|

市場調查報告書

商品編碼

1766303

細胞株開發市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cell Line Development Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

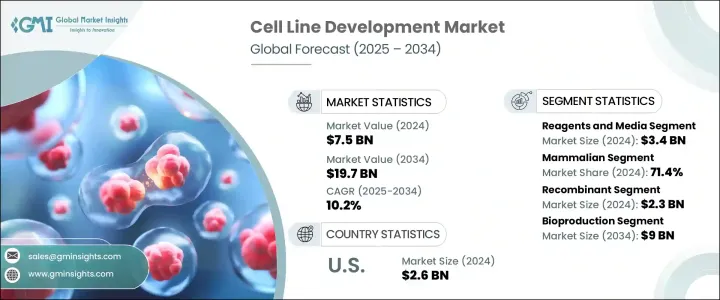

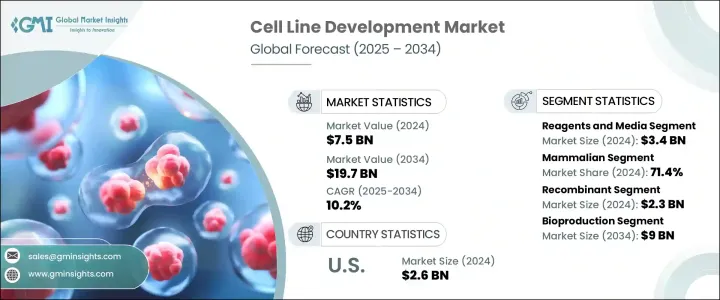

2024 年全球細胞株開發市場價值 75 億美元,預計到 2034 年將以 10.2% 的複合年成長率成長,達到 197 億美元。市場擴張的動力源於對生物製劑和生物相似藥日益成長的關注,尤其是隨著製藥業轉向個人化治療和精準醫療。對單株抗體、疫苗和重組蛋白的需求激增,使得開發高度穩定和高產量的細胞系成為當務之急。自體免疫疾病、癌症和傳染性疾病等慢性疾病的增加導致生物製劑的應用日益廣泛,而生物製劑在很大程度上依賴特徵明確的細胞系。這也增加了對品質控制生產系統的需求。合約開發和製造組織 (CDMO) 為市場發展做出了重大貢獻。

越來越多的中小型生物技術公司將細胞株開發外包給CDMO,以降低營運成本並加快進度,從而受益於CDMO的技術專長、可擴展的平台以及對FDA等機構的合規性。這一趨勢使公司能夠專注於研發創新等核心競爭力,同時利用CDMO提供端到端服務,包括細胞株篩選、克隆篩選、製程最佳化和GMP生產。這些合作關係還能提供先進的技術、簡化的工作流程和成熟的品質保證框架,從而加快進入臨床試驗階段,並降低與內部產能限制相關的風險。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 75億美元 |

| 預測值 | 197億美元 |

| 複合年成長率 | 10.2% |

2024年,試劑和培養基細分市場產值達34億美元。由於其在研發和生產階段的細胞生長和維持中發揮核心作用,該細分市場將繼續佔據主導地位。隨著哺乳動物細胞在生物製劑生產中的使用量顯著增加,對高效試劑和細胞培養基的需求也隨之激增。無蛋白質和無血清培養基的日益普及,正推動該細分市場的發展,它們能夠提高可擴展性、降低污染風險,並在大規模生產環境中保持一致性。此類培養基對於法規核准和生物製劑生產的效率至關重要,因為生物製劑生產需要嚴格的製程控制。

就細胞類型而言,哺乳動物細胞細分市場在2024年創造了最高的收入,佔71.4%。其主導地位與其卓越的表達人源性治療性蛋白的能力以及精準的翻譯後修飾能力息息相關。 CHO和HEK-293等廣泛使用的細胞係因其強大的蛋白質折疊、糖基化和可擴展性而備受生物製劑生產的青睞。 CRISPR-Cas9等基因編輯工具的技術進步,加上自動化和高通量系統,持續提升了哺乳動物細胞株開發的速度和穩定性,進一步鞏固了其在市場上的領先地位。

2024年,美國細胞株開發市場規模達26億美元,這得益於先進的生物製藥基礎設施、高發生率的慢性病發病率以及尖端生物療法的廣泛應用。美國完善的製藥生態系統,包括頂尖的生技公司和大量的研發投入,在市場擴張中扮演關鍵角色。美國各地的研究機構和創新中心也在加速基因編輯和自動化平台的技術進步,以實現更快、更有效率的開發週期。政府和私營部門的資金也在推動創新,進一步鞏固了美國在該領域的領先地位。

