|

市場調查報告書

商品編碼

1766216

汽車觸覺回饋系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Haptic Feedback System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

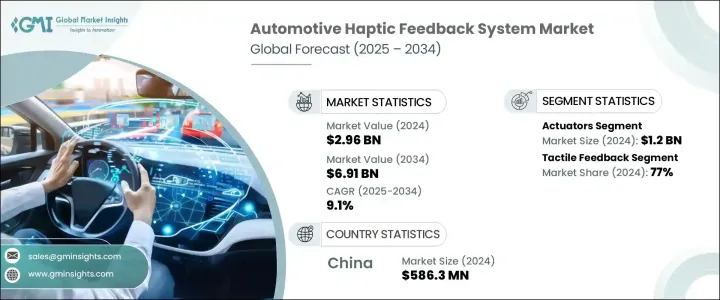

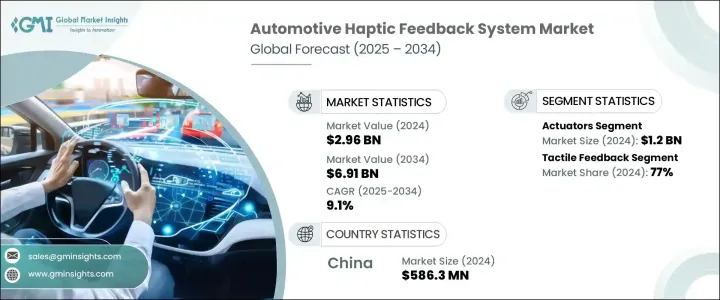

2024 年全球汽車觸覺回饋系統市值為 29.6 億美元,預計到 2034 年將以 9.1% 的複合年成長率成長,達到 69.1 億美元。數位化趨勢和高級駕駛輔助系統 (ADAS) 的興起,擴大了觸覺在各種汽車應用中的使用。製造商正在將複雜的觸覺回饋整合到方向盤、觸控螢幕和中控台中,以增強用戶體驗。對電動車和自動駕駛汽車日益成長的需求進一步加速了這種應用,因為這些汽車嚴重依賴先進的人機介面。消費者現在期望個人化、反應迅速的功能,促使汽車製造商投資於尖端的觸覺解決方案。北美和歐洲引領這項技術的採用,而亞太地區預計將在汽車產量成長和技術嫻熟的消費者的推動下實現最快成長。

政府法規和安全標準也強調減少駕駛分心並提高道路安全,從而推動了市場成長。觸覺回饋系統會在緊急情況下(例如車道偏離或碰撞警告)提醒駕駛者,使他們能夠專注於路況,而不會分散視線。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 29.6億美元 |

| 預測值 | 69.1億美元 |

| 複合年成長率 | 9.1% |

執行器細分市場在2024年以12億美元的營收領先市場。執行器在方向盤、資訊娛樂顯示器和觸控螢幕中提供即時觸覺響應、產生振動和觸感方面發揮著至關重要的作用。隨著高階駕駛輔助系統和觸控介面日益普及,對高性能執行器的需求也日益成長。這些組件能夠提供快速、精準的回饋,透過在虛擬控制上複製實體按鈕的觸感,從而提升駕駛安全性和舒適性。隨著連網汽車和自動駕駛汽車的興起,對可靠且即時的觸覺回饋的需求日益成長,這進一步鞏固了執行器的市場主導地位。

2024年,觸覺回饋細分市場佔了77%的市佔率。該技術利用細微的振動或脈衝來模擬資訊娛樂單元、觸控螢幕和空調控制面板等表面的觸感。基於觸控的人機介面 (HMI) 透過提供直覺易用的控件,幫助駕駛者保持專注並減少分心。與模擬阻力且主要用於轉向系統的力回饋相比,觸覺回饋更具成本效益且更易於實現。電容式觸控技術體積小巧、效率高且可靠性高,使其成為汽車製造商在虛擬按鈕、換檔桿和座椅調整方面的熱門選擇。高階汽車對響應迅速且直覺的用戶介面的需求日益成長,極大地推動了觸覺反饋市場佔有率的成長。

