|

市場調查報告書

商品編碼

1766176

混合印刷系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hybrid Printing System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

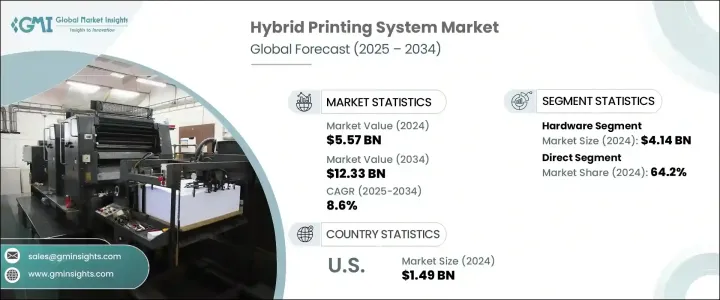

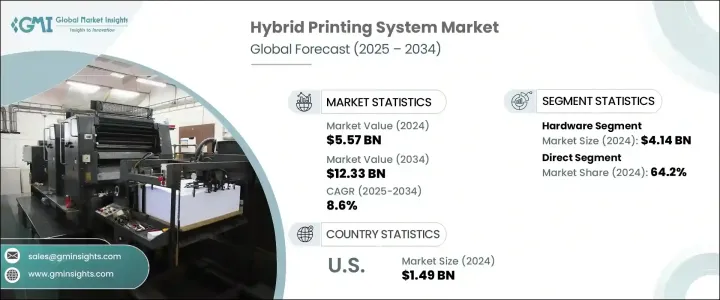

2024年,全球混合印刷系統市場規模達55.7億美元,預計到2034年將以8.6%的複合年成長率成長,達到123.3億美元。由於混合印刷能夠提供個人化、短版印刷和高速印刷,同時保持成本效益,多個行業對混合印刷的需求正在成長。個人護理、包裝商品和飲料等快節奏行業的企業正在轉向混合印刷系統,以客製化標籤和包裝來滿足即時行銷需求。透過將柔版印刷或凹版印刷等傳統類比技術與現代數位噴墨或墨粉系統相結合,這些解決方案支援靈活、大量生產,並縮短週轉時間。這種轉變正在重新定義包裝工作流程,並實現更快、更高品質的產出。

線上零售和智慧包裝的日益普及也提升了混合系統的吸引力。電子商務需要可追溯的品牌包裝,其中包含可掃描和安全元素——而混合印表機可以輕鬆處理這些功能。這些解決方案既能提升產品安全性,也能提升品牌知名度。除了包裝之外,混合系統還廣泛應用於時尚、標牌和廣告領域,這些領域需要快速的設計變更和客製化印刷。隨著這些應用的發展,混合印刷已成為高效率滿足複雜印刷需求的重要工具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 55.7億美元 |

| 預測值 | 123.3億美元 |

| 複合年成長率 | 8.6% |

硬體組件領域在2024年創造了41.4億美元的產值,預計到2034年將以8.5%的複合年成長率成長。隨著混合印刷市場的擴張,製造商正在大力投資強大且適應性強的硬體系統,這些系統能夠將類比可靠性與數位精度相結合。印刷機架構、油墨管理和列印頭方面的創新正在突破界限,從而提高品質和生產效率。這些升級對於滿足紡織、包裝和行銷等行業不斷變化的需求至關重要,因為這些行業對正常運行時間、速度和準確性的要求不容置疑。

2024年,直銷通路佔了64.2%的市場佔有率,預計2025年至2034年期間的複合年成長率將達到8.4%。這一成長歸因於買家在購買混合印表機等複雜系統時,更重視個人化服務和深入的技術指導。直銷模式能夠提供客製化的入門指導和維護計劃,並簡化軟體和硬體之間的整合。無需中介機構也簡化了溝通,縮短了支援回應時間,並增強了買家關係。擴大使用數位平台進行產品教育和客戶支持,也增強了直銷模式在該領域的吸引力。

2024年,美國混合印刷系統市場規模達14.9億美元,預計2034年將以8.7%的複合年成長率成長。美國憑藉其高度發展的製造業、對新技術的早期應用,以及醫療保健、消費品和商業印刷等各領域對高效、可定製印刷解決方案日益成長的需求,引領了這一區域市場。產業先鋒的湧現和強大的研發實力鞏固了這一領先地位。美國國內企業持續部署自動化工具、模組化印刷解決方案和人工智慧增強型工作流程,進一步鞏固了其在混合印刷創新和應用領域的主導地位。

業界頂尖企業包括富士軟片、惠普(HP Indigo)、得世特(Durst)、博斯特(Bobst)、柯尼卡美能達、MPS Systems、多米諾印刷科學、紐博泰(Nilpeter)、佳能、賽康(Xeikon)、Screen Graphic Solutions、歐米特(Omet)、EFI、Bitam(海德堡)。為了保持競爭力,混合印刷系統市場的公司正專注於策略性產品創新和垂直整合。許多公司正在透過在更靠近需求中心的地方建立製造和服務設施來擴大其全球影響力。企業正在投資於方便用戶使用的設計改進、先進的墨水技術和可擴展的列印模組。與軟體供應商的合作有助於改善工作流程自動化和基於雲端的列印管理。此外,企業正在加強技術培訓和售後支援計劃,以期為客戶創造長期價值並建立品牌忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 短期、客製化印刷和高速操作的需求不斷成長

