|

市場調查報告書

商品編碼

1766207

高脂(>85%)奶油市場機會、成長動力、產業趨勢分析及2025-2034年預測High Fat (>85%) Butter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

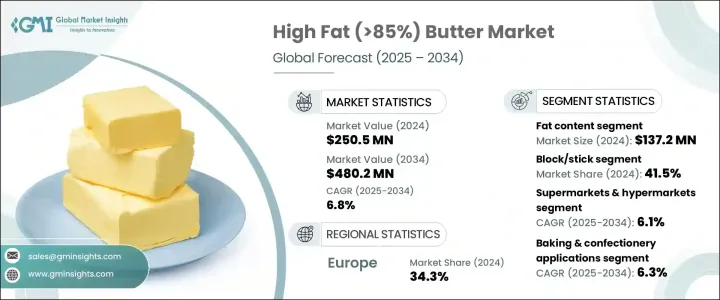

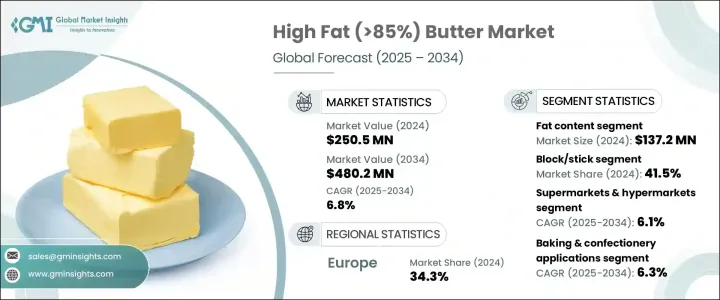

2024年,全球高脂(>85%)奶油市場規模達2.505億美元,預計到2034年將以6.8%的複合年成長率成長,達到4.802億美元。這項穩定成長的動力源自於消費者對更濃郁、更天然、更手工的乳製品日益成長的偏好。高脂奶油曾經一度僅限於美食烘焙和高級餐飲等小眾領域,如今隨著低碳水化合物和生酮飲食等潮流的興起,在注重健康的消費者群體中也逐漸受到青睞。此外,一個新興的高階細分市場也正在興起,專注於採用傳統攪拌方式生產的清潔標籤、有機認證和原產地認證奶油。

儘管供應和價格波動,但人們對美味乳製品的需求仍然強勁。產品創新、人們對脂肪功能益處的認知不斷提高,以及全球人口日益成長對品質和真實性的高標準,都推動了市場的擴張。此外,零售策略的不斷演變、新興市場准入的不斷擴大以及特色食品店和電商平台的興起,都支持著市場的持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.505億美元 |

| 預測值 | 4.802億美元 |

| 複合年成長率 | 6.8% |

烘焙和糖果市場預計將以更快的速度成長,複合年成長率為 6.3%。在高脂(>85%)奶油市場中,由於對優質糕點、餅乾和巧克力的卓越質地、濃郁風味和穩定品質的需求日益成長,烘焙和糖果佔據了主導地位。烹飪用途也在不斷成長,越來越多的廚師選擇高脂奶油用於煎炒、製作醬汁和提升風味。追求濃郁順滑塗抹醬和食材的消費者進一步推動了這項需求,而生酮飲食和高脂飲食等營養趨勢也正在擴大奶油在飲食應用中的作用。

到2024年,塊狀和條狀食品的市場佔有率將達到41.5%,預計複合年成長率將達到6.4%,從而吸引更廣泛的消費者群體。這些食品形式將繼續佔據主導地位,尤其是在西部地區,因為它們在烹飪和烘焙過程中方便、熟悉且易於計量。注重健康的城市消費者尤其青睞這些柔軟易塗抹的食品形式,因為它們可以直接塗抹在麵包和餅乾上,既方便又不影響口感。

2024年,歐洲高脂(>85%)奶油市場佔34.3%的佔有率。這一主導地位源自於該地區根深蒂固的烹飪傳統,而奶油在傳統食譜和美食烹飪中扮演著至關重要的角色。歐洲消費者對高品質乳製品有著成熟的鑑賞力,注重產品的真實性、濃郁的風味和手工生產流程。此外,消費者對優質和清潔標籤產品的廣泛認知,也推動了零售和餐飲服務業對高脂奶油的穩定需求。成熟的乳製品生產商和強大的分銷網路進一步鞏固了歐洲作為該市場關鍵參與者的地位,確保了其能夠持續供應滿足消費者挑剔口味的特色奶油產品。

推動高脂(>85%)奶油市場創新和分銷的關鍵參與者包括Ornua合作社有限公司(Kerrygold)、Arla Foods amba(Lurpak)、Lactalis集團(President)、恆天然合作社集團(Anchor)和古吉拉特邦合作牛奶行銷聯合會有限公司(Amul)。達能公司、雀巢公司、JM Smucker公司(Eagle Brand)、Arla Foods和Friesland Campina NV在煉乳和淡奶領域發揮重要作用。

