|

市場調查報告書

商品編碼

1766241

多西他賽市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Docetaxel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

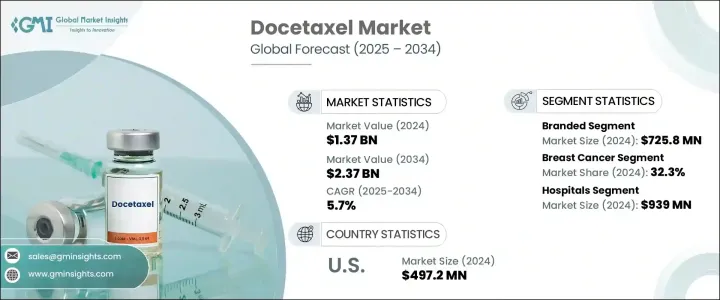

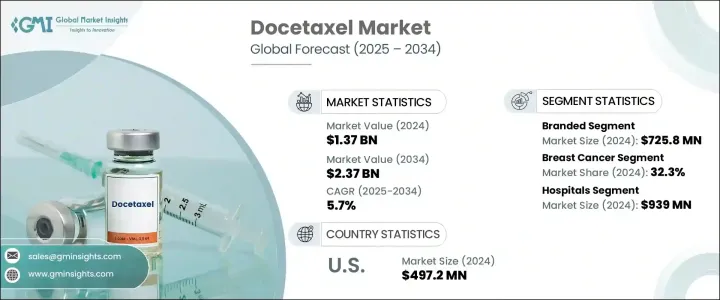

2024 年全球多西他賽市場價值為 13.7 億美元,預計到 2034 年將以 5.7% 的複合年成長率成長至 23.7 億美元。這一成長主要是由於乳腺癌、肺癌、前列腺癌和胃癌等多種癌症發病率不斷上升所致,而多西他賽在這些疾病中被廣泛使用。作為第二代紫杉烷,多西他賽可穩定微管並阻止癌細胞分裂,使其成為化療方案的重要組成部分。它在聯合療法中尤其有效,有助於提高三陰性乳癌和去勢抵抗性前列腺癌等晚期癌症患者的存活率。此外,奈米顆粒製劑和脂質體包覆等藥物傳遞方法的創新提高了藥物的生物利用度並降低了毒性,擴大了其臨床應用。

生物相似藥和多西他賽學名藥的核准數量不斷增加,使得該藥物更容易取得,尤其是在中低收入地區。同時,對腫瘤研發的日益關注也刺激了對這種重要細胞毒性藥物的需求。數位醫療技術也發揮著重要作用,它可以透過遠端監控治療反應和副作用,實現更佳的個人化治療。此外,癌症意識的提高、城市化進程的推進以及早期診斷的推進,也促進了人們對化療和多西他賽等藥物的更廣泛依賴。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13.7億美元 |

| 預測值 | 23.7億美元 |

| 複合年成長率 | 5.7% |

在多西他賽市場中,品牌藥部分在2024年創造了7.258億美元的收入,這得益於原廠藥在臨床上的良好聲譽和療效。儘管存在學名藥,但品牌藥憑藉其可靠的安全性、監管部門的批准和高品質的標準,在已開發市場仍佔據主導地位。品牌多西他賽通常是腫瘤學家治療乳腺癌、非小細胞肺癌 (NSCLC) 和前列腺癌等複雜癌症的首選,尤其是在住院治療中。此外,對新型給藥方式和合併療法的投入進一步提升了品牌價值。

2024年,乳癌領域佔32.3%,主要得益於針對HER2陰性和三陰性乳癌患者的早期和晚期治療方案。該藥物常用於TAC(多西他賽、阿黴素和環磷醯胺)等聯合治療,這些方案已被證明可以改善存活結果。個人化腫瘤治療系統的進展將繼續增加對多西他賽在乳癌治療的需求。

2024年,美國多西他賽市場規模達4.972億美元。優惠的報銷政策、日益成長的精準腫瘤學服務以及對個人化醫療的重視等因素正在推動市場需求。此外,門診化療可及性的擴大、癌症認知度的提高以及持續的臨床研究也正在鞏固美國市場的成長。製藥公司與研究中心之間的戰略合作夥伴關係進一步鞏固了美國作為關鍵市場的地位,從而加速了藥物開發和市場成長。

全球多西他賽產業的領導者包括 Alchem International、Alkem Labs、Arch Pharmalabs、Aspen Pharmacare、Cipla、Cisen Pharmaceutical、LGM Pharma、Phyton Biotech、齊魯製藥、Teva Active Pharmaceutical Ingredients (TAPI)、Teva Pharmaceuticals、Venus Remedies 和 Xiromed。在多西他賽市場營運的公司正致力於透過提供新配方、給藥方式和聯合療法來擴展其產品組合。與研究機構和醫院的合作對於加強多西他賽的臨床應用和採用至關重要。許多參與者正在投資生物相似藥和學名藥,以進入成本敏感市場,確保更廣泛地獲得這種基本藥物。此外,個人化醫療和先進數位健康技術的發展使公司能夠更好地滿足患者需求,並改善治療效果。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 全球癌症盛行率上升

- 擴大採用聯合療法

- 有利的監管批准和指導方針

- 藥物配方技術進步

- 產業陷阱與挑戰

- 嚴重的副作用和毒性問題

- 專利到期和學名藥競爭

- 市場機會

- 個人化腫瘤治療方法的擴展

- 增加腫瘤學研發的投資

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 報銷場景

- 報銷政策對市場成長的影響

- 消費者行為分析

- 貿易統計(HS編碼)

