|

市場調查報告書

商品編碼

1766266

料斗供料系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hopper Feeding System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

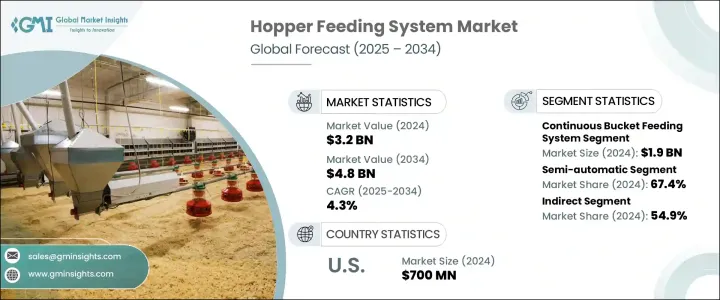

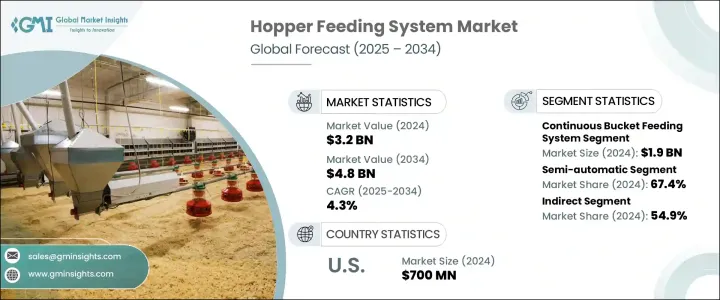

2024年,全球料斗供料系統市場規模達32億美元,預計2034年將以4.3%的複合年成長率成長,達到48億美元。隨著工業自動化在各行業日益普及,高效物料搬運解決方案的需求也日益成長。料斗供料系統正成為這項轉型的關鍵組成部分,它提供自動化、精簡的機制,無需人工干預即可輸送散裝物料。隨著對生產力和營運一致性的日益重視,各行各業正在將這些系統整合到生產線中,以最大限度地減少停機時間和人為錯誤。在那些需要維持高精度物料流以確保品質控制和營運連續性的產業中,這些系統尤其重要。

現代料斗供料系統配備感測器和電腦控制裝置,可實現無縫物料計量,並與攪拌機、輸送機和包裝系統等自動化設備整合。透過實現不間斷的物料輸送和即時控制,這些系統可協助企業維持高營運效率並減少物料浪費。它們相容於各種製程自動化設置,對於注重最佳化產量和保持合規性的製造商而言,是一項極具吸引力的投資。隨著勞動成本的上升和對穩定品質需求的不斷成長,料斗供料系統正成為全球流程製造環境中的策略資產。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 48億美元 |

| 複合年成長率 | 4.3% |

就產品類型而言,市場細分為連續式和間歇式料斗供料系統。其中,連續式料斗供料系統市場在2024年達到19億美元,預估至2034年複合年成長率為4.7%。這些系統旨在以恆定的速率輸送物料,非常適合依賴穩定輸入的自動化操作,例如粉末、顆粒和丸粒的生產。它們能夠保持不間斷的物料流動,並滿足大量生產的需求。此外,它們對智慧控制的適應性以及與數位化生產環境的完全整合,進一步增強了其對注重自動化和可擴展性的企業的吸引力。

依操作模式分類,市場分為半自動和全自動系統。 2024年,半自動系統以67.4%的市佔率佔據市場主導地位,預計在預測期內的複合年成長率為3.7%。這些系統在手動操作和自動化之間取得了平衡,為中小型企業提供了實用的解決方案。其價格實惠、易於使用,特別適合那些不需要完全自動化但仍希望提高流程一致性和減少勞動力依賴的操作。由於成本較低且維護要求較低,半自動料斗供料系統在預算有限、無法使用全自動技術的市場中被廣泛採用。其日益普及與中小企業的全球擴張息息相關,而中小企業則構成了全球企業的大多數。

市場也按配銷通路細分為直接銷售和間接銷售。間接分銷在2024年佔據主導地位,佔總收入的54.9%,預計在2025年至2034年期間的複合年成長率為4.8%。授權經銷商、經銷商和系統整合商等間接通路在拓展更廣泛的客戶群方面發揮著至關重要的作用。這些中間商通常對當地市場動態、技術要求和監管環境有著深入的了解,這使得他們能夠提供客製化的解決方案和卓越的支援。他們建立的網路可以幫助製造商在無需大量投資直接銷售基礎設施的情況下擴大業務範圍,從而使間接銷售成為一種高效的市場進入策略。

從地區來看,美國在北美料斗供料系統市場佔有重要佔有率,2024 年估值達 7 億美元。由於先進的工業基礎設施和自動化技術的日益普及,美國的需求正在穩步成長。圍繞生產效率和工作場所安全的監管標準也推動著各行各業向料斗供料系統等自動化解決方案邁進。隨著企業尋求提高精度並減少營運中斷,智慧工廠框架和數位化生產系統的日益普及進一步支撐了市場成長。憑藉著堅實的工業基礎和積極向智慧自動化轉型,美國繼續引領該地區的料斗供料系統市場。

塑造全球料斗供料系統市場格局的關鍵參與者包括 Eriez Manufacturing、Coperion、Festo、GEA Group、Hapman、Gericke、K-Tron、Novatec、Piab、Movacolor、Schenck Process、Spiroflow、Thayer Scale-Hyer Systems、Simatek Bulk 和 Volkmann。這些公司專注於創新、產品開發和策略性分銷合作夥伴關係,以擴大市場佔有率並滿足不斷變化的行業需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 工業自動化的成長

