|

市場調查報告書

商品編碼

1766195

AAC(加氣混凝土)砌塊市場機會、成長動力、產業趨勢分析及2025-2034年預測AAC (Autoclaved Aerated Concrete) Blocks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

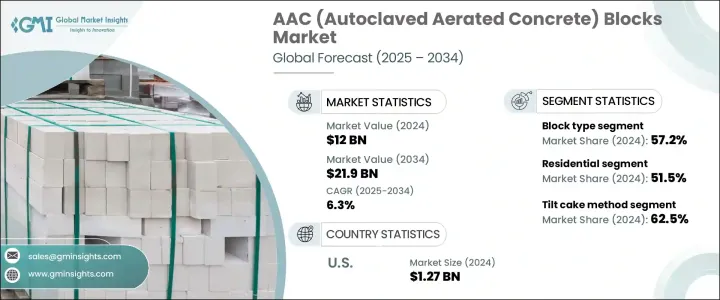

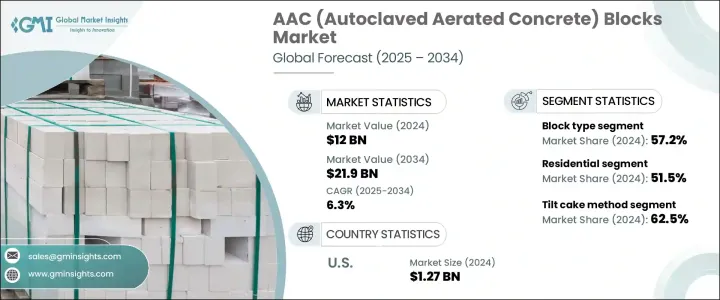

2024年,全球加氣混凝土(AAC)砌塊市場規模達120億美元,預計到2034年將以6.3%的複合年成長率成長,達到219億美元。隨著對減少環境影響的建築材料的需求不斷成長,該市場正在穩步擴張。 AAC塊以其輕質、永續、使用安全天然的原料和工業廢料製成而聞名,使其成為傳統磚塊的綠色替代品。其生產過程比紅粘土磚節能約30%,從而顯著降低碳排放。在印度等快速成長的經濟體中,這些材料因其支持國家永續發展目標並符合節能建築規範而日益受到青睞。

AAC砌塊的隔熱性能有助於防止室內過熱,減少對冷卻系統的依賴。這有助於降低能耗、節省成本並帶來環境效益。印度等國政府機構支持的能源效率標準進一步鼓勵AAC塊在房地產和公共基礎設施領域的應用。快速的城市發展、持續的基礎設施建設以及智慧城市計劃下向環保建築的轉變,都在推動市場擴張。 AAC砌塊也因其易於運輸和安裝、減少施工時間和人工而受到青睞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 120億美元 |

| 預測值 | 219億美元 |

| 複合年成長率 | 6.3% |

就產品類型而言,砌塊變體在2024年佔據了57.2%的市場佔有率,佔據了市場主導地位。標準尺寸的砌塊因其在成本、重量和隔熱性能方面的良好平衡,廣泛應用於住宅和商業建築。對於大型項目,巨型砌塊的使用日益增多,以減少接縫數量並加快牆體安裝速度。諸如過樑和U型砌塊等互補形狀的砌塊正變得越來越普遍,成為結構支撐和管道通道的增值解決方案,通常無需額外的模板。

生產方法是加氣混凝土市場的另一個關鍵因素。傾斜式砌塊法在2024年佔62.5%的市場佔有率,處於領先地位。這種方法需要在垂直切割砌塊之前對混合料進行部分固化,從而實現高產量並最佳化垂直空間利用率。它仍然是業內最成熟的方法,具有可擴展性。然而,由於修邊,它可能造成額外的材料浪費,並且比較新的自動化技術需要更多的人工投入。

2024年,美國加氣混凝土(AAC)砌塊市場佔據85%的市場佔有率,估值達12.7億美元。美國的成長得益於強勁的基礎設施建設以及對綠色建築替代品的需求激增。為了滿足這一需求並減少對進口材料的依賴,美國國內產能正在不斷擴大,從而確保更好的市場准入和更有效率的交付。這進一步鞏固了AAC作為美國建築業關鍵材料的地位。