全球細胞株開發市場的主要公司包括 PromoCell、諾華、Genscript Biotech、賽多利斯、賽默飛世爾科技、ProBioGen、Cytiva(丹納赫集團)、ASIMOV、Advanced Instruments、Sigma Aldrich(默克集團)、Eurofins Scientific、藥明康德、Aragen Life Sciences、Fyonigen Life 和沙龍集團。細胞株開發領域的頂尖企業正在大力投資技術創新,例如自動化細胞篩選平台、一次性生物反應器和基於 CRISPR 的基因組編輯。許多公司正在與生物技術公司和合約研發生產組織 (CDMO) 建立策略聯盟,以增強服務範圍並擴大生產能力。收購也是整合新技術或獲得區域准入的熱門舉措。各公司正專注於研發無血清和化學成分確定的培養基,以幫助提高法規遵循和可擴展性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 全球疫苗產量不斷成長

- 全球癌症發生率不斷上升

- 細胞株開發的技術創新

- 不斷發展的生物技術產業

- 產業陷阱與挑戰

- 複雜的監管格局

- 與幹細胞研究相關的挑戰

- 市場機會

- 個人化醫療和再生療法的新興應用

- 人工智慧在細胞株最佳化的應用

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- CHO 細胞系的新興治療應用

- 技術格局

- 當前的技術趨勢

- 新興技術

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品和服務,2021 年至 2034 年

- 主要趨勢

- 試劑和培養基

- 裝置

- 孵化器

- 離心機

- 生物反應器

- 倉儲設備

- 顯微鏡

- 電穿孔儀

- 螢光活化細胞分選

- 其他設備

- 配件和耗材

- 服務

第6章:市場估計與預測:依來源,2021 年至 2034 年

- 主要趨勢

- 哺乳動物

- 中國倉鼠卵巢(CHO)

- 人類胚胎腎(HEK)

- 幼倉鼠腎(BHK)

- 鼠骨髓瘤

- 其他哺乳動物來源

- 非哺乳動物

- 昆蟲

- 兩棲類

第7章:市場估計與預測:按細胞株,2021 – 2034

- 主要趨勢

- 重組

- 雜交瘤

- 連續性細胞系

- 原代細胞系

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 生物生產

- 藥物研發

- 毒性測試

- 組織工程

- 研究

第9章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製藥和生物技術公司

- 學術和研究機構

- 合約研究組織(CRO)

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Advanced Instruments

- Aragen Life Sciences

- ASIMOV

- Cytiva (Danaher Corporation)

- Eurofins Scientific

- Fyonibio

- Genscript Biotech

- Lonza Group

- Novartis

- ProBioGen

- PromoCell

- Sartorius

- Sigma Aldrich (Merck KGaA)

- Thermo Fisher Scientific

- WuXi AppTec

The Global Cell Line Development Market was valued at USD 7.5 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 19.7 billion by 2034. Market expansion is being fueled by a growing focus on biologics and biosimilars, particularly as the pharmaceutical industry shifts toward personalized therapies and precision medicine. The surge in demand for monoclonal antibodies, vaccines, and recombinant proteins has placed a strong emphasis on the development of highly stable and productive cell lines. The increase in chronic illnesses-such as autoimmune diseases, cancer, and infectious disorders-has led to the rising adoption of biologics, which depend heavily on well-characterized cell lines. This has also elevated the need for quality-controlled production systems. Contract development and manufacturing organizations (CDMOs) have contributed significantly to market momentum.

Small and mid-sized biotech firms are increasingly outsourcing their cell line development to CDMOs to reduce overhead costs and accelerate timelines, benefiting from their technical expertise, scalable platforms, and regulatory compliance with agencies like the FDA. This trend allows companies to focus on core competencies such as research and innovation while leveraging CDMOs for end-to-end services including cell line screening, clone selection, process optimization, and GMP manufacturing. These partnerships also offer access to advanced technologies, streamlined workflows, and proven quality assurance frameworks, enabling faster entry into clinical trials and reducing risks associated with internal capacity limitations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $19.7 Billion |

| CAGR | 10.2% |

The reagents and media segment generated USD 3.4 billion in 2024. This segment continues to dominate due to its central role in cell growth and maintenance across both R&D and production stages. With a notable increase in the use of mammalian cells for biologics manufacturing, the demand for high-efficiency reagents and cell culture media has surged. A growing preference for protein-free and serum-free media is helping the segment gain traction, offering improved scalability, reduced risk of contamination, and consistency in large-scale production environments. Such media types are essential for regulatory approval and efficiency in biologics manufacturing, which demands stringent process control.

