|

市場調查報告書

商品編碼

1766234

模組化機器平台市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Modular Machine Platforms Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

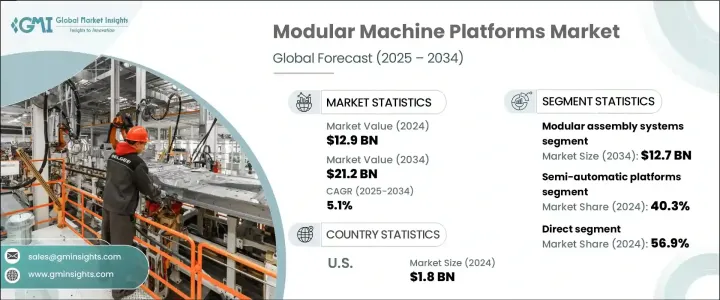

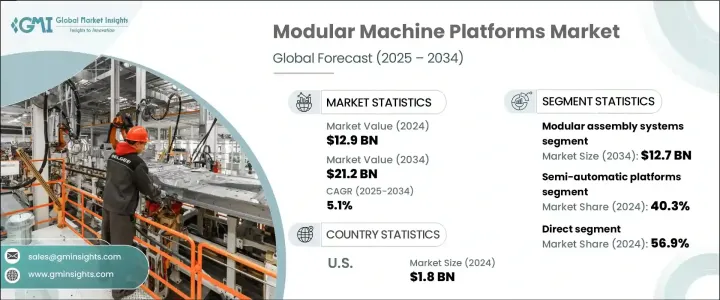

2024年,全球模組化機械平台市場規模達1,29億美元,預計到2034年將以5.1%的複合年成長率成長,達到212億美元。由於現代製造業對可客製化、可擴展和可重構機械的需求日益成長,該市場正在迅速擴張。模組化機械平台能夠更快地適應產品設計變更和大量生產需求,無需大量停機或重新裝配,從而簡化生產流程。這些解決方案對於電子、消費品和工業機械等行業的製造商至關重要,因為它們需要跟上不斷變化的客戶需求和大規模客製化趨勢。

隨著越來越多的產業優先考慮精實流程和即時工作流程,模組化解決方案正成為實現生產力和成本效益目標不可或缺的一部分。這些平台也支援工業 4.0 的目標,幫助製造商整合智慧系統並提高自動化程度,而無需進行全面檢修。在強大的工業自動化生態系統和日益成長的生產敏捷性壓力的支持下,北美、歐洲和亞太地區繼續推動全球採用模組化解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 129億美元 |

| 預測值 | 212億美元 |

| 複合年成長率 | 5.1% |

模組化組裝系統細分市場在2024年創造了82億美元的產值,預計到2034年將成長至127億美元。這些系統因其能夠使用模組化、可互換的單元快速適應不同類型和尺寸的產品而備受推崇。其可擴展性有助於減少代價高昂的停機時間,並最大限度地減少重新設計的需求,使其在快速發展的行業中特別有效。模組化組裝系統的受歡迎程度與精益製造計劃和注重效率的生產模式密切相關,這些模式旨在減少浪費並縮短響應時間。

半自動平台細分市場在2024年佔據了40.3%的市場佔有率,預計到2034年將以4.5%的複合年成長率成長。這些平台將人工輸入與機械化功能相結合,為需要人工監督品質敏感或客製化生產任務的製造商提供了平衡的解決方案。與全自動系統相比,它們的吸引力在於前期投資更低,同時顯著提高了產量和一致性。這些系統也對勞動力技能和可用性適中的地區具有吸引力,在手動操作和全自動化之間提供了理想的中間地帶。

2024年,美國模組化機械平台市場規模達18億美元,預計2034年複合年成長率將達5.7%。美國憑藉其高度先進的自動化基礎設施,以及航太、汽車和高科技製造等工業領域的旺盛需求,在北美地區保持領先地位。美國持續致力於製造業回流和智慧製造理念的採用,這有利於加速部署旨在實現彈性生產的模組化系統。在研發投入龐大和工業數位化不斷發展的推動下,北美將繼續成為早期技術應用的中心。

模組化機械平台產業的主要領導者包括ABB有限公司、倍福自動化、三菱電機、ATS自動化、博世力士樂、西門子股份公司、貝加萊工業自動化、史陶比爾國際股份公司、安川電機株式會社、庫卡股份公司、雄克有限公司、FlexLink系統公司、羅克韋爾自動化、費斯托股份公司和優機器人傲。為了鞏固市場地位,各大公司正致力於將物聯網、人工智慧和資料分析等數位技術整合到模組化系統中,以提升功能和效能。他們還在擴展產品組合,提供即插即用的模組化單元,以實現快速配置,並最大程度地減少系統升級期間的中斷。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 模組化組裝系統

- 模組化機器人平台

- 模組化CNC工具機

- 模組化包裝機

- 其他

第6章:市場估計與預測:依模組化水平,2021 - 2034 年

- 主要趨勢

- 固定模組化平台

- 靈活的模組化平台

- 可重構機器系統(RMS)

第7章:市場估計與預測:按營運,2021 - 2034 年

- 主要趨勢

- 手動模組化平台

- 半自動平台

- 全自動平台

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 集會

- 物料處理

- 檢查和測試

- 加工

- 包裝

- 其他

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 汽車

- 電子和半導體

- 食品和飲料

- 製藥

- 消費品

- 航太和國防

- 物流和倉儲

- 其他(紡織、印刷等)

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

第12章:公司簡介

- ABB Ltd.

