|

市場調查報告書

商品編碼

1766184

電子藥物輸送設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electronic Drug Delivery Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

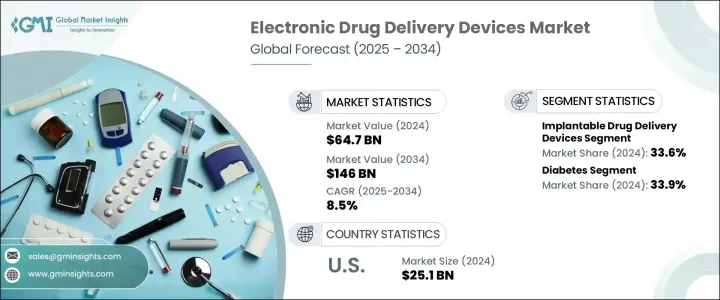

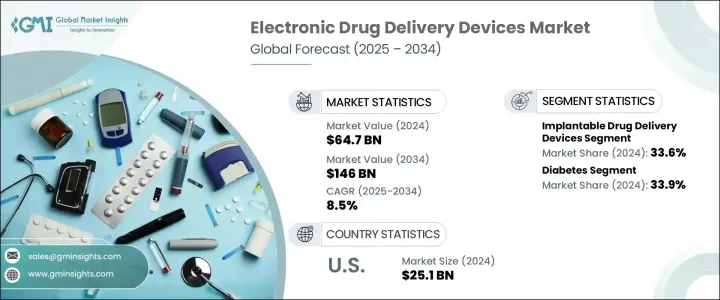

2024 年全球電子給藥設備市場價值為 647 億美元,預計到 2034 年將以 8.5% 的複合年成長率成長,達到 1,460 億美元。這些設備是先進的系統,旨在透過使用者手動啟動或自動編程以電子方式管理藥物,並且通常會記錄劑量事件以供監測和遵守。該技術與即時連接的感測器和微處理器整合,從而能夠根據預設的治療方案和即時生理資料提供精確的個人化藥物。與可能存在依從性問題的傳統藥物傳遞方法不同,電子設備提供可程式化、準確且以患者為中心的藥物解決方案。

這不僅可以透過持續給藥來改善治療效果,還有助於降低住院和監測成本,這對於高收入和資源受限的醫療保健環境都極具價值。老年人口的成長,往往伴隨著癌症、心血管疾病、糖尿病和慢性腎臟病等慢性疾病,是推動電子藥物傳遞系統需求的重要因素,因為這些患者需要持續、方便的治療。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 647億美元 |

| 預測值 | 1460億美元 |

| 複合年成長率 | 8.5% |

2024年,植入式藥物傳輸設備領域佔據市場主導地位,佔33.6%。隨著癌症、糖尿病和心臟病等慢性疾病的日益流行,對長期可控藥物傳輸系統的需求顯著成長。化療輸液港和標靶輸送系統等植入式設備可以減少不遵從性並改善臨床療效。可程式幫浦、標靶藥物洗脫植入物和可生物分解植入物的需求也正在擴展到其他治療領域,包括疼痛管理和神經病學。

2024年,糖尿病領域佔了33.9%的市場。全球糖尿病病例的不斷成長推動了對先進胰島素幫浦和貼片注射器等設備的需求,這些設備能夠持續監測血糖並自動輸送胰島素。此外,監管部門的批准和支持性報銷政策使得糖尿病電子給藥系統更加普及,促進了其普及。

2024年,美國電子給藥設備市場規模達251億美元。隨著人口老化和慢性病發病率持續上升,美國對電子給藥設備的需求預計將持續成長。受遠端門診監控、醫療支出成長以及價值導向醫療模式轉變的推動,先進的自動注射器、數位吸入器和智慧型穿戴式輸液幫浦的普及率不斷提升。美國完善的數位醫療基礎設施進一步支持了互聯醫療系統的整合,從而進一步推動了此類設備市場的發展。

全球電子給藥設備市場的主要參與者包括 Becton、Dickinson and Company、輝瑞、美敦力、Insulet、West Pharmaceutical Services、禮來公司、諾和諾德、Tandem Diabetes Care、Gerresheimer、Ypsomed、阿斯特捷利康、雅培實驗室、SHL 集團、Nemera 和賽諾菲諾菲諾。在電子給藥設備市場中營運的公司採用各種策略來加強其影響力。許多公司專注於技術創新,例如開發具有即時資料功能、更精確、方便用戶使用的設備。這些公司還透過提供跨多個治療領域的解決方案來擴展其產品組合,包括糖尿病和心血管疾病等慢性疾病。與醫療服務提供者和監管機構建立策略合作夥伴關係有助於加快核准並確保更廣泛的市場准入。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 慢性病發生率上升

