|

市場調查報告書

商品編碼

1766302

管道工業加熱器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Duct Industrial Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

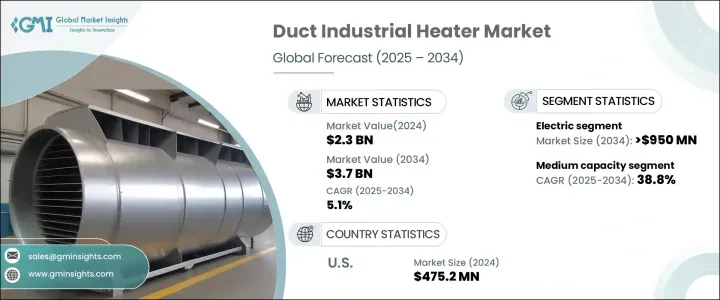

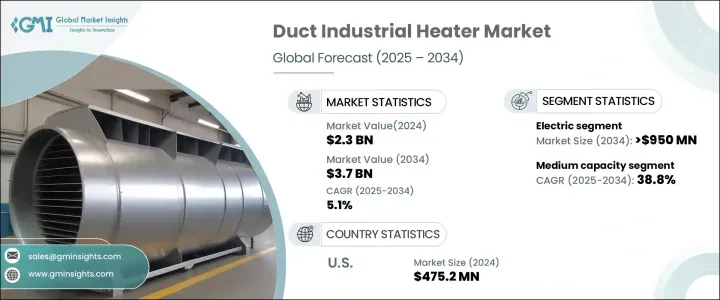

2024年,全球管道工業加熱器市場規模達23億美元,預計到2034年將以5.1%的複合年成長率成長,達到37億美元。智慧暖氣系統需求的不斷成長,以及人們對能源使用和環境責任日益成長的關注,預計將推動該行業的長期成長。日益嚴格的環境法規正在推動各行各業採用節能解決方案,這刺激了對符合現代永續發展標準的管道加熱器的需求。全球暖通空調基礎設施的成長也帶來了新的市場機會。

人們越來越傾向於模組化、節省空間的加熱器型號,因為它們更易於安裝並整合到各種工業設備中。這促進了產品開發並擴大了市場覆蓋範圍。隨著各行各業持續重視熱效率和法規合規性,管道工業加熱器作為可靠熱管理的首選解決方案,正日益受到青睞。隨著人們對氣候友善技術和支援排放控制的政策的認知不斷提高,對更有效率供暖系統的需求正在重塑工業供暖戰略。採用永續、經濟高效的暖氣設備正成為工業能源實踐的核心,而管道加熱器在這一轉變中發揮重要作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 37億美元 |

| 複合年成長率 | 5.1% |

這些加熱系統通常安裝在暖通空調 (HVAC) 管道網路中,用於調節整個工業設施的空氣溫度。它們能夠與現有空氣系統無縫整合,從而實現更好的性能和熱量分佈。海上作業對可靠熱解決方案的需求日益成長,加上智慧控制技術的廣泛應用,必將塑造市場趨勢。

2024年,固體管道工業加熱器市場價值達1.17億美元,這得益於工業運作中對穩定均勻熱量分佈日益成長的需求。這類加熱器在關鍵應用中尤其適用於控制空氣溫度,提供可靠性、長期節能和更高的熱效率。它們能夠滿足嚴格的性能標準,在對精確性和一致性熱量管理至關重要的行業中越來越受歡迎。對高效乾燥、固化和無塵室製程的需求正在加速各行各業的採用,尤其是在停機時間和加熱不穩定可能導致營運損失的行業中。

預計到2034年,低風管工業加熱器市場將以5.3%的強勁複合年成長率成長。這類加熱器以其小巧的體積、更低的能耗以及易於整合到現有暖通空調基礎設施中而備受讚譽。其靈活的設計和高效的熱響應使其成為注重空間效率和溫度精度的製造設施的理想解決方案。隨著降低營運成本成為工業設施的主要目標,這類加熱器可提供極具吸引力的投資回報。

2024年,美國管線工業加熱器市場規模達4.752億美元。人們對環保暖氣系統的興趣日益濃厚,加之排放法規的日益嚴格,支撐著市場強勁成長。隨著工業領域的發展壯大,尤其是在製藥和石化等領域,對高效能節能供暖解決方案的需求日益成長。自動化和清潔工業營運的持續進步預計將推動市場需求的成長。

全球管線工業暖爐市場的主要參與者包括 HEATCO、Wattco、Vulcanic、Watlow、Winterwarm Heating Solutions、Bucan、Indeeco、ExcelHeaters、Chromalox、Powrmatic、Accutherm、Backer Hotwatt、ELMATIC、Ulanet、Auzhan Electric Applimatics、Magma Technologies、Marcker Hotwatt、ELMATIC、Ulanet、Auzhan Electric Appliances、Magma Technologies、Marcker Hotwm、Fyater Electrical fona.和 Durex Industries。管道工業加熱器領域的領先製造商正在利用創新和市場擴張策略來鞏固其地位。許多公司專注於設計緊湊、節能和智慧整合的加熱系統,以滿足不斷發展的工業需求。產品客製化是一種核心方法,可協助企業滿足各行業特定應用的加熱要求。公司也在擴大其分銷網路,以進入新興區域市場。重點提供強大的售後服務,包括技術支援和系統維護,以建立長期的客戶關係。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 電的

