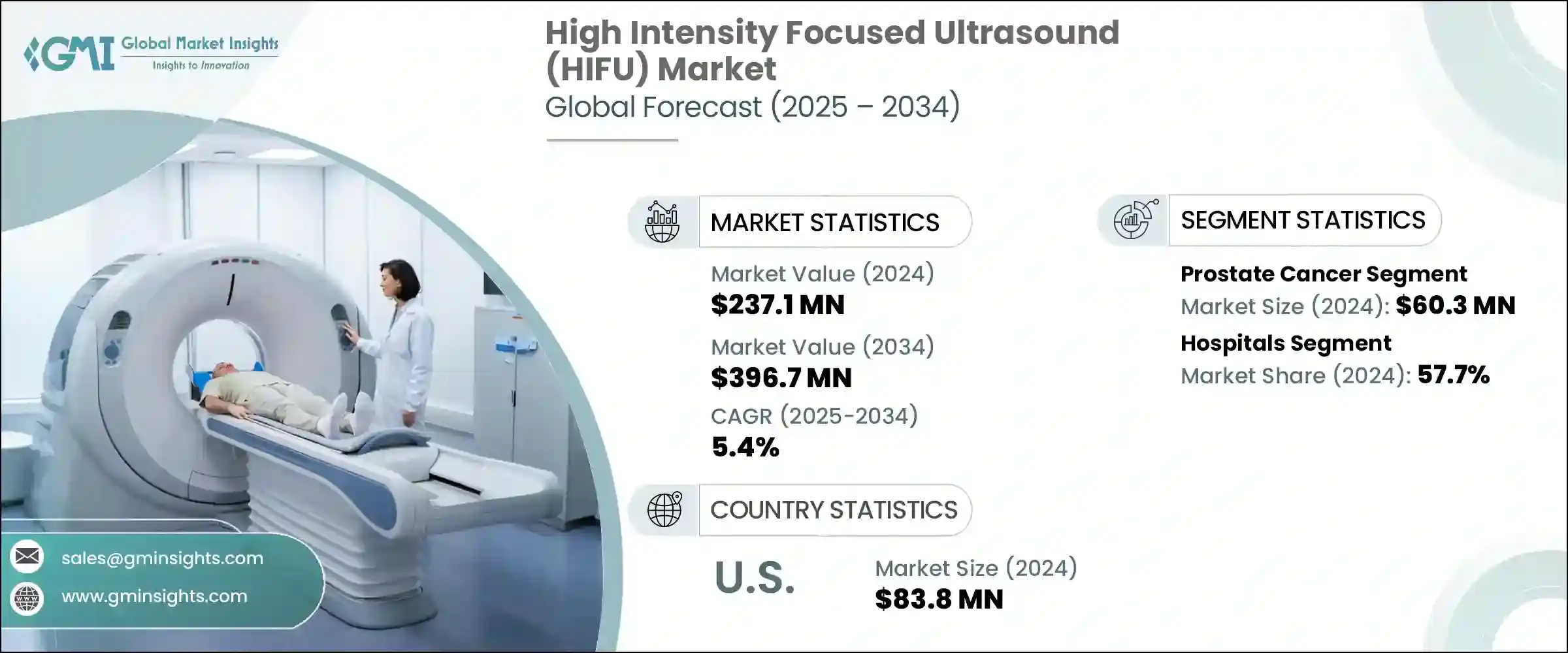

2024 年全球高強度聚焦超音波 (HIFU) 市值為 2.371 億美元,預計到 2034 年將以 5.4% 的複合年成長率成長至 3.967 億美元。 HIFU 是一種非侵入性治療方法,已獲得 FDA 批准用於治療腫瘤和震顫等各種慢性疾病。 HIFU 的普及歸功於它無需切口或長時間恢復即可治療患者。隨著人們對非侵入性治療方案的認知不斷提高以及癌症等疾病發病率的上升,預計未來幾年全球對 HIFU 的需求將激增。患者和醫療保健提供者都越來越傾向於選擇能夠最大限度降低手術風險、減少住院時間並縮短恢復時間的療法——這些因素強烈支持高強度聚焦超音波 (HIFU) 技術的應用。

