|

市場調查報告書

商品編碼

1766331

DNA 取證市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測DNA Forensics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

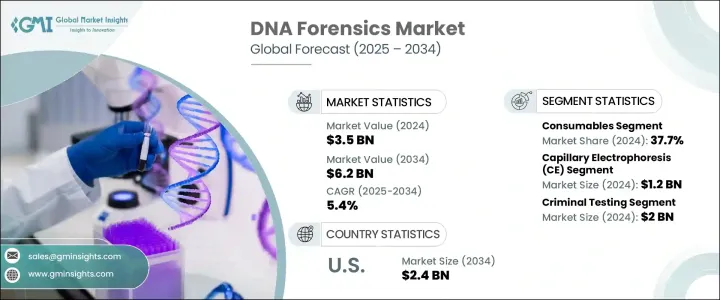

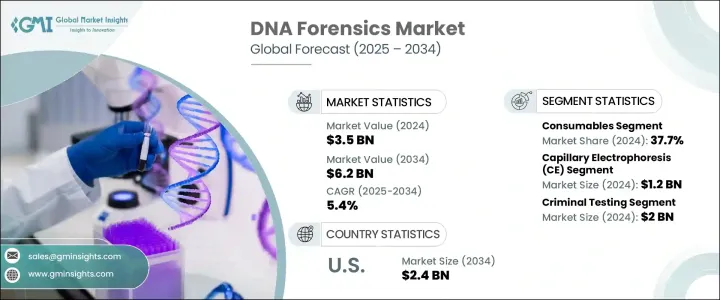

2024年,全球DNA取證市場規模達35億美元,預計2034年將以5.4%的複合年成長率成長,達到62億美元。這一穩步成長的動力源於法律和刑事調查領域對精準識別方法和先進分析工具日益成長的需求。隨著全球犯罪率持續上升,精準DNA分析在現代司法體系中的重要性日益凸顯。法醫DNA檢測之所以被廣泛採用,很大程度上歸功於其在將證據與嫌疑人關聯方面的可靠性,以及其能夠以高可信度支持法律訴訟的能力。

此外,法醫實驗室整合先進技術正在簡化分析流程,幫助當局更有效率地處理複雜的刑事案件。多個地區的政府正在積極支持法醫實驗室,為其提供資金和基礎設施升級,這進一步加速了DNA法醫在刑事司法系統中的應用。同時,私部門參與者正專注於創新,並透過策略聯盟、合作夥伴關係和研發計劃拓展其在尚未開發的市場的影響力。這些共同努力正在為未來十年的持續市場成長奠定堅實的基礎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 35億美元 |

| 預測值 | 62億美元 |

| 複合年成長率 | 5.4% |

DNA法醫領域的領先公司正大力投資新產品開發,以跟上技術進步和不斷發展的法醫標準。一個關鍵趨勢是轉向更便攜、更高速的DNA分析設備,這些設備能夠在不影響準確性的情況下提高效率。除了推出新產品外,各公司還在新興經濟體拓展業務,旨在吸引新的客戶群並提高法醫工具的可及性。生技公司與公共機構之間的合作也促進了市場擴張,促進了技術知識的交流,並簡化了將新技術融入常規法醫工作流程的流程。這些策略將為該產業在未來幾年的持續發展和競爭差異化奠定基礎。

根據解決方案,軟體細分市場包括實驗室資訊管理系統 (LIMS) 和其他法醫軟體工具。其中,耗材細分市場佔據主導地位,2024 年的營收佔有率最高,達 37.7%。耗材需求的成長與 DNA 分析技術的進步直接相關,這些技術需要持續使用高品質的材料進行樣品製備和檢測。隨著各行各業對 DNA 分析的依賴程度不斷提高,試劑、萃取工具和分析配件的消耗量持續激增,推動了該細分市場的持續成長。

市場也按方法細分,包括毛細管電泳 (CE)、PCR 擴增、新一代定序 (NGS) 和其他技術。毛細管電泳佔據領先地位,2024 年的收入達到 12 億美元。 CE 以其高解析度能力而聞名,即使在分解樣本中也能精確分離和分析 DNA 片段,因此在法醫實驗室中被廣泛採用。其可靠性和速度使其成為高通量法醫工作流程的理想選擇,尤其是在需要快速週轉以解決時間緊迫的案件時。

