|

市場調查報告書

商品編碼

1766277

直接包裝印表機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Direct-to-Package Printers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

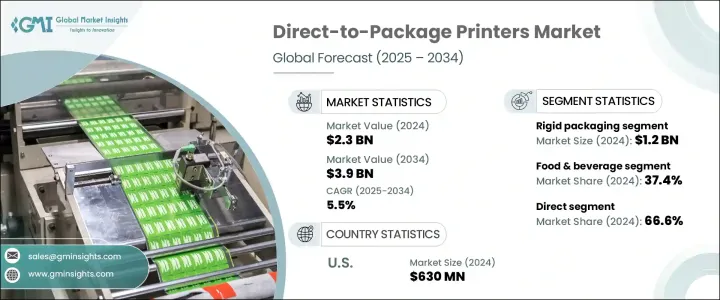

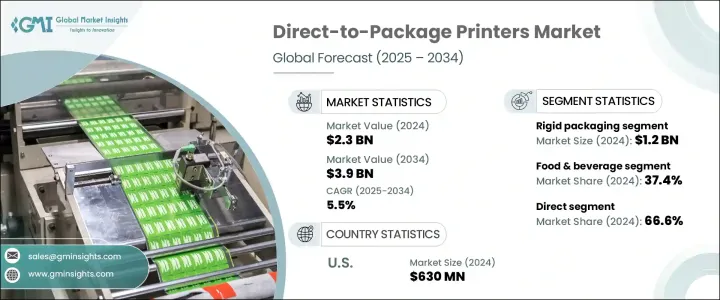

2024 年全球直接包裝印表機市場規模達 23 億美元,預計到 2034 年將以 5.5% 的複合年成長率成長至 39 億美元。食品飲料、化妝品和藥品等行業擴大採用直接包裝列印技術,以滿足嚴格的防偽法規要求、提升品牌知名度並改進可追溯性。此技術可確保在受控環境中滿足標籤要求,例如安全說明、有效期限和批號。透過以精確的間隔直接在包裝上列印,公司可以簡化流程並避免傳統標籤帶來的複雜性和成本。這種方法還支援小袋和小袋等靈活的包裝形式,可在各種不規則表面上列印,並減少材料浪費,符合永續發展目標和現代供應鏈需求。客製化和個人化需求是另一個促進因素。

隨著消費者追求獨特的包裝,直接包裝印表機能夠按需列印高品質圖形,以滿足限量版、促銷產品和個人化產品的需求。這種靈活性有助於品牌在高效管理生產的同時脫穎而出。此外,這些印表機允許更小的印刷批次,從而減少了對大量庫存的需求,從而最大限度地減少浪費並降低成本。它們還能加快產品上市速度,使企業能夠靈活地快速回應不斷變化的趨勢和消費者偏好。憑藉人工智慧和自動化等先進技術整合,直接包裝印表機能夠確保在各種材料和形狀上保持一致的列印質量,從而增強品牌吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 39億美元 |

| 複合年成長率 | 5.5% |

2024年,硬質包裝市場規模達12億美元,預計到2034年複合年成長率將達5.4%。瓶、罐、罐等硬質容器在食品和醫藥等關鍵產業中的廣泛使用,使得該市場至關重要。在這些表面直接印刷,使品牌無需依賴標籤即可提供色彩鮮豔、經久耐用的設計,從而提升美觀度並降低包裝的複雜性。

2024年,直銷佔比達66.6%,預計將以5.5%的複合年成長率持續成長。製造商更青睞直銷管道,因為它能夠提供客製化解決方案、更優質的售後支援和密切的技術支持,尤其適用於需要人工智慧和自動化等先進印刷技術的行業。與客戶直接互動可以加快培訓、維護和專有軟體升級的速度,從而確保系統效能達到最佳。

