|

市場調查報告書

商品編碼

1766177

分散式溫度感測市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Distributed Temperature Sensing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

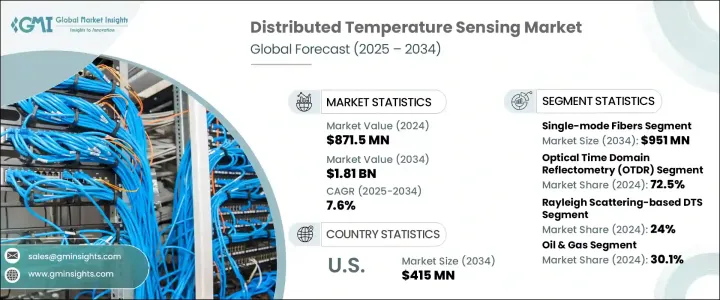

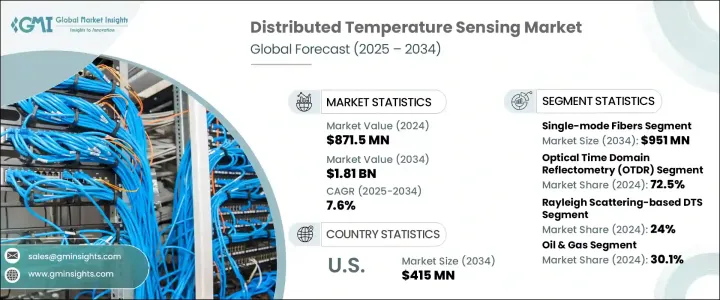

2024年,全球分散式溫度感測市場規模達8.715億美元,預計2034年將以7.6%的複合年成長率成長,達到18.1億美元。工業物聯網技術的日益普及,在推動該市場發展方面發揮關鍵作用。隨著各行各業擴大轉向數位系統以增強安全性和營運效率,對能夠提供準確即時資料的溫度監控解決方案的需求也日益成長。分佈式溫度感測透過提供長距離連續溫度測量來滿足這一需求。這可以提前發現異常,有助於預防系統故障並避免潛在的危險情況。

資料中心基礎設施建設、城市化進程以及電動車使用率的上升推動了電力消耗的快速成長,這促使公用事業和工業營運商採用更智慧的電網解決方案。 DTS 系統對這些發展至關重要,因為它們有助於管理熱負荷並提高電網可靠性。這些感測系統通常部署在具有挑戰性的環境中,例如地下和架空電力線、配電節點和變電站。它們能夠檢測電力電纜的過熱或應力,使其成為現代能源基礎設施中不可或缺的一部分。隨著各行各業致力於降低風險並延長資產使用壽命,對 DTS 的需求正在穩步成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.715億美元 |

| 預測值 | 18.1億美元 |

| 複合年成長率 | 7.6% |

就光纖類型而言,單模光纖預計將實現顯著成長,其市值預計到2034年將達到9.51億美元。這類光纖尤其適用於需要長距離高速資料傳輸的應用。其固有的資料傳輸能力,訊號損耗極小,頻寬容量更高,使其成為現代電信和工業設備的理想選擇。隨著全球網路連線的擴展,尤其是新一代寬頻和無線系統的發展,單模光纖在分散式傳輸系統(DTS)中的應用持續成長。這些光纖使分佈式感測器能夠精確測量延伸電纜長度上的溫度變化。

依技術分析,市場細分為光時域反射儀 (OTDR) 和光頻域反射儀 (OFDR)。 OTDR 仍然是主導技術,2024 年佔全球市場的 72.5%。此方法因其在光纖網路故障檢測和連續性驗證方面的精確性而被廣泛接受。 OTDR 透過識別精確的故障點、熔接損耗或光纖斷裂來實現高效維護,這對於依賴不間斷運作的產業至關重要。 DTS 系統使用 OTDR 分析背向散射光來確定光纖長度上的溫度曲線,從而增強即時監控能力。

根據工作原理,市場細分為基於瑞利散射、拉曼散射和布里淵散射的DTS系統。其中,基於瑞利散射的DTS在2024年佔了24%的市場。此技術特別適用於需要精細溫度監測的環境。其詳細的熱分析能力支援早期檢測溫度峰值至關重要的操作。在高風險區域運作的產業越來越依賴此類技術,以確保持續的監控並在重大故障發生前解決問題。

從應用角度來看,DTS 系統廣泛應用於多個產業,包括電力電纜監測、火災偵測、管道管理、環境評估等。然而,石油和天然氣應用在 2024 年佔據了最大的佔有率,達到 30.1%。這些產業需要遠距離持續溫度監測,以確保營運效率和安全性。 DTS 解決方案提供必要的精度和可靠性,以滿足這些需求,有助於最佳化效能和預防性維護。

