|

市場調查報告書

商品編碼

1766280

溶栓藥物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Thrombolytic Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

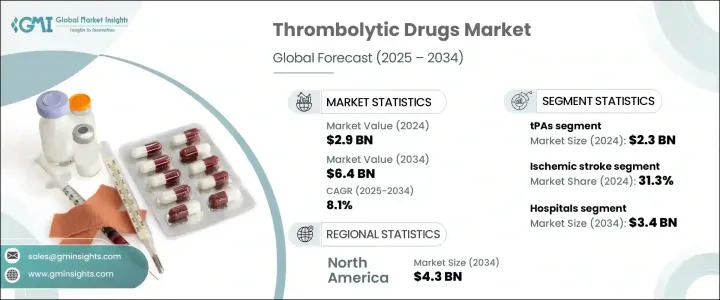

2024年,全球溶栓藥物市場規模達29億美元,預計2034年將以8.1%的複合年成長率成長,達到64億美元。這一穩定成長反映了全球心血管疾病負擔的日益加重,包括心臟病發作、中風、肺栓塞和其他血栓相關疾病。隨著久坐不動的生活方式、肥胖、高血壓和人口老化日益普遍,血栓栓塞事件的發生率正在加速上升。這些趨勢推動了對可在緊急情況下有效給藥的速效溶栓藥物的龐大需求。衛生系統正在認知到此類治療的迫切性,尤其是在急診環境中,快速介入對於改善患者預後至關重要。

科技在推動市場發展方面發揮著至關重要的作用。藥物研發和給藥方法的進步有助於提高溶栓療法的精準度和效率。劑量和劑型的創新也支持更廣泛的臨床應用。同時,由於診斷和影像技術的進步,人們對早期介入的認知也不斷提高。及時發現和及時治療正成為醫院和急診室的標準,而這些地方正是溶栓藥物最常用的地方。隨著臨床實踐的發展,對有效、安全且易於管理的治療方法的需求也在成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 29億美元 |

| 預測值 | 64億美元 |

| 複合年成長率 | 8.1% |

血栓溶解藥物,通常稱為纖溶酶原抑制劑,對於溶解因各種心血管疾病形成的血栓至關重要。這些藥物透過活化人體的纖溶系統來分解纖維蛋白(血塊中的主要蛋白質)。血栓溶解藥物市場包含幾個主要類別,包括組織型纖溶酶原活化劑 (tPA)、鏈激酶和尿激酶型纖溶酶原活化劑 (uPA),其應用主要集中在醫院和重症監護室。

其中,組織型纖溶酶原活化劑(tPA)領域引領全球市場,2024年收入達23億美元。預計到2034年,該領域營收將增加至51億美元,複合年成長率為8.2%。 tPA的主導地位源自於其在重大健康事件中高效溶解血栓。由於在急性病例中及時使用具有充分的臨床證據,這些藥物被廣泛使用。 tPA使用率上升的潛在促進因素之一是全球糖尿病病例激增。糖尿病會透過血管損傷、凝血傾向增強和代謝失衡增加血栓事件的風險,所有這些都增加了對積極溶栓療法的需求。

就溶栓藥物治療的疾病而言,缺血性中風是最大的適應症領域,2024年佔全球市場佔有率的31.3%。由於缺血性中風的高發病率,該領域預計在2034年之前保持強勁成長,缺血性中風佔全球中風病例的大多數。這些中風通常由腦部血流阻塞引起,需要立即就醫。全球中風病例數量的不斷成長,加上人們對中風預防和管理意識的不斷提高,正在增加對溶栓療法的需求。糖尿病、高血壓和肥胖等通常與中風風險相關的疾病,進一步推動了使用這些藥物進行有效醫療干預的需求。

以終端用戶分類,醫院在2024年成為領先的細分市場,佔54.8%的市場。預計到2034年,該細分市場的規模將達到34億美元,複合年成長率為7.7%。醫院憑藉其快速診斷和及時啟動治療的能力,成為需要溶栓治療患者的主要護理場所。心臟病發作和中風導致的急診入院率不斷上升,持續支撐著醫院的需求。此外,全球對重症監護基礎設施的投資正在擴大此類治療的可近性,尤其是在城市地區和發達的醫療保健系統中。雖然門診中心的吸引力日益增強,但醫院仍是溶栓藥物給藥的基石。