為了鞏固市場地位,高脂奶油行業的公司正優先考慮產品創新,專注於清潔標籤和有機認證,以滿足消費者日益成長的透明度和品質需求。他們不斷擴展風味組合,推出添加了香草、香料和益生菌的奶油,以佔領利基烹飪和健康細分市場。行銷工作強調產品的真實性和手工性,以吸引尋求優質天然乳製品的消費者。與專業零售商和線上平台建立策略夥伴關係,提升了產品的可近性和消費者覆蓋率。此外,對永續採購和生產實踐的投資正在提升品牌聲譽,同時也符合環保理念。這些綜合策略使公司能夠建立忠誠度,並進入不斷擴張的全球市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 按脂肪含量

- 脂肪含量85-90%

- 脂肪含量90-95%

- 脂肪含量 95%+(無水乳脂/奶油)

- 按風味特徵

- 鹹味

- 無鹽

- 培養/發酵

- 調味和注入

第6章:市場估計與預測:依形式,2021 - 2034 年

- 主要趨勢

- 阻擋/黏住

- 可塗抹

- 澄清/酥油

- 其他

第7章:市場估計與預測:按來源,2021 - 2034 年

- 主要趨勢

- 傳統的

- 有機的

- 草飼

- 特種動物來源

- 水牛

- 山羊

- 羊

- 其他

第8章:市場估計與預測:按包裝類型,2021 - 2034 年

- 主要趨勢

- 積木/木棍

- 桶子和容器

- 散裝包裝

- 特色及禮品包裝

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 超市和大賣場

- 特色商店和美食商店

- 網路零售

- 電子商務平台

- 直接面對消費者的網站

- 訂閱服務

- 餐飲業

- 其他

第 10 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 烹飪應用

- 烹飪與煎炒

- 醬汁和乳劑

- 其他烹飪用途

- 烘焙和糖果

- 糕點和疊層麵團

- 蛋糕和餅乾

- 糖果產品

- 塗抹醬和配料

- 麵包和吐司

- 餅乾和鹹味食品

- 其他傳播應用

- 飲食和營養應用

- 生酮飲食

- 防彈咖啡和飲料

- 其他飲食用途

- 工業應用

- 食品製造

- 化妝品和個人護理

- 其他工業用途

- 其他

第 11 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 家庭/零售消費者

- 食品服務業

- 高級餐廳

- 麵包店和糕點店

- 飯店和餐飲

- 其他餐飲服務機構

- 食品加工業

- 烘焙和糖果製造商

- 即食食品和預製食品

- 其他食品加工機

- 其他

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第13章:公司簡介

- Kerrygold (Ornua Co-operative Limited)

- Lurpak (Arla Foods amba)

- President (Lactalis Group)

- Anchor (Fonterra Co-operative Group)

- Amul (Gujarat Cooperative Milk Marketing Federation Ltd.)

- Land O'Lakes, Inc.

- Organic Valley

- Straus Family Creamery

- Vermont Creamery (Land O'Lakes, Inc.)

- Isigny Sainte-Mere

- Plugra (Dairy Farmers of America)

- Valio Ltd.

- Finlandia Cheese, Inc. (Valio Ltd.)

- Meggle Group GmbH

- Gourmet Food Holdings (Pepe Saya)

The Global High Fat (>85%) Butter Market was valued at USD 250.5 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 480.2 million by 2034. This steady growth is driven by a rising consumer preference for richer, more natural, and artisanal dairy products. High-fat butter, once limited to niche segments such as gourmet baking and fine dining, has now gained traction among health-conscious consumers following trends like low-carb and ketogenic diets. There is an emerging premium segment focused on clean-label, organically certified, and origin-verified butter produced through traditional churning methods.

Despite fluctuations in supply and price, the demand for indulgent, flavorful dairy items remains strong. Innovations in product offerings, increased awareness of fat's functional benefits, and growing global populations with high standards for quality and authenticity are all contributing to the market's expansion. Additionally, evolving retail strategies, greater access to emerging markets, and the rise of specialty food stores and e-commerce platforms support ongoing market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $250.5 Million |

| Forecast Value | $480.2 Million |

| CAGR | 6.8% |

The baking and confectionery segment is projected to grow at a faster pace, with a CAGR of 6.3%. Within the high-fat (>85%) butter market, baking and confectionery dominate application trends thanks to growing demand for superior texture, rich flavor, and consistent quality in premium pastries, cookies, and chocolates. Culinary uses are also on the rise, as chefs increasingly choose high-fat butter for sauteing, sauces, and boosting flavor profiles. Consumers seeking indulgent, creamy spreads and toppings are further driving this demand, while nutritional trends like keto and high-fat diets are expanding butter's role in dietary applications.

In 2024, the blocks and sticks segment accounted for a 41.5% share and is projected to grow at a CAGR of 6.4%, attracting a broader consumer base. These formats continue to dominate, especially in Western regions, due to their convenience, familiarity, and ease of measurement for cooking and baking. Urban health-conscious consumers particularly appreciate these soft, spreadable formats for their direct application on bread and crackers, combining convenience without compromising flavor.