塑造全球加氣混凝土 (AAC) 砌塊市場的主要公司包括 Aercon AAC、H+H International A/S、CSR Limited (Hebel)、ACICO Industries Company 和 Xella Group。這些公司透過創新、擴張業務範圍和強大的分銷策略保持競爭力。為了提升市場佔有率,AAC 砌塊製造商正專注於策略性舉措,例如擴大產能、在高需求地區設立工廠以及與建築公司建立合資企業。許多公司正在改進其製造技術,以減少浪費並提高產品一致性。針對特定建築功能進行砌塊設計創新,以及在監管和綠色建築框架中推廣 AAC 的努力,也正成為關鍵策略。此外,向承包商和建築師宣傳 AAC 塊的優勢,有助於其在新興市場和成熟市場中得到更廣泛的應用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對永續建築材料的需求不斷成長

- 能源效率和隔熱效益

- 快速城市化和基礎設施發展

- 輕量性能及施工速度優勢

- 產業陷阱與挑戰

- 原物料價格波動

- 運輸成本和物流

- 熟練勞動力短缺

- 區域建築規範合規性

- 市場機會

- 綠建築認證項目

- 製造業的技術進步

- 新興市場的擴張

- 預製和模組化建築的成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 區塊類型

- 標準塊

- 巨型積木

- 過梁塊

- U形塊

- 其他

- 尺寸

- 小型(長度最多 400 毫米)

- 中型(長度400-600毫米)

- 大型(長度600mm以上)

第6章:市場估計與預測:按原料,2021 年至 2034 年

- 主要趨勢

- 水泥

- 萊姆

- 粉煤灰

- 矽砂/石英砂

- 鋁粉

- 石膏

- 其他

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 牆體施工

- 外牆

- 內牆

- 隔間牆

- 屋頂隔熱

- 地板元素

- 門楣

- 覆層板

- 其他

第8章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 住宅建築

- 獨棟住宅

- 多戶建築

- 經濟適用房項目

- 商業建築

- 辦公大樓

- 零售空間

- 飯店及餐飲業

- 教育機構

- 醫療保健設施

- 工業建築

- 製造工廠

- 倉庫

- 其他

- 基礎建設發展

- 其他

第9章:市場估計與預測:依生產方式,2021 年至 2034 年

- 主要趨勢

- 傾斜蛋糕法

- 平餅法

- 其他

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- ACICO Industries Company

- Aercon AAC

- AKG Gazbeton

- Biltech Building Elements Limited

- Broco Industries

- Buildmate Projects Pvt. Ltd

- CSR Limited (Hebel)

- Eastland Building Materials Co., Ltd.

- H+H International A/S

- JK Lakshmi Cement Ltd.

- Magicrete Building Solutions Pvt. Ltd.

- Solbet Sp. z oo

- UAL Industries Limited

- Xella Group

The Global AAC (Autoclaved Aerated Concrete) Blocks Market was valued at USD 12 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 21.9 billion by 2034. This market is expanding steadily as demand increases for building materials that reduce environmental impact. AAC blocks are recognized for being lightweight, sustainable, and made using safe, natural raw materials and industrial waste-making them a green alternative to conventional bricks. Their production process consumes around 30% less energy than red clay bricks, contributing to significantly lower carbon emissions. In fast-growing economies like India, these materials are gaining momentum as they support national sustainability goals and align with energy-efficient construction norms.

The thermal insulation offered by AAC blocks helps prevent excess indoor heat, reducing reliance on cooling systems. This contributes to lower power usage, cost savings, and environmental benefits. Energy efficiency standards backed by government agencies in countries such as India further encourage AAC adoption in real estate and public infrastructure. Rapid urban growth, ongoing infrastructure development, and a shift toward environmentally sound construction under smart city initiatives are all fueling market expansion. AAC blocks are also preferred for being easy to transport and install, reducing construction time and labor.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12 Billion |

| Forecast Value | $21.9 Billion |

| CAGR | 6.3% |

In terms of product type, block variants dominated the market with a 57.2% share in 2024. Standard-sized blocks are widely used in both residential and commercial construction due to their favorable balance of cost, weight, and insulation. For larger-scale projects, jumbo blocks are increasingly used to reduce the number of joints and speed up wall installation. Complementary shapes like lintels and U-blocks are becoming more prevalent as value-added solutions for structural support and conduit passage, often eliminating the need for additional formwork.

