|

市場調查報告書

商品編碼

1766341

維生素成分市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vitamin Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

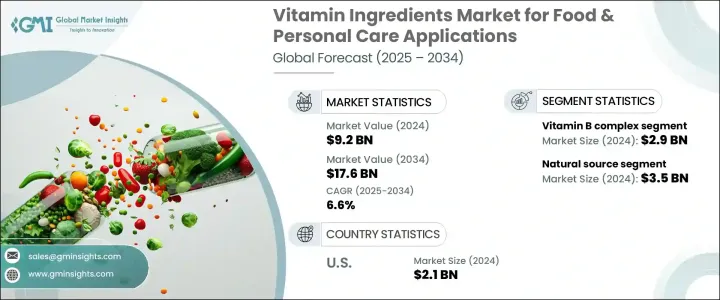

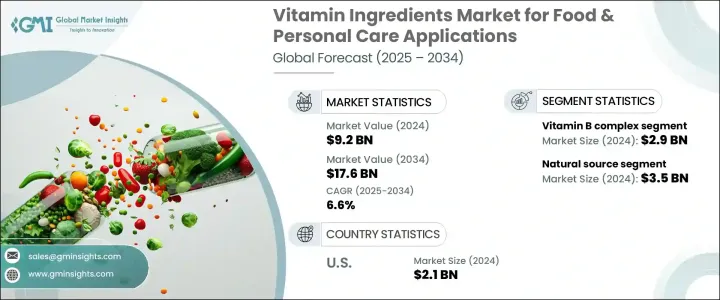

2024年,全球食品和個人護理用維生素成分市場規模達92億美元,預計到2034年將以6.6%的複合年成長率成長,達到176億美元。這一成長主要源於消費者對健康、營養和福祉日益成長的關注。隨著人們更加積極主動地進行預防性醫療保健和膳食最佳化,全球範圍內正在發生重大轉變,這推動了對富含維生素產品的需求。由於微量營養素缺乏症和生活方式相關健康問題的日益普遍,強化食品和飲料以及補充劑和功能性個人護理用品的需求正在成長。

維生素正擴大被融入穀物、零食、乳製品和飲料等食品中,而個人護理品牌則將其融入護膚和護髮配方中,以滿足消費者對抗衰老、補水和環保等功效的需求。這種跨行業的雙重應用正在加速市場對維生素的接受度。在個人護理領域,維生素作為活性成分,具有抗發炎、亮白和修復功效,尤其是在精華液、乳液和洗髮精中。消費者對清潔標籤、植物源成分和功能性健康益處的偏好不斷變化,進一步擴大了維生素成分(無論是在口服配方中還是外用配方中)的吸收。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 92億美元 |

| 預測值 | 176億美元 |

| 複合年成長率 | 6.6% |

2024年,B群維生素市場規模達29億美元,預計2034年將以6.4%的複合年成長率成長。 B群維生素因在新陳代謝、能量生成、神經功能和產前護理中的重要作用而聞名,其種類繁多,包括B1、B2、B3、B6、B9和B12等。這些成分廣泛用於膳食補充劑、能量飲料和強化食品。在個人護理領域,B3和B5等衍生物因其能夠促進皮膚保濕、減少泛紅和改善整體膚色而廣受歡迎。由於B群維生素用途廣泛且經濟實惠,其仍是製造商的首選成分。其多功能性和功效使其成為各種營養和化妝品應用的理想選擇,從而鞏固了其在維生素成分領域的市場地位。

2024年,天然來源細分市場的價值為35億美元,預計2025年至2034年期間的複合年成長率為6.5%,佔38.2%的市場佔有率。消費者對清潔標章、天然萃取和植物性成分的偏好日益成長,推動品牌在產品配方中使用天然維生素來源。這些從植物、水果和蔬菜中提取的維生素被廣泛認為更安全、更有效、更容易吸收。在食品和美容等高階類別中,對天然維生素的需求尤其高,因為這些類別注重透明度和永續性。天然來源,例如用於維生素C的西印度櫻桃油和用於維生素E的葵花籽油,因其與有機和低加工配方的兼容性而被廣泛採用,從而支持了產品開發向道德和透明化方向發展。