依應用領域分類,市場分為刑事鑑定、親子鑑定和家族鑑定。刑事鑑定是最大的細分市場,2024年的收入達到20億美元。刑事調查的日益複雜化以及對可靠DNA證據的日益重視,推動了這一細分市場的發展。隨著基因檢測在執法工作中變得越來越重要,對能夠有效識別和驗證嫌疑人的技術的需求持續成長。 DNA資料庫和調查工具的廣泛應用也擴大了各司法管轄區對DNA法醫的需求。

從地區來看,北美佔據全球市場主導地位,2024年佔總營收的42.1%以上。該地區的領先地位得益於DNA檢測技術的快速發展、公共和私營部門對法醫基礎設施的大力投資,以及對提高法律結果準確性的日益重視。在北美,美國仍是主要貢獻者,預計到2034年市場價值將達到24億美元。在旨在實現法醫系統現代化的有利政策框架和舉措的支持下,美國各州和聯邦犯罪實驗室都在擴大部署鑑識技術。

競爭格局以包括Illumina、QIAGEN、Thermo Fisher Scientific、Promega和Danaher在內的全球主要企業為標誌,這些企業合計佔據了超過50%的市場佔有率。這些公司積極致力於開發下一代法醫工具,包括快速DNA技術、家譜追蹤資料庫和緊湊型檢測系統。對研發的策略性投資、與研究機構的合作以及拓展新市場是其成長策略的核心。監管簡化和核准流程的縮短也使得企業能夠更快進入市場,從而滿足全球對可靠法醫解決方案日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 政府為法醫計畫提供的措施和資金

- 親子鑑定與家族鑑定的技術進步

- 犯罪活動增多

- 產業陷阱與挑戰

- 設備成本高

- 發展中國家缺乏熟練的專業人員

- 市場機會

- 在採集點採用快速 DNA 技術

- 人工智慧和機器學習在 DNA資料解讀中的日益融合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 技術格局

- 當前的技術趨勢

- 新興技術

- 定價分析

- 未來市場趨勢

- 差距分析

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按解決方案,2021 - 2034 年

- 主要趨勢

- 套件

- 分析儀和定序儀

- 軟體

- 實驗室資訊管理系統

- 其他軟體類型

- 耗材

第6章:市場估計與預測:依方法,2021 - 2034 年

- 主要趨勢

- 毛細管電泳(CE)

- 下一代定序(NGS)

- PCR擴增

- 其他方法

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 刑事測試

- 親子鑑定和家族史檢測

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- Bio-Rad Laboratories

- Danaher

- GORDIZ

- Illumina

- Laboratory Corporation of America Holdings

- LabVantage Solution

- LabWare

- Promega

- Qiagen

- Thermo Fisher Scientific

- VERISIS

The Global DNA Forensics Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 6.2 billion by 2034. This steady expansion is driven by a growing need for precise identification methods and advanced analytical tools in legal and criminal investigations. As crime rates continue to rise globally, the demand for accurate DNA profiling is becoming increasingly vital in modern judicial systems. The widespread adoption of forensic DNA testing is largely attributed to its reliability in linking evidence to suspects, as well as its ability to support legal proceedings with high credibility.

Furthermore, the integration of advanced technologies in forensic labs is streamlining the analysis process and helping authorities address complex criminal cases more efficiently. Governments across multiple regions are actively supporting forensic labs with funding and infrastructure upgrades, which is further accelerating the use of DNA forensics in criminal justice systems. Meanwhile, private sector players are focusing on innovation and expanding their reach across untapped markets through strategic alliances, partnerships, and research and development initiatives. These collective efforts are creating a robust foundation for consistent market growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 5.4% |

Leading companies in the DNA forensics space are investing heavily in new product development to keep pace with technological advancements and evolving forensic standards. A key trend is the shift toward more portable, high-speed DNA analysis devices that enhance efficiency without compromising accuracy. In addition to new product launches, players are expanding their operational footprints in emerging economies, aiming to capture new customer bases and improve accessibility to forensic tools. Collaborations between biotech firms and public institutions are also contributing to market expansion by fostering the exchange of technical knowledge and streamlining the integration of newer technologies into routine forensic workflows. These strategies are positioning the industry for continued advancement and competitive differentiation in the years ahead.

