|

市場調查報告書

商品編碼

1766211

超高溫陶瓷(UHTC)市場機會、成長動力、產業趨勢分析及2025-2034年預測Ultra-High Temperature Ceramics (UHTCs) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

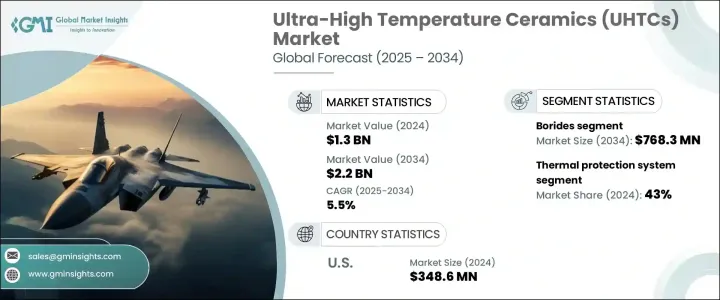

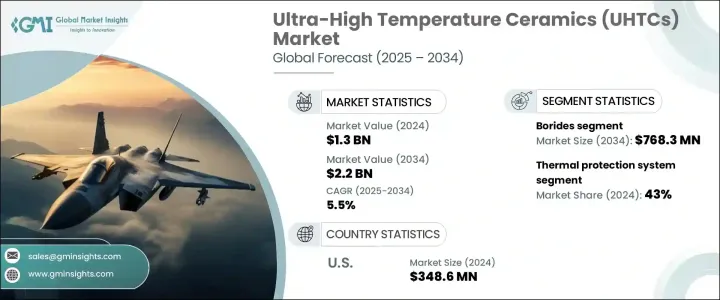

2024 年全球超高溫陶瓷市場價值為 13 億美元,預計到 2034 年將以 5.5% 的複合年成長率成長,達到 22 億美元。該領域的成長主要得益於國防、航太、汽車和能源領域的技術進步,這些領域越來越需要能夠在極端熱和機械條件下工作的材料。 UHTC 的設計可承受超過 3000°C 的溫度,這使其成為傳統材料失效環境中的必需品。這些陶瓷目前在提高能源效率和實現高溫系統的永續發展目標方面發揮關鍵作用。它們在先進推進系統、高速飛行系統和下一代熱防護應用中的應用正在不斷擴展。

隨著各行各業轉向注重性能和減排的創新,對超高溫熱塑材料 (UHTC) 的需求持續攀升。在不斷突破技術界限、要求卓越耐久性的高性能領域,超高溫熱塑材料的重要性日益凸顯。此外,全球軍事戰略的不斷發展以及對太空探索的日益關注,也加速了對耐熱材料的需求。隨著各工業領域(尤其是在美國)投資的不斷增加,超高溫熱塑材料在需要抗氧化、抗熱衝擊和抗機械應力的應用中變得不可或缺。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 22億美元 |

| 複合年成長率 | 5.5% |

硼化物細分市場在2024年的營收為4.561億美元,預計到2034年將成長至7.683億美元。該類別憑藉其卓越的導熱性、卓越的抗氧化性和超高的熔點,依然佔據主導地位,是性能要求極高的應用的理想之選。在超高溫熱電材料(UHTC)中,硼化物因其能夠承受的機械負荷和高溫遠超標準陶瓷,在極端環境下尤其重要。這些特性使其成為推進系統和隔熱層(可靠性至關重要)的首選材料。

熱防護系統領域佔43%的佔有率,仍是領先的應用領域。對能夠在極端惡劣環境下(例如高超音速飛行或太空任務)保持結構和熱完整性的材料的需求日益成長,這推動了該領域對超高溫熱材料(UHTC)的需求。它們能夠在持續的氣動應力、強烈的摩擦熱和快速的大氣轉變下保持性能,使其成為需要絕對熱控制的系統不可或缺的材料。隨著太空和國防技術創新的加速,對高耐熱性和機械彈性材料的需求也激增。

2024年,美國超高溫陶瓷 (UHTC) 市場規模達3.486億美元。強勁成長源自於對先進國防系統、太空技術和能源應用的大量投資,這些領域高度依賴耐高溫材料。美國積極推進軍事能力和太空計畫的現代化,加劇了對超耐高溫材料的依賴。鑑於對下一代推進系統和國防戰略的日益關注,美國超高溫陶瓷市場預計將保持穩定成長動能。

為全球超高溫陶瓷 (UTHC) 市場做出貢獻的關鍵公司包括勞斯萊斯、精密陶瓷、洛克希德馬丁公司、聖戈班和先進陶瓷製造公司。這些行業領導者正透過有針對性的研發投資來鞏固其市場地位,旨在開發具有更高斷裂韌性和更長使用壽命等增強性能的超高溫陶瓷 (UTHC)。與航太和國防組織的策略合作,使其能夠進行定製材料開發並將其整合到關鍵系統中。為了滿足日益成長的需求,各公司也在擴大產能並追求先進的製造技術。透過實現應用多元化並確保嚴格的品質控制,這些公司正在為在這一不斷發展的領域保持長期領先地位做好準備。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計資料(HS 編碼)(註:僅提供主要國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場規模及預測:依材料類型,2021-2034

- 主要趨勢

- 硼化物

- 二硼化鋯(ZrB?)

