|

市場調查報告書

商品編碼

1766194

工業清潔產品市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Cleaning Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

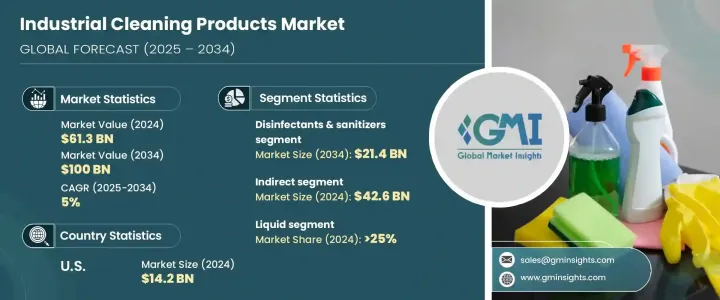

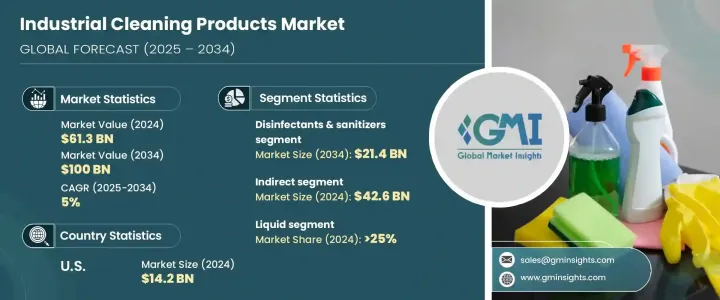

2024 年全球工業清潔產品市場價值為 613 億美元,預計到 2034 年將以 5% 的複合年成長率成長,達到 1,000 億美元。這一成長的一個重要驅動力是對工作場所衛生和個人衛生的日益重視,尤其是在食品加工、製藥和醫療保健等衛生至關重要的行業。世界各國政府和監管機構實施的更嚴格的法規正在促使企業使用經過認證的工業清潔產品。因此,各行各業在滿足衛生標準方面變得更加嚴格,以確保工人和最終用戶的安全。亞洲和拉丁美洲等新興經濟體的持續工業化正在為各行各業的清潔解決方案創造額外的需求,從製造業的強力脫脂劑到商業場所的環保消毒劑。

已開發經濟體和新興經濟體的工業基礎快速成長,大大推動了全球對高效可靠清潔產品的需求。隨著製造業、食品加工、製藥和化學等產業的持續擴張,對專業清潔解決方案的需求也日益凸顯,以維護安全、衛生和營運效率。隨著工業化程度的提高,清潔任務的複雜性不斷提升,需要更先進的清潔劑來處理油脂、化學殘留物和顆粒物等重污染應用。自動化、先進製造技術的興起以及向環保實踐的轉變進一步加劇了這一趨勢,所有這些都給清潔產品製造商帶來了額外的創新壓力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 613億美元 |

| 預測值 | 1000億美元 |

| 複合年成長率 | 5% |

消毒劑和殺菌劑市場規模在2024年達到125億美元,預計2034年將成長至214億美元。這些產品在各行各業需求旺盛,尤其是在醫療保健、食品加工和製藥領域,因為它們在保障衛生和預防感染傳播方面發揮著重要作用。新冠疫情進一步凸顯了消毒劑和殺菌劑的重要性,促使人們增加對這些解決方案的投資,以預防病原體的傳播。表面清潔劑也佔據了相當大的市場佔有率,廣泛應用於商業和工業領域。

工業清潔產品市場的間接配銷通路佔了相當大的佔有率,2024 年價值達 426 億美元,預計 2025 年至 2034 年的複合年成長率將達到 4.8%。該細分市場的蓬勃發展得益於完善的批發商、分銷商和專業供應商網路,這些供應商提供深入的本地專業知識,並與客戶保持長期合作關係。這些管道對於觸達製造業、醫療保健業、食品加工業等各行各業的廣泛終端用戶至關重要。依賴這些中介機構可以實現高效的產品分銷、及時交付和本地化支持,這對於滿足工業營運的動態需求至關重要。

2024年,北美工業清潔產品市場規模達142億美元,預計2034年將以5.3%的複合年成長率成長。美國市場的成長受到多種因素的推動,包括強調工作場所清潔的嚴格監管框架、頻繁的工業活動以及先進的醫療保健基礎設施。這些法規,例如美國職業安全與健康管理局(OSHA)制定的法規,創造了對工業清潔解決方案持續需求的環境。汽車、醫療保健、製藥和食品加工等關鍵產業推動了這一需求,對符合產業標準的專業清潔產品的需求持續成長。

影響工業清潔產品市場的關鍵公司包括 3M、巴斯夫、科萊恩、泰華施、陶氏、杜邦、藝康、贏創工業、漢高、金佰利、寶潔、利潔時、索爾維、斯泰潘和高樂氏公司。為了鞏固市場地位,工業清潔產品產業的公司正專注於產品創新並擴大產品組合。許多公司正在投資環保和永續的解決方案,以滿足消費者對環保產品日益成長的需求。隨著公司與其他行業參與者聯手提供全面的解決方案並進入更廣泛的分銷網路,合作夥伴關係和協作變得非常常見。製造商也越來越注重法規合規性,以滿足行業標準並提高產品可信度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監管格局

