|

市場調查報告書

商品編碼

1766173

鳥氨酸轉氨甲醯酶缺乏症治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ornithine Transcarbamylase Deficiency Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

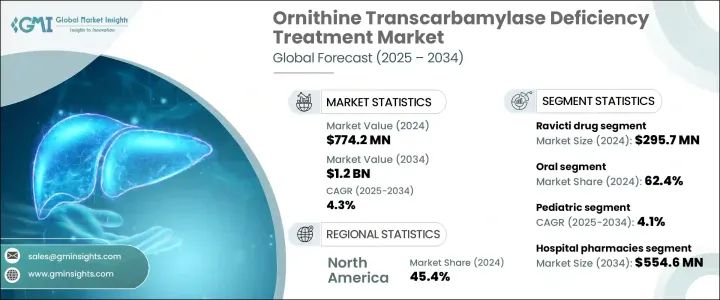

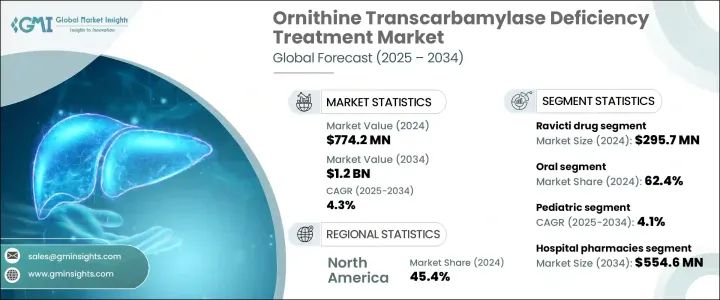

2024年,全球鳥氨酸轉氨甲醯酶缺乏症治療市場規模達7.742億美元,預計到2034年將以4.3%的複合年成長率成長,達到12億美元。尿素循環障礙(UCD)發病率的上升以及精準醫療和基因療法的持續創新推動了市場擴張。醫療保健專業人員和患者意識的提高,以及更先進的診斷工具,有助於提高疾病的檢出率並擴大治療需求。晚髮型病例(尤其是女性)的增多,正在擴大患者群體並刺激需求。

包括基因編輯技術、酵素替代療法和肝臟靶向小分子在內的新一代療法的開發,正得到大量研究和臨床試驗投入的支持。包括孤兒藥資格認定、財政誘因和加速核准流程在內的有利監管框架,正在進一步推動市場發展。醫療保健產業的這一領域專注於治療一種罕見遺傳性疾病,這種疾病會導致尿素循環受損,導致血氨水平升高,這種疾病通常危及生命,需要持續治療。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.742億美元 |

| 預測值 | 12億美元 |

| 複合年成長率 | 4.3% |

Ravicti 部門在 2024 年的營收為 2.957 億美元。該部門受益於其易用性和更高的耐受性,尤其受到兒童和老年人的青睞。其使用者友善的配方增強了治療依從性,這是管理慢性終身疾病的關鍵因素。該療法已在多個地區獲得監管部門的批准,提高了其在各個醫療體系中的可及性和應用率。其兒科用藥的核准顯著擴大了適用人群,鞏固了該部門的整體主導地位。

2024年,口服治療領域佔了62.4%的市場。口服給藥的偏好源於其便捷性,以及能夠減少對頻繁就診的依賴,這對於需要持續照護的疾病管理至關重要。緩釋技術等藥物製劑的進步提高了口服藥物的療效,使其與靜脈注射藥物相媲美。這項進步不僅提高了患者的依從性,也使得更個人化的給藥策略成為可能,促進了口服非處方藥的更廣泛應用。

2024年,美國鳥氨酸轉氨甲醯酶缺乏症治療市場規模達3.156億美元。美國高額的醫療保健支出確保了患有非處方藥(OTC)缺乏症等罕見疾病的患者能夠獲得更多治療選擇。製藥開發商、研究機構和生物技術公司之間的合作正在加速該領域的創新。此外,《孤兒藥法案》等支持性措施正在鼓勵罕見疾病療法的開發和更快的批准。政府資助和激勵計畫在推動研究和提供救命療法方面繼續發揮關鍵作用。

影響全球鳥氨酸轉氨甲醯酶缺乏症治療市場的關鍵參與者包括 Ultragenyx Pharmaceutical、雅培實驗室、博士倫斯醫療集團、Arcturus Therapeutics、紐迪希亞(達能集團)、美贊臣(利潔時)、Acer Therapeutics、OrphanPacific、雀巢和安進。為鞏固市場地位,鳥氨酸轉氨甲醯酶缺乏症治療市場的公司正專注於多項策略性措施。這些舉措包括加速創新基因療法和酵素替代解決方案的臨床開發、投資合作夥伴關係和許可交易以擴大全球可及性、以及透過孤兒藥資格認定確保監管優勢。許多公司也正在加強患者支持計畫以提高治療依從性,並建立製造能力以確保穩定的供應鏈。此外,他們還透過瞄準新興市場並與區域衛生機構合作以改善診斷和早期干預策略來擴大地域覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 提高對早期發現OTC缺陷的認知