- 油

- 堅硬的

- 氣體

第6章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 石油和天然氣

- 化學

- 食品和飲料

- 製造業

- 汽車

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 義大利

- 法國

- 荷蘭

- 西班牙

- 挪威

- 英國

- 瑞典

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 泰國

- 新加坡

- 馬來西亞

- 菲律賓

- 越南

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 伊拉克

- 土耳其

- 南非

- 拉丁美洲

- 巴西

- 智利

- 阿根廷

第9章:公司簡介

- Accutherm

- Auzhan Electric Appliances

- Backer Hotwatt

- Bucan

- Chromalox

- Durex Industries

- ELMATIC

- Elmec Heaters

- Excel Heaters

- HEATCO

- Heatrex

- Indeeco

- Magma Technologies

- Marathon Heater

- Powrmatic

- Tutco Frrnam

- Ulanet

- Vulcanic

- Warren Electric

- Watlow

- Wattco

- Winterwarm Heating Solutions

The Global Duct Industrial Heater Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 3.7 billion by 2034. Rising demand for smart heating systems, along with growing concerns around energy use and environmental responsibility, is expected to drive long-term industry growth. Increasingly stringent environmental regulations are pushing industries to adopt energy-efficient solutions, which is fueling demand for duct heaters that meet modern sustainability standards. The global growth of HVAC infrastructure is also opening new market opportunities.

There is a growing preference for modular and space-saving heater models that are easier to install and integrate into various industrial setups. This is encouraging product development and expanding the market's reach. As industries continue to prioritize thermal efficiency and regulatory compliance, duct industrial heaters are gaining traction as a go-to solution for reliable heat management. With growing awareness of climate-friendly technologies and policies that support emission control, the demand for more efficient heating systems is reshaping industrial heating strategies. The adoption of sustainable, cost-efficient heating equipment is becoming central to industrial energy practices, with duct heaters playing a major role in this transition.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $3.7 Billion |

| CAGR | 5.1% |

These heating systems are typically installed within HVAC duct networks to regulate air temperatures throughout industrial facilities. Their ability to integrate seamlessly with existing air systems allows for better performance and heat distribution. Rising demand for reliable thermal solutions across offshore operations, combined with the widespread adoption of smart control technologies, is set to shape market trends.

In 2024, the solid duct industrial heater segment recorded a market value of USD 117 million, driven by the rising importance across industrial operations demanding stable and uniform heat distribution. These heaters are especially effective in maintaining controlled air temperatures in critical applications, offering reliability, long-term energy savings, and enhanced thermal efficiency. Their ability to meet strict performance standards makes them increasingly favored in sectors where accuracy and consistency in heat management are essential. The need for efficient drying, curing, and cleanroom processes is accelerating adoption across various industries, especially where downtime and variability in heating can lead to operational losses.

The low duct industrial heater segment is projected to grow at a robust CAGR of 5.3% through 2034. These units are recognized for their sleek footprint, lower energy consumption, and ease of integration into existing HVAC infrastructures. Their flexible design and efficient thermal response make them an ideal solution for manufacturing setups that prioritize space efficiency and temperature precision. With operational cost reduction becoming a major goal for industrial facilities, these heaters provide an attractive return on investment.

U.S. Duct Industrial Heater Market was valued at USD 475.2 million in 2024. Increasing interest in environmentally responsible heating systems, along with tighter emission regulations, is supporting robust market activity. As industrial sectors evolve and expand-particularly in areas like pharmaceuticals and petrochemicals, the need for effective, energy-efficient heating solutions is rising. Continued progress in automation and cleaner industrial operations is expected to boost market demand.

Key players operating across the Global Duct Industrial Heater Market include HEATCO, Wattco, Vulcanic, Watlow, Winterwarm Heating Solutions, Bucan, Indeeco, ExcelHeaters, Chromalox, Powrmatic, Accutherm, Backer Hotwatt, ELMATIC, Ulanet, Auzhan Electric Appliances, Magma Technologies, Marathon Heater, Tutco Frrnam, Heatrex, Warren Electric, Elmec Heaters, and Durex Industries. Leading manufacturers in the duct industrial heater space are leveraging a mix of innovation and market expansion strategies to solidify their position. Many focus on engineering compact, energy-efficient, and smart-integrated heating systems to align with evolving industrial needs. Product customization is a core approach, helping businesses cater to application-specific heating requirements in various industries. Companies are also expanding their distribution networks to tap into emerging regional markets. Emphasis is placed on offering strong after-sales services, including technical support and system maintenance, to build long-term customer relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Electric

- 5.3 Oil

- 5.4 Solid

- 5.5 Gas

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Oil & gas

- 7.3 Chemical

- 7.4 Food & beverage

- 7.5 Manufacturing

- 7.6 Automotive

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Italy

- 8.3.3 France

- 8.3.4 Netherlands

- 8.3.5 Spain

- 8.3.6 Norway

- 8.3.7 UK

- 8.3.8 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Thailand

- 8.4.7 Singapore

- 8.4.8 Malaysia

- 8.4.9 Philippines

- 8.4.10 Vietnam

- 8.4.11 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Iran

- 8.5.4 Iraq

- 8.5.5 Turkey

- 8.5.6 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 Accutherm

- 9.2 Auzhan Electric Appliances

- 9.3 Backer Hotwatt

- 9.4 Bucan

- 9.5 Chromalox

- 9.6 Durex Industries

- 9.7 ELMATIC

- 9.8 Elmec Heaters

- 9.9 Excel Heaters

- 9.10 HEATCO

- 9.11 Heatrex

- 9.12 Indeeco

- 9.13 Magma Technologies

- 9.14 Marathon Heater

- 9.15 Powrmatic

- 9.16 Tutco Frrnam

- 9.17 Ulanet

- 9.18 Vulcanic

- 9.19 Warren Electric

- 9.20 Watlow

- 9.21 Wattco

- 9.22 Winterwarm Heating Solutions