2024年,美國食品和個人護理用維生素成分市場規模達21億美元,預計到2034年將以6.4%的複合年成長率成長。在美國,消費者對預防性保健的日益關注,加上對清潔標籤產品的認知度不斷提升,持續推動市場需求。先進的食品和美容行業,加上強力的監管支援和產品配方的創新,是推動市場擴張的關鍵因素。研發能力使企業能夠提高生物利用度和功效,而當局發布的營養強化指南則有助於提升消費者的信任。富含維生素的護膚品和功能性食品的使用也促進了市場的成長。

在食品和個人護理用維生素成分市場中營運的主要公司包括巴斯夫、哥蘭比亞、藍星安迪蘇、龍沙集團和帝斯曼。這些公司專注於創新、產品開發和擴大其天然成分組合以保持競爭力。為了加強其在食品和個人護理用維生素成分市場的地位,領先公司正在採取多管齊下的策略。這些措施包括擴大使用天然和清潔標籤成分的產品線、在食品和美容領域建立策略合作夥伴關係以及投資研發以提高成分的生物利用度和穩定性。公司還透過提供可追溯的採購和永續性認證來滿足消費者對透明度的需求。此外,公司擴大瞄準產前護理、皮膚老化和純素飲食等利基健康領域,以多樣化其產品並進入高成長類別。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 消費者對強化和功能性食品的需求不斷增加。

- 提高個人健康和保健意識。

- 擴大維生素在護膚品和化妝品配方中的應用。

- 政府推動營養強化的措施。

- 產業陷阱與挑戰

- 跨地區監管的複雜性

- 某些維生素配方的穩定性和保存期限問題

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- Pestel 分析

- 價格趨勢

- 按地區

- 按維生素

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依維生素類型,2021-2034

- 主要趨勢

- 維生素A

- 維生素B複合物

- 維生素B1(硫胺素)

- 維生素B2(核黃素)

- 維生素B3(菸鹼酸)

- 維生素B5(泛酸)

- 維生素B6(吡哆醇)

- 維生素B7(生物素)

- 維生素B9(葉酸)

- 維生素B12(鈷胺素)

- 維生素C(抗壞血酸)

- 維生素D

- 維生素 D2(麥角鈣化醇)

- 維生素 D3(膽鈣化醇)

- 維生素E

- 維生素K

第6章:市場估計與預測:依來源,2021-2034

- 主要趨勢

- 自然的

- 植物性

- 動物性

- 微生物

- 合成的

- 半合成

第7章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 粉末

- 液體

- 珠粒

- 膠囊

- 顆粒

- 其他

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食品和飲料應用

- 功能性食品

- 強化食品

- 乳製品

- 烘焙和糖果

- 早餐麥片

- 嬰兒配方奶粉

- 其他

- 飲料

- 功能性飲料

- 果汁和冰沙

- 能量飲料

- 其他

- 膳食補充劑

- 動物飼料

- 個人護理應用

- 保養品

- 抗衰老產品

- 保濕霜和乳霜

- 防曬產品

- 臉部精華液

- 其他

- 護髮

- 洗髮精和護髮素

- 髮油和精華素

- 生髮產品

- 其他

- 彩妝

- 口腔護理

- 身體護理

- 營養化妝品

- 其他

- 保養品

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Adisseo (Bluestar Adisseo Company)

- Archer Daniels Midland Company (ADM)

- BASF SE

- DSM-Firmenich AG

- Eastman Chemical Company

- Fenchem Biotek Ltd.

