|

市場調查報告書

商品編碼

1766314

實驗室能力測試市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Laboratory Proficiency Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

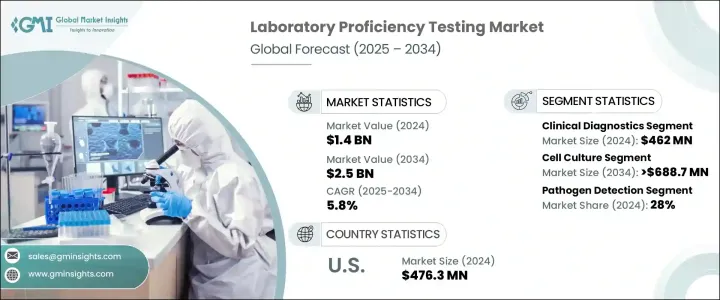

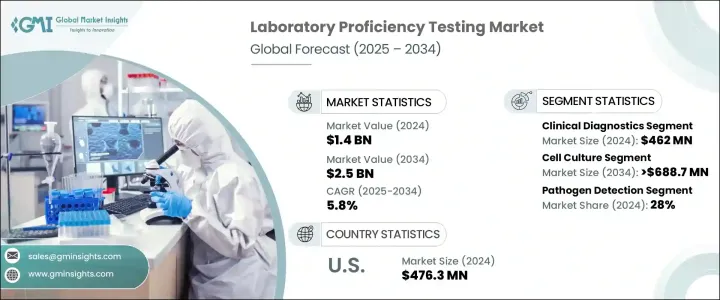

2024年,全球實驗室能力驗證市場規模達14億美元,預計2034年將以5.8%的複合年成長率成長,達到25億美元。推動這一成長的重要因素是實驗室環境中對穩健品質控制的需求不斷成長,以及各行各業對能力驗證應用的不斷增加。隨著監管審查力度的加強以及越來越多的實驗室尋求認證,市場參與度正在提升。臨床診斷實驗室的擴張以及對用於管理慢性病和傳染病的精準檢測的日益重視,進一步增強了市場發展勢頭。

隨著慢性健康問題和傳染病的持續激增,對精準診斷的依賴也顯著增加。為了維護國際標準並降低誤診風險,能力驗證計畫正得到更廣泛的應用。由於基因檢測和分子檢測等先進診斷技術的廣泛應用,這些品質保證計畫正變得至關重要。公共和私營部門的利益相關者都在投資加強實驗室基礎設施,以滿足這些不斷發展的標準。 CLIA、ISO 和 CAP 等組織的合規要求現在要求進行常規能力驗證,以維持認證並滿足全球品質基準。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 25億美元 |

| 複合年成長率 | 5.8% |

臨床診斷細分市場在2024年達到4.62億美元,佔市場最大佔有率。這種主導地位源於精準的診斷檢測在管理患者健康結果方面發揮的關鍵作用。隨著慢性病負擔的加重,人們對診斷準確性的依賴程度也隨之增加,這使得能力驗證測試對於高容量實驗室而言至關重要。在微生物學、分子檢測和血液學領域進行廣泛合作的機構正更加重視與ISO 15189等國際框架的接軌。隨著先進診斷技術在醫療機構中的應用日益廣泛,對嚴格的能力驗證測試的需求也日益成長,以確保降低錯誤率並改善患者預後。

細胞培養檢測市場預計將以5.3%的複合年成長率成長,到2034年將達到6.887億美元。細胞培養是生物製劑、疫苗和各種細胞療法生產的基礎。為了保持一致性並防止污染,實驗室必須定期通過能力驗證來評估其技術和材料。按照GMP指南運作的實驗室,尤其是生物製劑和再生醫學領域的實驗室,依賴這些評估來確保流程的可靠性和合規性。此外,隨著幹細胞治療和組織工程等新療法的發展,對標準化實驗室實踐和通過能力驗證獲得可靠結果的需求預計將持續成長。

