|

市場調查報告書

商品編碼

1766323

年齡相關性黃斑部病變市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Age-related Macular Degeneration Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

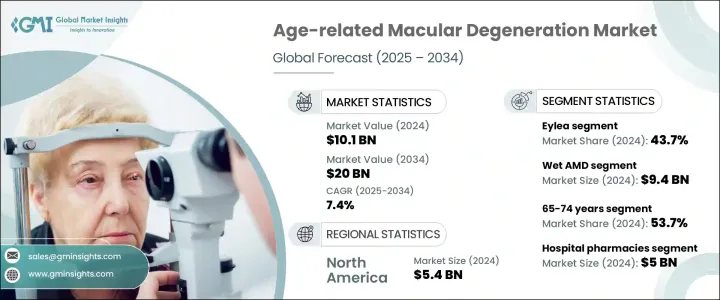

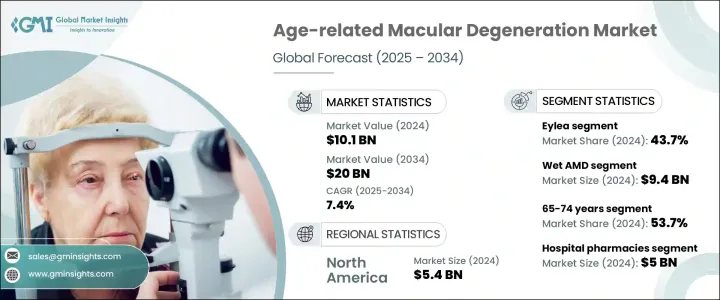

2024年,全球老年黃斑部病變市場規模達101億美元,預計到2034年將以7.4%的複合年成長率成長,達到200億美元。市場成長的驅動力包括:AMD盛行率的上升、全球人口老化、認知度的提高和早期診斷的提升,以及治療方案的不斷創新。 AMD是一種進行性眼部疾病,主要影響50歲以上族群,導致不可逆的中央視力喪失,並嚴重影響閱讀、駕駛和臉部辨識等日常活動,最終影響整體生活品質。

隨著病情進展,黃斑部(視網膜中負責清晰中央視力的部分)會受到損害,導致視野模糊或出現黑點,無法透過配戴眼鏡或隱形眼鏡矯正。這種獨立性的喪失常常會導致焦慮、憂鬱和社會孤立等心理問題,尤其是在老年人群體中。 AMD 日益加重的負擔與全球老化趨勢密切相關,65 歲以上族群的盛行率急劇上升。該疾病也與其他風險因素有關,例如吸煙、高血壓、肥胖、遺傳易感性和不良飲食習慣——這些因素在全球範圍內變得越來越普遍。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 101億美元 |

| 預測值 | 200億美元 |

| 複合年成長率 | 7.4% |

按疾病類型分類,濕性AMD在2024年佔據市場主導地位,市場規模達94億美元,這得益於抗VEGF療法的廣泛應用。這些療法已被證明能夠有效阻止病情進展、最大程度減少視網膜積液並保護視功能。 Eylea、Lucentis和Beovu等藥物的成功,使濕性AMD成為最有效的治療類型。同時,乾性AMD一直以來缺乏核准的藥物干預,如今正重新受到臨床關注。 Syfovre是首個獲得FDA批准的地圖樣萎縮(一種嚴重的乾性AMD)治療藥物,其上市以及一系列前景看好的補體通路抑制劑和基因療法,標誌著該領域治療的變革性轉變。

抗VEGF療法,例如Eylea、Lucentis和Vabysmo,已成為AMD治療的基石。其中,Eylea憑藉其在延長注射間隔和維持視力方面的功效,佔據了43.7%的市場。該藥物的升級劑型Eylea HD透過提供延長的給藥方案,提高了患者的依從性並減輕了治療負擔,正在獲得進一步的關注。像Vabysmo這樣的新進業者正透過雙通路抑制(VEGF-A + Ang-2)迅速搶佔市場佔有率,解決血管不穩定問題並提供更好的臨床療效。