- ATS Automation

- B&R Industrial Automation

- Beckhoff Automation

- Bosch Rexroth

- Festo AG & Co. KG

- FlexLink Systems

- KUKA AG

- Mitsubishi Electric

- Rockwell Automation

- Schunk GmbH

- Siemens AG

- Staubli International AG

- Universal Robots

- Yaskawa Electric Corporation

The Global Modular Machine Platforms Market was valued at USD 12.9 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 21.2 billion by 2034. This market is expanding rapidly due to the increasing demand for customizable, scalable, and reconfigurable machinery across modern manufacturing sectors. Modular machine platforms offer companies the ability to streamline production by allowing faster adaptation to product design changes and batch production needs without significant downtime or retooling. These solutions are vital for manufacturers in sectors like electronics, consumer goods, and industrial machinery that need to keep pace with evolving customer demands and mass customization trends.

As more industries prioritize lean processes and just-in-time workflows, modular solutions are becoming integral to achieving productivity and cost-efficiency goals. These platforms also support the goals of Industry 4.0, helping manufacturers integrate smart systems and increase automation without committing to full overhauls. North America, Europe, and Asia-Pacific continue to drive global adoption, supported by strong industrial automation ecosystems and increasing pressure to improve production agility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.9 Billion |

| Forecast Value | $21.2 Billion |

| CAGR | 5.1% |

The modular assembly systems segment generated USD 8.2 billion in 2024 and is forecasted to grow to USD 12.7 billion by 2034. These systems are highly valued for their ability to adapt quickly to different product types and sizes using modular, interchangeable units. Their scalable nature helps reduce costly downtimes and minimizes the need for reengineering, making them particularly effective in fast-moving sectors. Their popularity is closely linked to lean manufacturing initiatives and efficiency-focused production models aimed at reducing waste and improving response times.

The semi-automatic platforms segment captured 40.3% share in 2024 and is projected to grow at a CAGR of 4.5% through 2034. These platforms combine human input with mechanized functions, creating a balanced solution for manufacturers who require manual oversight for quality-sensitive or custom production tasks. Their appeal lies in lower upfront investment compared to fully automated systems while offering significant improvements in output and consistency. These systems also appeal to regions where labor skills and availability are moderate, offering an ideal middle ground between manual work and full automation.

United States Modular Machine Platforms Market was worth USD 1.8 billion in 2024 and is expected to register a CAGR of 5.7% through 2034. The U.S. maintains its leadership in the North American region due to its highly advanced automation infrastructure and high demand from industrial sectors like aerospace, automotive, and high-tech manufacturing. The country's ongoing commitment to reshoring and adopting smart manufacturing principles supports the accelerated deployment of modular systems designed to enable flexible production. North America continues to serve as a hub for early technology adoption, driven by significant investment in R&D and growing industrial digitization.

Key players leading the Modular Machine Platforms Industry include ABB Ltd., Beckhoff Automation, Mitsubishi Electric, ATS Automation, Bosch Rexroth, Siemens AG, B&R Industrial Automation, Staubli International AG, Yaskawa Electric Corporation, KUKA AG, Schunk GmbH, FlexLink Systems, Rockwell Automation, Festo AG & Co. KG, and Universal Robots. To reinforce their market position, major companies are focusing on integrating digital technologies such as IoT, AI, and data analytics into modular systems to improve functionality and performance. They are also expanding their product portfolios to offer plug-and-play modular units that allow rapid configuration and minimal disruption during system upgrades.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Modularity level

- 2.2.4 Operation

- 2.2.5 Application

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Modular assembly systems

- 5.3 Modular robotics platforms

- 5.4 Modular CNC machines

- 5.5 Modular packaging machines

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Modularity level, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Fixed modular platforms

- 6.3 Flexible modular platforms

- 6.4 Reconfigurable machine systems (RMS)

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual modular platforms

- 7.3 Semi-automatic platforms

- 7.4 Fully automatic platforms

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Assembly

- 8.3 Material handling

- 8.4 Inspection & testing

- 8.5 Machining

- 8.6 Packaging

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Electronics and semiconductors

- 9.4 Food and beverage

- 9.5 Pharmaceuticals

- 9.6 Consumer goods

- 9.7 Aerospace and defense

- 9.8 Logistics and warehousing

- 9.9 Others (textile, printing, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 UAE

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 ABB Ltd.

- 12.2 ATS Automation

- 12.3 B&R Industrial Automation

- 12.4 Beckhoff Automation

- 12.5 Bosch Rexroth

- 12.6 Festo AG & Co. KG

- 12.7 FlexLink Systems

- 12.8 KUKA AG

- 12.9 Mitsubishi Electric

- 12.10 Rockwell Automation

- 12.11 Schunk GmbH

- 12.12 Siemens AG

- 12.13 Staubli International AG

- 12.14 Universal Robots

- 12.15 Yaskawa Electric Corporation