|

市場調查報告書

商品編碼

1766232

糕點和蛋糕市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pastry and Cakes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

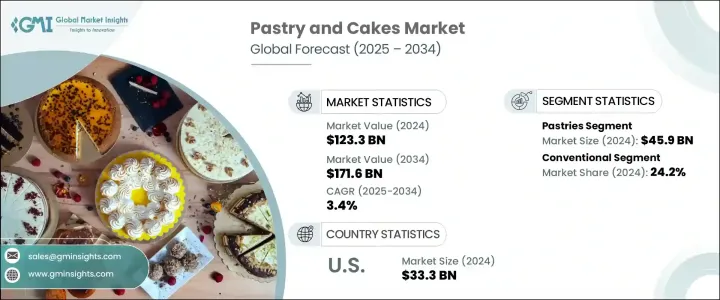

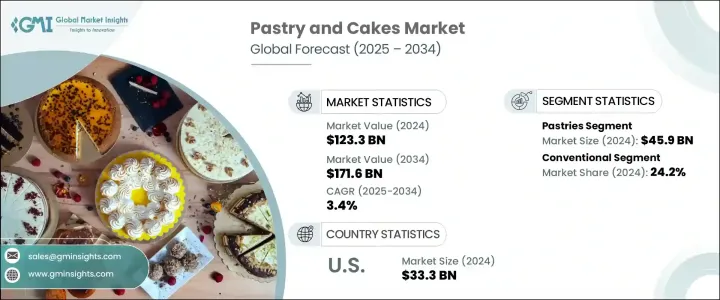

2024年,全球糕點和蛋糕市場規模達1,233億美元,預計到2034年將以3.4%的複合年成長率成長,達到1,716億美元。不同地區和不同收入階層日益興起的慶祝文化,繼續在推動這一市場發展方面發揮重要作用。隨著消費者越來越傾向於以奢華的食品來紀念日常時刻和特殊場合,糕點和蛋糕已成為情感消費和社交消費的首選。對日常奢侈品的渴望推動了消費重點的轉變,進一步助長了這個趨勢。烘焙食品已成為全球飲食習慣中不可或缺的一部分,尤其是在活動和聚會期間,它們的意義已超越了簡單的營養,進入了社交表達和禮物的領域。

無論是在已開發經濟體或發展中經濟體,烘焙食品都持續受到廣泛歡迎。便利性因素,加上生活方式的演變和城市化進程的加快,正在導致人們消費甜食的方式和時間持續變化。小巧、即食的烘焙食品越來越受歡迎,尤其是在消費者尋求能夠適應快節奏生活的食品的情況下。這種轉變也體現在食品零售商、超市、大型超市和專賣店業績的提升上,它們現在提供更豐富的糕點和蛋糕產品。此外,咖啡館、飯店和餐廳等商業部門透過提供多種形式、不同時段和不同客戶群的烘焙食品,為市場收入做出了顯著貢獻。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1233億美元 |

| 預測值 | 1716億美元 |

| 複合年成長率 | 3.4% |

市場成長的很大一部分也與全球中產階級的壯大及其對國際美食的影響息息相關。隨著人們對多元化烹飪體驗的認知度不斷提升,對糕點和蛋糕類別多樣性的需求也日益成長,無論是產品設計、食材或形式。創新趨勢顯而易見,人們對有機、無麩質、純素和低糖等特定飲食類別的興趣日益濃厚。這些產品在兼顧風味和滿足感的同時,也越來越受到注重健康的消費者的青睞。推動這項需求的既有家庭消費的住宅客戶,也有希望更新菜單、提供更健康、更豐富選擇的商業買家。

雖然實體店在市場覆蓋率和滲透率方面仍佔據主導地位,但數位化格局正在成為關鍵的推動因素。線上零售通路在擴大覆蓋不同地區消費者方面正變得越來越重要。憑藉直銷模式和增強的電商能力,品牌正在釋放新的人口機遇,並在傳統城市市場之外擴展客戶群。

光是糕點細分市場,2024 年的市場價值就高達 459 億美元,預計 2025 年至 2034 年的複合年成長率將達到 2.7%。糕點佔據了整個市場的最大佔有率,這得益於其普遍的吸引力以及在各種消費場景(從快餐到節日小吃)中的適應性。糕點在傳統零售和餐飲服務中都易於購買,這也進一步提升了其廣泛的吸引力。此外,對於追求美味和便利消費的消費者來說,糕點的便攜性和份量控制也是一種便捷的選擇。

就配料而言,傳統配料領域在2024年以298億美元的價值領先市場,佔總佔有率的24.2%。預計在預測期內,該領域的複合年成長率將達到3.3%。傳統配料的主導地位源自於其多功能性、易於採購和消費者熟悉度。這些產品使製造商能夠保持品質和口味的一致性,同時受益於規模經濟。它們在已開發市場和新興市場的廣泛接受度也為他們提供了競爭優勢,使其能夠更深入地滲透市場並精簡分銷策略。

