|

市場調查報告書

商品編碼

1766328

醫療冷鏈儲存設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Medical Cold Chain Storage Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

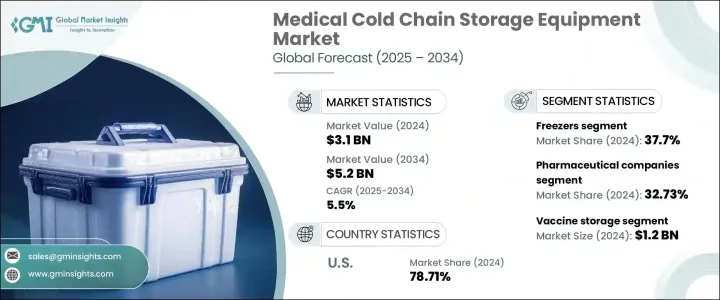

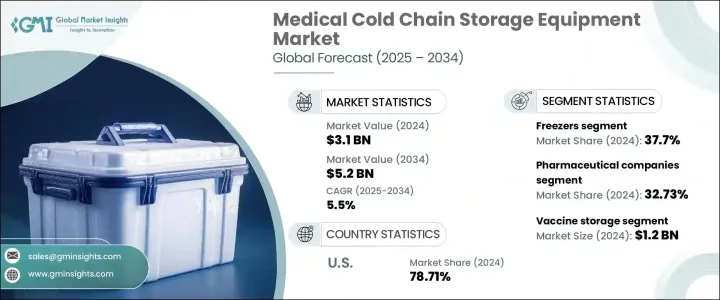

2024年,全球醫療冷鏈儲存設備市場規模達31億美元,預計到2034年將以5.5%的複合年成長率成長,達到52億美元。由於敏感醫藥產品對溫控物流的依賴日益增加,該市場正呈現強勁成長動能。隨著全球醫療保健供應鏈日益複雜,對可靠、安全、高效的冷鏈解決方案的需求持續成長。生物製劑、細胞療法和疫苗等藥品需要恆定的低溫環境,以確保其在運輸和儲存過程中的功效和安全性。世界各地的監管機構也正在執行更嚴格的溫控準則,這推動了高性能冷凍系統的普及。

隨著供應鏈挑戰日益嚴峻,產業參與者正在整合先進技術,包括溫度指示器、智慧感測器和即時資料記錄器,以確保整個冷鏈的品質。此外,智慧製冷系統、自動化工具和環保冷媒的應用正在成為行業標準,使企業能夠同時滿足全球永續發展的要求和環境法規的要求。遠端監控、物聯網功能和預測分析的整合極大地提高了冷鏈管理的營運透明度和績效。持續的數位基礎設施投資,加上國際免疫接種計畫和救命療法的普及,進一步加速了各個醫療保健領域對醫療冷藏系統的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 31億美元 |

| 預測值 | 52億美元 |

| 複合年成長率 | 5.5% |

就產品類型而言,冷凍櫃在 2024 年引領全球市場,佔總營收的 37.7%,預計 2025 年至 2034 年的複合年成長率為 6%。其日益成長的使用是由於需要在特定的低溫下儲存疫苗、藥物和實驗室樣本等關鍵醫療保健產品。這些系統因其穩定性和在不同環境條件下高效運作的能力而受到廣泛認可。符合行業法規的要求也支持了這一需求,因為配備精確溫度控制和警報機制的冷凍櫃被認為是醫療物流中必不可少的。它們能夠適應不同容量的處理,適用於不同的環境,包括醫院、製藥廠和診斷實驗室。雙隔間和節能設計等多功能特性也促使它們廣受歡迎。

根據最終用戶分析,製藥公司在2024年佔據了32.73%的市場佔有率,預計到2034年將以5.8%的複合年成長率擴張。這些公司在嚴格的溫度要求下儲存和運輸疫苗、生物製劑和臨床研究材料。遵守國際溫度控制標準至關重要,尤其是在處理敏感或實驗性化合物時。保持不間斷的冷鏈對於產品活力和保存期限至關重要。隨著產量的增加,製藥公司需要可擴展且合規的儲存系統,以降低產品變質風險並最佳化庫存管理。這些功能不僅有助於滿足監管要求,還能提高營運效率,從而鼓勵對先進冷藏設備的進一步投資。

在應用方面,疫苗儲存在2024年佔據全球市場主導地位,創造了12億美元的收入。預計2025年至2034年期間的複合年成長率將達到5.8%。疫苗必須在較窄的溫度範圍內儲存才能保持其效力,因此專用的冷鏈系統至關重要。全球為提高疫苗接種的可及性和提高疫苗接種意識所做的努力持續推動了對疫苗儲存設備的需求。即時監控技術與高效能冷凍設備結合,可確保在運輸和儲存過程中始終保持一致的溫度控制。由於疫苗在公共衛生中發揮著至關重要的作用,這一應用領域仍然是醫療冷鏈產業的基石。