- 危及生命的疾病尚未滿足的醫療需求很高

- 公共和私人保險公司提供強力的保險和報銷

- 產業陷阱與挑戰

- 核准療法的可用性有限

- 治療費用高昂

- 產業陷阱與挑戰

- 新生兒篩檢擴大,診斷率提高

- 專科藥房和罕見疾病基礎設施日益普及

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 未來市場趨勢

- 管道分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 重點發展

- 併購

- 夥伴關係和合作

- 新產品發布

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 丁苯

- 拉維奇蒂

- 阿蒙努爾

- 膳食補充劑

- 其他產品

第6章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 靜脈

第7章:市場估計與預測:依年齡層,2021 年至 2034 年

- 主要趨勢

- 兒科

- 成年人

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott Laboratories

- Acer Therapeutics

- Amgen

- Arcturus Therapeutics

- Bausch Health Companies

- Nutricia (Danone Group)

- Mead Johnson (Reckitt Benckiser)

- Nestle

- OrphanPacific

- Ultragenyx Pharmaceutical

The Global Ornithine Transcarbamylase Deficiency Treatment Market was valued at USD 774.2 million in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 1.2 billion by 2034. Market expansion is being driven by the rising incidence of urea cycle disorders (UCDs) and continued innovation in precision medicine and gene therapies. Increased awareness among healthcare professionals and patients, along with more advanced diagnostic tools, are contributing to higher detection rates and broader treatment needs. A growing number of late-onset cases, particularly in females, is expanding the patient base and fueling demand.

The development of next-generation therapies, including gene editing technologies, enzyme replacement treatments, and liver-targeted small molecules, is being supported by significant investments in research and clinical trials. A favorable regulatory framework, including orphan drug designations, financial incentives, and accelerated approval processes, is further propelling the market forward. This segment of the healthcare industry focuses on therapies that address a rare genetic disorder where the urea cycle is impaired, leading to elevated ammonia levels in the bloodstream, an often life-threatening condition requiring ongoing management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $774.2 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 4.3% |

The Ravicti segment generated USD 295.7 million in 2024. This segment benefits from strong patient preference due to its ease of use and improved tolerability, especially for children and the elderly. Its user-friendly formulation enhances treatment adherence, a crucial factor in managing chronic, lifelong conditions. The therapy has gained regulatory approval across several regions, increasing its accessibility and uptake across various healthcare systems. Its approval for pediatric use has notably expanded the eligible population, contributing to the segment's overall dominance.

The oral treatments segment held a 62.4% share in 2024. The preference for oral administration stems from its convenience and ability to reduce dependency on frequent hospital visits, which is essential for managing a condition that requires continuous care. Advancements in pharmaceutical formulations, such as extended-release technologies, have improved the therapeutic effectiveness of oral medications, making them comparable to intravenous options. This progress not only enhances patient compliance but also allows for more personalized dosing strategies, contributing to the broader adoption of oral OTC treatments.

United States Ornithine Transcarbamylase Deficiency Treatment Market was valued at USD 315.6 million in 2024. High healthcare spending in the country ensures greater access to treatment options for patients dealing with rare conditions like OTC deficiency. Collaborative efforts among pharmaceutical developers, research institutes, and biotechnology firms are accelerating innovation in this space. Additionally, supportive initiatives such as the Orphan Drug Act are encouraging the development and faster approval of therapies targeting rare diseases. Government funding and incentive programs continue to play a critical role in advancing research and the availability of life-saving treatments.

Key players shaping the Global Ornithine Transcarbamylase Deficiency Treatment Market include Ultragenyx Pharmaceutical, Abbott Laboratories, Bausch Health Companies, Arcturus Therapeutics, Nutricia (Danone Group), Mead Johnson (Reckitt Benckiser), Acer Therapeutics, OrphanPacific, Nestle, and Amgen. To strengthen their market positions, companies in the ornithine transcarbamylase deficiency treatment market are focusing on several strategic initiatives. These include accelerating clinical development of innovative gene therapies and enzyme replacement solutions, investing in partnerships and licensing deals to expand global access, and securing regulatory advantages through orphan drug designations. Many firms are also enhancing patient support programs to increase treatment adherence and building manufacturing capabilities to ensure steady supply chains. Additionally, they are broadening their geographic footprint by targeting emerging markets and aligning with regional health agencies to improve diagnosis and early intervention strategies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.1.1 Key market trends

- 2.1.2 Regional

- 2.1.3 Product

- 2.1.4 Route of administration

- 2.1.5 Age group

- 2.1.6 Distribution channel

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased awareness for earlier detection of OTC deficiency

- 3.2.1.2 High unmet medical need for life-threatening condition

- 3.2.1.3 Strong insurance and reimbursement by public and private insurers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited availability of approved therapies

- 3.2.2.2 High cost of treatment

- 3.2.3 Industry pitfalls and challenges

- 3.2.3.1 Increasing diagnosis rates due to expanded newborn screening

- 3.2.3.2 Growing availability of specialty pharmacies and rare disease infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Pipeline analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key development

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New Product Launches

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Buphenyl

- 5.3 Ravicti

- 5.4 Ammonul

- 5.5 Dietary supplements

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Intravenous

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pediatrics

- 7.3 Adults

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Acer Therapeutics

- 10.3 Amgen

- 10.4 Arcturus Therapeutics

- 10.5 Bausch Health Companies

- 10.6 Nutricia (Danone Group)

- 10.7 Mead Johnson (Reckitt Benckiser)

- 10.8 Nestle

- 10.9 OrphanPacific

- 10.10 Ultragenyx Pharmaceutical