|

市場調查報告書

商品編碼

1766237

醫療器材分銷服務市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Medical Device Distribution Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

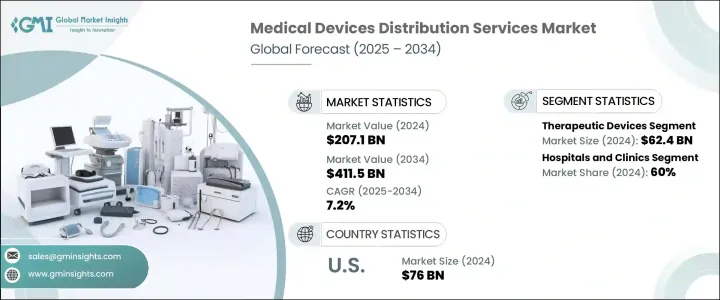

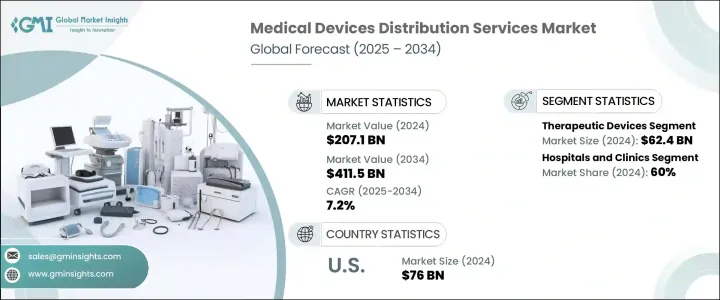

2024 年全球醫療器材分銷服務市場規模為 2,071 億美元,預計到 2034 年將以 7.2% 的複合年成長率成長,達到 4,115 億美元。這一成長主要受到多種趨勢融合的推動。越來越多的人被診斷出患有慢性疾病,導致對各種醫療器材的需求增加。除此之外,醫療領域的研發力道不斷加大,帶來了一波創新和法規核准浪潮,提高了產品的可用性和多樣性。醫療技術也變得越來越先進,尤其是數位和遠端監控功能的整合,這些功能在傳統臨床環境之外實現更高效的患者護理方面發揮著重要作用。隨著患者擴大選擇居家治療和遠端健康監控解決方案,分銷商正在擴展其服務以滿足這些不斷變化的偏好。

此外,醫療器械開發持續吸引公共和私營部門的大量資金支持。創投持續成長,尤其是在維持生命和創新治療解決方案領域,凸顯了這些器械在增強全球醫療保健體系方面的重要作用。這種充滿活力的環境促使老牌企業和新進業者加大對供應鏈效率和數位基礎設施的投資,以確保器械安全、迅速地送達最終用戶。隨著醫療保健服務模式轉向更加分散和以患者為中心的模式,對敏捷且響應迅速的分銷網路的需求比以往任何時候都高。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2071億美元 |

| 預測值 | 4115億美元 |

| 複合年成長率 | 7.2% |

市場按產品類型細分為診斷設備、治療設備、病患監護設備、家庭醫療保健解決方案和其他類別。其中,治療設備領域在2024年成為收入最高的領域,價值達624億美元。預計該領域在預測期內的複合年成長率將達到7.4%。該領域的強勁表現與全球對輔助治療和管理慢性病設備的持續需求息息相關。從藥物輸送系統到植入物和助行器,此類設備在長期治療方案中已變得越來越不可或缺。分銷商正在優先考慮這一類別,以滿足醫療保健領域不斷成長的需求。

從終端用戶的角度來看,2024年,醫院和診所佔據了全球醫療器材分銷服務市場60%的佔有率。這些醫療機構由於其處理的醫療案例範圍廣泛——從急性醫療干預到持續的慢性病護理——而始終處於採購的前沿。他們對多樣化設備的需求推動了大規模的採購行為。為了避免中斷並確保醫療服務的連續性,醫院通常會大量採購醫療器材並保持充足的庫存。醫院和診所的持續需求支撐著全球分銷生態系統的重要組成部分。