- 越來越傾向於家庭醫療保健解決方案

- 數位整合的進步和個人化治療意識的提高

- 老年人口不斷增加

- 產業陷阱與挑戰

- 先進藥物傳輸裝置成本高昂

- 患者意識低下和設備相關併發症

- 市場機會

- 向醫療基礎設施有限的新興市場擴張

- 人工智慧與分析的整合,實現個人化劑量

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 報銷場景

- 報銷政策對市場成長的影響

- 專利格局

- 消費者行為分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 智慧型輸液幫浦

- 智慧定量吸入器

- 植入式藥物傳輸裝置

- 智慧透皮貼片

- 其他產品

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 糖尿病

- 呼吸系統疾病

- 腫瘤學

- 心臟病學

- 其他應用

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- Abbott Laboratories

- AstraZeneca

- Becton, Dickinson and Company

- Eli Lilly and Company

- Gerresheimer

- Haselmeier

- Insulet

- Medtronic

- Nemera

- Novo Nordisk

- Pfizer

- Sanofi

- SHL Group

- Tandem Diabetes Care

- West Pharmaceutical Services

- Ypsomed

The Global Electronic Drug Delivery Devices Market was valued at USD 64.7 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 146 billion by 2034. These devices are advanced systems designed to administer medication electronically, either through manual initiation by the user or automatic programming, and often record dosage events for monitoring and compliance. The technology is integrated with sensors and microprocessors that connect in real-time, enabling the delivery of precise, individualized medication based on pre-set therapeutic protocols and real-time physiological data. Unlike traditional drug delivery methods, which may suffer from adherence issues, electronic devices offer programmable, accurate, and patient-focused medication solutions.

This not only improves treatment outcomes through consistent dosing but also helps reduce hospitalization and monitoring costs, which is valuable in both high-income and resource-constrained healthcare settings. The growing elderly population, who often face chronic diseases like cancer, cardiovascular conditions, diabetes, and chronic kidney disease, is a significant factor driving the demand for electronic drug delivery systems, as these patients require continuous, user-friendly treatments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $64.7 Billion |

| Forecast Value | $146 Billion |

| CAGR | 8.5% |

The implantable drug delivery devices segment led the market in 2024, accounting for 33.6% share. With the increasing prevalence of chronic diseases like cancer, diabetes, and heart conditions, the demand for long-term, controlled drug delivery systems has grown significantly. Implantable devices, such as chemotherapy ports and targeted delivery systems, reduce non-compliance and enhance clinical outcomes. The demand for programmable pumps, targeted drug-eluting implants, and biodegradable implants is also expanding into other therapeutic areas, including pain management and neurology.

In 2024, the diabetes segment represented 33.9% share. The rising number of diabetes cases worldwide has driven demand for devices like advanced insulin pumps and patch injectors that offer continuous glucose monitoring and automatic insulin delivery. Furthermore, regulatory approvals and supportive reimbursement policies have made electronic drug delivery systems for diabetes more widely accessible, boosting adoption.

U.S. Electronic Drug Delivery Devices Market was valued at USD 25.1 billion in 2024. As the population ages and chronic diseases continue to rise, the demand for electronic drug delivery devices in the U.S. is expected to grow. The adoption of advanced autoinjectors, digital inhalers, and smart wearable infusion pumps has increased, driven by remote outpatient monitoring, rising healthcare spending, and a shift toward value-based care. The well-established digital health infrastructure in the U.S. further supports the integration of connected medical systems, which fuels the market for these devices.

Major players in the Global Electronic Drug Delivery Devices Market include Becton, Dickinson and Company, Pfizer, Medtronic, Insulet, West Pharmaceutical Services, Eli Lilly and Company, Novo Nordisk, Tandem Diabetes Care, Gerresheimer, Ypsomed, AstraZeneca, Abbott Laboratories, SHL Group, Nemera, and Sanofi. Companies operating in the electronic drug delivery devices market employ various strategies to strengthen their presence. Many are focusing on technological innovation, such as the development of more precise, user-friendly devices with real-time data capabilities. These companies are also expanding their portfolios by offering solutions across multiple therapeutic areas, including chronic diseases like diabetes and cardiovascular conditions. Strategic partnerships with healthcare providers and regulatory bodies help expedite approvals and ensure broader market access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic diseases

- 3.2.1.2 Increasing inclination toward home-based healthcare solutions

- 3.2.1.3 Advancements in digital integration and heightened awareness around personalized therapeutics

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced drug delivery devices

- 3.2.2.2 Low patient awareness and device-related complications

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets with limited healthcare infrastructure

- 3.2.3.2 Integration of AI and analytics for personalized dosing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Reimbursement scenario

- 3.11.1 Impact of reimbursement policies on market growth

- 3.12 Patent landscape

- 3.13 Consumer behaviour analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Smart infusion pumps

- 5.3 Smart metered dose inhalers

- 5.4 Implantable drug delivery devices

- 5.5 Smart transdermal patches

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diabetes

- 6.3 Respiratory diseases

- 6.4 Oncology

- 6.5 Cardiology

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 AstraZeneca

- 8.3 Becton, Dickinson and Company

- 8.4 Eli Lilly and Company

- 8.5 Gerresheimer

- 8.6 Haselmeier

- 8.7 Insulet

- 8.8 Medtronic

- 8.9 Nemera

- 8.10 Novo Nordisk

- 8.11 Pfizer

- 8.12 Sanofi

- 8.13 SHL Group

- 8.14 Tandem Diabetes Care

- 8.15 West Pharmaceutical Services

- 8.16 Ypsomed