|

市場調查報告書

商品編碼

1766182

水痘疫苗市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Varicella Vaccine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

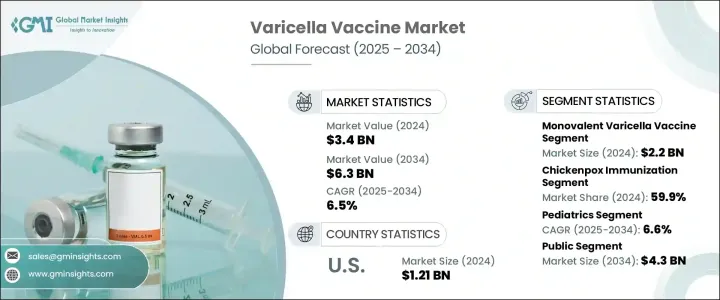

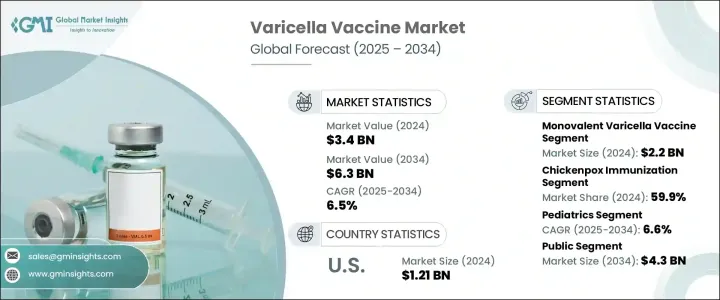

2024年,全球水痘疫苗市場規模達34億美元,預計2034年將以6.5%的複合年成長率成長至63億美元。全球水痘(又稱水痘)負擔的不斷加重,持續成為該市場的主要驅動力。高傳播率和反覆爆發的疫情(尤其是在人口稠密的地區)加劇了對有效免疫解決方案的需求。早期疫苗接種意識的不斷提升,加上政府主導的強大免疫接種運動和資金支持,正在加速全球水痘疫苗的普及。技術進步也在塑造市場發展勢頭,尤其是聯合疫苗的研發,這種疫苗可以減少所需劑量並提高患者的依從性。

國家免疫規劃中日益傾向於採用綜合免疫接種程序,這有助於提高疫苗覆蓋率。此外,隨著醫療保健系統強調預防措施和常規免疫接種,疫苗需求持續成長。一些地區老齡人口的不斷成長也促使人們對疫苗接種保持持續興趣,因為老年人更容易感染水痘-帶狀皰疹病毒。隨著醫療保健服務覆蓋範圍的擴大,以及旨在提高疫苗覆蓋率和可負擔性的公私合作的持續推進,預計未來幾年水痘疫苗市場將持續穩定成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 34億美元 |

| 預測值 | 63億美元 |

| 複合年成長率 | 6.5% |

單價水痘疫苗市場在2024年以22億美元的估值領先市場。其在常規免疫計劃中的廣泛應用,尤其是在資源匱乏的國家,進一步鞏固了其市場主導地位。與多價疫苗相比,單價疫苗通常價格更實惠、更易於儲存且物流更便捷,使其成為大規模公共衛生活動的理想選擇。長期以來,單價疫苗的持續使用贏得了衛生當局和臨床醫生的充分信任,並使其廣受歡迎。單價疫苗憑藉其可靠的有效性和長期的安全性記錄,成為全球兒童免疫接種計畫的首選。憑藉其可靠性和成本效益,單價疫苗在已開發國家和發展中國家都持續受到青睞。

2024年,水痘免疫接種佔比最高,達59.9%。這一領先地位歸功於兒童對水痘預防的廣泛需求。擁有先進醫療體系的國家已將水痘疫苗納入其全民免疫政策,實現了高接種率。即使在新興市場,更完善的醫療服務、日益提升的家長意識以及推廣水痘疫苗接種的國家計畫也正在推動這一趨勢。由於水痘病毒傳染性極強,各國繼續將疫苗的取得和接種放在首位。持續的教育和推廣工作正在提高兒童的依從性,並使水痘免疫接種成為全球兒童醫療保健的標準組成部分。

2024年,北美水痘疫苗市場佔據39.1%的市佔率。這一成長得益於完善的醫療體系和積極的監管環境。該地區的公共衛生機構致力於確保水痘疫苗的廣泛普及和保險報銷,從而最大限度地降低個人的直接成本。疫苗的早期普及、高額的保險覆蓋率以及強力的公共衛生宣傳推動了疫苗的廣泛應用。因此,該地區將繼續保持強勁的需求,預計在整個預測期內仍將是全球水痘疫苗市場的主要貢獻者。

全球水痘疫苗市場的領先公司包括 SK Bioscience、賽諾菲、GC Pharma(綠十字控股)、葛蘭素史克、武田藥品工業株式會社、Seqirus、田邊三菱製藥株式會社、諾和醫療、默克、科興生物、BPL、Bio-Med 和長春長生生命科學有限公司。水痘疫苗市場的主要參與者正在利用一系列策略性措施來加強其市場地位。主要重點是擴大生產能力和改善冷鏈物流,以確保全球供應的一致性。各公司也正在研發方面投入資金,以研發將水痘保護整合到更廣泛的免疫計畫中的聯合疫苗,從而提高便利性和依從性。與政府和全球衛生機構的策略合作正在促進更廣泛的分發,特別是在中低收入國家。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 水痘盛行率不斷上升

- 政府不斷擴大免疫計劃

- 疫苗研發技術進步

- 產業陷阱與挑戰

- 嚴格的監管要求

- 疫苗儲存和運輸成本高

- 市場機會

- 擴大國家免疫計劃

- 成人和青少年疫苗接種需求不斷成長

- 聯合疫苗的成長

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 管道分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按疫苗類型,2021 年至 2034 年