從區域來看,北美在2024年以37.4%的市佔率領先全球市場。該地區的主導地位可以歸因於人口老化以及糖尿病、心血管疾病等慢性病的高發生率。這些健康趨勢給現有的醫療基礎設施帶來了巨大壓力,並加速了對支援長期患者護理的設備進行高效分銷的需求。醫療保健需求的複雜性和規模日益成長,促使分銷商提升營運能力,利用傳統物流和數位工具來確保關鍵設備的及時交付。

在美國,該市場持續呈現上升勢頭,估值從2021年的634億美元成長至2022年的673億美元,預計在2024年達到760億美元。該市場的穩定成長反映了美國持續推動醫療體系現代化,以應對日益加重的生活方式相關疾病負擔的努力。隨著醫院、護理機構和患者對各種設備的依賴程度日益加深,分銷管道也日益完善,以確保產品在需要時隨時隨地可用。

競爭環境由少數幾家主要參與者主導,他們總共控制約45%的市場佔有率。這些全球分銷商憑藉完善的物流網路、豐富的產品組合以及與醫院和醫療保健提供者等關鍵買家的牢固關係,保持著競爭優勢。他們的策略重點包括對庫存管理、數位平台、法規合規性和即時供應鏈可視性的投資。另一方面,規模較小的區域性公司則利用本地市場知識以及與政府資助的醫療保健項目的密切聯繫,開拓利基市場。大型經銷商透過全球覆蓋範圍不斷擴張,而規模較小的公司則透過提供針對特定區域需求的靈活個人化服務蓬勃發展。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 慢性病盛行率不斷上升

- 研發投入激增,醫療器材核准數量增加

- 家庭醫療保健和遠端監控的需求不斷成長

- 醫療器材技術的進步

- 產業陷阱與挑戰

- 需要較高的初始資本支出

- 遵守嚴格的監管規定

- 市場機會

- 線上分銷服務和數位訂購系統的成長

- 加強公私合作,強化供應鏈

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 差距分析

- 定價分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 診斷設備

- 治療設備

- 病人監護設備

- 家庭醫療保健設備

- 其他產品類型

第6章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院和診所

- 診斷中心

- 門診手術中心(ASC)

- 長期照護機構

- 居家照護環境

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Alfresa Holdings

- B. Braun Melsungen

- Cardinal Health

- Henry Schein

- McKesson Corporation

- Medline Industries

- Meditek

- Medtronic

- Nipro

- Owens & Minor

- Patterson Companies

- Soquelec

- Southmedic

- Stat Medical

- The Stevens Company

The Global Medical Device Distribution Services Market was valued at USD 207.1 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 411.5 billion by 2034. This growth is primarily being fueled by several converging trends. A rising number of individuals are being diagnosed with chronic conditions, leading to higher demand for a variety of medical devices. Alongside this, the push for research and development in the medical field has intensified, bringing a wave of innovations and regulatory approvals that enhance product availability and variety. Medical technologies are also becoming more advanced, especially with the integration of digital and remote monitoring capabilities, which are playing a significant role in enabling more efficient patient care outside of conventional clinical environments. As patients increasingly opt for home-based treatment and remote health monitoring solutions, distributors are expanding their services to cater to these evolving preferences.

