|

市場調查報告書

商品編碼

1766252

亞磷醯胺市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Phosphoramidite Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

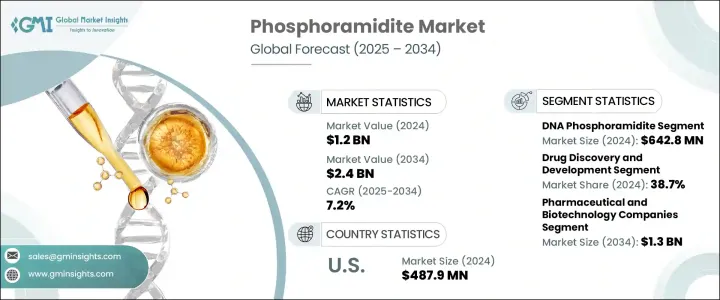

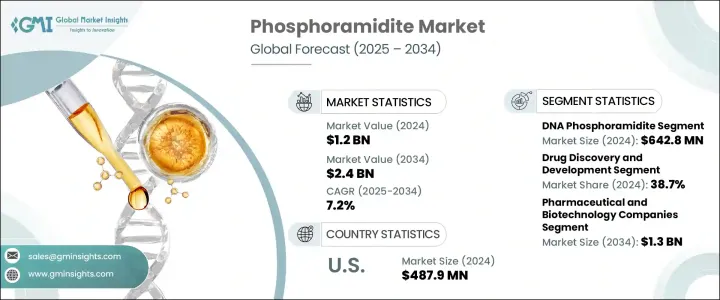

2024年,全球亞磷醯胺市場規模達12億美元,預計到2034年將以7.2%的複合年成長率成長,達到24億美元。這一市場成長主要源自於診斷、基因療法和藥物開發領域對寡核苷酸日益成長的需求。人們對基因研究和基因編輯的日益關注,以及亞磷醯胺在寡核苷酸合成中的應用日益廣泛,極大地促進了市場擴張。此外,CRISPR-Cas9等治療方法和其他分子生物學技術的進步也刺激了合成亞磷醯胺的需求。全球對分子生物學研究、基因組定序和合成生物學的關注,進一步推動了該市場的成長,尤其是在遺傳疾病、傳染病和癌症發病率不斷上升的背景下。

需要合成寡核苷酸的標靶療法正變得越來越普遍,從而推動了對亞磷醯胺的需求。這些療法旨在針對特定的基因突變或致病基因,其有效性在很大程度上依賴於精準高效的寡核苷酸合成。隨著基因療法、個人化醫療和基因組研究的不斷進步,對高品質亞磷醯胺的需求激增。亞磷醯胺在創建用於這些創新療法的客製化DNA和RNA序列方面發揮著至關重要的作用,從而推動了其市場的成長。寡核苷酸在癌症治療、遺傳疾病和傳染病領域的應用不斷擴展,進一步推動了亞磷醯胺的需求成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 24億美元 |

| 複合年成長率 | 7.2% |

DNA亞磷醯胺市場需求依然強勁,2024年市值將達6.428億美元。由於這些亞磷醯胺對於DNA和RNA序列的合成至關重要,其在基因治療和分子診斷等領域的應用日益廣泛。隨著合成技術、純化方法和自動化程度的提高,高品質亞磷醯胺的生產效率也隨之提高,使得DNA亞磷醯胺更容易取得且更具成本效益。隨著生物技術公司擴大將寡核苷酸的大規模生產外包,該市場將繼續保持顯著成長。

2024年,藥物研發領域佔了38.7%的市場。這主要得益於人們對需要精確寡核苷酸合成的DNA和RNA療法日益成長的關注。各種慢性疾病對創新療法的需求日益成長,以及PCR等早期診斷方法的進步,進一步刺激了亞磷醯胺市場的發展。對遺傳和傳染性疾病診斷準確性的日益成長的需求也促進了這一成長。此外,篩選方法的不斷改進正在加速藥物研發,並最佳化亞磷醯胺在研發過程中的使用。

2024年,美國亞磷醯胺市場規模達4.879億美元,其中,分子診斷和基因治療領域對寡核苷酸療法的需求不斷成長,推動了市場發展。包括基因治療進展在內的基因研究投資,帶動了美國資金和基礎設施的增加,進一步推動了市場發展。此外,對用於DNA和RNA療法合成以及下一代定序的高品質試劑和解決方案的需求,預計將推動美國對亞磷醯胺的需求。此外,政府的利好政策和行業領導者的加入也推動了市場的發展。

全球亞磷醯胺市場的主要參與者包括 Bioneer、PolyOrg、Biosynth、BOC Sciences、ChemGenes、Sigma-Aldrich(默克集團)、Creative Biolabs、丹納赫、Glen Research、Hongene Biotech、LGC Biosearch Technologies、Lumiprobe、Qiagen、賽默飛世爾科技和 TriLink Bio Technologies。亞磷醯胺市場中的公司透過投資研發來鞏固其地位,尤其是在基因治療和診斷應用領域。他們專注於推進合成技術並提高生產流程效率,以降低成本並增強基於 DNA 和 RNA 的療法的可擴展性。許多公司正在與生物技術公司建立策略合作夥伴關係,以增強其產品供應並擴大其市場覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 對基因研究和生物技術的需求不斷成長

