|

市場調查報告書

商品編碼

1766339

大腸直腸癌診斷市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Colorectal Cancer Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

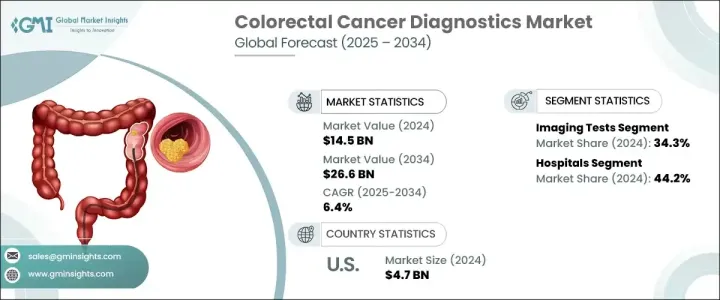

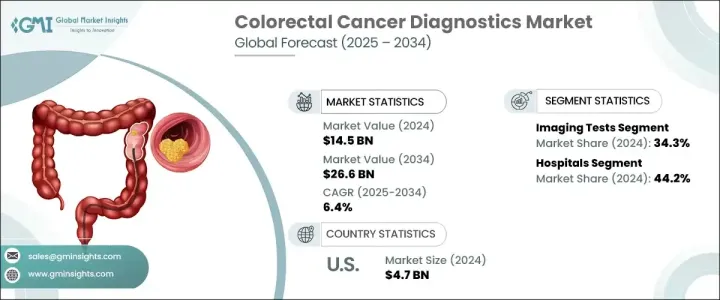

2024 年全球大腸直腸癌診斷市場價值為 145 億美元,預計到 2034 年將以 6.4% 的複合年成長率成長至 266 億美元。

市場成長的驅動力源於大腸直腸癌發病率的上升、公共衛生早期篩檢計劃的不斷推進以及診斷技術的持續進步。液體切片、人工智慧輔助影像和糞便DNA檢測等創新技術正在重塑大腸直腸癌檢測的格局,提供侵入性更低、更精準、更便捷的診斷方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 145億美元 |

| 預測值 | 266億美元 |

| 複合年成長率 | 6.4% |

日益增加的宣傳活動和更新的篩檢指南(例如將常規大腸癌篩檢的建議年齡降至45歲)有助於提高早期診斷率。此外,全球人口老化,加上久坐不動和飲食習慣等生活方式因素,加重了全球大腸癌的負擔,凸顯了對有效且便捷的診斷方法的迫切需求。世界各國政府和醫療保健組織正在啟動大規模計劃,以改善大腸癌篩檢的可近性,而私人企業也在大力投資研發,以將下一代診斷工具推向市場。人工智慧、新一代定序 (NGS) 和微流控技術有望顯著提高診斷精度和患者預後。

大腸直腸癌診斷市場主要按檢測類型細分,其中影像學檢測在2024年佔據34.3%的佔有率。 CT大腸造影、MRI和PET掃描等影像檢查方式對於早期發現、分期和治療計畫仍然至關重要。採用AI增強影像技術提高了檢測準確性,有助於在早期發現癌前病變。此外,影像學檢查的非侵入性或微創性將繼續推動患者接受度和篩檢率的提高。

就終端用途而言,醫院在2024年佔據了44.2%的市場佔有率,鞏固了其作為結直腸癌診斷領先終端用戶的地位。醫院是大腸直腸癌檢測、診斷、分期和治療計劃的主要中心,並擁有完善的診斷基礎設施,包括先進的影像系統、分子病理學實驗室、內視鏡設備和腫瘤外科病房。醫院的多學科協作方法——匯集腫瘤科醫生、放射科醫生、病理科醫生、胃腸科醫生和外科醫生——實現了結直腸癌患者從早期發現到治療後監測的全程無縫銜接的護理協調。

2024年,北美大腸癌診斷市場佔35.2%的市佔率。該地區的主導地位源於其強大的醫療基礎設施、篩檢計畫的廣泛實施以及先進診斷技術的高採用率,例如人工智慧大腸鏡檢查、液體活體組織切片和分子生物標記檢測。在美國,美國疾病管制與預防中心(CDC)的結直腸癌控制計畫(CRCCP)等措施在提高早期篩檢率方面發揮了重要作用,尤其是在醫療資源匱乏的人群中。

雅培實驗室、Exact Sciences Corporation、西門子醫療股份公司、Guardant Health Inc.、羅氏公司和通用電氣醫療科技公司等主要市場參與者正大力投資,透過液體活體組織切片、人工智慧成像和分子診斷領域的創新來擴展其診斷產品組合。策略合作夥伴關係、併購以及新產品的法規核准仍然是這些參與者加強全球影響力和推動未來市場成長的關鍵策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 大腸直腸癌發生率和盛行率不斷上升

- 與癌症篩檢測試相關的政府措施和政策

- 癌症診斷領域的技術進步

- 早期診斷意識不斷增強

- 產業陷阱與挑戰

- 診斷測試和程序成本高昂

- 缺乏診斷測試的報銷政策

- 市場機會

- 非侵入性和人工智慧驅動的診斷技術的擴展和採用

- 新興地區市場快速成長

- 成長動力

- 未來市場趨勢

- 報銷場景

- 消費者行為分析

- 成長潛力分析

- 技術格局

- 監管格局

- 差距分析

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按測試類型,2021 - 2034 年

- 主要趨勢

- 血液檢查

- 糞便檢查

- 糞便潛血試驗(FOBT)

- 糞便生物標記檢測

- CRC DNA篩檢測試

- 影像學檢查

- CT

- 超音波

- 磁振造影

- 寵物

- 大腸鏡檢查

- 其他影像學檢查

- 活體組織切片

- 其他測試類型

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 診斷影像中心

- 癌症研究中心

- 其他最終用途

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Abbott Laboratories

- Danaher Corporation

- DiaCarta

- Exact Sciences Corporation

- F-Hoffmann-La Roche

- GE HealthCare Technologies

- Geneoscopy

- Guardant Health

- HU Group Holdings

- New Day Diagnostics

- Olympus Corporation

- Phase Scientific International

- QIAGEN NV

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific

The Global Colorectal Cancer Diagnostics Market was valued at USD 14.5 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 26.6 billion by 2034.

