|

市場調查報告書

商品編碼

1766340

局部麻醉藥物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Local Anesthesia Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

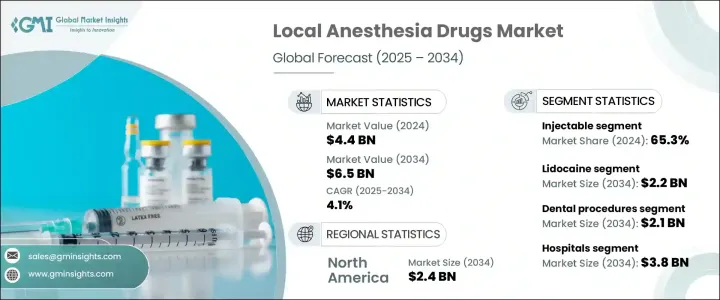

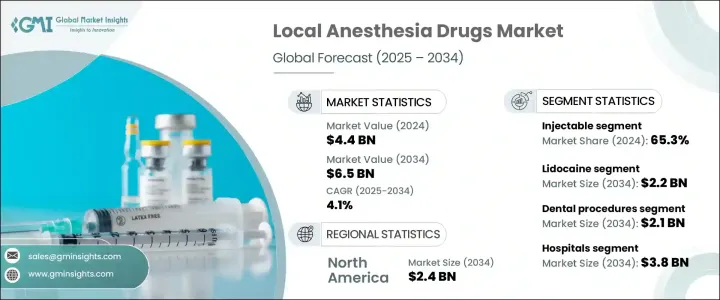

2024 年全球局部麻醉藥物市場價值為 44 億美元,預計到 2034 年將以 4.1% 的複合年成長率成長至 65 億美元。這一成長主要歸因於各類醫療機構手術和微創手術數量的增加。隨著門診、牙科診所和美容治療中心對針對性和短期疼痛管理的需求不斷成長,對有效局部麻醉劑的需求持續穩定成長。人們越來越傾向於選擇能夠讓患者更快康復並避免全身麻醉相關風險的手術,這有助於推動局部麻醉劑型的廣泛使用。老年人口的成長是推動市場擴張的另一個因素,他們通常需要針對特定部位且全身影響較小的手術。此外,新興市場醫療基礎設施的不斷發展和外科護理的可近性為這些藥物的更廣泛應用創造了有利條件。

隨著醫療價值導向的轉變,人們更加重視更快的復健速度和更短的住院時間,局部麻醉已成為許多治療的首選。製藥公司正積極投資研發,以提升麻醉劑型的療效、起效時間和持續時間,從而進一步提升產品的可及性和臨床應用。監管支援和更快捷的核准流程也在促進市場滲透和技術創新方面發揮著至關重要的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 44億美元 |

| 預測值 | 65億美元 |

| 複合年成長率 | 4.1% |

局部麻醉是指使用藥物麻醉特定身體部位,但不影響病人的整體意識。這類麻醉劑有多種形式,包括注射、外用溶液和噴霧劑。這類常用藥物包括布比卡因、利多卡因、丙胺卡因、羅哌卡因、苯佐卡因和氯普魯卡因。

根據藥物類型,市場細分為布比卡因、利多卡因、苯佐卡因、丙胺卡因、羅哌卡因、氯普魯卡因和其他變體。其中,利多卡因市場規模在2024年達到15億美元,位居榜首,預計到2034年將成長至22億美元,複合年成長率為3.7%。利多卡因起效迅速、用途廣泛,應用範圍廣泛,尤其是在小手術、皮膚科、牙科和疼痛管理領域,因此仍是最廣泛使用的局部麻醉藥物之一。利多卡因既有注射劑型,也有外用劑型,這進一步增強了其在各個醫學專科領域的吸引力。

根據給藥途徑,局部麻醉藥可分為注射劑和外用劑。注射劑在2024年佔據最大佔有率,達65.3%,預計在整個預測期內仍將保持主導地位。注射劑因其快速起效、精準靶向以及適用於多種臨床操作(例如神經阻斷和小型外科手術)而廣受青睞。給藥方法和緩釋劑型的持續創新進一步支持了其廣泛應用,尤其是在門診和外科護理領域。

