|

市場調查報告書

商品編碼

1773215

固定式燃料電池市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Stationary Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球固定式燃料電池市場規模達16億美元,預計2034年將以13.7%的複合年成長率成長,達到59億美元。這些燃料電池提供穩定可靠的電力來源,使其成為永久裝置的理想選擇。它們可以使用各種燃料,例如氫氣、沼氣或天然氣,具體取決於燃料電池技術的類型。小型和大型燃料電池系統的需求不斷成長,以及公共和私營部門對氫能基礎設施的投資,可能會推動市場成長。

隨著企業尋求可靠清潔的能源解決方案,燃料電池擴大用於關鍵區域供電,從而減少對電網的依賴並增強能源安全。這些系統提供不間斷供電,排放量極低,非常適合停機可能導致重大營運損失的行業。其可擴展性和靈活性也使其能夠整合到各種應用中——從資料中心和醫院到遠端設施以及製造業的備用電源。此外,隨著永續發展目標的日益嚴格和碳減排目標的日益嚴格,向燃料電池技術的轉變與更廣泛的環境和監管要求相一致。這種轉變正在推動公共和私營部門的投資和創新,進一步加速燃料電池在全球的普及。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 59億美元 |

| 複合年成長率 | 13.7% |

預計到2034年,住宅市場規模將超過22億美元,這得益於住宅環境對更小尺寸、更低噪音電源的需求日益成長。這些特性使得固定式燃料電池能夠以可靠、緊湊的能源解決方案,為城郊和城市住宅提供高效的能源解決方案。此外,消費者對能源獨立性、永續性和清潔能源優勢的認知也將推動該產業的擴張。

預計到2034年,熱電聯產(CHP)市場價值將超過9億美元,這得益於燃料電池系統卓越的熱效率,該系統能夠同時產生電能和熱能,從而最大限度地提高能源利用率並減少損耗。 2024年2月,Scale Microgrids收購了位於康乃狄克州布里奇波特的一個9.6兆瓦的熱電聯產燃料電池項目,該項目包含一個1.6英里(約2.6公里)的熱迴路,將由HyAxiom公司製造和營運。此外,工業製程熱能需求的不斷成長將影響產品的部署。

預計2034年,亞太地區固定式燃料電池市場規模將達48億美元。中國和印度等國的快速城鎮化預計將刺激燃料電池的普及。此外,隨著各行各業日益尋求經濟高效、永續的能源解決方案來滿足其高功率需求,亞太地區的主要製造業中心也將推動市場大幅成長,從而進一步加速該地區固定式燃料電池的部署。

固定式燃料電池產業的知名企業有 Altergy、AFC Energy、Bloom Energy、Ballard Power Systems、Cummins、Doosan Fuel Cell、Fuji Electric、Fuel Cell Energy、GenCell、poscoenergy、Plug Power、Nuvera Fuel Cells、西門子能源、SFC Energy 和東芝公司。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- < 3 千瓦