Production methods are another key factor in the AAC market. The tilt cake method led with a 62.5% market share in 2024. This method involves partially curing the mix before cutting the blocks vertically, allowing high-volume output and optimal vertical space usage. It remains the most established method in the industry, ideal for scalability. However, it may create additional material waste due to trimming and requires more manual input than newer automated techniques.

United States AAC (Autoclaved Aerated Concrete) Blocks Market held 85% share in 2024, with a valuation of USD 1.27 billion. The country's growth is tied to robust infrastructure development and a surge in demand for green construction alternatives. Domestic production capacity is expanding to meet this demand and reduce reliance on imported materials, ensuring better market access and delivery efficiency. This has further strengthened the position of AAC as a key material in the US construction sector.

Major companies shaping the Global AAC (Autoclaved Aerated Concrete) Blocks Market include Aercon AAC, H+H International A/S, CSR Limited (Hebel), ACICO Industries Company, and Xella Group. These players remain competitive through innovation, expanding footprints, and strong distribution strategies. To boost their market presence, AAC block manufacturers are focusing on strategic moves such as capacity expansion, plant setup in high-demand regions, and entering joint ventures with construction firms. Many companies are enhancing their manufacturing technologies to reduce waste and improve product consistency. Innovation in block design to cater to specific building functions, and efforts to promote AAC in regulatory and green building frameworks, are also becoming critical strategies. Additionally, educating contractors and architects about the benefits of AAC blocks supports wider adoption across both emerging and mature markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Raw Material

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Production process

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for sustainable construction materials

- 3.2.1.2 Energy efficiency and thermal insulation benefits

- 3.2.1.3 Rapid urbanization and infrastructure development

- 3.2.1.4 Lightweight properties and construction speed advantages

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material price fluctuations

- 3.2.2.2 Transportation costs and logistics

- 3.2.2.3 Skilled labor shortages

- 3.2.2.4 Regional building code compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Green building certification programs

- 3.2.3.2 Technological advancements in manufacturing

- 3.2.3.3 Expansion in emerging markets

- 3.2.3.4 Prefabricated and modular construction growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Block type

- 5.2.1 Standard blocks

- 5.2.2 Jumbo blocks

- 5.2.3 Lintel blocks

- 5.2.4 U-shaped blocks

- 5.2.5 Others

- 5.3 Size

- 5.3.1 Small (Up to 400mm Length)

- 5.3.2 Medium (400-600mm Length)

- 5.3.3 Large (Above 600mm Length)

Chapter 6 Market Estimates and Forecast, By Raw Material, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cement

- 6.3 Lime

- 6.4 Fly Ash

- 6.5 Silica sand/quartz sand

- 6.6 Aluminum powder

- 6.7 Gypsum

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Wall construction

- 7.2.1 External walls

- 7.2.2 Internal walls

- 7.2.3 Partition walls

- 7.3 Roof insulation

- 7.4 Floor elements

- 7.5 Lintels

- 7.6 Cladding panels

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential construction

- 8.2.1 Single-family homes

- 8.2.2 Multi-family buildings

- 8.2.3 Affordable housing projects

- 8.3 Commercial construction

- 8.3.1 Office buildings

- 8.3.2 Retail spaces

- 8.3.3 Hotels and hospitality

- 8.3.4 Educational institutions

- 8.3.5 Healthcare facilities

- 8.4 Industrial construction

- 8.4.1 Manufacturing plants

- 8.4.2 Warehouses

- 8.4.3 Others

- 8.5 Infrastructure development

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Production Method, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Tilt cake method

- 9.3 Flat cake method

- 9.4 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 ACICO Industries Company

- 11.2 Aercon AAC

- 11.3 AKG Gazbeton

- 11.4 Biltech Building Elements Limited

- 11.5 Broco Industries

- 11.6 Buildmate Projects Pvt. Ltd

- 11.7 CSR Limited (Hebel)

- 11.8 Eastland Building Materials Co., Ltd.

- 11.9 H+H International A/S

- 11.10 JK Lakshmi Cement Ltd.

- 11.11 Magicrete Building Solutions Pvt. Ltd.

- 11.12 Solbet Sp. z o.o

- 11.13 UAL Industries Limited

- 11.14 Xella Group