|

市場調查報告書

商品編碼

1766230

商業及工業高壓清洗機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial and Industrial Pressure Washers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

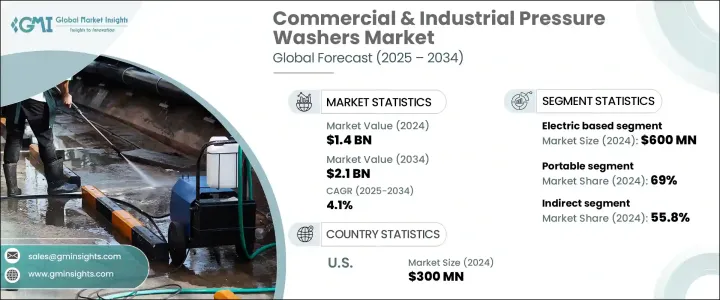

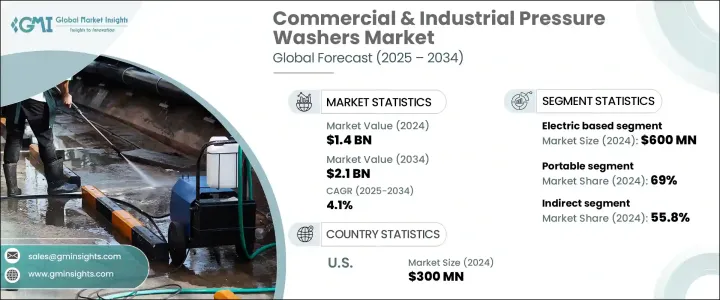

2024年,全球商用和工業高壓清洗機市場規模達14億美元,預計2034年將以4.1%的複合年成長率成長,達到21億美元。汽車和運輸業的需求正在大幅成長,全球車輛數量的不斷增加使得高壓清洗設備至關重要。高壓清洗機正成為維護各類車輛功能和外觀不可或缺的一部分。由於對快速、持續的車輛清潔需求,洗車服務快速成長,這也推動了對先進高壓清洗系統的需求。

如今,快遞服務、物流供應商和公共交通車隊越來越依賴工業級清洗機。機場、港口和火車站等交通設施擴大使用這些機器來維護人流量大的環境衛生。全球衛生危機爆發後,美國疾病管制與預防中心等機構強調了徹底清潔的必要性,進一步推動了工業清洗機的普及。此外,電子商務和分銷網路的持續擴張也導致倉庫和物流中心對高壓清洗機的使用率上升。環保意識的增強和法規的日益嚴格也促使業界從燃油驅動轉向電動和電池驅動。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 21億美元 |

| 複合年成長率 | 4.1% |

2024年,電動高壓清洗機市場產值達6億美元,預計2025年至2034年期間的複合年成長率將達到4.8%。由於日益成長的環境問題、成本效益以及合規標準的不斷改進,向電氣化的轉變正在加速。儘管燃氣和柴油動力機型一度佔據主導地位,但電動馬達型在商業和輕工業應用中越來越受歡迎。這些電動機器因其零直接排放和極低的噪音水平而受到封閉或半封閉區域的青睞。加工單元、室內清潔作業和機構環境等設施優先考慮電動清洗機,因為它們符合嚴格的安全和空氣品質要求。其簡化的設計也減少了維護需求,為長期依賴它們的企業帶來了長期成本節約。

攜帶式高壓清洗機市場在2024年佔據了69%的市場佔有率,預計到2034年將以4.4%的複合年成長率成長。攜帶式高壓清洗機運輸方便、設計緊湊、適應性強,在多個行業都極具吸引力。這些設備配有輪子或把手,移動性強,可提高維修團隊、清潔人員和服務提供者的工作效率。無論是在大型設施內或工作地點之間移動,攜帶式清洗機都能提供高度的便利性。其靈活的特性使其成為物業管理、酒店、零售和設備維護等行業專業人士的理想選擇。