2024年,美國實驗室能力驗證市場規模達4.763億美元,預計2025年至2034年的複合年成長率為4.9%。憑藉強大的監管基礎和完善的診斷基礎設施,美國在全球市場處於領先地位。策略性資金投入計畫進一步推動了實驗室準確性的提升。總計17億美元的投資用於提升檢測能力,尤其是在傳染病檢測和分子診斷領域。聯邦衛生計畫也在推動更高水準的能力驗證參與度,截至2024年,公共衛生實驗室幾乎實現全面覆蓋,這將有力地支持該地區的市場成長。

實驗室能力驗證市場的知名產業參與者包括 Aashvi PT、BIO-RAD、LGC、美國能力驗證研究所、美國病理學家學院、QACS LAB、FAPAS、FLUXANA、AOAC INTERNATIONAL、RANDOX、MERCK、Trilogy、WEQAS、Waters 和 ABSOLUTE STANDARDS。這包括透過擴展到分子生物學、微生物學和毒理學等專業測試領域來增強其服務組合。該公司還在投資數位平台,以簡化能力驗證結果提交並自動化資料分析。針對新興診斷技術量身定做的 PT 方案已成為關注的焦點,而與監管機構的合作正在幫助這些公司與不斷發展的全球品質標準保持一致。此外,策略合併、與診斷實驗室的合作以及向新興經濟體的地理擴張有助於提高他們的競爭力並滿足對認可測試服務日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 食品和藥品的嚴格安全和品質法規

- 水質檢測需求不斷成長

- 能力驗證是實驗室卓越運作的必要前提

- 醫用大麻合法化和大麻檢測實驗室數量的增加

- 產業陷阱與挑戰

- 缺乏熟練的專業人員

- 需要大量資本投資來建造先進的測試設施

- 市場機會

- 測試產業的技術進步

- 擴大採用能力測試來防止食品摻假

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 差距分析

- 波特的分析

- PESTEL分析

- 政策格局

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新服務推出

- 擴張計劃

第5章:市場估計與預測:按產業,2021 年至 2034 年

- 主要趨勢

- 臨床診斷

- 微生物學

- 製藥

- 食品和飲料

- 生物製劑

- 其他行業

第6章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 細胞培養

- 免疫測定

- 聚合酶鍊式反應

- 光譜法

- 色譜法

- 其他技術

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 病原體檢測

- 分子傳染病檢測

- 血液化學和血液學檢查

- 無菌保證

- 內毒素和熱原檢測

- 殘留溶劑和污染物分析

- 其他應用

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Aashvi PT

- ABSOLUTE STANDARDS

- American Proficiency Institute

- AOAC INTERNATIONAL

- BIO-RAD

- COLLEGE of AMERICAN PATHOLOGISTS

- FAPAS

- FLUXANA

- LGC

- MERCK

- QACS LAB

- RANDOX

- Trilogy

- Waters

- WEQAS

The Global Laboratory Proficiency Testing Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 2.5 billion by 2034. A significant driver behind this expansion is the rising demand for robust quality control in laboratory settings, as well as increased usage of proficiency testing across a range of sectors. With growing regulatory scrutiny and more laboratories seeking accreditation, the market is experiencing a boost in participation. The expansion of clinical diagnostics labs and heightened focus on precision testing to manage chronic and infectious diseases are further strengthening market momentum.

As chronic health issues and communicable diseases continue to surge, the reliance on accurate diagnostics has grown substantially. To uphold international standards and reduce the risk of misdiagnosis, proficiency testing programs are being adopted more widely. These quality assurance programs are becoming critical due to the broader application of advanced diagnostic technologies like genetic and molecular testing. Public and private stakeholders alike are investing in strengthening laboratory infrastructure to meet these evolving standards. Compliance requirements from organizations such as CLIA, ISO, and CAP now mandate routine proficiency evaluations to sustain certifications and meet global quality benchmarks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 5.8% |

The clinical diagnostics segment reached USD 462 million in 2024, accounting for the largest share in the market. This dominance stems from the critical role accurate diagnostic testing plays in managing patient health outcomes. With the growing burden of chronic illness, there is a higher dependency on diagnostic accuracy, which makes proficiency testing non-negotiable for high-volume labs. Facilities conducting extensive panels in microbiology, molecular testing, and hematology are placing an even greater emphasis on alignment with international frameworks like ISO 15189. As advanced diagnostics see greater adoption across medical institutions, the need for rigorous proficiency assessment continues to rise, ensuring reduced error rates and improved patient outcomes.