2025-2034年,北美老年性黃斑部病變市場將以7%的複合年成長率成長,這得益於強大的醫療基礎設施、創新療法的早期應用以及支持性監管框架。 OCT等先進影像技術的廣泛普及以及對預防性眼科護理的日益重視,進一步支撐了較高的診斷率。近期,美國食品藥物管理局(FDA)批准了用於治療乾性老年性黃斑部病變的光生物調節等新型非侵入性療法,凸顯了該地區正朝著更便捷的治療方式轉變,這些方式更符合患者的偏好,並能提高患者的長期依從性。

為了鞏固其在老年黃斑部病變市場的地位,Xbrane Biopharma AB、輝瑞公司、Formycon AG、Celltrion, Inc.、諾華公司、安進公司、山德士集團、Apellis Pharmaceuticals, Inc.、STADA Arzneimittel AG、F. Hoffmann-La Rocheics Ltd.、Biocon Biologics Limited、再生元製藥公司、拜耳公司和百健公司等公司正在採取策略性舉措,包括研發投資、生物相似藥開發和長效製劑。再生元推出的Eylea HD和羅氏推出的Vabysmo體現了創新驅動的競爭。各公司也透過與合約研究組織(CRO)合作進行臨床試驗並利用數位工具進行真實世界資料收集來擴大規模。全球市場領導者專注於基因療法、雙通路抑制劑和補體標靶藥物,以實現產品組合多元化。此外,定價策略、策略許可和監管合作可以加快市場准入速度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 老年黃斑部病變(AMD)盛行率上升

- 老齡人口成長

- 治療方案的進步

- 提高認知和早期診斷

- 產業陷阱與挑戰

- 治療費用高昂

- 玻璃體內注射併發症的風險

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲(不包括英國)

- 英國

- 印度

- 巴西

- 中國

- 技術格局

- 核心技術

- 鄰近技術

- 未來市場趨勢

- 專利分析

- 管道分析

- 臨床試驗概況

- 已獲批准的療法

- 正在臨床試驗中的新興生物相似藥

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 競爭市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 艾莉婭

- 樂康

- 貝奧武

- 瓦比斯莫

- 賽福弗爾

- 阿瓦斯汀

- 其他產品

第6章:市場估計與預測:依疾病類型,2021 年至 2034 年

- 主要趨勢

- 濕性AMD

- 乾性AMD

第7章:市場估計與預測:依年齡層,2021 年至 2034 年

- 主要趨勢

- 50–64歲

- 65–74歲

- 75歲以上

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 專業藥局和零售藥局

- 電子商務

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Amgen

- Apellis Pharmaceuticals

- Bayer

- Biocon Biologics

- Biogen

- Celltrion

- F. Hoffmann-La Roche

- Formycon

- Novartis

- Pfizer

- Regeneron Pharmaceuticals

- Sandoz Group

- STADA Arzneimittel

- Xbrane Biopharma

The Global Age-related Macular Degeneration Market was valued at USD 10.1 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 20 billion by 2034. The market growth is driven by a rising prevalence of AMD, an aging global population, increased awareness and early diagnosis, and ongoing innovations in treatment options. AMD is a progressive eye condition affecting individuals aged 50 and above, leading to central vision loss and significantly impacting quality of life. AMD is a progressive eye condition that primarily affects individuals aged 50 and above, leading to irreversible central vision loss and significantly impairing daily activities such as reading, driving, and recognizing faces, ultimately impacting the overall quality of life.

As the disease advances, it compromises the macula-the part of the retina responsible for sharp, central vision-resulting in blurred or dark spots in the visual field that cannot be corrected with glasses or contact lenses. This loss of independence often contributes to psychological effects such as anxiety, depression, and social isolation, especially among older adults. The growing burden of AMD is closely tied to the global aging trend, with its prevalence sharply increasing in populations over 65. The disease is also associated with other risk factors such as smoking, hypertension, obesity, genetic predisposition, and poor dietary habits-factors that are becoming more prevalent globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.1 Billion |

| Forecast Value | $20 Billion |

| CAGR | 7.4% |

By disease type, wet AMD dominated the market with USD 9.4 billion in 2024, driven by the widespread adoption of anti-VEGF therapies, which have proven effective in halting disease progression, minimizing retinal fluid accumulation, and preserving visual function. The success of agents like Eylea, Lucentis, and Beovu has positioned wet AMD as the most actively treated form of the disease. Meanwhile, dry AMD, historically lacking approved pharmacologic interventions, is now seeing renewed clinical focus. The launch of Syfovre, the first FDA-approved treatment for geographic atrophy (a severe form of dry AMD), along with a promising pipeline of complement pathway inhibitors and gene therapies, signals a transformative shift in managing this segment.