美國是全球市場的主要貢獻者,其糕點和蛋糕產業在2024年的價值達到333億美元。預計2025年至2034年期間的複合年成長率將達到3.3%。美國消費者對烘焙食品的強勁支出,加上零售烘焙店、專賣店和快餐店的蓬勃發展,使得烘焙食品的需求持續保持高位。產品創新、頻繁的季節性活動以及功能性食材的加入,都是美國維持消費者興趣的策略。數位平台和應用程式訂購的便利性進一步增強了烘焙食品的可及性,尤其是在郊區和城市地區。

全球市場的競爭格局由眾多專注於產品開發、品牌建立和擴大消費者覆蓋範圍的領導企業所塑造。競爭日益集中在針對高收入消費者的健康配方上,促使各大品牌紛紛轉向以健康為導向的產品線。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 優質手工產品的需求不斷成長

- 簡便食品消費量增加

- 可支配所得增加和都市化

- 擴大咖啡文化和麵包連鎖店

- 產業陷阱與挑戰

- 健康和飲食問題

- 原物料價格波動

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- Pestel 分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 蛋糕

- 千層蛋糕

- 紙杯蛋糕

- 薄餅

- 起司蛋糕

- 慶祝蛋糕

- 其他

- 糕點

- 丹麥糕點

- 羊角麵包

- 酥皮糕點

- 閃電泡芙

- 派

- 其他

- 甜餡餅

- 水果派

- 奶油餡餅

- 其他

- 甜點棒和布朗尼

- 其他

第6章:市場估計與預測:依成分,2021-2034

- 主要趨勢

- 傳統的

- 有機的

- 不含麩質

- 無糖/減糖

- 素食

- 其他

第7章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 零售麵包店

- 手工麵包店

- 連鎖麵包店

- 超市和大賣場

- 便利商店

- 特色食品店

- 網路零售

- 電商平台

- 直接面對消費者的網站

- 食品服務業

- 咖啡館和餐廳

- 飯店

- 餐飲服務

- 其他

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 住宅

- 商業的

- 咖啡館和連鎖麵包店

- 餐廳和飯店

- 餐飲服務

- 活動管理公司

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AAK AB

- Archer Daniels Midland Company

- Associated British Foods plc

- Bakels Group

- BASF SE

- Cargill, Incorporated

- Corbion NV

- Dawn Food Products, Inc.

- DuPont de Nemours, Inc.

- Flowers Foods, Inc.

- General Mills, Inc.

- Grupo Bimbo, SAB de CV

- Ingredion Incorporated

- Kerry Group plc

- Koninklijke DSM NV

- Lesaffre Group

- Mondel?z International, Inc.

- Puratos Group

- DSM-Firmenich AG

- Tate & Lyle PLC

The Global Pastry and Cakes Market was valued at USD 123.3 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 171.6 billion by 2034. The rising culture of celebration across regions and income brackets continues to play a significant role in driving this market. As consumers increasingly lean toward indulgent food items to commemorate daily moments and special occasions alike, pastries and cakes have become a preferred choice for both emotional and social consumption. The shift in spending priorities, driven by a desire for everyday luxuries, has fueled this trend further. With baked goods being a consistent part of global dietary habits, particularly during events and gatherings, their significance goes beyond simple nourishment and enters the territory of social expression and gifting.

In both established and developing economies, baked goods continue to witness widespread adoption. The convenience factor-combined with evolving lifestyles and increasing urbanization-is leading to consistent changes in how and when people consume sweet snacks. Compact, ready-to-eat baked items are enjoying growing popularity, especially as consumers seek out products that match their fast-paced lives. This shift is also mirrored in the rising performance of food retailers, supermarkets, hypermarkets, and specialty outlets that now feature an expanded array of pastry and cake products. Moreover, commercial sectors such as cafes, hotels, and restaurants are contributing notably to market revenues by offering these items across formats, time slots, and customer segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $123.3 Billion |

| Forecast Value | $171.6 Billion |

| CAGR | 3.4% |

A significant portion of market growth is also tied to the growing global middle class and its exposure to international food influences. As awareness around diverse culinary experiences rises, so does the demand for variety across the pastry and cake category, whether it's in terms of product design, ingredients, or formats. A move toward innovation is visible, with increasing interest in diet-specific variants such as organic, gluten-free, vegan, and low-sugar options. These offerings are gaining favor among health-conscious consumers while still delivering on flavor and satisfaction. The demand is being fueled by both residential customers buying for home consumption and commercial buyers looking to update their menus with healthier yet indulgent choices.