- 3 - 10 千瓦

- >10 - 50 千瓦

- >50千瓦

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 主電源

- 熱電聯產

- 其他

第7章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業/公用事業

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 奧地利

- 亞太地區

- 日本

- 韓國

- 中國

- 印度

- 菲律賓

- 越南

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 拉丁美洲

- 巴西

- 秘魯

- 墨西哥

第9章:公司簡介

- Altergy

- AFC Energy

- Bloom Energy

- Ballard Power Systems

- Cummins

- Doosan Fuel Cell

- Fuji Electric

- Fuel Cell Energy

- GenCell

- poscoenergy

- Plug Power

- Nuvera Fuel Cells

- Siemens Energy

- SFC Energy

- Toshiba Corporation

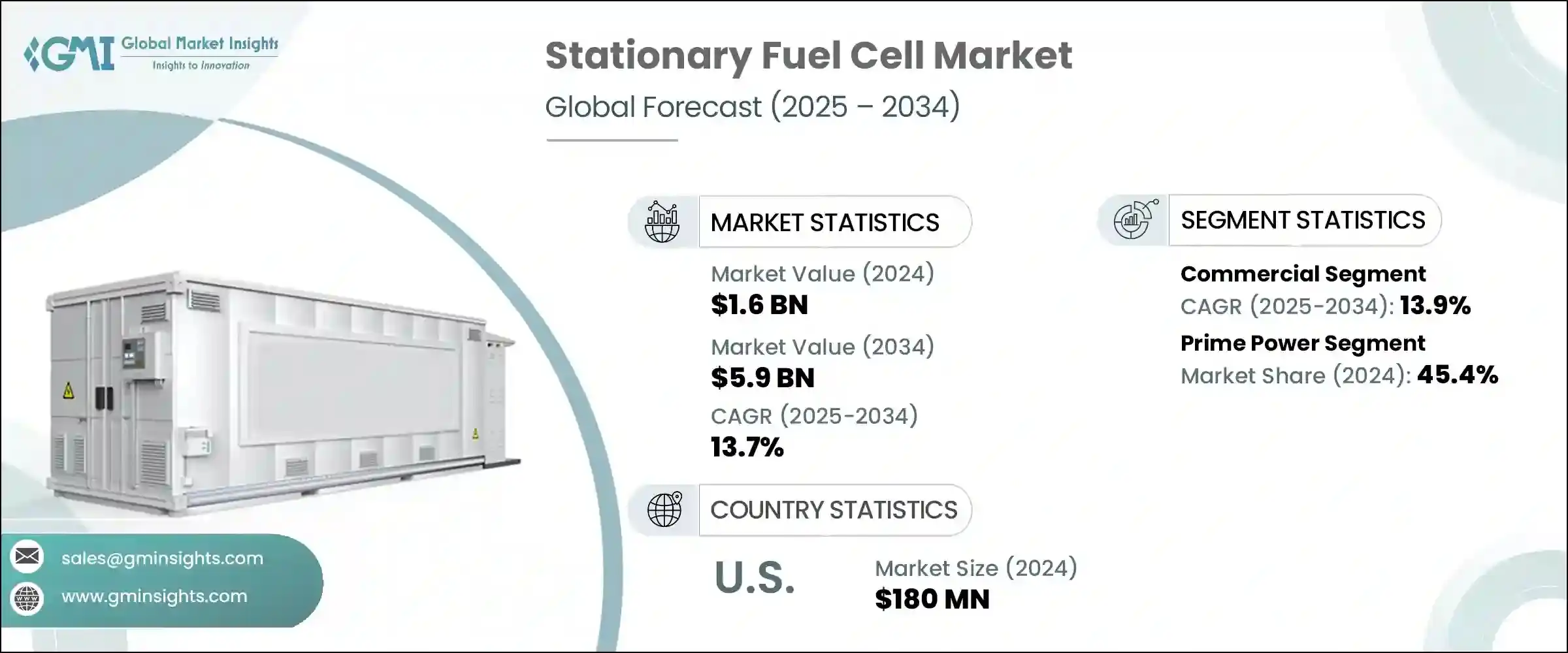

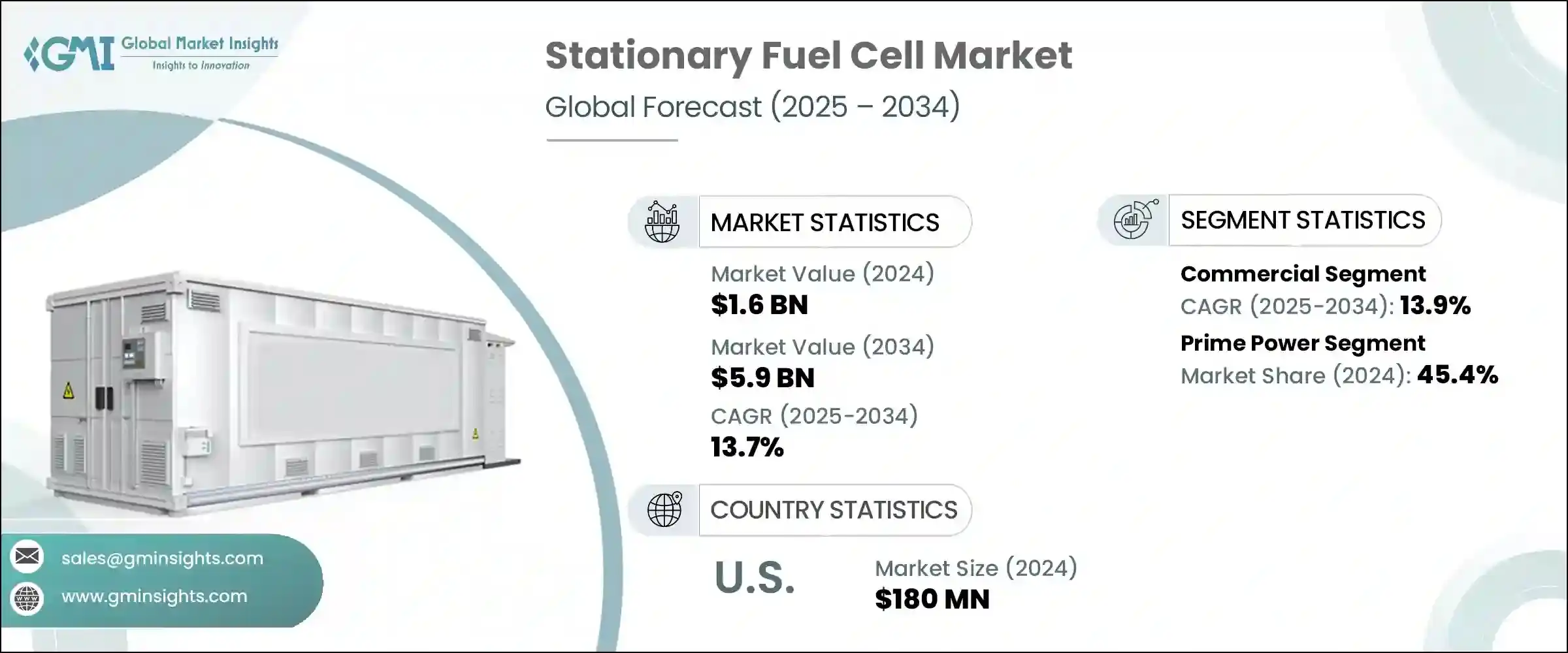

The Global Stationary Fuel Cell Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 13.7% to reach USD 5.9 billion by 2034. These fuel cells provide a stable and dependable electricity source, making them ideal for permanent installations. They can run on various fuels, such as hydrogen, biogas, or natural gas, depending on the type of fuel cell technology. The rising demand for both small and large-capacity fuel cell systems, along with investments in hydrogen infrastructure by both public and private sectors, will likely boost market growth.

As businesses seek reliable and clean energy solutions, fuel cells are increasingly used to provide power in critical areas, reducing grid dependence and enhancing energy security. These systems offer uninterrupted power supply with minimal emissions, making them ideal for industries where downtime can lead to significant operational losses. Their scalability and flexibility also allow integration across a wide range of applications-from data centers and hospitals to remote facilities and backup power in manufacturing. Moreover, as sustainability goals tighten and carbon reduction targets become more stringent, the shift toward fuel cell technology aligns with broader environmental and regulatory mandates. This transition is driving investment and innovation across both public and private sectors, further accelerating fuel cell adoption globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 13.7% |

