|

市場調查報告書

商品編碼

1766351

藥物篩選市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Drug Screening Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

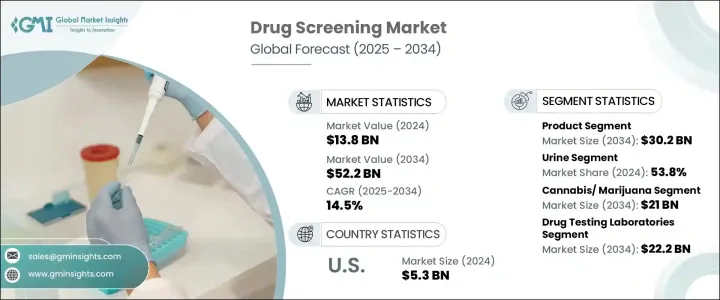

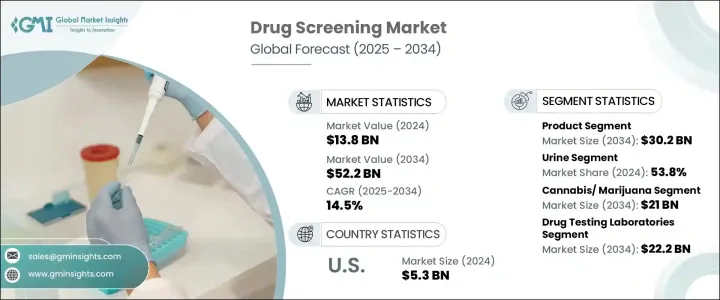

2024年,全球藥物篩檢市場規模達138億美元,預計年複合成長率將達14.5%,到2034年將達到522億美元。這一成長得益於人們對藥物濫用問題的日益關注、藥物檢測技術的進步,以及就業、體育和醫療保健等各個領域訂定的更嚴格政策。世界各國政府正在加強打擊藥物濫用的力度,這進一步刺激了市場對有效篩檢解決方案的需求。

液相層析質譜法 (LC-MS) 和免疫分析等尖端技術顯著提高了藥物篩檢流程的準確性和效率。此外,快速篩檢試劑盒和現場檢測設備的普及也使篩檢流程更加便捷,並縮短了獲得結果所需的時間。這使得藥物篩檢解決方案對於工作場所安全和合規性至關重要,尤其是在《無毒品工作場所法案》等法規的監管下,該法案已成為市場擴張的驅動力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 138億美元 |

| 預測值 | 522億美元 |

| 複合年成長率 | 14.5% |

藥物篩檢涉及檢測血液、尿液、毛髮、唾液或汗水等生物樣本,以檢測藥物或其代謝物。市場涵蓋各種用於藥物檢測的工具和服務,包括免疫分析儀、色譜系統、呼吸分析儀、口腔液體檢測試劑盒和快速檢測設備等檢測設備。實驗室篩檢和現場篩檢都是業界常用的方法。

該產品細分市場佔據了最大的市場佔有率,2024年價值達81億美元。此細分市場包括免疫分析儀、色譜儀和呼吸分析儀等重要工具,這些工具對於提供準確可靠的檢測結果至關重要。快速檢測設備因其便攜性、易用性和即時結果的能力而特別搶手,是工作場所和緊急檢測場景的理想選擇。樣本採集套件、校準套件和控制裝置等耗材也需求旺盛,因為它們使用頻繁,需要定期補充。

2024年,尿液藥物檢測佔最大佔有率,達53.8%,預計預測期內將進一步成長。尿液檢測因其成本效益高、可靠性高且能夠檢測多種物質,仍是最廣泛使用的方法。由於代謝物會隨尿液排出,因此尿液是識別近期藥物使用情況的理想樣本。尿液檢測通常用於工作場所藥物檢測、入職前篩檢和復健計畫。其非侵入式採集方法以及檢測大麻素、鴉片類藥物、苯丙胺和苯二氮平類藥物等物質的能力,使其成為藥物濫用管理計畫中不可或缺的一部分。

2024年,北美藥物篩檢市場規模達59億美元,預計2034年將達212億美元,複合年成長率達14%。北美市場引領市場,這得益於嚴格的監管要求、技術創新以及高度的工作場所安全意識。美國的監管框架,包括交通部(DOT)和藥物濫用與精神健康服務管理局(SAMHSA)的授權,要求在交通運輸、醫療保健和政府等各行各業進行藥物檢測。