從區域來看,北美在2024年引領市場,創造了20億美元的收入。預計到2034年,該地區的收入將達到43億美元,複合年成長率為7.9%。北美的市場領導地位歸功於其先進的醫療基礎設施、良好的報銷環境以及血栓性疾病的高發病率。該地區擴大採用先進療法,並推行支持性醫療政策,這持續推動了對溶栓劑的需求。此外,藥物創新、強大的臨床產品線以及強大的產業影響力,也有助於該地區在全球市場中佔據主導地位。

競爭環境的本質在於,領先的企業不斷投資研發,拓展產品線,並瞄準新興市場以拓寬市場進入管道。各公司正努力提升藥物安全性,簡化給藥方式,以在嚴格監管、注重療效的市場中保持優勢。這些努力凸顯了溶栓藥物研發的持續發展,而這種發展受到創新、臨床需求和策略定位的影響。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心腦血管事件發生率上升

- 擴大初級中風中心和急救護理基礎設施

- 溶栓藥物製劑的進展

- 有利的指導方針和協議納入

- 產業陷阱與挑戰

- 出血風險高且治療窗口窄

- 來自機械干預和直介面服抗凝血劑(DOAC)的競爭

- 市場機會

- 政府措施和資金

- 針對罕見凝血障礙的溶栓劑的開發

- 成長動力

- 成長潛力分析

- 管道分析

- 未來市場趨勢

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 臨床試驗分析

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 擴張計劃

第5章:市場估計與預測:按藥物類別,2021 年至 2034 年

- 主要趨勢

- 組織纖溶酶原活化劑(tPA)

- 鏈激酶衍生物

- 尿激酶型纖溶酶原活化劑(uPA)

第6章:市場估計與預測:按適應症,2021 年至 2034 年

- 主要趨勢

- 缺血性中風

- 心肌梗塞

- 肺栓塞

- 深層靜脈栓塞

- 導管阻塞

- 其他適應症

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- Boehringer Ingelheim

- Chiesi Farmaceutici

- Genentech (F. Hoffmann-La Roche)

- Gennova Biopharmaceuticals

- Karma Pharmatech

- Lupin

- MicrobixBiosystems

- Reliance Lifesciences

- TechpoolBio-Pharma (Shanghai Pharma)

The Global Thrombolytic Drugs Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 6.4 billion by 2034. This steady rise reflects the growing burden of cardiovascular diseases across the globe, including heart attacks, strokes, pulmonary embolism, and other clot-related conditions. As sedentary lifestyles, obesity, hypertension, and aging populations become increasingly common, the prevalence of thromboembolic events is accelerating. These trends are driving significant demand for fast-acting clot-dissolving medications that can be administered effectively in emergencies. Health systems are recognizing the urgency of such treatments, especially in acute care settings, where rapid intervention is critical for improving patient outcomes.

Technology is playing a vital role in propelling the market forward. Advancements in drug development and delivery methods are helping enhance the precision and efficiency of thrombolytic therapies. Innovations in dosing and formulation are also supporting broader clinical adoption. Alongside these developments, awareness surrounding early intervention is growing, thanks to improved diagnostic and imaging technologies. Timely detection and prompt treatment are becoming the standard in hospitals and emergency rooms, where these drugs are most commonly used. As clinical practice evolves, so does the need for therapeutics that are not only effective but also safe and easy to administer.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 8.1% |

Thrombolytic drugs, often referred to as fibrinolytic agents, are essential in dissolving blood clots that form due to various cardiovascular conditions. These medications work by activating the body's fibrinolytic system to break down fibrin, the primary protein found in clots. The market comprises several key categories, including tissue plasminogen activators (tPAs), streptokinase, and urokinase-type plasminogen activators (uPAs), with applications mostly concentrated in hospitals and critical care settings.

Among these, the tPAs segment led the global market, generating USD 2.3 billion in revenue in 2024. This segment is expected to rise to USD 5.1 billion by 2034, growing at a CAGR of 8.2%. The dominance of tPAs stems from their high efficacy in clot resolution during critical health events. These agents are widely prescribed due to well-documented clinical benefits when used promptly in acute cases. One of the underlying drivers of increased tPA utilization is the global surge in diabetes cases. The disease heightens the risk of thrombotic events through vascular damage, increased clotting tendencies, and metabolic imbalances, all of which raise the need for aggressive clot-busting therapies.