The cell culture testing segment is set to grow at a CAGR of 5.3%, reaching USD 688.7 million by 2034. Cell culture is foundational to the production of biologics, vaccines, and various cell-based therapeutics. To maintain consistency and prevent contamination, laboratories must regularly assess their techniques and materials through proficiency testing. Labs operating under GMP guidelines, particularly those in biologics and regenerative medicine, depend on these evaluations to ensure process reliability and regulatory compliance. Furthermore, as new therapies like stem cell treatments and tissue engineering gain momentum, demand for standardized lab practices and reliable results through proficiency testing is expected to escalate.

United States Laboratory Proficiency Testing Market was valued at USD 476.3 million in 2024 and is forecast to grow at a CAGR of 4.9% from 2025 to 2034. The country leads the global market due to its strong regulatory foundation and robust diagnostics infrastructure. Strategic funding initiatives have further fueled progress in lab accuracy. Investments totaling USD 1.7 billion were dedicated to expanding testing capacity, particularly in the areas of infectious disease detection and molecular diagnostics. Federal health programs are also pushing for higher participation in proficiency evaluations, with nearly full coverage of public health labs as of 2024, which significantly supports market growth in the region.

Prominent industry players in the Laboratory Proficiency Testing Market include Aashvi PT, BIO-RAD, LGC, American Proficiency Institute, COLLEGE of AMERICAN PATHOLOGISTS, QACS LAB, FAPAS, FLUXANA, AOAC INTERNATIONAL, RANDOX, MERCK, Trilogy, WEQAS, Waters, and ABSOLUTE STANDARDS. This include strengthening their service portfolios through expansion into specialized testing areas such as molecular biology, microbiology, and toxicology. Firms are also investing in digital platforms to streamline proficiency test result submissions and automate data analysis. Custom-designed PT schemes tailored to emerging diagnostic technologies have become a central focus, while partnerships with regulatory bodies are helping these companies align with evolving global quality standards. Additionally, strategic mergers, collaborations with diagnostic laboratories, and geographic expansion into emerging economies help increase their competitive footprint and meet the growing demand for accredited testing services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Industry trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent safety and quality regulations for food and pharmaceuticals products

- 3.2.1.2 Increasing demand for water testing

- 3.2.1.3 Proficiency testing is a necessary pre-requisite for laboratory's operational excellence

- 3.2.1.4 Legalization of medical cannabis and increasing number of cannabis testing laboratories

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals

- 3.2.2.2 Requirement of high-capital investments for advance testing facilities

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements in testing industry

- 3.2.3.2 Increasing adoption of proficiency tests to prevent food adulteration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Policy landscape

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By Region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1 By Region

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New services launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Industry, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Clinical diagnostics

- 5.3 Microbiology

- 5.4 Pharmaceuticals

- 5.5 Food and beverages

- 5.6 Biologics

- 5.7 Other industries

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cell culture

- 6.3 Immunoassays

- 6.4 Polymerase chain reaction

- 6.5 Spectrometry

- 6.6 Chromatography

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pathogen detection

- 7.3 Molecular infectious disease testing

- 7.4 Blood chemistry and hematology panels

- 7.5 Sterility assurance

- 7.6 Endotoxin and pyrogen testing

- 7.7 Residual solvent and contaminant analysis

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aashvi PT

- 9.2 ABSOLUTE STANDARDS

- 9.3 American Proficiency Institute

- 9.4 AOAC INTERNATIONAL

- 9.5 BIO-RAD

- 9.6 COLLEGE of AMERICAN PATHOLOGISTS

- 9.7 FAPAS

- 9.8 FLUXANA

- 9.9 LGC

- 9.10 MERCK

- 9.11 QACS LAB

- 9.12 RANDOX

- 9.13 Trilogy

- 9.14 Waters

- 9.15 WEQAS