全球藥物篩選市場的主要參與者包括雅培、安捷倫、Dragerwerk、美國實驗室公司 (LabCorp)、Quest Diagnostics、賽默飛世爾科技、羅氏和 Lifeloc Technologies 等公司。這些公司合計佔有相當大的市場佔有率,在推動創新、法規遵循和開發高效能的藥物檢測技術方面發揮重要作用。為了提升市場地位,藥物篩選市場的公司專注於多種策略。領先的公司正在大力投資研發,以創新和提高檢測技術的準確性和速度。他們也正在擴大產品組合,以滿足醫療保健、就業和執法等廣泛行業的需求。他們也正在與研究機構和其他企業建立策略夥伴關係和合作關係,以擴大市場範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 毒品和酒精消費量不斷增加

- 有嚴格的法律支援藥物篩選

- 藥物濫用檢測產品和服務日益普及

- 產業陷阱與挑戰

- 禁止工作場所藥物測試

- 缺乏訓練有素的實驗室專業人員

- 市場機會

- 工作場所擴大採用藥物檢測政策

- 發展中國家意識的提高與政策執行的加強

- 成長動力

- 成長潛力分析

- 監管格局

- 技術和創新格局

- 差距分析

- 2024 年按產品和服務分類的藥物篩選量分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 按產品和服務進行的公司佔有率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 擴張計劃

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 產品

- 分析儀器

- 免疫分析儀

- 色譜分析儀

- 呼吸分析儀

- 口腔液體檢測分析儀

- 快速檢測設備

- 耗材

- 分析儀器

- 藥物篩選服務

第6章:市場估計與預測:依樣本類型,2021 - 2034 年

- 主要趨勢

- 尿

- 氣息

- 口腔液體

- 頭髮

- 其他樣本類型

第7章:市場估計與預測:按藥物類型,2021 - 2034 年

- 主要趨勢

- 大麻

- 鴉片類藥物

- 酒精

- 安非他明

- 其他藥物類型

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 藥物檢測實驗室

- 工作場所

- 醫院

- 執法機構

- 其他最終用途

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott

- Agilent

- Alcohol Countermeasure Systems

- Alfa Scientific Designs

- Dragerwerk

- Eurofins Scientific

- F. Hoffmann-La Roche

- Laboratory Corporation of America (LabCorp)

- Lifeloc Technologies

- Omega Laboratories

- OraSure Technologies

- PerkinElmer

- Premier Biotech

- Psychemedics

- Quest Diagnostics

- Shimadzu

- Siemens Healthineers

- Thermo Fisher Scientific

The Global Drug Screening Market was valued at USD 13.8 billion in 2024 and is estimated to grow at a CAGR of 14.5% to reach USD 52.2 billion by 2034. This growth can be attributed to an increasing focus on addressing substance abuse issues, advancements in drug testing technologies, and the rise of stricter policies in various sectors, including employment, sports, and healthcare. Governments worldwide are intensifying efforts to combat drug abuse, which is further spurring market demand for effective screening solutions.

Cutting-edge technologies like liquid chromatography-mass spectrometry (LC-MS) and immunoassays have significantly improved the accuracy and efficiency of drug screening processes. Moreover, the rise in accessibility to rapid screening kits and on-site testing devices is making the process more convenient and reducing the time required for results. This has made drug screening solutions indispensable for workplace safety and compliance, especially under regulations like the Drug-Free Workplace Act, which has become a driving force behind the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.8 Billion |

| Forecast Value | $52.2 Billion |

| CAGR | 14.5% |

Drug screening involves testing biological samples such as blood, urine, hair, saliva, or sweat to detect drugs or their metabolites. The market encompasses a wide range of tools and services designed for drug detection, including testing devices such as immunoassay analyzers, chromatography systems, breath analyzers, oral fluid testing kits, and rapid test devices. Both laboratory and on-site screenings are common methods used in the industry.