While brick-and-mortar stores continue to dominate in terms of market reach and penetration, the digital landscape is emerging as a key enabler. Online retail channels are becoming increasingly crucial in expanding access to consumers across diverse geographies. With direct-to-consumer delivery models and enhanced e-commerce capabilities, brands are unlocking new demographic opportunities and increasing their customer base beyond traditional urban markets.

The pastry segment alone was valued at USD 45.9 billion in 2024 and is projected to register a CAGR of 2.7% from 2025 to 2034. This segment holds the largest share of the overall market, driven by its universal appeal and adaptability across various consumption scenarios-from quick snacks to celebratory treats. Easy availability through both traditional retail and foodservice outlets contributes to its widespread appeal. Additionally, portability and portion control make pastries a convenient choice for consumers seeking both indulgence and ease of consumption.

In terms of ingredients, the conventional segment led the market with a value of USD 29.8 billion in 2024, accounting for 24.2% of the total share. It is expected to grow at a CAGR of 3.3% over the forecast period. The dominance of conventional ingredients stems from their versatility, ease of procurement, and consumer familiarity. These products enable manufacturers to maintain consistency in quality and taste while benefiting from economies of scale. Their wide acceptance in both advanced and growing markets also provides them with a competitive edge, allowing for deeper market penetration and streamlined distribution strategies.

The United States stood out as a key contributor to the global market, with the pastry and cakes sector valued at USD 33.3 billion in 2024. It is anticipated to expand at a CAGR of 3.3% from 2025 through 2034. The country's strong consumer spending on baked goods, coupled with a robust presence of retail bakeries, specialty stores, and quick-service restaurants, keeps demand levels consistently high. Product innovation, frequent seasonal campaigns, and the inclusion of functional ingredients are strategies being used to maintain consumer interest. The convenience of digital platforms and app-based ordering has further strengthened accessibility, particularly in suburban and urban areas.

The competitive landscape of the global market is shaped by numerous leading players focused on product development, branding, and expanding their consumer reach. Competition is increasingly centered around health-forward formulations aimed at high-income consumers, leading brands to shift their offerings toward wellness-driven product lines.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1.1 Regional

- 2.2.1.2 Product type

- 2.2.1.3 Ingredient

- 2.2.1.4 Distribution channel

- 2.2.1.5 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical success factors

- 2.7 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for premium and artisanal products

- 3.2.1.2 Increasing consumption of convenience foods

- 3.2.1.3 Rising disposable income and urbanization

- 3.2.1.4 Expanding cafe culture and bakery chains

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Health and dietary concerns

- 3.2.2.2 Fluctuating raw material prices

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cakes

- 5.2.1 Layer cakes

- 5.2.2 Cupcakes

- 5.2.3 Sheet cakes

- 5.2.4 Cheesecakes

- 5.2.5 Celebration cakes

- 5.2.6 Others

- 5.3 Pastries

- 5.3.1 Danish pastries

- 5.3.2 Croissants

- 5.3.3 Puff pastries

- 5.3.4 Eclairs

- 5.3.5 Tarts

- 5.3.6 Others

- 5.4 Sweet pies

- 5.4.1 Fruit pies

- 5.4.2 Cream pies

- 5.4.3 Others

- 5.5 Dessert bars and brownies

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Ingredient, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Conventional

- 6.3 Organic

- 6.4 Gluten-free

- 6.5 Sugar-free / reduced sugar

- 6.6 Vegan

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Retail bakeries

- 7.2.1 Artisanal bakeries

- 7.2.2 Chain bakeries

- 7.3 Supermarkets and hypermarkets

- 7.4 Convenience stores

- 7.5 Specialty food stores

- 7.6 Online retail

- 7.6.1 E-commerce platform

- 7.6.2 Direct-to-consumer websites

- 7.7 Food service sector

- 7.7.1 Cafes and restaurants

- 7.7.2 Hotels

- 7.7.3 Catering services

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Cafes and bakery chains

- 8.3.2 Restaurants and hotels

- 8.3.3 Catering services

- 8.3.4 Event management companies

- 8.3.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AAK AB

- 10.2 Archer Daniels Midland Company

- 10.3 Associated British Foods plc

- 10.4 Bakels Group

- 10.5 BASF SE

- 10.6 Cargill, Incorporated

- 10.7 Corbion N.V.

- 10.8 Dawn Food Products, Inc.

- 10.9 DuPont de Nemours, Inc.

- 10.10 Flowers Foods, Inc.

- 10.11 General Mills, Inc.

- 10.12 Grupo Bimbo, S.A.B. de C.V.

- 10.13 Ingredion Incorporated

- 10.14 Kerry Group plc

- 10.15 Koninklijke DSM N.V.

- 10.16 Lesaffre Group

- 10.17 Mondel?z International, Inc.

- 10.18 Puratos Group

- 10.19 DSM-Firmenich AG

- 10.20 Tate & Lyle PLC