In terms of medical conditions treated with thrombolytics, ischemic stroke represented the largest indication segment, accounting for 31.3% of the global market share in 2024. This segment is on track to maintain strong growth through 2034, supported by the high incidence of ischemic strokes, which make up the majority of stroke cases globally. These strokes are typically caused by obstructions in cerebral blood flow and require immediate medical attention. The growing number of stroke cases worldwide, combined with rising awareness of stroke prevention and management, is increasing the demand for thrombolytic therapies. Conditions such as diabetes, high blood pressure, and obesity-commonly linked to stroke risk-are further boosting the need for effective medical intervention using these drugs.

By end user, hospitals emerged as the leading segment in 2024, holding a 54.8% share of the market. This segment is expected to reach USD 3.4 billion by 2034, progressing at a CAGR of 7.7%. Hospitals serve as the primary point of care for patients requiring thrombolytic treatment, thanks to their ability to conduct rapid diagnostics and initiate therapy without delay. The increasing frequency of emergency admissions due to heart attacks and strokes continues to support hospital demand. Additionally, global investment in critical care infrastructure is expanding access to such treatments, especially in urban areas and developed healthcare systems. While outpatient centers are gaining traction, hospital settings remain the cornerstone of thrombolytic drug administration.

Regionally, North America led the market in 2024, generating USD 2 billion in revenue. The region is forecasted to reach USD 4.3 billion by 2034, growing at a CAGR of 7.9%. The market leadership of North America can be attributed to its advanced healthcare infrastructure, favorable reimbursement environment, and high prevalence of thrombotic disorders. The increased adoption of advanced therapies and supportive healthcare policies in this region continue to drive the demand for thrombolytics. Additionally, pharmaceutical innovation, a robust clinical pipeline, and strong industry presence contribute to the region's dominance in the global landscape.

The competitive environment is defined by leading players investing in research, expanding product lines, and targeting emerging markets to broaden access. Companies are striving to improve drug safety profiles and streamline delivery methods to maintain their edge in a tightly regulated, performance-focused market. These efforts underscore the ongoing evolution of thrombolytic drug development, shaped by innovation, clinical demand, and strategic positioning.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug class

- 2.2.3 Indication

- 2.2.4 End use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of cardiovascular and cerebrovascular events

- 3.2.1.2 Expansion of primary stroke centers and emergency care infrastructure

- 3.2.1.3 Advancements in thrombolytic drug formulations

- 3.2.1.4 Favorable guidelines and protocol inclusion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk of bleeding and narrow therapeutic window

- 3.2.2.2 Competition from mechanical interventions and direct oral anticoagulants (DOACs)

- 3.2.3 Market opportunities

- 3.2.3.1 Government initiatives and funding

- 3.2.3.2 Development of thrombolytics tailored to rare clotting disorders

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.7 Clinical trial analysis

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tissue plasminogen activators (tPAs)

- 5.3 Streptokinase derivatives

- 5.4 Urokinase-type plasminogen activators (uPAs)

Chapter 6 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ischemic stroke

- 6.3 Myocardial infarction

- 6.4 Pulmonary embolism

- 6.5 Deep vein thrombosis

- 6.6 Catheter occlusion

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Boehringer Ingelheim

- 9.3 Chiesi Farmaceutici

- 9.4 Genentech (F. Hoffmann-La Roche)

- 9.5 Gennova Biopharmaceuticals

- 9.6 Karma Pharmatech

- 9.7 Lupin

- 9.8 MicrobixBiosystems

- 9.9 Reliance Lifesciences

- 9.10 TechpoolBio-Pharma (Shanghai Pharma)

![血栓藥物市場- 按藥物類別(抗凝血劑[維生素K、DOA、肝素、Xa 抑制劑]、抗血小板藥物[P2Y12、阿斯匹靈、糖蛋白]、血栓溶解劑)、疾病類型(DVT、PE、VTE、 AT)、RoA、配銷通路- 全球預測,2024 - 2032](/sample/img/cover/42/default_cover_gmi.png)