從地區來看,美國在2024年引領全球市場,佔北美總佔有率的78.71%,營收達8億美元。美國受惠於強大的醫療基礎設施和高度監管的醫藥物流環境。對創新儲存技術和端到端供應鏈視覺化工具的投資,使美國在冷鏈管理領域處於領先地位。此外,大型醫療物流供應商的存在以及製藥廠的高度集中,也有助於鞏固其在該地區的優勢地位。美國機構的嚴格監管也促使企業部署先進的冷藏系統,以提供能源效率和即時合規追蹤。

全球醫療冷鏈儲存設備市場的主要公司包括Binder、Azenta、Cardinal Health、Darwin Chambers、Carebios Biological Technology、Elanpro、海爾生物醫療、Farrar、Hoshizaki America、Memmert、Philipp Kirsch、Kendall Cold Chain System、Summit Appliances、Rommert、Philipp Kirsch、Kendall Cold Chain System、Summit Appliances、Roemer Kuhlung。這些公司持續投資於產品創新和數位解決方案,以滿足不斷變化的市場需求並保持競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 生物製劑和疫苗需求不斷成長

- 嚴格遵守法規

- 技術進步

- 產業陷阱與挑戰

- 初始資本投入高

- 新興市場的基礎建設差距

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依設備類型

- 監理框架

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(84186990)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按設備類型,2021 - 2034 年(十億美元)

- 冰箱

- 實驗室冰箱

- 血庫冰箱

- 藥房冰箱

- 色譜冰箱

- 冷凍機

- 超低溫冷凍機

- 血漿冷凍機

- 速凍機

- 低溫儲存系統

- 液態氮儲存系統

- 氣相儲存系統

- 冷藏室

- 其他

第6章:市場估計與預測:依溫度範圍,2021 年至 2034 年(十億美元)

- 2°C 至 8°C

- -20°C 至 -40°C

- -40°C 至 -80°C

- 低於-80°C

第7章:市場估計與預測:按產能,2021 - 2034 年(十億美元)

- 小型(最多 300 公升)

- 中型(300-700公升)

- 大型(700公升以上)

第8章:市場估計與預測:按技術分類,2021 - 2034 年(十億美元)

- 基於壓縮機的系統

- 基於吸收的系統

- 基於熱電的系統

第9章:市場估計與預測:按應用,2021 - 2034 年(十億美元)

- 主要趨勢

- 疫苗儲存

- 血液及血液製品儲存

- 生物樣本儲存

- 藥品和藥物儲存

- 其他

第 10 章:市場估計與預測:按最終用途,2021 年至 2034 年(十億美元)

- 主要趨勢

- 醫院和診所

- 製藥公司

- 研究實驗室

- 血庫

- 藥局

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- Azenta Inc.

- Binder

- Cardinal Health

- Carebios Biological Technology

- Darwin Chambers

- Elanpro

- Farrar

- Haier Biomedical

- Hoshizaki America

- Kendall Cold Chain System

- Memmert

- Philipp Kirsch

- Roemer Industries

- Summit Appliances

- Thalheimer Kuhlung

The Global Medical Cold Chain Storage Equipment Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 5.2 billion by 2034. The market is witnessing significant momentum due to the growing reliance on temperature-controlled logistics for sensitive pharmaceutical products. As global healthcare supply chains become more complex, the demand for reliable, secure, and efficient cold chain solutions continues to rise. Pharmaceuticals such as biologics, cell therapies, and vaccines require consistent low-temperature environments to maintain efficacy and safety throughout transportation and storage. Regulatory agencies worldwide are also enforcing stricter temperature-control guidelines, which drives the adoption of high-performance refrigeration systems.

With increasing supply chain challenges, industry participants are integrating advanced technologies, including temperature indicators, intelligent sensors, and real-time data loggers, to ensure quality assurance across the entire cold chain. Furthermore, the adoption of smart cooling systems, automation tools, and eco-conscious refrigerants is becoming a standard, enabling companies to align with global sustainability mandates while remaining compliant with environmental regulations. The integration of remote monitoring, IoT capabilities, and predictive analytics has greatly enhanced operational transparency and performance in cold chain management. The ongoing investment in digital infrastructure, combined with international immunization initiatives and expanded access to life-saving treatments, is further accelerating the need for medical cold storage systems across various healthcare segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 5.5% |

In terms of product type, freezers led the global market in 2024, accounting for 37.7% of total revenue, and are projected to register a CAGR of 6% from 2025 to 2034. Their growing use is driven by the need to store critical healthcare products such as vaccines, drugs, and laboratory samples at specific low temperatures. These systems are widely regarded for their stability and ability to function efficiently under diverse environmental conditions. The demand is also supported by the need for compliance with industry regulations, as freezers equipped with accurate temperature controls and alarm mechanisms are considered essential in medical logistics. Their adaptability in handling varying volumes makes them suitable for use in different environments, including hospitals, pharmaceutical manufacturing units, and diagnostic laboratories. Multipurpose features such as dual compartments and energy-efficient designs also contribute to their widespread preference.