The product segment accounted for the largest share of the market, valued at USD 8.1 billion in 2024. This segment includes essential tools such as immunoassay analyzers, chromatographic instruments, and breath analyzers, which are pivotal in delivering accurate and reliable results. Rapid testing devices are particularly in demand due to their portability, ease of use, and ability to provide immediate results, which makes them ideal for use in workplace and emergency testing scenarios. Consumables like sample collection kits, calibration kits, and control devices are also in high demand, as they are used frequently and require regular replenishment.

The urine-based drug testing segment held the largest share of 53.8% in 2024, with further growth anticipated during the forecast period. Urine testing remains the most widely used method due to its cost-effectiveness, reliability, and ability to detect a broad range of substances. Since metabolites are excreted in urine, it serves as an ideal sample for identifying recent drug use. Urine tests are commonly used for workplace drug testing, pre-employment screenings, and rehabilitation programs. Their non-invasive collection method and ability to detect substances like cannabinoids, opioids, amphetamines, and benzodiazepines make them indispensable in substance abuse management programs.

North America Drug Screening Market generated USD 5.9 billion in 2024 and is projected to reach USD 21.2 billion by 2034, growing at a CAGR of 14%. North America leads the market, driven by stringent regulatory requirements, technological innovations, and high awareness of workplace safety. The regulatory framework in the U.S., including mandates by the Department of Transportation (DOT) and the Substance Abuse and Mental Health Services Administration (SAMHSA), requires drug testing in various industries, including transportation, healthcare, and government.

Key players in the Global Drug Screening Market include companies such as Abbott, Agilent, Dragerwerk, Laboratory Corporation of America (LabCorp), Quest Diagnostics, Thermo Fisher Scientific, F. Hoffmann-La Roche, and Lifeloc Technologies. These companies collectively hold a substantial portion of the market share and are instrumental in driving innovation, regulatory compliance, and developing efficient drug testing technologies. To enhance their market position, companies in the drug screening market focus on several strategies. Leading players are heavily investing in research and development to innovate and improve the accuracy and speed of testing technologies. They are also expanding their product portfolios to cater to a wide range of industries, including healthcare, employment, and law enforcement. Strategic partnerships and collaborations with research institutions and other businesses are also being formed to expand their market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Sample type

- 2.2.4 Drug type

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing drug and alcohol consumption

- 3.2.1.2 Presence of stringent laws to support drug screening

- 3.2.1.3 Growing availability of products and services for drug-of abuse testing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Prohibition on workplace drug testing

- 3.2.2.2 Dearth of trained laboratory professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption of drug testing policies in workplaces

- 3.2.3.2 Rising awareness and policy enforcement in developing countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.6 Gap analysis

- 3.7 Drug screening volume analysis, by product and service, 2024

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 MEA

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company share analysis, by product and service

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Product

- 5.2.1 Analytical instruments

- 5.2.1.1 Immunoassay analyzers

- 5.2.1.2 Chromatographic analyzers

- 5.2.1.3 Breath analyzers

- 5.2.1.4 Oral fluid testing analyzers

- 5.2.2 Rapid testing devices

- 5.2.3 Consumables

- 5.2.1 Analytical instruments

- 5.3 Drug screening services

Chapter 6 Market Estimates and Forecast, By Sample Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Urine

- 6.3 Breath

- 6.4 Oral fluids

- 6.5 Hair

- 6.6 Other sample types

Chapter 7 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cannabis/ marijuana

- 7.3 Opiods

- 7.4 Alcohol

- 7.5 Amphetamines

- 7.6 Other drug types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Drug testing laboratories

- 8.3 Workplace

- 8.4 Hospitals

- 8.5 Law enforcement agencies

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Agilent

- 10.3 Alcohol Countermeasure Systems

- 10.4 Alfa Scientific Designs

- 10.5 Dragerwerk

- 10.6 Eurofins Scientific

- 10.7 F. Hoffmann-La Roche

- 10.8 Laboratory Corporation of America (LabCorp)

- 10.9 Lifeloc Technologies

- 10.10 Omega Laboratories

- 10.11 OraSure Technologies

- 10.12 PerkinElmer

- 10.13 Premier Biotech

- 10.14 Psychemedics

- 10.15 Quest Diagnostics

- 10.16 Shimadzu

- 10.17 Siemens Healthineers

- 10.18 Thermo Fisher Scientific