- 類比和數位技術的融合

- 電子商務和智慧包裝的成長

- 擴大在各行業的應用

- 產業陷阱與挑戰

- 技術複雜性和整合問題

- 維護和營運成本

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS 編碼 - 8443)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- Industry structure and concentration

- Competitive intensity assessment

- 公司市佔率分析

- 競爭定位矩陣

- 產品定位

- 性價比定位

- 地理分佈

- 創新能力

- 戰略儀表板

- Competitive benchmarking

- Strategic initiatives assessment

- SWOT analysis of key players

- 未來競爭前景

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 傳統印刷

- 非擊打式印刷

第6章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 軟體

- 服務

第7章:市場估計與預測:依自動化水平,2021 - 2034 年

- 主要趨勢

- 手動混合印刷系統

- 半自動混合印刷系統

- 全自動混合印刷系統

第8章:市場估計與預測:依油墨類型,2021 - 2034 年

- 主要趨勢

- UV油墨

- 溶劑型墨水

- 水性墨水

- 乳膠墨水

- 熱昇華墨水

第9章:市場預估與預測:依基材類型,2021 - 2034

- 主要趨勢

- 紙

- 塑膠薄膜

- 箔

- 紡織品/布料

- 玻璃

- 其他(金屬板、瓦楞紙板/紙板)

第10章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- LED UV混合印刷

- 傳統UV混合印刷

- 柔印噴墨混合

- 柔版印刷-墨粉混合

- 螢幕-DTG(直接成衣)混合

- 螢幕-DTF(直接製片)混合

- 膠印噴墨混合

- 膠印墨粉混合

- 加減混合

- 多材料混合系統

第 11 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 標籤

- 軟包裝

- 折疊紙盒

- 瓦楞包裝

- 行銷資料

- 書籍和出版物

- 時尚紡織品

- 家紡

- 其他(安全印刷、玻璃印刷)

第 12 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 快速消費品

- 製藥

- 紡織服裝

- 汽車

- 電子產品

- 其他(零售和電子商務)

第 13 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 14 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第15章:公司簡介

- Bobst

- Canon

- Domino Printing Sciences

- Durst

- EFI

- Fujifilm

- Gallus (a Heidelberg company)

- HP (HP Indigo)

- Konica Minolta

- Mark Andy

- MPS Systems

- Nilpeter

- Omet

- Screen Graphic Solutions

- Xeikon

The Global Hybrid Printing System Market was valued at USD 5.57 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 12.33 billion by 2034. Demand for hybrid printing is rising across multiple sectors due to its ability to offer personalized, short-run, and high-speed printing, all while maintaining cost-effectiveness. Businesses in fast-paced industries like personal care, packaged goods, and beverages are turning to hybrid systems to meet real-time marketing demands with custom labeling and packaging. By merging traditional analog technologies such as flexographic or gravure printing with modern digital inkjet or toner systems, these solutions support flexible, high-volume production with reduced turnaround. This shift is redefining packaging workflows and enabling faster, higher-quality outputs.

The increasing popularity of online retail and smart packaging has also boosted the appeal of hybrid systems. E-commerce requires traceable, branded packaging that includes scannable and secure elements-functions that hybrid printers can handle with ease. These solutions enhance both product security and brand visibility. Beyond packaging, hybrid systems are being widely used in fashion, signage, and advertising, where rapid design changes and custom prints are routine. As these applications evolve, hybrid printing becomes a vital tool to meet complex printing requirements efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.57 Billion |

| Forecast Value | $12.33 Billion |

| CAGR | 8.6% |

The hardware component segment generated USD 4.14 billion in 2024 and is anticipated to grow at a CAGR of 8.5% through 2034. As the market for hybrid printing expands, manufacturers are investing heavily in robust and adaptable hardware systems capable of merging analog reliability with digital precision. Innovations in press architecture, ink management, and print heads are pushing boundaries to deliver enhanced quality and production efficiency. These upgrades are critical to meeting the evolving needs of sectors like textiles, packaging, and marketing, where uptime, speed, and accuracy are non-negotiable.

The direct sales channel segment accounted for 64.2% share in 2024 and is forecasted to grow at a CAGR of 8.4% between 2025 and 2034. This growth is attributed to the value buyers place on personalized service and deep technical guidance when purchasing complex systems like hybrid printers. Selling directly allows for tailored onboarding, maintenance plans, and easier integration between the software and hardware. The absence of intermediaries also streamlines communication, enhances support response time, and strengthens buyer relationships. Increasing use of digital platforms for product education and customer support is also reinforcing the appeal of direct-to-customer sales in this space.