在區域分析中,美國是一個突出的主要市場,預計到2034年其市場規模將達到4.15億美元。在美國,DTS系統廣泛部署,用於井筒和電網的即時熱監測。隨著致力於改造老化基礎設施的舉措不斷湧現,先進的溫度感測解決方案的應用勢頭強勁。這些系統支援高效的負載管理和效能問題的早期檢測,從而降低意外停機的風險。

市場競爭激烈,斯倫貝謝有限公司、哈里伯頓公司、AP Sensing GmbH、Silixa Ltd. 和 Bandweaver Technologies 等主要參與者合計佔全球收入的 43.3% 以上。為了保持領先地位並適應不斷變化的行業需求,各公司正在大力投資下一代光纖材料和感測器技術,以提高測量精度和環境耐久性。為了滿足日益成長的即時高精度監測需求,各公司正在推出緊湊、節能且解析度更高的 DTS 系統。

人工智慧驅動的診斷和分析技術也被整合到DTS解決方案中,以支援預測性維護並提昇系統可靠性。行業參與者正在響應用戶需求,提供針對特定行業挑戰的客製化DTS配置。此外,策略合作夥伴關係、收購和協作正成為擴展技術能力和地理覆蓋範圍的核心。透過與監管機構和公用事業營運商合作,企業還可以確保其DTS產品符合不斷發展的環境和安全標準。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對先進管道監控的需求不斷增加

- 對火災偵測和預防系統的需求日益成長

- 電網基礎設施投資不斷增加

- 光纖感測技術進步

- 智慧基礎設施和工業物聯網(IIoT)的擴展

- 產業陷阱與挑戰

- 初始資本投入高

- 複雜的安裝和整合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理分佈比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:依纖維類型,2021-2034

- 主要趨勢

- 單模光纖

- 多模光纖

第6章:市場估計與預測:依技術類型,2021-2034

- 主要趨勢

- 光時域反射儀 (OTDR)

- 光頻域反射儀(OFDR)

第7章:市場估計與預測:依經營原則,2021-2034

- 主要趨勢

- 基於瑞利散射的DTS

- 基於拉曼散射的DTS

- 基於布里淵散射的DTS

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 石油和天然氣

- 電力電纜監控

- 火災偵測

- 流程和管道監控

- 環境監測

- 變壓器溫度監測

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- AOMS Technologies

- AP Sensing GmbH

- Bandweaver Technologies

- Fluves

- GESO GmbH & Co.

- Halliburton Company

- Inventec BV

- Micron Optics

- NKT Photonics A/S

- OFS Fitel, LLC

- Omicron Electronics

- Omnisens SA

- Optromix, Inc.

- Schlumberger Limited

- Silixa Ltd.

- Sumitomo Electric Industries, Ltd.

- Yokogawa Electric Corporation

The Global Distributed Temperature Sensing Market was valued at USD 871.5 million in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 1.81 billion by 2034. The rising adoption of industrial IoT technologies is playing a key role in driving this market forward. With industries increasingly turning to digital systems for enhanced safety and operational efficiency, there is a growing need for temperature monitoring solutions that deliver accurate, real-time data. Distributed temperature sensing meets this demand by offering continuous temperature measurements over long distances. This allows early detection of anomalies, helping to prevent system failures and avoid potentially hazardous conditions.

The rapid increase in electricity consumption-fueled by growing data center infrastructure, urbanization, and rising electric vehicle usage-is pushing utilities and industrial operators to adopt smarter power grid solutions. DTS systems are vital to these developments, as they assist in managing thermal loads and improving grid reliability. These sensing systems are commonly deployed in challenging environments like underground and overhead power lines, distribution nodes, and substations. Their ability to detect overheating or stress in power cables makes them indispensable in modern energy infrastructure. As industries aim to mitigate risks and improve asset lifespan, the demand for DTS is steadily rising.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $871.5 Million |

| Forecast Value | $1.81 Billion |

| CAGR | 7.6% |

In terms of fiber type, single-mode fibers are expected to record significant growth, with their market value projected to reach USD 951 million by 2034. These fibers are favored for applications requiring high-speed data transfer over long distances. Their inherent ability to transmit data with minimal signal loss and higher bandwidth capacity makes them ideal for modern telecommunication and industrial setups. As network connectivity expands globally, especially with the development of next-generation broadband and wireless systems, the use of single-mode fiber in DTS applications continues to increase. These fibers enable distributed sensors to measure temperature variations accurately along extended cable lengths.