- 主要進口國

- 主要出口國

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 品牌

- 泛型

第6章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 乳癌

- 非小細胞肺癌(NSCLC)

- 荷爾蒙難治性前列腺癌

- 胃腺癌

- 頭頸部鱗狀細胞癌(HNSCC)

- 其他適應症

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 腫瘤診所

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Alchem International

- Alkem Labs

- Arch Pharmalabs

- Aspen Pharmacare

- Cipla

- Cisen Pharmaceutical

- LGM Pharma

- Phyton Biotech

- Qilu Pharmaceutical

- Teva Active Pharmaceutical Ingredients (TAPI)

- Teva Pharmaceuticals

- Venus Remedies

- Xiromed

The Global Docetaxel Market was valued at USD 1.37 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 2.37 billion by 2034. This growth is largely driven by the increasing incidence of various cancers, including breast, lung, prostate, and gastric cancers, where docetaxel is widely used. As a second-generation taxane, docetaxel stabilizes microtubules and halts the division of cancer cells, making it a crucial part of chemotherapy regimens. It is particularly effective in combination therapies, helping to improve survival rates for patients with advanced cancers, such as triple-negative breast cancer and castration-resistant prostate cancer. Additionally, innovations in drug delivery methods, such as nanoparticle formulations and liposomal encapsulations, have improved their bioavailability and reduced toxicity, expanding their clinical applications.

The growing approvals for biosimilars and generic docetaxel are making the drug more accessible, particularly in lower-middle-income regions, while the increasing focus on oncology R&D boosts demand for this essential cytotoxic agent. Digital health technologies also play a role by enabling better treatment personalization through remote monitoring of treatment responses and side effects. Furthermore, greater cancer awareness, urbanization, and early diagnosis efforts are contributing to the broader reliance on chemotherapy and drugs like docetaxel.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.37 Billion |

| Forecast Value | $2.37 Billion |

| CAGR | 5.7% |

The branded segment of the docetaxel market generated USD 725.8 million in 2024, benefiting from the established clinical reputation and efficacy of original formulations. Despite the presence of generics, branded products continue to dominate in developed markets due to their trusted safety profiles, regulatory approvals, and high-quality standards. Branded docetaxel is often preferred by oncologists for treating complex cancers such as breast cancer, non-small cell lung cancer (NSCLC), and prostate cancer, particularly in hospital settings. Moreover, the investment in new delivery methods and combination therapies further strengthens the brand's value.

In 2024, breast cancer segment held 32.3% driven by early and advanced treatment regimens for HER2-negative and triple-negative breast cancer patients. It is commonly used in combination treatments like TAC (docetaxel, doxorubicin, and cyclophosphamide), which have been shown to improve survival outcomes. Advances in personalized oncology systems continue to increase the demand for docetaxel in managing breast cancer cases.

U.S. Docetaxel Market was valued at USD 497.2 million in 2024. Factors such as favorable reimbursement policies, growing precision oncology services, and a focus on personalized medicine are fueling the demand. Furthermore, the expansion of outpatient chemotherapy access, increasing cancer awareness, and continuous clinical research are reinforcing the U.S. market's growth. The role of the U.S. as a key market is further strengthened by strategic partnerships between pharmaceutical companies and research centers, which accelerate drug development and market growth.

Leading players in the Global Docetaxel Industry include Alchem International, Alkem Labs, Arch Pharmalabs, Aspen Pharmacare, Cipla, Cisen Pharmaceutical, LGM Pharma, Phyton Biotech, Qilu Pharmaceutical, Teva Active Pharmaceutical Ingredients (TAPI), Teva Pharmaceuticals, Venus Remedies, and Xiromed. Companies operating in the docetaxel market are focusing on expanding their product portfolios by offering new formulations, delivery methods, and combination therapies. Partnerships with research institutions and hospitals are vital to enhancing the clinical applications and adoption of docetaxel. Many players are investing in biosimilars and generics to tap into cost-sensitive markets, ensuring broader access to this essential drug. Additionally, the development of personalized medicine and advanced digital health technologies allows companies to better cater to patient needs, improving treatment outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Indication

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global cancer prevalence

- 3.2.1.2 Increasing adoption of combination therapies

- 3.2.1.3 Favorable regulatory approvals and guidelines

- 3.2.1.4 Technological advancements in drug formulation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Severe side effects and toxicity concerns

- 3.2.2.2 Patent expirations and generic competition

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of personalized oncology treatment approaches

- 3.2.3.2 Increasing investments in oncology research and development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Reimbursement scenario

- 3.10.1 Impact of reimbursement policies on market growth

- 3.11 Consumer behaviour analysis

- 3.12 Trade statistics (HS code)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Branded

- 5.3 Generics

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Breast cancer

- 6.3 Non-small cell lung cancer (NSCLC)

- 6.4 Hormone refractory prostate cancer

- 6.5 Gastric adenocarcinoma

- 6.6 Head and neck squamous cell carcinoma (HNSCC)

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Oncology clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alchem International

- 9.2 Alkem Labs

- 9.3 Arch Pharmalabs

- 9.4 Aspen Pharmacare

- 9.5 Cipla

- 9.6 Cisen Pharmaceutical

- 9.7 LGM Pharma

- 9.8 Phyton Biotech

- 9.9 Qilu Pharmaceutical

- 9.10 Teva Active Pharmaceutical Ingredients (TAPI)

- 9.11 Teva Pharmaceuticals

- 9.12 Venus Remedies

- 9.13 Xiromed