United States Hybrid Printing System Market was valued at USD 1.49 billion in 2024 and is estimated to grow at a CAGR of 8.7% through 2034. The U.S. leads this regional segment due to its highly developed manufacturing sector, early adoption of new technologies, and increasing demand for efficient, customizable print solutions across varied fields like healthcare, consumer goods, and commercial printing. The presence of industry pioneers and strong R&D backing contributes to this leadership. Domestic businesses continue to implement automation tools, modular printing solutions, and AI-enhanced workflows, further supporting the country's dominance in hybrid printing innovation and implementation.

Top industry players include Fujifilm, HP (HP Indigo), Durst, Bobst, Konica Minolta, MPS Systems, Domino Printing Sciences, Nilpeter, Canon, Xeikon, Screen Graphic Solutions, Omet, EFI, Gallus (a Heidelberg company), Mark Andy. To stay competitive, companies in the hybrid printing system market are focusing on strategic product innovation and vertical integration. Many are expanding their global footprints by launching manufacturing and service facilities closer to demand centers. Firms are investing in user-friendly design improvements, advanced ink technologies, and scalable print modules. Partnerships with software vendors help improve workflow automation and cloud-based print management. Additionally, players are ramping up technical training and after-sales support programs to create long-term value for customers and build brand loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for short-run, customizable printing and high-speed operation

- 3.2.1.2 Integration of analog and digital technologies

- 3.2.1.3 Growth in e-commerce and smart packaging

- 3.2.1.4 Expanding use in various industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Technical complexity and integration issues

- 3.2.2.2 Maintenance and operational costs

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code - 8443)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.1.1 Industry structure and concentration

- 4.1.2 Competitive intensity assessment

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.3.1 Product positioning

- 4.3.2 Price-performance positioning

- 4.3.3 Geographic presence

- 4.3.4 Innovation capabilities

- 4.4 Strategic dashboard

- 4.4.1 Competitive benchmarking

- 4.4.1.1 Manufacturing capabilities

- 4.4.1.2 Product portfolio strength

- 4.4.1.3 Distribution network

- 4.4.1.4 R&D investments

- 4.4.2 Strategic initiatives assessment

- 4.4.3 SWOT analysis of key players

- 4.4.1 Competitive benchmarking

- 4.5 Future competitive outlook

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Conventional printing

- 5.3 Non-Impact printing

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates & Forecast, By Automation Level, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Manual hybrid printing systems

- 7.3 Semi-automated hybrid printing systems

- 7.4 Fully automated hybrid printing systems

Chapter 8 Market Estimates & Forecast, By Ink Type, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 UV-based ink

- 8.3 Solvent-based ink

- 8.4 Aqueous ink

- 8.5 Latex ink

- 8.6 Dye sublimation ink

Chapter 9 Market Estimates & Forecast, By Substrate Type, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Paper

- 9.3 Plastic films

- 9.4 Foils

- 9.5 Textiles/Fabrics

- 9.6 Glass

- 9.7 Others (Metal sheets, Corrugated boards/Cardboard)

Chapter 10 Market Estimates & Forecast, By Technology, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 LED UV hybrid printing

- 10.3 Conventional UV hybrid printing

- 10.4 Flexo-inkjet hybrid

- 10.5 Flexo-toner hybrid

- 10.6 Screen-DTG (Direct to Garment) hybrid

- 10.7 Screen-DTF (Direct to Film) hybrid

- 10.8 Offset-inkjet hybrid

- 10.9 Offset-toner hybrid

- 10.10 Additive-subtractive hybrid

- 10.11 Multi-material hybrid systems

Chapter 11 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Labels

- 11.3 Flexible packaging

- 11.4 Folding cartons

- 11.5 Corrugated packaging

- 11.6 Marketing materials

- 11.7 Books and publications

- 11.8 Fashion textiles

- 11.9 Home textiles

- 11.10 Other (Security printing, Glass printing)

Chapter 12 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 FMCG

- 12.3 Pharmaceutical

- 12.4 Textile and apparel

- 12.5 Automotive

- 12.6 Electronics

- 12.7 Other (Retail and E-commerce)

Chapter 13 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Direct

- 13.3 Indirect

Chapter 14 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 UK

- 14.3.3 France

- 14.3.4 Italy

- 14.3.5 Spain

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 India

- 14.4.3 Japan

- 14.4.4 South Korea

- 14.4.5 Australia

- 14.4.6 Indonesia

- 14.4.7 Malaysia

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.6 MEA

- 14.6.1 Saudi Arabia

- 14.6.2 UAE

- 14.6.3 South Africa

Chapter 15 Company Profiles

- 15.1 Bobst

- 15.2 Canon

- 15.3 Domino Printing Sciences

- 15.4 Durst

- 15.5 EFI

- 15.6 Fujifilm

- 15.7 Gallus (a Heidelberg company)

- 15.8 HP (HP Indigo)

- 15.9 Konica Minolta

- 15.10 Mark Andy

- 15.11 MPS Systems

- 15.12 Nilpeter

- 15.13 Omet

- 15.14 Screen Graphic Solutions

- 15.15 Xeikon