此外,隨著全球醫療保健體系強調早期發現和標靶治療,HIFU因其能夠精準破壞腫瘤組織而不損傷周圍健康結構,成為極具吸引力的解決方案。 HIFU的應用範圍不斷擴展,超越腫瘤領域,例如子宮肌瘤、前列腺疾病和神經系統疾病的治療,進一步提升了其市場潛力。影像引導、即時監測以及與機器人平台整合的進步,正在提升HIFU的臨床療效和可近性。此外,主要市場加大研發投入,以及監管機構的積極核准,預計將加速下一代HIFU系統的開發和商業化。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.371億美元 |

| 預測值 | 3.967億美元 |

| 複合年成長率 | 5.4% |

2024年,攝護腺癌細分市場收入達6,030萬美元。人們對早期診斷的認知不斷提高以及高強度聚焦超音波(HIFU)技術的進步,顯著促進了該細分市場的擴張。 HIFU已成為手術和放射治療等傳統療法的微創替代方案,其恢復期更短,副作用更少。這些優勢使其成為患者和醫護人員的首選治療方案。持續的研發投入,致力於提高HIFU系統的精準度和有效性,進一步促進了此細分市場的成長。

依終端用戶分類,市場分為醫院、影像中心和其他領域。 2024年,醫院領域佔最大佔有率,達57.7%。醫院提供全面的治療選擇,使其成為HIFU治療的主要場所。 HIFU在兒童和成人等不同年齡層中的廣泛接受度和有效性,進一步鞏固了其在這些醫療機構中的應用。此外,醫院基礎設施投資的不斷增加,以及FDA和CE等監管機構對HIFU設備的批准,也推動了該領域的進一步成長。

2024年,美國高強度聚焦超音波 (HIFU) 市場規模達8,380萬美元。美國前列腺癌的高發生率,加上其先進的醫療基礎設施,正在推動對HIFU等非侵入性治療方案的需求。嚴格的監管環境,加上醫療創新領域不斷增加的投資,正推動這項技術的普及,確保未來幾年市場持續擴張。

一些知名公司正在積極塑造高強度聚焦超音波 (HIFU) 產業的競爭格局。主要參與者包括 Sonablate、Profound Medical、EDAP TMS、Insightec、重慶海扶醫療科技、ULTRAISER、ILJIN Holdings、Verasonics、Theraclion、FUSMobile、Lynton Lasers、EpiSonic 和 EpiSonic。這些參與者正在策略性地投資於產品創新、臨床研究和全球擴張,以維持和擴大其市場地位。為了鞏固市場地位,HIFU 產業的公司正在採取幾項關鍵策略。這些包括將其臨床應用組合從腫瘤學擴展到神經病學、婦科和泌尿科。他們正在與醫院和研究機構建立合作夥伴關係,以驗證和商業化 HIFU 技術的新用例。此外,許多參與者正專注於向非侵入性療法越來越受歡迎的新興市場進行地理擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病發生率上升

- 增加監管批准和報銷政策

- 非侵入性療法日益受到青睞

- 擴大在非癌症疾病的應用

- 產業陷阱與挑戰

- 設備和手術成本高昂

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 未來市場趨勢

- 差距分析

- LIFU 的新興和研究應用

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 子宮肌瘤

- 攝護腺癌

- 特發性震顫

- 皮膚科

- 乳癌

- 青光眼

- 背痛

- 其他應用

第6章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 影像中心

- 其他最終用途

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- Chongqing Haifu Medical Technology

- EDAP TMS

- EpiSonic

- FUSMobile

- Insightec

- ILJIN Holdings

- Lynton Lasers

- Profound Medical

- Sonablate

- Theraclion

- ULTRAISER

- Verasonics

The Global High Intensity Focused Ultrasound (HIFU) Market was valued at USD 237.1 million in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 396.7 million by 2034. HIFU is a non-invasive treatment that has gained FDA approval for addressing various chronic conditions, including tumors and tremors. The growing adoption of HIFU is attributed to its ability to treat patients without the need for incisions or long recovery times. With increasing awareness of non-invasive treatment options and the rising prevalence of conditions like cancer, the demand for HIFU is expected to surge globally in the coming years. Patients and healthcare providers alike are showing a growing preference for therapies that minimize surgical risks, reduce hospital stays, and offer faster recovery times-factors that strongly favor the adoption of high-intensity focused ultrasound (HIFU) technologies.