Europe High Fat (>85%) Butter Market held a 34.3% share in 2024. This dominance is driven by the region's deep-rooted culinary heritage, where butter plays a vital role in traditional recipes and gourmet cooking. European consumers have a well-developed appreciation for high-quality dairy, prioritizing authenticity, rich flavor, and artisanal production methods. Additionally, widespread consumer education around premium and clean-label products fuels steady demand for high-fat butter across both retail and food service sectors. The presence of established dairy producers and a robust distribution network further strengthens Europe's position as a key player in this market, ensuring continuous availability of specialty butter products that meet the discerning tastes of its consumers.

Key players driving innovation and distribution in the High Fat (>85%) Butter Market include Ornua Co-operative Limited (Kerrygold), Arla Foods amba (Lurpak), Lactalis Group (President), Fonterra Co-operative Group (Anchor), and Gujarat Cooperative Milk Marketing Federation Ltd. (Amul). Danone S.A., Nestle S.A., The J.M. Smucker Company (Eagle Brand), Arla Foods, and Friesland Campina N.V. play influential roles in the condensed and evaporated milk segments.

To strengthen their market position, companies in the high-fat butter sector are prioritizing product innovation, focusing on clean-label and organic certifications to meet growing consumer demands for transparency and quality. They are expanding their flavor portfolios by introducing infused butter with herbs, spices, and probiotics to capture niche culinary and health-focused segments. Marketing efforts emphasize the authentic, artisanal nature of their products, connecting with consumers seeking premium, natural dairy options. Strategic partnerships with specialty retailers and online platforms enhance accessibility and consumer reach. Furthermore, investments in sustainable sourcing and production practices are improving brand reputation while aligning with environmental concerns. These combined strategies allow companies to build loyalty and tap into expanding global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 By fat content

- 5.2.1 85-90% fat content

- 5.2.2 90-95% fat content

- 5.2.3 95%+ fat content (Anhydrous Milk Fat/Butter Oil)

- 5.3 By flavor profile

- 5.3.1 Salted

- 5.3.2 Unsalted

- 5.3.3 Cultured/Fermented

- 5.3.4 Flavored & Infused

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Block/Stick

- 6.3 Spreadable

- 6.4 Clarified/Ghee

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 Organic

- 7.4 Grass-Fed

- 7.5 Specialty animal sources

- 7.5.1 Buffalo

- 7.5.2 Goat

- 7.5.3 Sheep

- 7.5.4 Others

Chapter 8 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Blocks/Sticks

- 8.3 Tubs & Containers

- 8.4 Bulk packaging

- 8.5 Specialty & Gift packaging

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Supermarkets & Hypermarkets

- 9.3 Specialty & gourmet stores

- 9.4 Online retail

- 9.4.1 E-commerce platforms

- 9.4.2 Direct-to-consumer websites

- 9.4.3 Subscription services

- 9.5 Foodservice industry

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Culinary Applications

- 10.2.1 Cooking & Sauteing

- 10.2.2 Sauces & Emulsions

- 10.2.3 Other culinary uses

- 10.3 Baking & Confectionery

- 10.3.1 Pastries & laminated dough

- 10.3.2 Cakes & Cookies

- 10.3.3 Confectionery products

- 10.4 Spreads & toppings

- 10.4.1 Bread & toast

- 10.4.2 Crackers & savory items

- 10.4.3 Other spread applications

- 10.5 Dietary & nutritional applications

- 10.5.1 Ketogenic diet

- 10.5.2 Bulletproof coffee & beverages

- 10.5.3 Other dietary uses

- 10.6 Industrial applications

- 10.6.1 Food manufacturing

- 10.6.2 Cosmetics & personal care

- 10.6.3 Other industrial uses

- 10.7 Others

Chapter 11 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 Household/Retail consumers

- 11.3 Food service industry

- 11.3.1 Fine dining restaurants

- 11.3.2 Bakeries & patisseries

- 11.3.3 Hotels & catering

- 11.3.4 Other foodservice establishments

- 11.4 Food processing industry

- 11.4.1 Bakery & confectionery manufacturers

- 11.4.2 Ready meals & prepared foods

- 11.4.3 Other food processors

- 11.5 Others

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Kerrygold (Ornua Co-operative Limited)

- 13.2 Lurpak (Arla Foods amba)

- 13.3 President (Lactalis Group)

- 13.4 Anchor (Fonterra Co-operative Group)

- 13.5 Amul (Gujarat Cooperative Milk Marketing Federation Ltd.)

- 13.6 Land O'Lakes, Inc.

- 13.7 Organic Valley

- 13.8 Straus Family Creamery

- 13.9 Vermont Creamery (Land O'Lakes, Inc.)

- 13.10 Isigny Sainte-Mere

- 13.11 Plugra (Dairy Farmers of America)

- 13.12 Valio Ltd.

- 13.13 Finlandia Cheese, Inc. (Valio Ltd.)

- 13.14 Meggle Group GmbH

- 13.15 Gourmet Food Holdings (Pepe Saya)