|

市場調查報告書

商品編碼

1766235

超音波組織消融系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ultrasonic Tissue Ablation System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

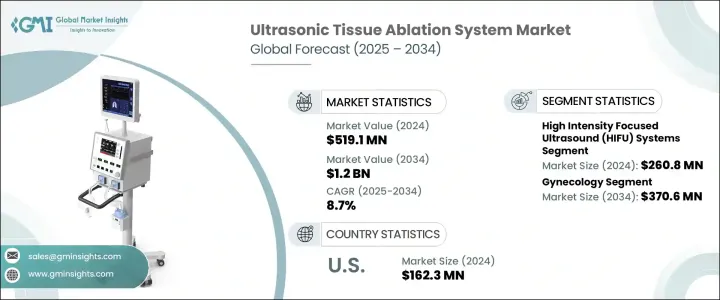

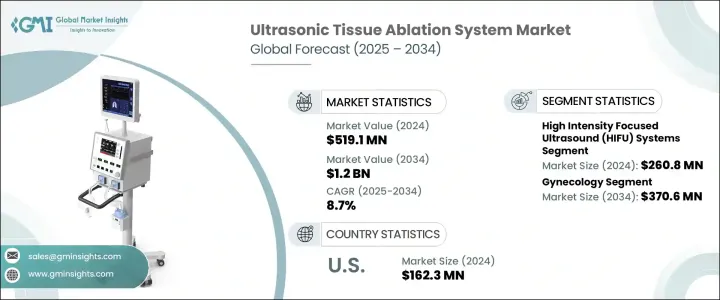

2024年,全球超音波組織消融系統市場規模達5.191億美元,預計複合年成長率為8.7%,到2034年將達12億美元。這一顯著成長主要得益於神經系統手術頻率的不斷提高、超音波消融系統在非癌性疾病中的應用範圍不斷擴大以及設備技術的持續進步。此外,超音波消融系統在腫瘤學以外的領域也日益得到應用,例如子宮肌瘤、良性前列腺增生 (BPH)、子宮內膜異位症,甚至心律不整,從而促進了其臨床應用的廣泛性。這些設備的多功能性和非侵入性使其對各種醫學專業領域都極具吸引力,進一步推動了市場成長。

超音波和核磁共振等即時成像系統以及攜帶式自動化能量調節系統的不斷發展,提高了靶向精度,顯著提高了這些治療的安全性和有效性。這些創新也使這些設備更加便捷易用,並促進了其在更多醫療機構的應用。高強度聚焦超音波 (HIFU) 系統是該市場中最大的細分市場,由於其非侵入性方法以及在不損傷周圍組織的情況下治療敏感部位的能力,其受歡迎程度持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.191億美元 |

| 預測值 | 12億美元 |

| 複合年成長率 | 8.7% |

高強度聚焦超音波 (HIFU) 系統領域在 2024 年佔據了 2.608 億美元的市場佔有率,佔據主要地位,其在大腦、前列腺和子宮等精細敏感部位的應用日益廣泛。 HIFU 系統目前常用於治療肝癌、腎臟癌和攝護腺癌等癌症,特別適用於無法或不願接受手術的病人。在婦科領域,HIFU 因其保留子宮且非侵入性的優勢,正迅速成為治療子宮肌瘤的首選方法。此外,它在治療帕金森氏症和特發性震顫等神經系統疾病方面也越來越受到關注,尤其是在結合 MRI 引導的情況下。

婦科領域在2024年佔據了最大的市場佔有率,預計到2034年將達到3.706億美元。受育齡女性子宮肌瘤和子宮內膜異位症盛行率上升的推動,該領域正經歷強勁成長。隨著越來越多的女性尋求非侵入性治療方案,高強度聚焦超音波 (HIFU) 正獲得顯著關注,與子宮切除術和肌瘤切除術等傳統手術方法相比,它提供了一種創傷性較小的選擇。