The market growth is driven by the increasing incidence of colorectal cancer, rising public health initiatives for early screening, and continuous technological advancements in diagnostic modalities. Innovations such as liquid biopsy, AI-assisted imaging, and stool-based DNA tests are reshaping the landscape of colorectal cancer detection, offering less invasive, more accurate, and patient-friendly diagnostic options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.5 Billion |

| Forecast Value | $26.6 Billion |

| CAGR | 6.4% |

Growing awareness campaigns and updated screening guidelines, such as lowering the recommended age for routine CRC screening to 45, contribute to early diagnosis rates. Furthermore, an aging global population, combined with lifestyle factors like sedentary behavior and dietary habits, has heightened the global burden of colorectal cancer, underscoring the urgent need for effective and accessible diagnostics. Governments and healthcare organizations worldwide are launching large-scale initiatives to improve access to colorectal cancer screening, while private companies are investing heavily in R&D to bring next-generation diagnostic tools to the market. Artificial intelligence, next-generation sequencing (NGS), and microfluidic technologies are poised to enhance diagnostic precision and patient outcomes significantly.

The colorectal cancer diagnostics market is primarily segmented by test type, with the imaging tests segment holding 34.3% share in 2024. Imaging modalities such as CT colonography, MRI, and PET scans remain crucial for early detection, staging, and treatment planning. Adopting AI-enhanced imaging has improved detection accuracy, helping to identify precancerous lesions at earlier stages. Moreover, imaging tests' non-invasive or minimally invasive nature continues to drive patient acceptance and screening rates.

In terms of end-use, the hospitals segment held 44.2% share in 2024, solidifying its position as the leading end-user for colorectal cancer diagnostics. Hospitals are the primary centers for colorectal cancer detection, diagnosis, staging, and treatment planning, supported by a comprehensive diagnostic infrastructure that includes advanced imaging systems, molecular pathology labs, endoscopic equipment, and surgical oncology units. Their multidisciplinary approach-bringing together oncologists, radiologists, pathologists, gastroenterologists, and surgeons-enables the seamless coordination of care for colorectal cancer patients, from early detection through post-treatment monitoring.

North America Colorectal Cancer Diagnostics Market held a 35.2% share in 2024. The region's dominance stems from a robust healthcare infrastructure, widespread implementation of screening programs, and high adoption rates of advanced diagnostic technologies, such as AI-enabled colonoscopy, liquid biopsies, and molecular biomarker testing. In the United States, initiatives like the Colorectal Cancer Control Program (CRCCP) by the CDC have been instrumental in increasing early screening rates, particularly among underserved populations.

Key market players such as Abbott Laboratories, Exact Sciences Corporation, Siemens Healthineers AG, Guardant Health Inc., F-Hoffmann-La Roche Ltd., and GE HealthCare Technologies, Inc. are heavily investing in expanding their diagnostic portfolios through innovations in liquid biopsy, AI-driven imaging, and molecular diagnostics. Strategic partnerships, mergers and acquisitions, and regulatory approvals for new products remain crucial strategies for these players to strengthen their global presence and drive future market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Test type

- 2.2.2 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence and prevalence of colorectal cancer

- 3.2.1.2 Government initiatives and policies associated with cancer screening tests

- 3.2.1.3 Technological advancements in field of cancer diagnostics

- 3.2.1.4 Growing awareness regarding early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of diagnostic tests and procedures

- 3.2.2.2 Lack of reimbursement policies for diagnostic tests

- 3.2.3 Market Opportunities

- 3.2.3.1 Expansion and Adoption of Non-Invasive and AI-Driven Diagnostic Technologies

- 3.2.3.2 Rapid Market Growth in Emerging Regions

- 3.2.1 Growth drivers

- 3.3 Future market trends

- 3.4 Reimbursement scenario

- 3.5 Consumer behaviour analysis

- 3.6 Growth potential analysis

- 3.7 Technology landscape

- 3.8 Regulatory landscape

- 3.9 Gap analysis

- 3.10 Patent analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Blood tests

- 5.3 Stool tests

- 5.3.1 Fecal occult blood test (FOBT)

- 5.3.2 Fecal biomarker test

- 5.3.3 CRC DNA screening test

- 5.4 Imaging tests

- 5.4.1 CT

- 5.4.2 Ultrasound

- 5.4.3 MRI

- 5.4.4 PET

- 5.4.5 Colonoscopy

- 5.4.6 Other imaging tests

- 5.5 Biopsy

- 5.6 Other test types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic imaging centers

- 6.4 Cancer research centers

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 Danaher Corporation

- 8.3 DiaCarta

- 8.4 Exact Sciences Corporation

- 8.5 F-Hoffmann-La Roche

- 8.6 GE HealthCare Technologies

- 8.7 Geneoscopy

- 8.8 Guardant Health

- 8.9 H.U. Group Holdings

- 8.10 New Day Diagnostics

- 8.11 Olympus Corporation

- 8.12 Phase Scientific International

- 8.13 QIAGEN N.V.

- 8.14 Siemens Healthineers

- 8.15 Sysmex Corporation

- 8.16 Thermo Fisher Scientific