依應用領域分類,市場分為外科手術、牙科手術、美容及皮膚科手術、疼痛管理等。牙科手術在2024年成為領先細分市場,佔據33.2%的市場佔有率,預計到2034年將達到21億美元。局部麻醉在促進牙科護理方面發揮關鍵作用,它可以最大限度地減少根管治療、拔牙和補牙等治療過程中的不適感。全球口腔健康問題負擔日益加重,以及常規牙科護理的普及率不斷提高,進一步推動了這個細分市場的突出地位。

根據最終用途,市場包括醫院、門診手術中心和其他醫療保健提供者。 2024年,醫院佔據56.2%的市場佔有率,預計到2034年將創造38億美元的收入,複合年成長率為4.4%。醫院仍然是各種需要局部麻醉的外科和診斷程序的主要場所。先進的外科基礎設施、訓練有素的專業人員和全面的醫療服務鞏固了醫院作為關鍵終端使用者群體的地位。

從區域來看,北美地區以2024年17億美元的收入引領全球市場,預計2034年將達到24億美元,複合年成長率為3.8%。該地區受益於發達的醫療保健系統、對局部疼痛管理解決方案的認知度不斷提高,以及使用局部麻醉的醫療和外科手術頻率較高。穩定的研發活動和領先製藥公司的存在也為該地區的市場領導地位做出了重要貢獻。

市場整合程度適中,前五大公司佔約55%的總佔有率。輝瑞、費森尤斯卡比、B. Braun Melsungen、Septodont和Pacira Biosciences等主要公司繼續憑藉創新、全球影響力和策略合作展開競爭,以搶佔更大的市場佔有率。這些公司在拓展產品線、進入新市場和提升製造能力方面的持續努力預計將在未來幾年影響市場動態。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 手術量不斷增加

- 老年人口狀況良好

- 局部麻醉藥比鴉片類藥物的偏好度日益增加

- 藥物輸送技術的進步推動了需求

- 產業陷阱與挑戰

- 劑量依賴性副作用和有限的作用持續時間

- 嚴格的監管複雜性

- 市場機會

- 擴大美容手術

- 長效麻醉藥物的開發

- 成長動力

- 成長潛力分析

- 管道分析

- 未來市場趨勢

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

第5章:市場估計與預測:按藥物類型,2021 - 2034 年

- 主要趨勢

- 利多卡因

- 布比卡因

- 苯佐卡因

- 羅哌卡因

- 普魯卡因

- 氯普魯卡因

- 其他藥物類型

第6章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 外用

- 注射劑

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 牙科手術

- 外科手術

- 美容和皮膚科手術

- 疼痛管理

- 其他應用

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 牙醫診所

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- AdvaCare

- Aspen Pharmacare

- B. Braun Melsungen

- Baxter

- Fresenius Kabi

- GE Healthcare

- HANSAmed

- Hikima

- Pacira BioSciences

- Pfizer

- Pierrel Spa

- Piramal

- Septodont

The Global Local Anesthesia Drugs Market was valued at USD 4.4 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 6.5 billion by 2034. This growth is largely attributed to the rising volume of surgeries and minimally invasive procedures across various healthcare facilities. As demand rises for targeted and short-term pain management in outpatient clinics, dental offices, and cosmetic treatment centers, the need for effective local anesthetics continues to grow steadily. An increasing preference for procedures that allow quicker patient recovery and avoid the risks associated with general anesthesia is helping drive the widespread use of local anesthetic formulations. The growing population of older adults, who often require site-specific surgeries with fewer systemic effects, is another factor contributing to the market expansion. Additionally, ongoing development in healthcare infrastructure and access to surgical care in emerging markets are creating favorable conditions for the broader adoption of these drugs.

The shift toward value-based healthcare, where quicker recovery and shorter hospital stays are emphasized, has made local anesthesia a preferred choice in many treatments. Pharmaceutical companies are actively investing in research to improve the efficacy, onset, and duration of anesthetic formulations, further boosting product accessibility and clinical use. Regulatory support and faster approval pathways are also playing a vital role in facilitating market penetration and technological innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $6.5 Billion |

| CAGR | 4.1% |

Local anesthesia refers to the administration of drugs that numb a specific part of the body without affecting the patient's overall consciousness. These anesthetics come in various forms, including injections, topical solutions, and sprays. Commonly used drugs in this category include bupivacaine, lidocaine, prilocaine, ropivacaine, benzocaine, and chloroprocaine.