亞太地區汽車觸覺回饋系統市場佔54%的佔有率。中國以2024年5.863億美元的估值領先該地區市場。中國的優勢源於其強大的製造業基礎、快速的汽車產量成長以及ADAS和資訊娛樂技術的廣泛應用。中國、日本和韓國強勁的汽車產業為觸覺系統在下一代汽車中的整合做出了貢獻。中國在汽車創新領域的領導地位得益於政府的舉措、大量的研發投入以及消費者對連網汽車和電動車日益成長的需求。隨著中國朝向智慧移動和自動駕駛方向發展,觸覺回饋系統的應用正在加速推進。

活躍於汽車觸覺回饋系統市場的主要參與者包括博世、德州儀器、ALPS Alpine、電裝、大陸集團、松下汽車、Immersion、TDK、Aptiv 和 ZF Friedrichshafen。汽車觸覺回饋系統市場中的公司專注於創新以維持和擴大其市場佔有率。他們在研發方面投入巨資,以開發更先進、更快回應、更節能的執行器和觸覺回饋技術。與汽車製造商和科技公司的策略合作夥伴關係和合作有助於加速產品開發和與新車型的整合。透過合資企業擴大地理覆蓋範圍並建立本地製造中心,公司可以進入快速成長的地區,尤其是亞太地區。參與者強調創建可自訂、可擴展的解決方案,以滿足電動和自動駕駛汽車的多樣化需求。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對先進資訊娛樂和 HMI 系統的需求不斷成長

- 注重駕駛員安全並減少干擾

- 消費者對高階功能的偏好日益增加

- 觸覺技術的技術進步

- 產業陷阱與挑戰

- 整合成本高

- 系統設計和整合的複雜性

- 市場機會

- 轉向基於觸控的介面和簡約的內飾

- 擴展安全和駕駛輔助應用

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利分析

- 價格趨勢

- 按地區

- 按組件

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 執行器

- 控制器

- 軟體

- 感應器

第6章:市場估計與預測:按回饋,2021 - 2034 年

- 主要趨勢

- 觸覺回饋

- 力回饋

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車

- 中型商用車

- 重型商用車

- 電動車(EV)

第8章:市場估計與預測:按銷售管道,2021 - 2034 年

- 主要趨勢

- 原始設備製造商

- 售後市場

第9章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 機械觸覺

- 超音波觸覺

- 電磁觸覺

- 電活性聚合物(EAP)

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- ALPS Alpine

- Analog Devices

- Aptiv

- Bosch

- Continental

- Denso

- Immersion

- Johnson Electric

- Methode Electronics

- Microchip Technology

- Neonode

- Nidec

- Panasonic Automotive

- Precision Microdrives

- Stanley Electric

- Synaptics

- TDK

- Texas Instruments

- Valeo

- ZF Friedrichshafen

The Global Automotive Haptic Feedback System Market was valued at USD 2.96 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 6.91 billion by 2034. The rise of digital trends and advanced driver-assistance systems (ADAS) has expanded the use of haptics across various automotive applications. Manufacturers are integrating sophisticated haptic feedback into steering wheels, touchscreens, and center consoles to enhance user experience. The growing demand for electric and autonomous vehicles further accelerates this adoption, as these cars rely heavily on advanced human-machine interfaces. Consumers now expect personalized, responsive features, prompting automakers to invest in cutting-edge haptic solutions. North America and Europe lead the adoption of this technology, while the Asia-Pacific region is poised to grow the fastest, driven by increasing vehicle production and tech-savvy consumers.

Government regulations and safety standards also fuel market growth by emphasizing reduced driver distraction and improved road safety. Haptic feedback systems alert drivers during critical situations, such as lane departures or collision warnings, allowing them to stay focused on the road without diverting their gaze.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.96 Billion |

| Forecast Value | $6.91 Billion |

| CAGR | 9.1% |

The actuators segment led the market with revenues of USD 1.2 billion in 2024. Actuators play a crucial role in delivering real-time tactile responses, generating vibrations, and touch sensations in steering wheels, infotainment displays, and touchscreens. As advanced driver-assistance systems and touch interfaces become more prevalent, demand for high-performance actuators grows. These components provide fast, precise feedback that enhances driving safety and comfort by replicating the feel of physical buttons on virtual controls. With the rise of connected and autonomous vehicles, the need for reliable and instantaneous haptic feedback is increasing, solidifying actuators' dominant market position.