Based on solution, the software segment includes LIMS and other forensic software tools. Among these, the consumables segment emerged as the dominant category, accounting for the largest revenue share of 37.7% in 2024. The rising demand for consumables is directly linked to advancements in DNA analysis techniques that require consistent use of high-quality materials for sample preparation and examination. As the reliance on DNA profiling increases across sectors, the consumption of reagents, extraction tools, and analysis accessories continues to surge, driving segment growth.

The market is also segmented by method, including capillary electrophoresis (CE), PCR amplification, next-generation sequencing (NGS), and other techniques. Capillary electrophoresis held the leading position, generating a revenue of USD 1.2 billion in 2024. Known for its high-resolution capabilities, CE is widely adopted in forensic labs due to its precision in separating and analyzing DNA fragments, even in degraded samples. Its reliability and speed make it an ideal choice for high-throughput forensic workflows, especially when quick turnarounds are essential for solving time-sensitive cases.

By application, the market is divided into criminal testing and paternity and familial testing. Criminal testing represented the largest segment, with a revenue of USD 2 billion in 2024. The increasing sophistication of criminal investigations and the growing emphasis on reliable DNA evidence are pushing this segment forward. With genetic testing becoming more integral to law enforcement, demand continues to grow for technologies that enable efficient identification and suspect verification. The expanding use of DNA databases and investigative tools is also amplifying the need for DNA forensics across jurisdictions.

Regionally, North America dominated the global market, accounting for more than 42.1% of total revenue in 2024. The region's leadership is fueled by rapid advancements in DNA testing technologies, strong public and private investments in forensic infrastructure, and a growing emphasis on improving the accuracy of legal outcomes. Within North America, the United States remains the key contributor and is forecast to reach a market value of USD 2.4 billion by 2034. The U.S. is witnessing increased deployment of forensic technologies across both state and federal crime labs, supported by favorable policy frameworks and initiatives aimed at modernizing forensic systems.

The competitive landscape is marked by the presence of major global players, including Illumina, QIAGEN, Thermo Fisher Scientific, Promega, and Danaher, which collectively contribute to more than 50% of the total market share. These companies are actively engaged in the development of next-generation forensic tools, including rapid DNA technologies, genealogical tracing databases, and compact testing systems. Strategic investments in R&D, partnerships with research institutes, and expansion into new markets are central to their growth strategies. Regulatory streamlining and quicker approval timelines are also enabling faster market entry, allowing companies to meet the growing demand for reliable forensic solutions globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Solution

- 2.2.3 Method

- 2.2.4 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Government initiatives and funds for forensic programs

- 3.2.1.2 Technological advancements in paternity and familial testing

- 3.2.1.3 Increasing criminal activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of equipment

- 3.2.2.2 Dearth of skilled professional in developing countries

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption of rapid DNA technologies at point-of-collection

- 3.2.3.2 Growing integration of AI and machine learning in DNA data interpretation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Solution, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Kits

- 5.3 Analyzers and sequencers

- 5.4 Software

- 5.4.1 LIMS

- 5.4.2 Other software types

- 5.5 Consumables

Chapter 6 Market Estimates and Forecast, By Method, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Capillary electrophoresis (CE)

- 6.3 Next generation sequencing (NGS)

- 6.4 PCR amplification

- 6.5 Other methods

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Criminal testing

- 7.3 Paternity and familial testing

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Bio-Rad Laboratories

- 9.3 Danaher

- 9.4 GORDIZ

- 9.5 Illumina

- 9.6 Laboratory Corporation of America Holdings

- 9.7 LabVantage Solution

- 9.8 LabWare

- 9.9 Promega

- 9.10 Qiagen

- 9.11 Thermo Fisher Scientific

- 9.12 VERISIS