Anti-VEGF therapies such as Eylea, Lucentis, and Vabysmo have become the cornerstone of AMD treatment. Among these, the Eylea segment held 43.7% share owing to its efficacy in extending injection intervals and maintaining visual acuity. The drug's updated formulation, Eylea HD, is gaining further traction by offering extended dosing schedules that improve patient adherence and reduce treatment burden. New entrants like Vabysmo are rapidly gaining market share through dual-pathway inhibition (VEGF-A + Ang-2), addressing vascular instability and offering enhanced clinical outcomes.

North America Age-related Macular Degeneration Market will grow at a CAGR of 7% during 2025-2034, driven by robust healthcare infrastructure, early adoption of innovative therapies, and supportive regulatory frameworks. High diagnosis rates are further supported by widespread access to advanced imaging technologies such as OCT and an increasing focus on preventative eye care. Recent FDA approvals of novel, non-invasive therapies such as photobiomodulation for dry AMD underscore a regional shift toward less burdensome treatment modalities, aligning with patient preferences and improving long-term adherence.

To strengthen their position in the Age-related Macular Degeneration Market, companies like Xbrane Biopharma AB, Pfizer Inc., Formycon AG, Celltrion, Inc., Novartis AG, Amgen Inc., Sandoz Group AG, Apellis Pharmaceuticals, Inc., STADA Arzneimittel AG, F. Hoffmann-La Roche Ltd., Biocon Biologics Limited, Regeneron Pharmaceuticals Inc., Bayer AG, Biogen, Inc. are adopting strategic initiatives including R&D investments, biosimilar development, and long-acting formulations. Regeneron's launch of Eylea HD and Roche's introduction of Vabysmo demonstrate innovation-driven competition. Companies are also expanding through partnerships with CROs for clinical trials and leveraging digital tools for real-world data collection. Global market leaders focus on gene therapies, dual-pathway inhibitors, and complement-targeting drugs to diversify their portfolios. Additionally, pricing strategies, strategic licensing, and regulatory collaborations enable faster market access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Market size estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Forecast model

- 1.6 Data mining sources

- 1.6.1 Global

- 1.6.2 Regional/Country

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of age-related macular degeneration (AMD)

- 3.2.1.2 Growth in aging population

- 3.2.1.3 Advancements in treatment options

- 3.2.1.4 Increased awareness and early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Risk of complications from intravitreal injections

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe (excluding UK)

- 3.4.3 UK

- 3.4.4 India

- 3.4.5 Brazil

- 3.4.6 China

- 3.5 Technology landscape

- 3.5.1 Core technologies

- 3.5.2 Adjacent technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pipeline analysis

- 3.9 Clinical trial landscape

- 3.9.1 Approved therapies

- 3.9.2 Emerging biosimilars under clinical trials

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Eylea

- 5.3 Lucentis

- 5.4 Beovu

- 5.5 Vabysmo

- 5.6 Syfovre

- 5.7 Avastin

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Wet AMD

- 6.3 Dry AMD

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 50–64 years

- 7.3 65–74 years

- 7.4 75 and above

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Specialty and retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.4 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amgen

- 10.2 Apellis Pharmaceuticals

- 10.3 Bayer

- 10.4 Biocon Biologics

- 10.5 Biogen

- 10.6 Celltrion

- 10.7 F. Hoffmann-La Roche

- 10.8 Formycon

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Regeneron Pharmaceuticals

- 10.12 Sandoz Group

- 10.13 STADA Arzneimittel

- 10.14 Xbrane Biopharma