Additionally, medical device development continues to attract substantial financial backing from both the public and private sectors. Venture capital investment has grown, particularly in life-sustaining and innovative therapeutic solutions, underscoring the essential role of these devices in enhancing the global healthcare system. This dynamic environment is prompting both established players and new entrants to boost investment in supply chain efficiency and digital infrastructure, ensuring that devices reach end-users safely and swiftly. With healthcare delivery models shifting to more decentralized and patient-centered care, the demand for agile and responsive distribution networks is higher than ever.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $207.1 Billion |

| Forecast Value | $411.5 Billion |

| CAGR | 7.2% |

The market is segmented by product type into diagnostic devices, therapeutic devices, patient monitoring equipment, home healthcare solutions, and other categories. Among these, the therapeutic devices segment emerged as the highest revenue generator in 2024, valued at USD 62.4 billion. It is expected to expand at a CAGR of 7.4% over the forecast period. The strong performance of this segment can be linked to the consistent global demand for equipment that aids in treating and managing chronic illnesses. From drug delivery systems to implants and mobility aids, the use of such devices has become increasingly indispensable in long-term treatment protocols. Distributors are prioritizing this category to meet the surging demand across healthcare settings.

When viewed from an end-use perspective, hospitals and clinics held a commanding 60% share of the global medical device distribution services market in 2024. These healthcare institutions remain at the forefront of procurement due to the wide range of medical cases they handle-from acute medical interventions to ongoing chronic care. Their need for a diverse set of devices drives large-scale purchasing behavior. To avoid disruptions and ensure continuity of care, hospitals typically purchase medical devices in bulk and maintain robust inventories. This consistent demand from hospitals and clinics sustains a critical portion of the global distribution ecosystem.

Regionally, North America led the global market with a 37.4% share in 2024. The region's dominance can be attributed to a combination of an aging population and the high incidence of chronic diseases like diabetes and cardiovascular conditions. These health trends are straining existing medical infrastructure and accelerating the need for efficient distribution of devices that support long-term patient care. The growing complexity and volume of healthcare needs are prompting distributors to enhance their operational capacity, leveraging both traditional logistics and digital tools to ensure timely delivery of critical devices.

In the United States, the market has shown consistent upward momentum, with valuations increasing from USD 63.4 billion in 2021 to USD 67.3 billion in 2022, and reaching USD 76 billion in 2024. The market's steady rise reflects the nation's ongoing efforts to modernize its healthcare system and respond to the escalating burden of lifestyle-related illnesses. As hospitals, care facilities, and patients increasingly rely on a diverse range of devices, distribution channels are becoming more sophisticated, ensuring that products are available where and when they are needed.

The competitive environment is shaped by a handful of major players that collectively control around 45% of the market. These global distributors maintain a competitive edge through well-established logistics networks, wide product portfolios, and strong relationships with key buyers like hospitals and healthcare providers. Their strategic focus includes investments in inventory management, digital platforms, regulatory compliance, and real-time supply chain visibility. On the other hand, smaller regional firms are carving out niches by leveraging local market knowledge and close ties with government-funded healthcare programs. While large distributors scale up with global reach, smaller firms are thriving by offering agile and personalized services tailored to specific regional demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of chronic diseases

- 3.2.1.2 Surge in investments for research and growth in medical device approvals

- 3.2.1.3 Rising demand for home healthcare and remote monitoring

- 3.2.1.4 Advancements in medical device technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Requirement for high initial capital expenditure

- 3.2.2.2 Presence of stringent regulatory compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in online distribution services and digital ordering systems

- 3.2.3.2 Increasing public-private partnership to strengthen supply chains

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Pricing analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic devices

- 5.3 Therapeutic devices

- 5.4 Patient monitoring devices

- 5.5 Home healthcare devices

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Diagnostic centers

- 6.4 Ambulatory surgical centers (ASCs)

- 6.5 Long-term care facilities

- 6.6 Homecare settings

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Alfresa Holdings

- 8.2 B. Braun Melsungen

- 8.3 Cardinal Health

- 8.4 Henry Schein

- 8.5 McKesson Corporation

- 8.6 Medline Industries

- 8.7 Meditek

- 8.8 Medtronic

- 8.9 Nipro

- 8.10 Owens & Minor

- 8.11 Patterson Companies

- 8.12 Soquelec

- 8.13 Southmedic

- 8.14 Stat Medical

- 8.15 The Stevens Company