2024年,美國直接包裝印刷市場規模達6.3億美元,預計2034年將以5.4%的複合年成長率成長。先進的製造業基礎設施、對創新包裝解決方案的強勁需求以及數位印刷技術的早期應用推動了這一成長。食品飲料、製藥和個人護理等關鍵行業推動了對支持合規性、品牌化和可追溯性的包裝印刷的需求。此外,美國企業對自動化、永續性和產品個人化的關注與直接包裝印刷所提供的功能高度契合。

全球直接包裝印表機產業的主要參與者包括:富士軟片控股公司、愛普生(精工愛普生公司)、LSINC 公司、海德堡(Gallus)、Roland DG 公司、Pineberry Manufacturing Inc.、Domino Printing Sciences、佳能生產印刷、Tonejet Limited、Markem-Imaje、全錄公司、Velxi Ltd. AG、惠普公司、Sneed Coding Solutions、Inkcups、Durst Phototechnik AG 和 Videojet Technologies, Inc. 直接包裝印表機市場的領先公司採用各種策略來鞏固其地位。

他們投入巨資研發,以提升印刷技術,包括整合人工智慧、物聯網和自動化技術,進而提高精度和效率。與包裝製造商和最終用戶建立策略合作夥伴關係,能夠根據特定行業需求提供客製化解決方案。公司也專注於拓展地域覆蓋範圍,瞄準新興市場並提供在地化支援。透過全面的售後服務、培訓和維護來提升客戶體驗是建立長期合作關係的首要任務。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 在食品飲料、化妝品和製藥領域的應用日益增多

- 降低營運成本

- 軟包裝創新

- 永續性和減少浪費

- 產業陷阱與挑戰

- 初始資本投入高

- 基材相容性有限

- 複雜的維護和停機時間

- 機會

- 個性化和客製化包裝的成長

- 電子商務和D2C品牌的需求不斷成長

- 新興市場的擴張

- 與工業4.0和智慧製造的融合

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 單程

- 多程

第6章:市場估計與預測:依技術分類,2021 年至 2034 年

- 主要趨勢

- 噴墨列印

- UV列印

- 雷射列印

- 熱轉印

- 其他(例如,電子照相技術)

第7章:市場估計與預測:依包裝類型,2021 年至 2034 年

- 主要趨勢

- 硬質包裝

- 軟包裝

- 半硬質包裝

第8章:市場估計與預測:依印刷過程,2021 年至 2034 年

- 主要趨勢

- 直接柔版印刷

- 數位印刷

- 標籤列印和安裝

- 模切

第9章:市場估計與預測:依自動化水平,2021 年至 2034 年

- 主要趨勢

- 自動的

- 手動的

第 10 章:市場估計與預測:按油墨類型,2021 年至 2034 年

- 主要趨勢

- 基於紫外線

- 溶劑型

- 水性

第 11 章:市場估計與預測:按材料/基材,2021 年至 2034 年

- 主要趨勢

- 塑膠

- 玻璃

- 金屬

- 紙和紙板

- 其他(例如木材、複合材料)

第 12 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 塑膠

- 乙烯基塑膠

- 丙烯酸纖維

- 擠壓PVC

- 發泡聚氯乙烯

- 塗層鋁

- 黃銅

第 13 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 製藥和醫療保健

- 化妝品和個人護理

- 家居用品

- 工業化學品

- 電子產品和電器

- 其他

第 14 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 15 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 16 章:公司簡介

- Canon Production Printing

- Domino Printing Sciences

- Durst Phototechnik AG

- Epson (Seiko Epson Corporation)

- Fujifilm Holdings Corporation

- Heidelberg (Gallus)

- HP Inc.

- Inkcups

- Koenig & Bauer AG

- LSINC Corporation

- Markem-Imaje

- Mimaki Engineering Co., Ltd.

- Pineberry Manufacturing Inc.

- Roland DG Corporation

- Sneed Coding Solutions

- Tonejet Limited

- Velox Ltd.

- Videojet Technologies, Inc.