The tactile feedback segment accounted for a 77% share in 2024. This technology uses subtle vibrations or pulses to mimic touch sensations on surfaces like infotainment units, touchscreens, and climate control panels. Touch-based human-machine interfaces (HMIs) help drivers stay attentive and reduce distraction by offering intuitive and easy-to-use controls. Compared to force feedback, which simulates resistance and is mostly used in steering systems, tactile feedback is more cost-effective and simpler to implement. Its compact size, efficiency, and reliability make capacitive touch technology a popular choice among automakers for virtual buttons, gear selectors, and seat adjustments. The increasing demand for responsive and intuitive user interfaces in premium vehicles has significantly driven the market share of haptic feedback.

Asia-Pacific Automotive Haptic Feedback System Market held a 54% share. China leads this regional market with a valuation of USD 586.3 million in 2024. China's prominence stems from a robust manufacturing base, rapid vehicle production growth, and widespread adoption of ADAS and infotainment technologies. The strong automotive sectors in China, Japan, and South Korea contribute to the integration of haptic systems in next-generation vehicles. China's leadership in automotive innovation is supported by government initiatives, substantial R&D investments, and rising consumer demand for connected and electric vehicles. As the country pushes towards intelligent mobility and autonomous driving, haptic feedback systems are being adopted at an accelerated pace.

Key players active in the Automotive Haptic Feedback System Market include Bosch, Texas Instruments, ALPS Alpine, Denso, Continental, Panasonic Automotive, Immersion, TDK, Aptiv, and ZF Friedrichshafen. Companies in the automotive haptic feedback system market focus on innovation to maintain and grow their market share. They invest heavily in R&D to develop more advanced, responsive, and energy-efficient actuators and tactile feedback technologies. Strategic partnerships and collaborations with automakers and technology firms help accelerate product development and integration into new vehicle models. Expanding geographic reach through joint ventures and establishing local manufacturing hubs allows companies to tap into fast-growing regions, particularly in Asia-Pacific. Players emphasize creating customizable, scalable solutions to cater to the diverse needs of electric and autonomous vehicles.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for advanced infotainment and HMI systems

- 3.2.1.2 Focus on driver safety and reduction of distractions

- 3.2.1.3 Increasing consumer preference for premium features

- 3.2.1.4 Technological advancements in haptic technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of integration

- 3.2.2.2 Complexity in system design and integration

- 3.2.3 Market opportunities

- 3.2.3.1 Shift toward touch-based interfaces and minimalist interiors

- 3.2.3.2 Expansion of safety and driver assistance applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Actuators

- 5.3 Controllers

- 5.4 Software

- 5.5 Sensors

Chapter 6 Market Estimates & Forecast, By Feedback, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Tactile feedback

- 6.3 Force feedback

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles

- 7.3.2 Medium commercial vehicles

- 7.3.3 Heavy commercial vehicles

- 7.4 Electric vehicles (EVs)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Mechanical haptics

- 9.3 Ultrasonic haptics

- 9.4 Electromagnetic haptics

- 9.5 Electroactive polymers (EAP)

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 ALPS Alpine

- 11.2 Analog Devices

- 11.3 Aptiv

- 11.4 Bosch

- 11.5 Continental

- 11.6 Denso

- 11.7 Immersion

- 11.8 Johnson Electric

- 11.9 Methode Electronics

- 11.10 Microchip Technology

- 11.11 Neonode

- 11.12 Nidec

- 11.13 Panasonic Automotive

- 11.14 Precision Microdrives

- 11.15 Stanley Electric

- 11.16 Synaptics

- 11.17 TDK

- 11.18 Texas Instruments

- 11.19 Valeo

- 11.20 ZF Friedrichshafen