Based on end-user analysis, pharmaceutical companies held a 32.73% share of the market in 2024 and are anticipated to expand at a CAGR of 5.8% through 2034. These companies operate under strict temperature requirements to store and transport vaccines, biologics, and clinical research materials. Adherence to international standards for temperature control is non-negotiable, especially when dealing with sensitive or experimental compounds. Maintaining an uninterrupted cold chain is critical for product viability and shelf life. As production volumes increase, pharmaceutical firms require scalable and compliant storage systems that reduce the risk of spoilage and optimize inventory management. These capabilities not only help in meeting regulatory requirements but also enhance operational efficiency, encouraging further investment in advanced cold storage equipment.

In terms of applications, vaccine storage dominated the global market in 2024, generating USD 1.2 billion in revenue. It is expected to grow at a CAGR of 5.8% from 2025 to 2034. Vaccines must be stored within a narrow temperature range to retain their potency, making dedicated cold chain systems essential. Global efforts to improve vaccination access and awareness continue to boost demand for vaccine storage equipment. Real-time monitoring technologies, coupled with high-performance refrigeration units, ensure consistent temperature control during transit and storage. This application segment remains a cornerstone of the medical cold chain industry due to the critical role vaccines play in public health.

Regionally, the United States led the global market in 2024, accounting for 78.71% of North America's total share, with revenue reaching USD 800 million. The country benefits from a robust healthcare infrastructure and a highly regulated pharmaceutical logistics environment. Investments in innovative storage technologies and end-to-end supply chain visibility tools have made the US a leader in cold chain management. Additionally, the presence of major healthcare logistics providers and a high concentration of pharmaceutical manufacturing facilities contribute to regional dominance. Stringent regulations from US agencies have also pushed companies to deploy advanced cold storage systems that offer energy efficiency and real-time compliance tracking.

Key companies operating in the global medical cold chain storage equipment market include Binder, Azenta, Cardinal Health, Darwin Chambers, Carebios Biological Technology, Elanpro, Haier Biomedical, Farrar, Hoshizaki America, Memmert, Philipp Kirsch, Kendall Cold Chain System, Summit Appliances, Roemer Industries, and Thalheimer Kuhlung. These players continue to invest in product innovation and digital solutions to meet evolving market demands and maintain a competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collections methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By region

- 2.2.2 By equipment type

- 2.2.3 By temperature range

- 2.2.4 By capacity

- 2.2.5 By technology

- 2.2.6 By application

- 2.2.7 By end use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for biologics and vaccines

- 3.2.1.2 Stringent regulatory compliance

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Infrastructure gaps in emerging markets

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Equipment type

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (84186990)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger & acquisitions

- 4.6.2 Partnership & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Refrigerators

- 5.1.1 Laboratory refrigerators

- 5.1.2 Blood bank refrigerators

- 5.1.3 Pharmacy refrigerators

- 5.1.4 Chromatography refrigerators

- 5.2 Freezers

- 5.2.1 Ultra-low temperature freezers

- 5.2.2 Plasma freezers

- 5.2.3 Shock freezers

- 5.3 Cryogenic storage systems

- 5.3.1 Liquid nitrogen storage systems

- 5.3.2 Vapor phase storage systems

- 5.4 Cold rooms

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Temperature Range, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 2°C to 8°C

- 6.2 -20°C to -40°C

- 6.3 -40°C to -80°C

- 6.4 Below -80°C

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Small (up to 300 liters)

- 7.2 Medium (300-700 liters)

- 7.3 Large (above 700 liters)

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Compressor-based systems

- 8.2 Absorption-based systems

- 8.3 Thermoelectric-based systems

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Vaccine storage

- 9.3 Blood & blood products storage

- 9.4 Biological sample storage

- 9.5 Drug & pharmaceutical storage

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 Hospitals & clinics

- 10.3 Pharmaceutical companies

- 10.4 Research laboratories

- 10.5 Blood banks

- 10.6 Pharmacies

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Azenta Inc.

- 12.2 Binder

- 12.3 Cardinal Health

- 12.4 Carebios Biological Technology

- 12.5 Darwin Chambers

- 12.6 Elanpro

- 12.7 Farrar

- 12.8 Haier Biomedical

- 12.9 Hoshizaki America

- 12.10 Kendall Cold Chain System

- 12.11 Memmert

- 12.12 Philipp Kirsch

- 12.13 Roemer Industries

- 12.14 Summit Appliances

- 12.15 Thalheimer Kuhlung