- RNA療法日益普及

- 診斷技術的進步

- 產業陷阱與挑戰

- 合成與純度標準的複雜性

- 新興市場的市場意識和基礎設施有限

- 市場機會

- 對高通量和自動化寡核苷酸合成的需求不斷成長

- 政府和國防基因組學計劃的興起

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- DNA亞磷醯胺

- RNA亞磷醯胺

- 其他類型

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 藥物發現與開發

- 診斷

- 個人化醫療

- 其他應用

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製藥和生物技術公司

- 學術和研究機構

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Bioneer

- Biosynth

- BOC Sciences

- ChemGenes

- Creative Biolabs

- Danaher

- Glen Research

- Hongene Biotech

- LGC Biosearch Technologies

- Lumiprobe

- PolyOrg

- Sigma-Aldrich (Merck KGaA)

- Qiagen

- Thermo Fisher Scientific

- TriLink Bio Technologies

The Global Phosphoramidite Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 2.4 billion by 2034. This market growth is driven by the rising demand for oligonucleotides used in diagnostics, gene therapy, and drug development. The increasing focus on genetic research and gene editing, alongside the growing application of phosphoramidite for the synthesis of oligonucleotides, has contributed significantly to the market's expansion. Additionally, advancements in therapeutic methods such as CRISPR-Cas9 and other molecular biology technologies have spurred the demand for synthetic phosphoramidites. The global focus on molecular biology research, genome sequencing, and synthetic biology further fuels the growth of this market, especially with the rising prevalence of genetic disorders, infectious diseases, and cancers.

Targeted therapies that require the synthesis of oligonucleotides are becoming more common, thus driving the need for phosphoramidites. These therapies, which are designed to target specific genetic mutations or disease-causing genes, rely heavily on precise and efficient synthesis of oligonucleotides for their effectiveness. As advancements in gene therapies, personalized medicine, and genomic research continue to grow, the demand for high-quality phosphoramidites has surged. Phosphoramidites play a crucial role in enabling the creation of custom DNA and RNA sequences for use in these innovative treatments, thus fueling their growing market. The expanding applications of oligonucleotides in cancer treatment, genetic disorders, and infectious diseases further contribute to the increased need for phosphoramidites.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 7.2% |

The demand for the DNA phosphoramidites segment remains robust valued at USD 642.8 million in 2024. As these phosphoramidites are essential for the synthesis of both DNA and RNA sequences, their use has expanded in fields such as gene therapy and molecular diagnostics. The production of high-quality phosphoramidites has become more efficient due to advancements in synthesis technologies, purification methods, and automation, making DNA phosphoramidites more accessible and cost-effective. As biotechnology companies increasingly outsource the large-scale production of oligonucleotides, this segment continues to see significant growth.

The drug discovery and development segment accounted for a 38.7% share in 2024. This is largely driven by the growing focus on DNA and RNA-based therapies that require precise oligonucleotide synthesis. The rising need for innovative therapies for various chronic diseases, along with advances in early diagnostic methods like PCR, further stimulates the market for phosphoramidite. The increasing demand for accuracy in diagnosing genetic and infectious disorders is contributing to this growth. In addition, ongoing improvements in screening methods are accelerating drug development and optimizing the use of phosphoramidite in the process.

U.S. Phosphoramidite Market was valued at USD 487.9 million in 2024, with the growing demand for oligonucleotide-based therapies for molecular diagnostics and gene therapies driving the market. Investments in genetic research, including gene therapy advancements, have led to a rise in funding and infrastructure in the U.S., further fueling the market. In addition, the need for high-quality reagents and solutions for the synthesis of DNA and RNA-based therapies, as well as next-generation sequencing, is expected to drive the demand for phosphoramidites in the U.S. The market is also benefiting from favorable government initiatives and the presence of leading industry players.

Key players in the Global Phosphoramidite Market include Bioneer, PolyOrg, Biosynth, BOC Sciences, ChemGenes, Sigma-Aldrich (Merck KGaA), Creative Biolabs, Danaher, Glen Research, Hongene Biotech, LGC Biosearch Technologies, Lumiprobe, Qiagen, Thermo Fisher Scientific, and TriLink Bio Technologies. Companies in the phosphoramidite market strengthen their position by investing in research & development, especially in the fields of gene therapy and diagnostic applications. They focus on advancing synthesis technologies and improving the efficiency of production processes to reduce costs and enhance the scalability of DNA and RNA-based therapies. Many companies are forming strategic partnerships with biotechnology firms to enhance their product offerings and extend their market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for genetic research and biotechnology

- 3.2.1.2 Rising prevalence of RNA-based therapeutics

- 3.2.1.3 Technological advancements in diagnostic techniques

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complexity in synthesis and purity standards

- 3.2.2.2 Limited market awareness and infrastructure in emerging markets

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for high-throughput and automated oligo synthesis

- 3.2.3.2 Rise in government and defense genomics initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 DNA phosphoramidites

- 5.3 RNA phosphoramidites

- 5.4 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug discovery and development

- 6.3 Diagnostics

- 6.4 Personalized medicine

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pharmaceutical and biotechnology companies

- 7.3 Academic and research institutes

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bioneer

- 9.2 Biosynth

- 9.3 BOC Sciences

- 9.4 ChemGenes

- 9.5 Creative Biolabs

- 9.6 Danaher

- 9.7 Glen Research

- 9.8 Hongene Biotech

- 9.9 LGC Biosearch Technologies

- 9.10 Lumiprobe

- 9.11 PolyOrg

- 9.12 Sigma-Aldrich (Merck KGaA)

- 9.13 Qiagen

- 9.14 Thermo Fisher Scientific

- 9.15 TriLink Bio Technologies