Based on drug type, the market is segmented into bupivacaine, lidocaine, benzocaine, prilocaine, ropivacaine, chloroprocaine, and other variants. Among these, the lidocaine segment led the market with a value of USD 1.5 billion in 2024 and is expected to grow to USD 2.2 billion by 2034, advancing at a CAGR of 3.7%. Lidocaine remains one of the most extensively used local anesthetics due to its rapid onset, versatility, and wide range of applications, particularly in minor surgeries, dermatology, dentistry, and pain management. The availability of both injectable and topical lidocaine formulations adds to its appeal in various medical specialties.

By route of administration, local anesthetics are divided into injectable and topical types. The injectable segment held the largest share of 65.3% in 2024 and is expected to maintain its dominance throughout the forecast period. Injectables are widely preferred for their quick action, precise targeting, and suitability across numerous clinical procedures, such as nerve blocks and minor surgical interventions. Continuous innovation in delivery methods and extended-release formulations is further supporting their widespread use, particularly in outpatient and surgical care settings.

In terms of application, the market is classified into surgical procedures, dental procedures, cosmetic and dermatological procedures, pain management, and others. Dental procedures emerged as the leading segment in 2024, accounting for 33.2% of the market and projected to reach USD 2.1 billion by 2034. Local anesthesia plays a critical role in facilitating dental care by minimizing discomfort during treatments such as root canals, extractions, and cavity fillings. This segment's prominence is fueled by the increasing global burden of oral health issues and greater access to routine dental care.

According to end use, the market includes hospitals, ambulatory surgical centers, and other healthcare providers. Hospitals represented the dominant share of 56.2% in 2024 and are expected to generate USD 3.8 billion in revenue by 2034, growing at a CAGR of 4.4%. Hospitals continue to serve as the primary site for various surgical and diagnostic procedures that demand the use of local anesthesia. The availability of advanced surgical infrastructure, trained professionals, and comprehensive medical services solidifies their position as a key end-user segment.

Regionally, North America led the global market with USD 1.7 billion in revenue in 2024 and is forecast to reach USD 2.4 billion by 2034, expanding at a CAGR of 3.8%. The region benefits from well-developed healthcare systems, increased awareness regarding localized pain management solutions, and a high frequency of medical and surgical procedures that utilize local anesthesia. Steady R&D activities and the presence of leading pharmaceutical players also contribute significantly to the region's market leadership.

The market is moderately consolidated, with the top five players accounting for approximately 55% of the overall share. Key companies such as Pfizer, Fresenius Kabi, B. Braun Melsungen, Septodont, and Pacira Biosciences continue to compete based on innovation, global presence, and strategic collaborations to capture greater market share. Their ongoing efforts in expanding product lines, entering new markets, and enhancing manufacturing capabilities are expected to influence market dynamics over the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug type

- 2.2.3 Route of administration

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising surgical volume

- 3.2.1.2 Favorable geriatric demographics

- 3.2.1.3 Increasing preference for local anesthetics over opioids

- 3.2.1.4 Advancement in drug delivery drives the demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dose dependent side effects and limited duration of action

- 3.2.2.2 Stringent regulatory complexities

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding aesthetic procedures

- 3.2.3.2 Development of long-acting anesthetics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Lidocaine

- 5.3 Bupivacaine

- 5.4 Benzocaine

- 5.5 Ropivacaine

- 5.6 Prilocaine

- 5.7 Chloroprocaine

- 5.8 Other drug types

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Topical

- 6.3 Injectable

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dental procedures

- 7.3 Surgical procedures

- 7.4 Cosmetic and dermatological procedures

- 7.5 Pain management

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Dental clinics

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 AdvaCare

- 10.3 Aspen Pharmacare

- 10.4 B. Braun Melsungen

- 10.5 Baxter

- 10.6 Fresenius Kabi

- 10.7 GE Healthcare

- 10.8 HANSAmed

- 10.9 Hikima

- 10.10 Pacira BioSciences

- 10.11 Pfizer

- 10.12 Pierrel Spa

- 10.13 Piramal

- 10.14 Septodont