- 二硼化鉿(HfB?)

- 二硼化鉭(TaB?)

- 二硼化鈦(TiB?)

- 其他硼化物

- 碳化物

- 碳化鋯(ZrC)

- 碳化鉿(HfC)

- 碳化鉭(TaC)

- 碳化鈦(TiC)

- 碳化矽(SiC)

- 其他碳化物

- 氮化物

- 氮化鉿(HfN)

- 氮化鋯(ZrN)

- 氮化鉭(TaN)

- 氮化矽(Si?N?)

- 其他氮化物

- 複合系統

- 硼化物基複合材料

- 碳化物基複合材料

- 氮化物基複合材料

- 其他複合系統

- 其他材料類型

第6章:市場規模及預測:依產品形式,2021-2034

- 主要趨勢

- 粉末

- 散裝組件

- 單體組件

- 複合組件

- 塗料

- 熱障塗層

- 抗氧化塗層

- 耐腐蝕塗層

- 其他塗層類型

- 纖維和晶須

- 其他產品形式

第7章:市場規模及預測:依製造方法,2021-2034

- 主要趨勢

- 熱壓

- 放電等離子燒結(SPS)

- 反應熱壓

- 無壓燒結

- 化學氣相沉積(CVD)

- 積層製造

- 其他製造方法

第 8 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 熱保護系統

- 高超音速飛行器前緣

- 再入飛行器隔熱板

- 火箭噴嘴喉口

- 燃燒室襯套

- 其他熱保護應用

- 推進系統

- 火箭引擎部件

- 燃氣渦輪機部件

- 超燃沖壓引擎組件

- 其他推進應用

- 高溫感測器和儀器

- 切削刀具及耐磨部件

- 爐元件和坩堝

- 核應用

- 其他應用

第9章:市場規模及預測:依最終用途產業,2021-2034

- 主要趨勢

- 航太與國防

- 軍事航太

- 民用航太

- 太空探索

- 飛彈系統

- 其他航太和國防應用

- 工業的

- 金屬加工

- 玻璃製造

- 化學加工

- 其他工業應用

- 能源

- 核能

- 化石燃料發電

- 其他能源應用

- 電子和半導體

- 研究與學術

- 其他最終用途產業

第 10 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- Lockheed Martin Corporation

- Rolls-Royce

- Ultramet

- BAE Systems

- 3M Company

- CoorsTek

- Morgan Advanced Materials

- Kennametal

- Aremco Products

- Advanced Ceramics Manufacturing

- Precision Ceramics USA

- Kyocera Corporation

- Saint-Gobain

The Global Ultra-High Temperature Ceramics Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 2.2 billion by 2034. Growth in this sector is largely driven by technological advancements in defense, aerospace, automotive, and energy, which increasingly require materials capable of operating under extreme thermal and mechanical conditions. UHTCs are engineered to withstand temperatures exceeding 3000°C, making them essential in environments where conventional materials fail. These ceramics are now playing a pivotal role in enhancing energy efficiency and meeting sustainability goals in high-heat systems. Their use is expanding in advanced propulsion, high-speed flight systems, and next-gen thermal protection applications.

As industries shift towards performance-focused and emission-reducing innovations, demand for UHTCs continues to climb. Their importance is magnified in high-performance sectors pushing technological boundaries and requiring unmatched durability. In addition, evolving global military strategies and a greater focus on space exploration are accelerating the need for thermally resilient materials. With escalating investments across industrial verticals, particularly in the US, UHTCs are becoming indispensable in applications that demand resistance to oxidation, thermal shock, and mechanical stress.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 5.5% |

The Borides segment generated USD 456.1 million in 2024 and is expected to grow to USD 768.3 million by 2034. This category remains dominant due to its superior thermal conductivity, exceptional oxidation resistance, and ultra-high melting points, making it ideal for applications that demand the highest levels of performance. Among UHTCs, borides are specifically valued in extreme environments due to their capacity to endure mechanical loads and temperatures well beyond what standard ceramics can tolerate. These attributes make them the preferred material class in propulsion systems and thermal barriers where reliability is critical.

The thermal protection systems segment accounted for 43% share, remaining the leading application segment. The increasing need for materials that can maintain structural and thermal integrity in extremely harsh environments, such as during hypersonic travel or space-bound missions, is fueling demand for UHTCs in this segment. Their ability to perform under sustained aerodynamic stress, intense frictional heat, and rapid atmospheric transitions makes them indispensable for systems requiring absolute thermal control. As innovation accelerates in space and defense technologies, demand for materials with high heat tolerance and mechanical resilience is surging.