Additionally, as global healthcare systems emphasize early detection and targeted treatment, HIFU presents a compelling solution due to its precision in destroying tumor tissues without damaging surrounding healthy structures. The expanding applications of HIFU beyond oncology, such as in the treatment of uterine fibroids, prostate disorders, and neurological conditions, further boost its market potential. Advancements in imaging guidance, real-time monitoring, and integration with robotic platforms are enhancing HIFU's clinical efficacy and accessibility. Moreover, increased investments in research and favorable regulatory approvals across key markets are expected to accelerate the development and commercialization of next-generation HIFU systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $237.1 Million |

| Forecast Value | $396.7 Million |

| CAGR | 5.4% |

The prostate cancer segment generated USD 60.3 million in 2024. Increased awareness around early diagnosis and advancements in HIFU technology have significantly contributed to the segment's expansion. HIFU had emerged as a minimally invasive alternative to conventional treatments like surgery and radiation therapy, offering shorter recovery periods and fewer side effects. These benefits have positioned it as a preferred option for both patients and medical professionals. The segment's growth was further reinforced by continuous research and development initiatives focused on improving the accuracy and effectiveness of HIFU systems.

By end-user, the market is divided into hospitals, imaging centers, and other sectors. In 2024, the hospital segment accounted for the largest share of 57.7%. Hospitals provide comprehensive therapeutic options, making them the primary location for HIFU treatments. The wide acceptance and effectiveness of HIFU across various age groups, including children and adults, has further reinforced its use in these healthcare settings. Moreover, increasing investments in hospital infrastructure and the approval of HIFU devices by regulatory bodies such as the FDA and CE drive further growth within this segment.

U.S. High Intensity Focused Ultrasound (HIFU) Market generated USD 83.8 million in 2024. The high incidence of prostate cancer in the U.S., coupled with the country's advanced healthcare infrastructure, is fueling demand for non-invasive treatment options like HIFU. The strong regulatory environment, combined with increasing investment in healthcare innovations, is contributing to the growing adoption of this technology, ensuring continued market expansion in the coming years.

Several prominent companies are actively shaping the competitive landscape of the High-Intensity Focused Ultrasound (HIFU) Industry. Key participants include Sonablate, Profound Medical, EDAP TMS, Insightec, Chongqing Haifu Medical Technology, ULTRAISER, ILJIN Holdings, Verasonics, Theraclion, FUSMobile, Lynton Lasers, EpiSonic, and EpiSonic. These players are strategically investing in product innovation, clinical research, and global expansion to maintain and grow their market positions. To strengthen their market foothold, companies in the HIFU industry are adopting several key strategies. These include expanding their clinical application portfolio beyond oncology to include neurology, gynecology, and urology. They are forming partnerships with hospitals and research institutes to validate and commercialize new use cases for HIFU technology. Furthermore, many players are focusing on geographical expansion into emerging markets where non-invasive therapies are gaining traction.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Application

- 2.2.2 End use

- 2.2.3 Regional

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic diseases

- 3.2.1.2 Increasing regulatory approvals and reimbursement policies

- 3.2.1.3 Increasing preference for non-invasive therapies

- 3.2.1.4 Expanding applications in non-cancer diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of equipment and procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.3.1 By application

- 3.3.2 By end use

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Emerging and investigational applications of LIFU

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Uterine fibroids

- 5.3 Prostate cancer

- 5.4 Essential tremor

- 5.5 Dermatology

- 5.6 Breast cancer

- 5.7 Glaucoma

- 5.8 Backpain

- 5.9 Other applications

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Imaging centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Chongqing Haifu Medical Technology

- 8.2 EDAP TMS

- 8.3 EpiSonic

- 8.4 FUSMobile

- 8.5 Insightec

- 8.6 ILJIN Holdings

- 8.7 Lynton Lasers

- 8.8 Profound Medical

- 8.9 Sonablate

- 8.10 Theraclion

- 8.11 ULTRAISER

- 8.12 Verasonics