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 表面清潔劑

- 廁所清潔劑

- 玻璃和金屬清潔劑

- 地板清潔劑

- 織物清潔劑

- 洗碗產品

- 消毒劑和殺菌劑

- 除油劑

- 除垢器

- 其他

第6章:市場估計與預測:依形式類型,2021-2034

- 主要趨勢

- 液體

- 粉末

- 凝膠

- 泡棉

- 氣霧劑/噴霧

- 其他

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 水和廢水

- 石油和天然氣

- 能源和電力

- 製藥

- 化學品

- 汽車和航太

- 食品和飲料

- 金屬與礦業

- 其他

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- 3M

- BASF

- Clariant

- Diversey

- Dow

- DuPont

- Ecolab

- Evonik Industries

- Henkel

- Kimberly-Clark

- Procter & Gamble (P&G)

- Reckitt Benckiser

- Solvay

- Stepan

- The Clorox Company

The Global Industrial Cleaning Products Market was valued at USD 61.3 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 100 billion by 2034. A significant driver of this growth is the increasing focus on workplace sanitation and hygiene, especially in sectors like food processing, pharmaceuticals, and healthcare, where hygiene is crucial. Stricter regulations imposed by governments and regulatory bodies worldwide are pushing businesses to use certified industrial cleaning products. As a result, industries have become more diligent in meeting hygiene standards to ensure the safety of workers and end-users. The ongoing industrialization in emerging economies, such as those in Asia and Latin America, is creating additional demand for cleaning solutions across a variety of sectors, from heavy-duty degreasers in manufacturing to eco-friendly disinfectants in commercial spaces.

The rapidly growing industrial base across both developed and emerging economies is significantly driving the demand for effective and reliable cleaning products worldwide. As industries such as manufacturing, food processing, pharmaceuticals, and chemicals continue to expand, the need for specialized cleaning solutions to maintain safety, hygiene, and operational efficiency has become more pronounced. With increased industrialization, the complexity of cleaning tasks has escalated, requiring more advanced cleaning agents to tackle heavy-duty applications such as grease, chemical residues, and particulate matter. This trend is further amplified by the rise of automation, advanced manufacturing techniques, and the shift towards eco-friendly practices, all of which place additional pressure on cleaning product manufacturers to innovate.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $61.3 Billion |

| Forecast Value | $100 Billion |

| CAGR | 5% |

The disinfectants and sanitizers segment, valued at USD 12.5 billion in 2024, is expected to grow to USD 21.4 billion by 2034. These products are in high demand across industries, particularly in healthcare, food processing, and pharmaceuticals, due to their role in ensuring hygiene and preventing the spread of infections. The COVID-19 pandemic further highlighted the importance of disinfectants and sanitizers, leading to even greater investments in these solutions to prevent the spread of pathogens. Surface cleaners also maintain a significant market share, with widespread applications in both commercial and industrial settings.

The indirect distribution channel in the industrial cleaning products market held a significant share, valued at USD 42.6 billion in 2024, and is forecasted to grow at a CAGR of 4.8% from 2025 to 2034. This segment thrives due to a well-established network of wholesalers, distributors, and specialized suppliers that provide in-depth local expertise and maintain long-term relationships with their customers. These channels are instrumental in reaching a broad array of end-users across industries, including manufacturing, healthcare, food processing, and more. The reliance on these intermediaries allows for efficient product distribution, timely delivery, and localized support, which are critical in meeting the dynamic needs of industrial operations.

North America Industrial Cleaning Products Market was valued at USD 14.2 billion in 2024 and is projected to grow at a CAGR of 5.3% by 2034. The growth of the U.S. market is driven by a combination of factors, including rigorous regulatory frameworks that emphasize workplace cleanliness, high industrial activity, and advanced healthcare infrastructure. These regulations, such as those set by OSHA (Occupational Safety and Health Administration), create an environment where industrial cleaning solutions are in constant demand. Key sectors such as automotive, healthcare, pharmaceuticals, and food processing fuel this demand, with a continued need for specialized cleaning products that meet industry standards.

Key companies shaping the Industrial Cleaning Products Market include 3M, BASF, Clariant, Diversey, Dow, DuPont, Ecolab, Evonik Industries, Henkel, Kimberly-Clark, Procter & Gamble (P&G), Reckitt Benckiser, Solvay, Stepan, and The Clorox Company. To strengthen their position in the market, companies in the industrial cleaning products sector are focusing on product innovation and expanding their product portfolios. Many are investing in environmentally friendly and sustainable solutions to align with growing consumer demand for eco-conscious products. Partnerships and collaborations are common, as companies team up with other industry players to offer comprehensive solutions and access wider distribution networks. Manufacturers are also increasing their focus on regulatory compliance to meet industry standards and improve product credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Form type

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Surface cleaners

- 5.3 Toilet cleaners

- 5.4 Glass & metal cleaners

- 5.5 Floor cleaners

- 5.6 Fabric cleaners

- 5.7 Dishwashing products

- 5.8 Disinfectants & sanitizers

- 5.9 Degreasers

- 5.10 Descalers

- 5.11 Others

Chapter 6 Market Estimates & Forecast, By Form Type, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Liquid

- 6.3 Powder

- 6.4 Gel

- 6.5 Foam

- 6.6 Aerosol/spray

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Water and wastewater

- 7.3 Oil and gas

- 7.4 Energy and power

- 7.5 Pharmaceuticals

- 7.6 Chemicals

- 7.7 Automotive & aerospace

- 7.8 Food & beverage

- 7.9 Metals & mining

- 7.10 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 3M

- 10.2 BASF

- 10.3 Clariant

- 10.4 Diversey

- 10.5 Dow

- 10.6 DuPont

- 10.7 Ecolab

- 10.8 Evonik Industries

- 10.9 Henkel

- 10.10 Kimberly-Clark

- 10.11 Procter & Gamble (P&G)

- 10.12 Reckitt Benckiser

- 10.13 Solvay

- 10.14 Stepan

- 10.15 The Clorox Company