United States Ultra-High Temperature Ceramics (UHTCs) Market generated USD 348.6 million in 2024. This strong presence is driven by significant investments in advanced defense systems, space technology, and energy applications that rely heavily on materials capable of performing at elevated temperatures. The country's aggressive push to modernize military capabilities and space initiatives is increasing reliance on ultra-durable materials. Given the rising focus on next-generation propulsion and national defense strategies, the market for UHTCs in the US is expected to maintain steady momentum.

Key companies contributing to the Global Ultra-High Temperature Ceramics (UTHCs) Market include Rolls-Royce, Precision Ceramics, Lockheed Martin Corporation, Saint-Gobain, and Advanced Ceramics Manufacturing. These industry leaders are strengthening their market positions through targeted investments in R&D, aiming to develop UHTCs with enhanced properties such as higher fracture toughness and longer service life. Strategic collaborations with aerospace and defense organizations allow for customized material development and integration into critical systems. Firms are also scaling production capacities and pursuing advanced manufacturing techniques to meet growing demand. By diversifying applications and ensuring stringent quality control, these companies are positioning themselves for long-term leadership in this evolving field.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Product form

- 2.2.4 Manufacturing method

- 2.2.5 Application

- 2.2.6 End use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Size and Forecast, By Material Type, 2021-2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Borides

- 5.2.1 Zirconium diboride (ZrB?)

- 5.2.2 Hafnium diboride (HfB?)

- 5.2.3 Tantalum diboride (TaB?)

- 5.2.4 Titanium diboride (TiB?)

- 5.2.5 Other borides

- 5.3 Carbides

- 5.3.1 Zirconium carbide (ZrC)

- 5.3.2 Hafnium carbide (HfC)

- 5.3.3 Tantalum carbide (TaC)

- 5.3.4 Titanium carbide (TiC)

- 5.3.5 Silicon carbide (SiC)

- 5.3.6 Other carbides

- 5.4 Nitrides

- 5.4.1 Hafnium nitride (HfN)

- 5.4.2 Zirconium nitride (ZrN)

- 5.4.3 Tantalum nitride (TaN)

- 5.4.4 Silicon nitride (Si?N?)

- 5.4.5 Other nitrides

- 5.5 Composite systems

- 5.5.1 Boride-based composites

- 5.5.2 Carbide-based composites

- 5.5.3 Nitride-based composites

- 5.5.4 Other composite systems

- 5.6 Other material types

Chapter 6 Market Size and Forecast, By Product Form, 2021-2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Powders

- 6.3 Bulk components

- 6.3.1 Monolithic components

- 6.3.2 Composite components

- 6.4 Coatings

- 6.4.1 Thermal barrier coatings

- 6.4.2 Oxidation-resistant coatings

- 6.4.3 Erosion-resistant coatings

- 6.4.4 Other coating types

- 6.5 Fibers & whiskers

- 6.6 Other product forms

Chapter 7 Market Size and Forecast, By Manufacturing Method, 2021-2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Hot pressing

- 7.3 Spark plasma sintering (SPS)

- 7.4 Reactive hot pressing

- 7.5 Pressureless sintering

- 7.6 Chemical vapor deposition (CVD)

- 7.7 Additive manufacturing

- 7.8 Other manufacturing methods

Chapter 8 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Thermal protection systems

- 8.2.1 Hypersonic vehicle leading edges

- 8.2.2 Reentry vehicle heat shields

- 8.2.3 Rocket nozzle throats

- 8.2.4 Combustion chamber liners

- 8.2.5 Other thermal protection applications

- 8.3 Propulsion systems

- 8.3.1 Rocket engine components

- 8.3.2 Gas turbine components

- 8.3.3 Scramjet components

- 8.3.4 Other propulsion applications

- 8.4 High-temperature sensors & instrumentation

- 8.5 Cutting tools & wear-resistant components

- 8.6 Furnace elements & crucibles

- 8.7 Nuclear applications

- 8.8 Other applications

Chapter 9 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 Aerospace & defense

- 9.2.1 Military aerospace

- 9.2.2 Civil aerospace

- 9.2.3 Space exploration

- 9.2.4 Missile systems

- 9.2.5 Other aerospace & defense applications

- 9.3 Industrial

- 9.3.1 Metal processing

- 9.3.2 Glass manufacturing

- 9.3.3 Chemical processing

- 9.3.4 Other industrial applications

- 9.4 Energy

- 9.4.1 Nuclear energy

- 9.4.2 Fossil fuel power generation

- 9.4.3 Other energy applications

- 9.5 Electronics & semiconductor

- 9.6 Research & academia

- 9.7 Other end use industries

Chapter 10 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Lockheed Martin Corporation

- 11.2 Rolls-Royce

- 11.3 Ultramet

- 11.4 BAE Systems

- 11.5 3M Company

- 11.6 CoorsTek

- 11.7 Morgan Advanced Materials

- 11.8 Kennametal

- 11.9 Aremco Products

- 11.10 Advanced Ceramics Manufacturing

- 11.11 Precision Ceramics USA

- 11.12 Kyocera Corporation

- 11.13 Saint-Gobain