北美商用和工業高壓清洗機市場也正在強勁成長。 2024年,美國市場價值達3億美元,預計2025年至2034年期間的複合年成長率將達到4.8%。該地區的需求主要源於建築、汽車和物流行業的蓬勃發展——這些行業都需要可靠且頻繁的清潔解決方案。醫療保健和食品加工等行業嚴格的衛生法規進一步擴大了這一需求。成熟的設施管理和專業清潔公司的存在增強了市場吸引力。美國尤其受益於其堅實的工業基礎和先進、永續清潔技術的採用。

塑造商業和工業高壓清洗機市場競爭格局的主要參與者包括 Simpson Cleaning、Pressure-Pro、MTM Hydro、Stanley Black & Decker、Honda Power Equipment、Bosch、Nilfisk、Ryobi、Generac Power Systems、Karcher、Sun Joe、Be Pressure、Hotsy、Craftsman 和 Trootsy-Bilt。商業和工業高壓清洗機行業的公司正在部署一系列策略以鞏固其市場地位。一個主要重點是創新——各大品牌正加大對環保節能高壓清洗機型號開發的投資,以符合監管趨勢和消費者期望。許多品牌正在擴展其產品線,包括電池供電和電動裝置,以降低營運成本和排放。與分銷網路和電子商務平台建立策略合作夥伴關係正在幫助企業接觸更廣泛的客戶群。此外,各大品牌正專注於加強售後服務和客戶支持,以提高客戶忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 設施維護需求不斷成長

- 汽車和運輸業的擴張

- 建築業和製造業活動不斷增加

- 政府對清潔的嚴格規定

- 產業陷阱與挑戰

- 初始和維護成本高

- 水和電消耗問題

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計數據

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 電動型

- 天然氣基

- 燃料型

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 便攜的

- 非攜帶式

第7章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 水泵浦

- 電動馬達/燃氣引擎

- 高壓軟管

- 噴嘴

第8章:市場估計與預測:按水務營運,2021 - 2034 年

- 主要趨勢

- 熱水

- 冷水

第9章:市場估計與預測:按 PSI 壓力,2021 - 2034 年

- 主要趨勢 0- 1500 PSI

- 1501-3000 磅/平方英寸

- 3001-4000 磅/平方英寸

- 高於4000 PSI

第10章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 商業的

- 工業的

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第13章:公司簡介

- Be Pressure

- Bosch

- Craftsman

- Generac Power Systems

- Hotsy

- Honda Power Equipment

- Karcher

- MTM Hydro

- Nilfisk

- Pressure-Pro

- Ryobi

- Simpson Cleaning

- Stanley Black & Decker

- Sun Joe

- Troy-Bilt

The Global Commercial and Industrial Pressure Washers Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 2.1 billion by 2034. A significant surge in demand is being seen across the automotive and transportation sectors, where the increasing number of vehicles worldwide has made high-pressure cleaning equipment essential. Pressure washers are becoming an integral part of maintaining the functionality and appearance of various types of vehicles. The fast-paced growth of car wash services, driven by the need for fast and consistent vehicle cleaning, is boosting the demand for advanced pressure washing systems.

Delivery services, logistics providers, and public transport fleets are now depending more on industrial-grade washers. Transportation facilities-such as airports, ports, and train stations-are increasingly utilizing these machines for maintaining hygiene in high-traffic environments. Following the global health crisis, organizations like the Centers for Disease Control and Prevention highlighted the need for thorough cleaning, further driving adoption. Additionally, the continued expansion of e-commerce and distribution networks has led to heightened usage of pressure washers in warehouses and logistics hubs. Increased environmental awareness and stricter regulations are also encouraging a shift from fuel-powered to electric and battery-powered alternatives within the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 4.1% |

In 2024, the electric-powered pressure washers segment generated USD 600 million in 2024 and is expected to grow at a CAGR of 4.8% between 2025 and 2034. The shift toward electrification is accelerating due to growing environmental concerns, cost efficiency, and evolving compliance standards. Although gas and diesel-powered models once dominated the landscape, electric variants are gaining preference for commercial and lighter industrial applications. These electric machines are favored for use in enclosed or semi-enclosed areas due to their zero direct emissions and minimal noise levels. Facilities such as processing units, indoor cleaning operations, and institutional environments are prioritizing electric washers as they meet rigorous safety and air quality requirements. Their simplified design also reduces maintenance needs, translating into long-term savings for businesses that rely on them consistently.