- 主要趨勢

- 單價水痘疫苗

- 水痘聯合疫苗

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 水痘免疫

- 腮腺炎、麻疹、德國麻疹和水痘 (MMRV) 免疫接種

第7章:市場估計與預測:依年齡層,2021 年至 2034 年

- 主要趨勢

- 兒科

- 青少年和成年人

第 8 章:市場估計與預測:按採購,2021 年至 2034 年

- 主要趨勢

- 民眾

- 私人的

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Bio-Med

- Changchun Changsheng Life Sciences Limited

- GC Pharma (Green Cross Holdings)

- GlaxoSmithKline

- Merck

- Mitsubishi Tanabe Pharma Corporation

- Novo Medi Sciences

- Sanofi

- Seqirus

- Sinovac Biotech

- SK Bioscience

- Takeda Pharmaceutical Company Limited

The Global Varicella Vaccine Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 6.3 billion by 2034. The increasing global burden of varicella, or chickenpox, continues to be a major driver of this market. High transmission rates and recurring outbreaks, especially in densely populated regions, are raising the demand for effective immunization solutions. The rising awareness of early vaccination, combined with strong government-led immunization campaigns and funding support, is accelerating the uptake of varicella vaccines globally. Technological advancements are also shaping the market's momentum, particularly the development of combination vaccines that reduce the number of required doses and enhance patient compliance.

The growing shift toward integrated immunization schedules in national programs is helping increase coverage. Additionally, as healthcare systems emphasize preventive measures and routine immunization, demand continues to grow. The increasing elderly population in several regions has also contributed to sustained interest in vaccination due to susceptibility to varicella-zoster reactivation. With expanded access to healthcare and ongoing public-private partnerships aimed at improving vaccine reach and affordability, the market for varicella vaccines is anticipated to experience consistent and steady growth in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $6.3 Billion |

| CAGR | 6.5% |

The monovalent varicella vaccine segment led the market with a valuation of USD 2.2 billion in 2024. Its widespread use in routine immunization programs, especially in countries with limited resources, supports this dominance. These vaccines are often more affordable, easier to store, and logistically simpler than multivalent alternatives, making them ideal for large-scale public health campaigns. Their consistent usage over time has built strong trust among health authorities and clinicians, helping maintain their popularity. Proven efficacy and long-standing safety records have made monovalent vaccines the preferred choice for childhood immunization schedules globally. They continue to gain traction in both developed and developing countries due to their reliability and cost-efficiency.

In 2024, the chickenpox immunization segment accounted for the largest share at 59.9%. This leadership is attributed to the widespread demand for childhood varicella protection. Countries with advanced healthcare systems have integrated varicella vaccination into their universal immunization policies, resulting in high uptake. Even in emerging markets, stronger healthcare access, growing parental awareness, and national programs promoting varicella vaccination are helping drive this trend. With the virus being highly contagious, countries continue to prioritize vaccine access and delivery. Continuous education and outreach efforts are increasing compliance and making immunization against chickenpox a standard part of pediatric healthcare globally.

North America Varicella Vaccine Market held a 39.1% share in 2024. This growth is supported by well-established healthcare systems and proactive regulatory environments. Public health agencies in the region have helped ensure that varicella vaccines are widely available and reimbursed under insurance plans, minimizing direct costs for individuals. The early availability of the vaccine, high insurance coverage, and strong public health messaging have driven significant adoption. As a result, the region continues to show strong demand and is expected to remain a dominant contributor to the global varicella vaccine market throughout the forecast period.

Leading companies in the Global Varicella Vaccine Market include SK Bioscience, Sanofi, GC Pharma (Green Cross Holdings), GlaxoSmithKline, Takeda Pharmaceutical Company Limited, Seqirus, Mitsubishi Tanabe Pharma Corporation, Novo Medi Sciences, Merck, Sinovac Biotech, BPL, Bio-Med, and Changchun Changsheng Life Sciences Limited. Key players in the varicella vaccine market are leveraging a range of strategic initiatives to strengthen their market presence. A major focus is on expanding production capacity and improving cold-chain logistics to ensure consistent global supply. Companies are also investing in research and development to create combination vaccines that integrate varicella protection into broader immunization schedules, enhancing convenience and compliance. Strategic collaborations with governments and global health agencies are facilitating broader distribution, especially in low- and middle-income countries.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vaccine type

- 2.2.3 Application

- 2.2.4 Age group

- 2.2.5 Procurement

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chickenpox

- 3.2.1.2 Growing immunization programs by the government

- 3.2.1.3 Technological advancements in vaccine development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory requirements

- 3.2.2.2 High cost of storage and transportation of vaccine

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of National Immunization Programs

- 3.2.3.2 Rising demand for adult and adolescent vaccination

- 3.2.3.3 Growth in combination vaccines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Vaccine Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Monovalent varicella vaccine

- 5.3 Combination varicella vaccine

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Chickenpox immunization

- 6.3 Mumps, measles, rubella, and varicella (MMRV) immunization

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatrics

- 7.3 Adolescents and adults

Chapter 8 Market Estimates and Forecast, By Procurement, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Public

- 8.3 Private

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bio-Med

- 10.2 Changchun Changsheng Life Sciences Limited

- 10.3 GC Pharma (Green Cross Holdings)

- 10.4 GlaxoSmithKline

- 10.5 Merck

- 10.6 Mitsubishi Tanabe Pharma Corporation

- 10.7 Novo Medi Sciences

- 10.8 Sanofi

- 10.9 Seqirus

- 10.10 Sinovac Biotech

- 10.11 SK Bioscience

- 10.12 Takeda Pharmaceutical Company Limited