- Xerox Corporation

The Global Direct-to-Package Printers Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 3.9 billion by 2034. Industries such as food and beverage, cosmetics, and pharmaceuticals are increasingly adopting direct-to-package printing to meet strict anti-counterfeiting regulations, enhance brand visibility, and improve traceability. This technology ensures compliance with labeling requirements like safety instructions, expiration dates, and lot numbers, all within controlled environments. By printing directly onto packaging at precise intervals, companies can simplify processes and avoid the complexities and costs associated with traditional labeling. This approach also supports flexible packaging formats like sachets and pouches, accommodates printing on various irregular surfaces, and reduces material waste, aligning with sustainability goals and modern supply chain demands. Demand for customization and personalization is another driving factor.

As consumers seek unique packaging, direct-to-package printers enable high-quality, on-demand graphics that cater to limited editions, promotional products, and personalized items. This flexibility supports brands in standing out while efficiently managing production. Moreover, these printers reduce the need for large inventory storage by allowing smaller print runs, which minimize waste and lower costs. They also speed up time-to-market, giving companies the agility to respond quickly to changing trends and consumer preferences. With advanced technology integration, such as AI and automation, direct-to-package printers ensure consistent print quality across various materials and shapes, enhancing brand appeal.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 5.5% |

In 2024, the rigid packaging segment generated USD 1.2 billion and is forecasted to grow at a CAGR of 5.4% through 2034. The widespread use of rigid containers like bottles, jars, and cans across key sectors such as food and pharmaceuticals makes this segment vital. Direct printing on these surfaces allows brands to deliver vibrant, durable designs without relying on labels, improving aesthetics and reducing packaging complexity.

Direct sales accounted for a 66.6% share in 2024 and are expected to continue growing at a CAGR of 5.5%. Manufacturers prefer direct channels to offer customized solutions, better post-sale support, and close technical assistance, particularly for industries that require sophisticated printing technology, including AI and automation. Direct interaction with customers enables faster training, maintenance, and access to proprietary software upgrades, ensuring optimal system performance.

U.S. Direct-To-Package Printers Market was valued at USD 630 million in 2024 and is estimated to grow at a CAGR of 5.4% through 2034. Growth is driven by advanced manufacturing infrastructure, strong demand for innovative packaging solutions, and early adoption of digital printing technologies. Key sectors such as food and beverage, pharmaceuticals, and personal care boost demand for on-package printing that supports compliance, branding, and traceability. Moreover, U.S. companies' focus on automation, sustainability, and product personalization aligns well with the capabilities offered by direct-to-package printing.

Major players in the Global Direct-To-Package Printers Industry include: Fujifilm Holdings Corporation, Epson (Seiko Epson Corporation), LSINC Corporation, Heidelberg (Gallus), Roland DG Corporation, Pineberry Manufacturing Inc., Domino Printing Sciences, Canon Production Printing, Tonejet Limited, Markem-Imaje, Xerox Corporation, Velox Ltd., Mimaki Engineering Co., Ltd., Koenig & Bauer AG, HP Inc., Sneed Coding Solutions, Inkcups, Durst Phototechnik AG, and Videojet Technologies, Inc. Leading companies in the direct-to-package printers market adopt various strategies to strengthen their position.

They invest heavily in research and development to enhance printing technologies, including integrating AI, IoT, and automation to improve precision and efficiency. Strategic collaborations and partnerships with packaging manufacturers and end-users enable customized solutions tailored to specific industry needs. Companies also focus on expanding their geographic presence by targeting emerging markets and offering localized support. Enhancing customer experience through comprehensive after-sales services, training, and maintenance is a priority to build long-term relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Packaging Type

- 2.2.5 Printing Process

- 2.2.6 Automation level

- 2.2.7 Ink Type

- 2.2.8 Material/Substrate

- 2.2.9 Application

- 2.2.10 End Use

- 2.2.11 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising use in food & beverage, cosmetics, and pharma