The residential segment is estimated to reach over USD 2.2 billion by 2034, augmented by the growing need for smaller sizes and lower noise-level power sources in the residential environment. These features make stationary fuel cells highly efficient for suburban and urban residences in the form of reliable and compact energy solutions. Additionally, consumer awareness about energy independence, sustainability, and the benefits of clean energy will drive the industry expansion.

The CHP segment is estimated to be worth more than USD 0.9 billion by 2034, owing to the great thermal efficiency of fuel cell systems that generate power and heat together, maximizing the energy utilization and reducing losses. In February 2024, Scale Microgrids acquired a 9.6 MW CHP fuel cell project in Bridgeport, Connecticut, which includes a 1.6-mile thermal loop and will be fabricated and operated by HyAxiom. Moreover, growing demand for industrial process heat will influence product deployment.

Asia Pacific stationary fuel cell market is projected to hit USD 4.8 billion by 2034. Rapid urbanization in countries including China and India is expected to stimulate fuel cell adoption. Additionally, Asia Pacific's major manufacturing hubs will foster substantial market growth as industries increasingly seek cost-effective, efficient, and sustainable energy solutions to meet their high-power requirements, further accelerating stationary fuel cell deployment in the region.

Eminent players operating in the stationary fuel cell industry are Altergy, AFC Energy, Bloom Energy, Ballard Power Systems, Cummins, Doosan Fuel Cell, Fuji Electric, Fuel Cell Energy, GenCell, poscoenergy, Plug Power, Nuvera Fuel Cells, Siemens Energy, SFC Energy, and Toshiba Corporation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 < 3 kW

- 5.3 3 - 10 kW

- 5.4 >10 - 50 kW

- 5.5 >50 kW

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Prime power

- 6.3 CHP

- 6.4 Others

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industry/utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 South Korea

- 8.4.3 China

- 8.4.4 India

- 8.4.5 Philippines

- 8.4.6 Vietnam

- 8.5 Middle East & Africa

- 8.5.1 South Africa

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 Altergy

- 9.2 AFC Energy

- 9.3 Bloom Energy

- 9.4 Ballard Power Systems

- 9.5 Cummins

- 9.6 Doosan Fuel Cell

- 9.7 Fuji Electric

- 9.8 Fuel Cell Energy

- 9.9 GenCell

- 9.10 poscoenergy

- 9.11 Plug Power

- 9.12 Nuvera Fuel Cells

- 9.13 Siemens Energy

- 9.14 SFC Energy

- 9.15 Toshiba Corporation