- 對精確和連續進料的需求不斷增加

- 食品和製藥業的擴張

- 客製化和模組化設計需求

- 產業陷阱與挑戰

- 與現有系統的複雜整合

- 初期投資成本高

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 連續鏟鬥供料系統

- 間歇式料斗供料系統

第6章:市場估計與預測:依營運模式,2021 年至 2034 年

- 主要趨勢

- 半自動

- 全自動

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 農業

- 食品工業

- 化學工業

- 其他

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- Coperion

- Eriez Manufacturing

- Festo

- GEA Group

- Gericke

- Hapman

- K-Tron

- Movacolor

- Novatec

- Piab

- Schenck Process

- Simatek Bulk Systems

- Spiroflow

- Thayer Scale-Hyer Industries

- Volkmann

The Global Hopper Feeding System Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 4.8 billion by 2034. As industrial automation becomes increasingly widespread across sectors, the demand for efficient material handling solutions is growing rapidly. Hopper feeding systems are emerging as key components in this transformation, offering automated and streamlined mechanisms for feeding bulk materials without manual intervention. With growing emphasis on productivity and operational consistency, industries are integrating these systems into their production lines to minimize downtime and human error. These systems have become especially important in sectors where maintaining material flow with high precision is essential for quality control and operational continuity.

Modern hopper feeding systems, equipped with sensors and computer controls, enable seamless material dosing and integration with automated equipment such as mixers, conveyors, and packaging systems. By facilitating uninterrupted material transfer and offering real-time control, these systems help companies maintain a high level of operational efficiency and reduce material waste. Their compatibility with various process automation setups makes them an attractive investment for manufacturers focusing on optimizing throughput and maintaining regulatory compliance. With rising labor costs and increasing demand for consistent quality, hopper feeding systems are becoming a strategic asset in process manufacturing environments globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 4.3% |

In terms of product type, the market is segmented into continuous and intermittent bucket feeding systems. Among these, the continuous bucket feeding system segment accounted for USD 1.9 billion in 2024 and is projected to register a CAGR of 4.7% through 2034. These systems are designed to deliver material at a constant rate, making them ideal for automated operations that rely on steady input, such as in the production of powders, granules, and pellets. Their ability to maintain uninterrupted flow aligns with the needs of high-volume manufacturing setups. Moreover, their adaptability to intelligent controls and full integration into digital production environments further enhance their appeal for companies prioritizing automation and scalability.

When categorized by mode of operation, the market is divided into semi-automatic and fully automatic systems. In 2024, the semi-automatic segment led the market with a 67.4% share and is expected to grow at a CAGR of 3.7% during the forecast period. These systems strike a balance between manual effort and automation, offering a practical solution for small and medium-sized enterprises. Their affordability and ease of use make them particularly suitable for operations that don't require full automation but still seek to improve process consistency and reduce labor dependency. Due to their lower cost and reduced maintenance requirements, semi-automatic hopper feeding systems are widely adopted in markets where budget constraints limit access to fully automated technology. Their growing popularity can be linked to the global expansion of SMEs, which make up the majority of businesses worldwide.

The market is also segmented by distribution channel into direct and indirect sales. The indirect distribution segment dominated in 2024, accounting for 54.9% of total revenue, and is anticipated to grow at a CAGR of 4.8% between 2025 and 2034. Indirect channels such as authorized distributors, resellers, and system integrators play a vital role in reaching a broader customer base. These intermediaries often possess deep knowledge of local market dynamics, technical requirements, and regulatory environments, enabling them to provide tailored solutions and superior support. Their established networks help manufacturers expand their reach without significant investment in direct sales infrastructure, making indirect sales a highly effective go-to-market strategy.

Regionally, the United States held a significant share in the North American hopper feeding system market, with a valuation of USD 700 million in 2024. The country is witnessing steady growth in demand due to its advanced industrial infrastructure and rising adoption of automation technologies. Regulatory standards around manufacturing efficiency and workplace safety are also pushing industries toward automated solutions like hopper feeding systems. The increasing adoption of smart factory frameworks and digitalized production systems further supports market growth, as companies look to improve precision and reduce operational disruptions. With a solid industrial base and a proactive shift toward intelligent automation, the U.S. continues to lead the region's market for hopper feeding systems.

Key players shaping the global hopper feeding system market landscape include Eriez Manufacturing, Coperion, Festo, GEA Group, Hapman, Gericke, K-Tron, Novatec, Piab, Movacolor, Schenck Process, Spiroflow, Thayer Scale-Hyer Industries, Simatek Bulk Systems, and Volkmann. These companies are focused on innovation, product development, and strategic distribution partnerships to expand their market presence and cater to evolving industry demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Mode of operation

- 2.2.4 End use

- 2.2.5 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in industrial automation

- 3.2.1.2 Increasing demand for accurate and continuous feeding

- 3.2.1.3 Expansion of food and pharmaceutical sectors

- 3.2.1.4 Customization and modular design demand

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Complex integration with existing systems

- 3.2.2.2 High initial investment costs

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Continuous bucket feeding systems

- 5.3 Intermittent bucket feeding systems

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 – 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

Chapter 7 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Agriculture

- 7.3 Food industrial

- 7.4 Chemical industrial

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Coperion

- 10.2 Eriez Manufacturing

- 10.3 Festo

- 10.4 GEA Group

- 10.5 Gericke

- 10.6 Hapman

- 10.7 K-Tron

- 10.8 Movacolor

- 10.9 Novatec

- 10.10 Piab

- 10.11 Schenck Process

- 10.12 Simatek Bulk Systems

- 10.13 Spiroflow

- 10.14 Thayer Scale-Hyer Industries

- 10.15 Volkmann