Portable pressure washers segment held 69% share in 2024 and is expected to grow at a CAGR of 4.4% through 2034. Their ease of transport, compact design, and adaptability make them highly appealing across multiple sectors. Equipped with wheels or handles, these units offer mobility that enhances productivity for maintenance teams, cleaning crews, and service providers. Whether moving across large facilities or between job sites, portable washers offer a high level of convenience. Their flexible nature makes them an ideal fit for professionals operating in industries like property management, hospitality, retail, and equipment maintenance.

North America Commercial and Industrial Pressure Washers Market is also witnessing robust growth. The United States was valued at USD 300 million in 2024 and is expected to grow at a CAGR of 4.8% between 2025 and 2034. Demand across the region is driven by increasing activity in the construction, automotive, and logistics sectors-all of which require reliable and frequent cleaning solutions. Strict hygiene regulations within sectors like healthcare and food processing further amplify this demand. The presence of established facilities management and professional cleaning firms enhances market traction. The US, in particular, benefits from a solid industrial base and the adoption of advanced, sustainable cleaning technologies.

Leading players shaping the competitive landscape of the Commercial and Industrial Pressure Washers Market include Simpson Cleaning, Pressure-Pro, MTM Hydro, Stanley Black & Decker, Honda Power Equipment, Bosch, Nilfisk, Ryobi, Generac Power Systems, Karcher, Sun Joe, Be Pressure, Hotsy, Craftsman, and Troy-Bilt. Companies operating in the commercial and industrial pressure washer industry are deploying a range of strategies to solidify their market positions. One major focus is innovation-brands are increasingly investing in the development of eco-friendly and energy-efficient pressure washer models to align with regulatory trends and consumer expectations. Many are expanding their product lines to include battery-powered and electric units that reduce operational costs and emissions. Strategic partnerships with distribution networks and e-commerce platforms are helping businesses reach a broader customer base. In addition, brands are concentrating on enhancing after-sales services and customer support to improve loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Type

- 2.2.4 Component

- 2.2.5 Water operation

- 2.2.6 PSI pressure

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for facility maintenance

- 3.2.1.2 Expansion of the automotive and transportation sectors

- 3.2.1.3 Rising construction & manufacturing activities

- 3.2.1.4 Stringent government regulations on cleanliness

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial and maintenance cost

- 3.2.2.2 Water and power consumption issues

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Electric-based

- 5.3 Gas-based

- 5.4 Fuel-based

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Non-portable

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Water pump

- 7.3 Electric motor/gas engine

- 7.4 High-pressure hose

- 7.5 Nozzle

Chapter 8 Market Estimates & Forecast, By Water Operation, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Cold water

Chapter 9 Market Estimates & Forecast, By PSI Pressure, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends 0- 1500 PSI

- 9.2 1501-3000 PSI

- 9.3 3001-4000 PSI

- 9.4 ABOVE 4000 PSI

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Commercial

- 10.3 Industrial

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Be Pressure

- 13.2 Bosch

- 13.3 Craftsman

- 13.4 Generac Power Systems

- 13.5 Hotsy

- 13.6 Honda Power Equipment

- 13.7 Karcher

- 13.8 MTM Hydro

- 13.9 Nilfisk

- 13.10 Pressure-Pro

- 13.11 Ryobi

- 13.12 Simpson Cleaning

- 13.13 Stanley Black & Decker

- 13.14 Sun Joe

- 13.15 Troy-Bilt