In terms of cell type, mammalian cells segment generated the highest revenue in 2024, accounting for 71.4%. Their dominance is linked to their superior ability to express human-compatible therapeutic proteins with accurate post-translational modifications. Widely used cell lines such as CHO and HEK-293 are favored in biologics production due to their robust protein folding, glycosylation, and scalability. Technological progress in gene editing tools, such as CRISPR-Cas9, combined with automation and high-throughput systems, continues to enhance the speed and stability of mammalian cell line development, further reinforcing their leadership in the market.

United States Cell Line Development Market was valued at USD 2.6 billion in 2024, driven by a combination of advanced biopharma infrastructure, high rates of chronic disease, and strong adoption of cutting-edge biologic therapies. The country's well-established pharmaceutical ecosystem, which includes top-tier biotech firms and extensive R&D investment, plays a pivotal role in expanding the market. Research institutions and innovation hubs across the US are also accelerating technological advancements in gene editing and automated platforms, leading to faster and more efficient development cycles. Government and private sector funding are also propelling innovation, further supporting the country's leadership in the field.

Key companies operating in the Global Cell Line Development Market include PromoCell, Novartis, Genscript Biotech, Sartorius, Thermo Fisher Scientific, ProBioGen, Cytiva (Danaher Corporation), ASIMOV, Advanced Instruments, Sigma Aldrich (Merck KGaA), Eurofins Scientific, WuXi AppTec, Aragen Life Sciences, Fyonibio, and Lonza Group. Top-tier players in the cell line development space are heavily investing in technological innovations like automated cell screening platforms, single-use bioreactors, and CRISPR-based genome editing. Many companies are forming strategic alliances with biotech firms and CDMOs to enhance service offerings and expand production capabilities. Acquisitions are also a popular move to integrate novel technologies or gain regional access. Firms are focusing on R&D to develop serum-free and chemically defined media, helping improve regulatory compliance and scalability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Products & services

- 2.2.3 Source

- 2.2.4 Cell line

- 2.2.5 Application

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing vaccine production worldwide

- 3.2.1.2 Increasing prevalence of cancer across the globe

- 3.2.1.3 Technological innovations in cell line development

- 3.2.1.4 Growing biotechnology industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex regulatory landscape

- 3.2.2.2 Challenges related to stem cell research

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging applications in personalized medicine and regenerative therapies

- 3.2.3.2 Adoption of artificial intelligence in cell line optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Emerging therapeutic applications of CHO cell lines

- 3.7 Technology landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Products & Services, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reagents and media

- 5.3 Equipment

- 5.3.1 Incubator

- 5.3.2 Centrifuges

- 5.3.3 Bioreactors

- 5.3.4 Storage equipment

- 5.3.5 Microscopes

- 5.3.6 Electroporators

- 5.3.7 Fluorescence-activated cell sorting

- 5.3.8 Other equipment

- 5.4 Accessories and consumables

- 5.5 Services

Chapter 6 Market Estimates and Forecast, By Source, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Mammalian

- 6.2.1 Chinese Hamster Ovary (CHO)

- 6.2.2 Human Embryonic Kidney (HEK)

- 6.2.3 Baby Hamster Kidney (BHK)

- 6.2.4 Murine myeloma

- 6.2.5 Other mammalian sources

- 6.3 Non-mammalian

- 6.3.1 Insects

- 6.3.2 Amphibians

Chapter 7 Market Estimates and Forecast, By Cell Line, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Recombinant

- 7.3 Hybridomas

- 7.4 Continuous cell lines

- 7.5 Primary cell lines

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Bioproduction

- 8.3 Drug discovery

- 8.4 Toxicity testing

- 8.5 Tissue engineering

- 8.6 Research

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Pharmaceutical and biotechnology companies

- 9.3 Academic and research institutes

- 9.4 Contract research organizations (CROs)

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Advanced Instruments

- 11.2 Aragen Life Sciences

- 11.3 ASIMOV

- 11.4 Cytiva (Danaher Corporation)

- 11.5 Eurofins Scientific

- 11.6 Fyonibio

- 11.7 Genscript Biotech

- 11.8 Lonza Group

- 11.9 Novartis

- 11.10 ProBioGen

- 11.11 PromoCell

- 11.12 Sartorius

- 11.13 Sigma Aldrich (Merck KGaA)

- 11.14 Thermo Fisher Scientific

- 11.15 WuXi AppTec