- 3.2.1.2 Cost reduction in operations

- 3.2.1.3 Flexible packaging innovations

- 3.2.1.4 Sustainability and waste reduction

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Limited substrate compatibility

- 3.2.2.3 Complex maintenance and downtime

- 3.2.3 Opportunities

- 3.2.3.1 Growth in personalized and customized packaging

- 3.2.3.2 Rising demand from E-commerce and D2C brands

- 3.2.3.3 Expansion in emerging markets

- 3.2.3.4 Integration with industry 4.0 and smart manufacturing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Single pass

- 5.3 Multi pass

Chapter 6 Market Estimates & Forecast, By Technology, 2021 – 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Inkjet printing

- 6.3 UV printing

- 6.4 Laser printing

- 6.5 Thermal transfer printing

- 6.6 Others (e.g., Electrophotography)

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021 – 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Rigid packaging

- 7.3 Flexible packaging

- 7.4 Semi-rigid packaging

Chapter 8 Market Estimates & Forecast, By Printing process, 2021 – 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Direct flexo printing

- 8.3 Digital printing

- 8.4 Label printing and mounting

- 8.5 Die cutting

Chapter 9 Market Estimates & Forecast, By Automation level, 2021 – 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Automatic

- 9.3 Manual

Chapter 10 Market Estimates & Forecast, By Ink Type, 2021 – 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 UV-based

- 10.3 Solvent-based

- 10.4 Aqueous based

Chapter 11 Market Estimates & Forecast, By Material/Substrate, 2021 – 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Plastic

- 11.3 Glass

- 11.4 Metal

- 11.5 Paper & paperboard

- 11.6 Others (e.g., Wood, Composite materials)

Chapter 12 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Plastic

- 12.3 vinyl

- 12.4 Acrylic

- 12.5 Extruded PVC

- 12.6 Expanded PVC

- 12.7 Coated aluminum

- 12.8 Brass

Chapter 13 Market Estimates & Forecast, By End Use Industry, 2021 – 2034, (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Food & Beverage

- 13.3 Pharmaceuticals & Healthcare

- 13.4 Cosmetics & Personal care

- 13.5 Household Products

- 13.6 Industrial chemicals

- 13.7 Electronics & Appliances

- 13.8 Others

Chapter 14 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 Direct

- 14.3 Indirect

Chapter 15 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 15.1 Key trends

- 15.2 North America

- 15.2.1 U.S.

- 15.2.2 Canada

- 15.3 Europe

- 15.3.1 Germany

- 15.3.2 UK

- 15.3.3 France

- 15.3.4 Italy

- 15.3.5 Spain

- 15.4 Asia Pacific

- 15.4.1 China

- 15.4.2 India

- 15.4.3 Japan

- 15.4.4 South Korea

- 15.4.5 Australia

- 15.4.6 Indonesia

- 15.4.7 Malaysia

- 15.5 Latin America

- 15.5.1 Brazil

- 15.5.2 Mexico

- 15.6 MEA

- 15.6.1 Saudi Arabia

- 15.6.2 UAE

- 15.6.3 South Africa

Chapter 16 Company Profiles

- 16.1 Canon Production Printing

- 16.2 Domino Printing Sciences

- 16.3 Durst Phototechnik AG

- 16.4 Epson (Seiko Epson Corporation)

- 16.5 Fujifilm Holdings Corporation

- 16.6 Heidelberg (Gallus)

- 16.7 HP Inc.

- 16.8 Inkcups

- 16.9 Koenig & Bauer AG

- 16.10 LSINC Corporation

- 16.11 Markem-Imaje

- 16.12 Mimaki Engineering Co., Ltd.

- 16.13 Pineberry Manufacturing Inc.

- 16.14 Roland DG Corporation

- 16.15 Sneed Coding Solutions

- 16.16 Tonejet Limited

- 16.17 Velox Ltd.

- 16.18 Videojet Technologies, Inc.

- 16.19 Xerox Corporation