2024年,美國超音波組織消融系統市場規模達1.623億美元。由於優惠的報銷政策以及人們對微創或非侵入性手術的日益青睞,此類系統的需求正在不斷成長。美國醫療保健系統擴大採用高強度聚焦超音波(HIFU)治療各種疾病,包括前列腺癌、子宮肌瘤和神經系統疾病,這推動了該產品的普及。即時影像技術的整合正在提高手術的準確性和安全性,同時,醫療保健提供者和設備製造商之間的合作也正在進一步擴大超音波組織消融系統在美國的應用範圍。

全球超音波組織消融系統市場的主要參與者包括 FUSMobile、bioventus、BRAINSONIX、EDAP TMS、INSIGHTEC、Haifu、Soring、Verasonics、STRYKER、PROFOUND、OLYMPUS、sonablate、ASTAR 和 INTEGRA 等。在競爭激烈的超音波組織消融市場中,各公司正專注於制定策略方案,以維持並擴大市場佔有率。他們積極與醫療保健提供者建立合作夥伴關係,以增強臨床應用並擴大超音波系統的使用範圍。主要參與者正在持續投資研發,以推出整合即時成像功能並提供更精準治療標靶的先進設備。一些公司正在擴大產品組合,推出攜帶式消融系統,以滿足門診患者的需求。此外,一些製造商正致力於提高患者舒適度、縮短手術時間並加強安全規程,以使其系統對醫療保健專業人員更具吸引力。此外,這些公司還透過為臨床醫生和醫療保健提供者提供培訓和教育項目,旨在提高採用率並建立品牌忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 神經系統手術發生率上升

- 增加監管批准和報銷政策

- 非侵入性療法日益受到青睞

- 擴大在非癌症疾病的應用

- 產業陷阱與挑戰

- 設備和手術成本高昂

- 機會

- 人工智慧與影像引導系統的整合,實現精確瞄準

- 攜帶式、小型化的HIFU設備的開發

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 按產品分類的價格趨勢

- 未來市場趨勢

- 報銷場景

- 報銷政策對市場成長的影響

- 消費者行為分析

- LIFU 的新興和研究應用

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 世界其他地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 高強度聚焦超音波(HIFU)系統

- 磁振造影引導HIFU系統

- 超音波引導HIFU系統

- 超音波手術消融系統

- 衝擊波治療系統

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 婦科

- 癌症

- 心血管疾病

- 泌尿科

- 神經病學

- 其他應用

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 影像中心

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ASTAR

- bioventus

- BRAINSONIX

- EDAP TMS

- FUSMobile

- Haifu

- INSIGHTEC

- INTEGRA

- OLYMPUS

- PROFOUND

- sonablate

- Soring

- stryker

- THERACLION

- Verasonics

The Global Ultrasonic Tissue Ablation System Market was valued at USD 519.1 million in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 1.2 billion by 2034. This significant growth is primarily driven by the increasing frequency of neurological procedures, the expanding scope of ultrasound ablation systems in non-cancerous diseases, and ongoing advancements in device technologies. Additionally, ultrasound ablation systems are being increasingly applied outside oncology for conditions like uterine fibroids, benign prostatic hyperplasia (BPH), endometriosis, and even cardiac arrhythmias, contributing to their wider clinical use. The versatility and non-invasive nature of these devices make them highly attractive for various medical specialties, further driving market growth.

Improvements in targeting precision, bolstered by real-time imaging systems like ultrasound and MRI, as well as the development of portable and automated energy modulation systems, have significantly enhanced the safety and efficacy of these procedures. These innovations have also made the devices more accessible and user-friendly, encouraging their adoption in additional healthcare settings. High-intensity focused ultrasound (HIFU) systems, which represent the largest segment in this market, continue to gain popularity due to their non-invasive approach and ability to treat sensitive areas without damaging surrounding tissue.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $519.1 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 8.7% |

The high-intensity focused ultrasound (HIFU) systems segment held a major market share of USD 260.8 million in 2024, showing increasing use in delicate and sensitive areas, including the brain, prostate, and uterus. HIFU systems are now commonly used to treat cancers such as liver, kidney, and prostate, particularly in patients who are unable or unwilling to undergo surgery. In gynecology, HIFU is rapidly becoming the preferred method for treating uterine fibroids, as it offers a uterus-preserving and non-invasive approach. Additionally, it is gaining traction for the treatment of neurological disorders like Parkinson's disease and essential tremor, especially when combined with MRI guidance.