- Foodchem International Corporation

- Glanbia plc

- Kappa Bioscience AS

- Koninklijke DSM NV

- Lonza Group

- Lycored

- Nutraceutical Corporation

- Prinova Group LLC

- Sternchemie GmbH & Co. KG

- The Lubrizol Corporation

- Vertellus Holdings LLC

- Vitablend Nederland BV

- Vitalife Biosciences

- Zhejiang NHU Co., Ltd

The Global Vitamin Ingredients Market for Food and Personal Care Applications was valued at USD 9.2 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 17.6 billion by 2034. This growth is primarily driven by increasing consumer attention toward health, nutrition, and well-being. A significant shift is occurring worldwide as people become more proactive about preventive healthcare and dietary enhancement, fueling the demand for vitamin-enriched products. Fortified foods and beverages, along with supplements and functional personal care items, are gaining momentum due to the rising prevalence of micronutrient deficiencies and lifestyle-related health issues.

Vitamins are increasingly being integrated into food products like cereals, snacks, dairy, and beverages, while personal care brands are embedding them in skincare and haircare formulations to cater to demands for anti-aging, hydration, and environmental protection benefits. This dual application across sectors is accelerating market adoption. In personal care, vitamins serve as active ingredients offering anti-inflammatory, brightening, and restorative properties, particularly in serums, lotions, and shampoos. Evolving consumer preferences toward clean labels, plant-derived ingredients, and functional health benefits further amplify the uptake of vitamin ingredients, both in ingestible and topical formulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $17.6 Billion |

| CAGR | 6.6% |

The vitamin B complex segment accounted for USD 2.9 billion in 2024 and is expected to grow at a CAGR of 6.4% through 2034. Known for its essential role in metabolism, energy production, neurological function, and prenatal care, this category includes various forms like B1, B2, B3, B6, B9, and B12. These ingredients are widely formulated in dietary supplements, energy drinks, and fortified foods. In personal care, derivatives such as B3 and B5 are popular for their ability to support skin hydration, reduce redness, and enhance overall skin tone. Due to their wide applicability and cost-effectiveness, B complex vitamins remain a preferred ingredient for manufacturers. Their versatility and efficacy make them ideal for a range of both nutritional and cosmetic applications, strengthening their footprint in the vitamin ingredients space.

The natural source segment was valued at USD 3.5 billion in 2024 and is projected to grow at a CAGR of 6.5% between 2025 and 2034, holding a 38.2% market share. A growing consumer preference for clean-label, naturally derived, and plant-based ingredients is pushing brands to use natural vitamin sources in product formulations. These vitamins, extracted from botanicals, fruits, and vegetables, are widely perceived as safer, more effective, and better absorbed. Demand is especially high in premium categories across food and beauty, where transparency and sustainability are top priorities. Natural sources such as acerola for vitamin C or sunflower oil for vitamin E are widely adopted for their compatibility with organic and minimally processed formulations, supporting the push toward ethical and transparent product development.

U.S. Vitamin Ingredients Market for Food & Personal Care Applications was valued at USD 2.1 billion in 2024 and is anticipated to grow at a 6.4% CAGR through 2034. In the U.S., increasing consumer focus on preventive health, coupled with rising awareness of clean-label products, continues to fuel demand. The advanced food and beauty industries, combined with strong regulatory support and innovation in product formulation, are key factors driving market expansion. R&D capabilities allow companies to improve bioavailability and efficacy, while nutrient fortification guidelines issued by authorities foster consumer trust. The use of vitamin-infused skincare and functional foods also contributes to market traction.

Key companies operating in this Vitamin Ingredients Market for Food & Personal Care Applications include BASF, Glanbia, Bluestar Adisseo, Lonza Group, and DSM N.V. These players are focusing on innovation, product development, and expanding their natural ingredient portfolios to stay competitive. To strengthen their presence in the vitamin ingredients market for food and personal care, leading companies are adopting multi-pronged strategies. These include expanding product lines with natural and clean-label ingredients, forming strategic partnerships across food and beauty sectors, and investing in R&D to enhance ingredient bioavailability and stability. Firms are also leveraging consumer demand for transparency by offering traceable sourcing and sustainability certifications. In addition, companies are increasingly targeting niche health segments like prenatal care, aging skin, and vegan diets to diversify their offerings and tap into high-growth categories.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1.1 Regional

- 2.2.1.2 Vitamin type

- 2.2.1.3 Source

- 2.2.1.4 Form

- 2.2.1.5 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical success factors

- 2.7 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for fortified and functional food products.