When analyzed by technology, the market is segmented into Optical Time Domain Reflectometry (OTDR) and Optical Frequency Domain Reflectometry (OFDR). OTDR remains the dominant technology, accounting for 72.5% of the global market in 2024. The method is widely accepted for its precision in detecting faults and verifying continuity in optical fiber networks. OTDR enables efficient maintenance by identifying exact fault points, splice losses, or fiber breaks, which is essential for sectors that rely on uninterrupted operations. DTS systems using OTDR analyze backscattered light to determine temperature profiles across a fiber's length, enhancing real-time monitoring capabilities.

By operating principle, the market is segmented into Rayleigh scattering-based, Raman scattering-based, and Brillouin scattering-based DTS systems. Among these, Rayleigh scattering-based DTS captured 24% of the market share in 2024. This technology is particularly suitable for environments that demand fine-grained temperature monitoring. Its capacity for detailed thermal analysis supports operations where early detection of temperature spikes is critical. Industries operating in high-risk zones are increasingly relying on such technologies to ensure consistent monitoring and issue resolution before major failures occur.

From an application standpoint, DTS systems are used across several industries, including power cable monitoring, fire detection, pipeline management, environmental assessments, and more. However, oil and gas applications held the largest share of 30.1% in 2024. These sectors require continuous temperature monitoring over long distances to ensure operational efficiency and safety. DTS solutions offer the necessary precision and reliability to support these needs, contributing to optimized performance and preventive maintenance.

In regional analysis, the United States stands out as a major market, with projections indicating it will reach USD 415 million by 2034. Within the country, DTS systems are widely deployed for real-time thermal monitoring of wellbores and electrical grids. With initiatives focused on modernizing aging infrastructure, the adoption of advanced temperature sensing solutions is gaining momentum. These systems support efficient load management and early detection of performance issues, reducing the risk of unplanned outages.

The market landscape is competitive, with key players including Schlumberger Limited, Halliburton Company, AP Sensing GmbH, Silixa Ltd., and Bandweaver Technologies collectively accounting for over 43.3% of global revenue. To maintain leadership and adapt to evolving industry demands, companies are investing heavily in next-generation fiber materials and sensor technologies that improve measurement accuracy and environmental durability. Compact and energy-efficient DTS systems with enhanced resolution are being introduced to meet the growing demand for real-time, high-precision monitoring.

AI-driven diagnostics and analytics are also being integrated into DTS solutions to support predictive maintenance and extend system reliability. Industry participants are responding to user needs by offering customized DTS configurations tailored for specific industrial challenges. In addition, strategic partnerships, acquisitions, and collaborations are becoming central to expanding technological capabilities and geographic reach. By engaging with regulatory bodies and utility operators, firms are also ensuring that their DTS offerings align with evolving environmental and safety standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.3 Fiber type

- 2.4 Technology type

- 2.5 Operating principle

- 2.6 Application

- 2.7 Regional

- 2.8 TAM Analysis, 2025-2034 (USD Billion)

- 2.9 CXO perspectives: Strategic imperatives

- 2.9.1 Executive decision points

- 2.9.2 Critical Success Factors

- 2.10 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for advanced pipeline monitoring

- 3.2.1.2 Growing need for fire detection and prevention systems

- 3.2.1.3 Rising investments in power grid infrastructure

- 3.2.1.4 Technological advancements in optical fiber sensing

- 3.2.1.5 Expansion of smart Infrastructure and Industrial IoT (IIoT)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Complex installation and integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing Strategies

- 3.10 Emerging Business Models

- 3.11 Compliance Requirements

- 3.12 Sustainability Measures

- 3.13 Consumer Sentiment Analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Fiber Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Single-mode fibers

- 5.3 Multimode fibers

Chapter 6 Market Estimates & Forecast, By Technology Type, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Optical Time Domain Reflectometry (OTDR)

- 6.3 Optical Frequency Domain Reflectometry (OFDR)

Chapter 7 Market Estimates & Forecast, By Operating Principle, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Rayleigh scattering-based DTS

- 7.3 Raman scattering-based DTS

- 7.4 Brillouin scattering-based DTS

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Oil & gas

- 8.3 Power cable monitoring

- 8.4 Fire detection

- 8.5 Process & pipeline monitoring

- 8.6 Environmental monitoring

- 8.7 Transformer temperature monitoring

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AOMS Technologies

- 10.2 AP Sensing GmbH

- 10.3 Bandweaver Technologies

- 10.4 Fluves

- 10.5 GESO GmbH & Co.

- 10.6 Halliburton Company

- 10.7 Inventec B.V.

- 10.8 Micron Optics

- 10.9 NKT Photonics A/S

- 10.10 OFS Fitel, LLC

- 10.11 Omicron Electronics

- 10.12 Omnisens SA

- 10.13 Optromix, Inc.

- 10.14 Schlumberger Limited

- 10.15 Silixa Ltd.

- 10.16 Sumitomo Electric Industries, Ltd.

- 10.17 Yokogawa Electric Corporation