The gynecology segment held the largest market share in 2024 and is projected to reach USD 370.6 million by 2034. This sector is experiencing robust growth driven by the rising prevalence of uterine fibroids and endometriosis among women of reproductive age. As more women seek non-invasive alternatives, high-intensity focused ultrasound (HIFU) is gaining significant traction, offering a less invasive option compared to traditional surgical methods like hysterectomy and myomectomy.

U.S. Ultrasonic Tissue Ablation System Market was valued at USD 162.3 million in 2024. Demand for these systems is rising due to favorable reimbursement policies, as well as a growing preference for minimally invasive or non-invasive procedures. The U.S. healthcare system's increasing adoption of HIFU for various indications, including prostate cancer, uterine fibroids, and neurological disorders, is driving product uptake. Integration of real-time imaging technologies is improving procedural accuracy and safety, while collaborative efforts between healthcare providers and device manufacturers are further expanding the scope of ultrasonic tissue ablation systems in the country.

Key players in the Global Ultrasonic Tissue Ablation System Market include names like FUSMobile, bioventus, BRAINSONIX, EDAP TMS, INSIGHTEC, Haifu, Soring, Verasonics, STRYKER, PROFOUND, OLYMPUS, sonablate, ASTAR, and INTEGRA. In the competitive ultrasonic tissue ablation market, companies are focusing on strategic approaches to maintain and expand their market share. Collaborations and partnerships with healthcare providers are being actively pursued to enhance clinical applications and broaden the use of ultrasonic systems. Key players are investing in continuous research and development to introduce advanced devices that integrate real-time imaging and provide more accurate treatment targeting. Expanding their product portfolios, some companies are introducing portable versions of their ablation systems to cater to outpatient settings. Moreover, several manufacturers are focusing on improving patient comfort, reducing procedure time, and enhancing safety protocols to make their systems more appealing to healthcare professionals. Additionally, by offering training and educational programs to clinicians and healthcare providers, these companies aim to increase adoption rates and build brand loyalty.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of neurological procedures

- 3.2.1.2 Increasing regulatory approvals and reimbursement policies

- 3.2.1.3 Increasing preference for non-invasive therapies

- 3.2.1.4 Expanding applications in non-cancer diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of equipment and procedures

- 3.2.3 Opportunities

- 3.2.3.1 Integration of AI and image-guided systems for precision targeting

- 3.2.3.2 Development of portable and compact HIFU devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends, by product

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.8.1 Impact of reimbursement policies on market growth

- 3.9 Consumer behaviour analysis

- 3.10 Emerging and investigational applications of LIFU

- 3.11 Gap analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Rest of the world

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 High intensity focused ultrasound (HIFU) systems

- 5.2.1 MR-guided HIFU systems

- 5.2.2 Ultrasound-guided HIFU systems

- 5.3 Ultrasonic surgical ablation systems

- 5.4 Shock wave therapy systems

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gynecology

- 6.3 Cancer

- 6.4 Cardiovascular disease

- 6.5 Urology

- 6.6 Neurology

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Imaging centers

- 7.4 Ambulatory surgical centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ASTAR

- 9.2 bioventus

- 9.3 BRAINSONIX

- 9.4 EDAP TMS

- 9.5 FUSMobile

- 9.6 Haifu

- 9.7 INSIGHTEC

- 9.8 INTEGRA

- 9.9 OLYMPUS

- 9.10 PROFOUND

- 9.11 sonablate

- 9.12 Soring

- 9.13 stryker

- 9.14 THERACLION

- 9.15 Verasonics