- 3.2.1.2 Increasing awareness of personal health and wellness.

- 3.2.1.3 Expanding application of vitamins in skincare and cosmetic formulations.

- 3.2.1.4 Government initiatives promoting nutrient fortification.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory complexities across regions

- 3.2.2.2 Stability and shelf-life issues in certain vitamin formulations

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia pacific

- 3.4.4 Latin America

- 3.4.5 Middle east & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By vitamin

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Vitamin Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Vitamin A

- 5.3 Vitamin B Complex

- 5.3.1 Vitamin B1 (Thiamine)

- 5.3.2 Vitamin B2 (Riboflavin)

- 5.3.3 Vitamin B3 (Niacin)

- 5.3.4 Vitamin B5 (Pantothenic Acid)

- 5.3.5 Vitamin B6 (Pyridoxine)

- 5.3.6 Vitamin B7 (Biotin)

- 5.3.7 Vitamin B9 (Folic Acid)

- 5.3.8 Vitamin B12 (Cobalamin)

- 5.4 Vitamin C (Ascorbic Acid)

- 5.5 Vitamin D

- 5.5.1 Vitamin D2 (Ergocalciferol)

- 5.5.2 Vitamin D3 (Cholecalciferol)

- 5.6 Vitamin E

- 5.7 Vitamin K

Chapter 6 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Natural

- 6.2.1 Plant-based

- 6.2.2 Animal-based

- 6.2.3 Microbial

- 6.3 Synthetic

- 6.4 Semi-synthetic

Chapter 7 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Liquid

- 7.4 Beadlets

- 7.5 Encapsulated

- 7.6 Granules

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage applications

- 8.2.1 Functional foods

- 8.2.2 Fortified foods

- 8.2.2.1 Dairy products

- 8.2.2.2 Bakery & confectionery

- 8.2.2.3 Breakfast cereals

- 8.2.2.4 Infant formula

- 8.2.2.5 Others

- 8.2.3 Beverages

- 8.2.3.1 Functional drinks

- 8.2.3.2 Juices & smoothies

- 8.2.3.3 Energy drinks

- 8.2.3.4 Others

- 8.2.4 Dietary supplements

- 8.2.5 Animal feed

- 8.3 Personal care applications

- 8.3.1 Skincare

- 8.3.1.1 Anti-aging products

- 8.3.1.2 Moisturizers & creams

- 8.3.1.3 Sun care products

- 8.3.1.4 Facial serums

- 8.3.1.5 Others

- 8.3.2 Haircare

- 8.3.2.1 Shampoos & conditioners

- 8.3.2.2 Hair oils & serums

- 8.3.2.3 Hair growth products

- 8.3.2.4 Others

- 8.3.3 Color cosmetics

- 8.3.4 Oral care

- 8.3.5 Body care

- 8.3.6 Nutricosmetics

- 8.3.7 Others

- 8.3.1 Skincare

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adisseo (Bluestar Adisseo Company)

- 10.2 Archer Daniels Midland Company (ADM)

- 10.3 BASF SE

- 10.4 DSM-Firmenich AG

- 10.5 Eastman Chemical Company

- 10.6 Fenchem Biotek Ltd.

- 10.7 Foodchem International Corporation

- 10.8 Glanbia plc

- 10.9 Kappa Bioscience AS

- 10.10 Koninklijke DSM N.V.

- 10.11 Lonza Group

- 10.12 Lycored

- 10.13 Nutraceutical Corporation

- 10.14 Prinova Group LLC

- 10.15 Sternchemie GmbH & Co. KG

- 10.16 The Lubrizol Corporation

- 10.17 Vertellus Holdings LLC

- 10.18 Vitablend Nederland B.V.

- 10.19 Vitalife Biosciences

- 10.20 Zhejiang NHU Co., Ltd