|

市場調查報告書

商品編碼

1766169

神經導管、神經包覆及神經移植修復產品市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

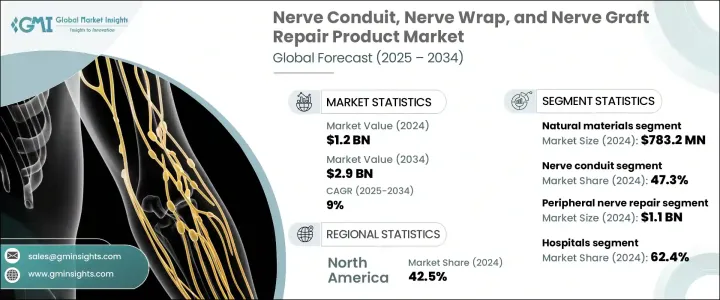

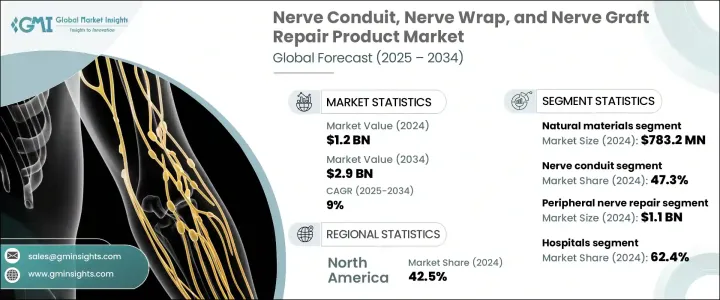

2024年,全球神經導管、神經包覆和神經移植修復產品市場價值為12億美元,預計2034年將以9%的複合年成長率成長,達到29億美元。推動此市場發展的因素包括:周邊神經損傷病例的增加、生物材料的進步、對神經保留方案日益成長的偏好,以及對神經修復醫療器材的監管支持。由於事故、創傷、手術和人口老化等因素,發生在大腦和脊髓以外的周邊神經損傷病例正在增加。這些損傷通常影響上肢,並且常常導致運動或感覺功能喪失、疼痛以及長期的社會心理影響。

道路交通事故、工傷、運動相關事故以及穿透性創傷的發生率日益上升,顯著增加了對涉及神經導管、神經繃帶和神經移植的外科手術的需求。這些損傷通常會導致周邊神經大面積損傷,尤其是在四肢,由於神經缺口的大小或位置,直接縫合變得非常困難。在這種情況下,神經修復產品(例如神經導管、神經繃帶和神經移植)是恢復功能和促進神經再生的重要解決方案。道路交通事故已成為周邊神經損傷的主要原因,因為撞擊力通常會導致關鍵神經通路受到嚴重損傷。同樣,工傷,包括在工廠或建築工地等高風險環境中的工傷,仍然是神經損傷的主要原因,尤其是在體力勞動者中。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 29億美元 |

| 複合年成長率 | 9% |

2024年,神經導管領域佔最大佔有率,達47.3%。神經導管因其易於使用且能夠修復小至中等程度的神經缺損,在臨床應用上備受青睞。這些裝置提供了一種創傷較小、無張力的替代自體移植的方法,而自體移植更為複雜,且常常導致供體部位出現併發症。神經導管作為引導軸突穿過神經缺損的通道,確保神經正常再生。神經導管的應用日益廣泛,尤其是在用於修復那些因缺損過小而無法進行移植的神經缺損時,這顯著推動了市場擴張。

2024年,天然材料細分市場收入達7.832億美元,這得益於其與生物系統卓越的兼容性以及增強組織整合的能力。這些材料在促進最佳神經再生方面發揮關鍵作用,因為它們與人體的自然結構高度相似,比合成材料更能促進癒合。膠原蛋白、去細胞細胞外基質 (ECM) 和經過處理的人體同種異體移植物等天然材料因其能夠為軸突生長創造有利的微環境而受到青睞。

2024年,美國神經導管、神經包紮和神經移植修復產品市場規模達4.611億美元,主要得益於創傷護理、整形重建手術、骨科手術以及道路交通事故導致的神經損傷高發生率。 FDA批准的神經移植、導管和神經包紮產品的普及,加上神經修復的優惠報銷政策,推動了這些產品在全美各地醫院和門診的普及。

神經導管、神經包覆和神經移植修復產品市場的領先公司包括 Axogen、Axolotl Biologix、BioCircuit Technologies、Checkpoint Surgical、Collagen Matrix、Cook Group、Integra LifeSciences、KeriMedical、Medovent、Newrotex、Orthocell、Polyganics、Skerces、KeriMedical、Medovent、Newrotex、Orthocell、Polyganics、Skertry Corporation、Synovis 和 Tooboy's。為了鞏固市場地位,神經導管、神經包裹和神經移植修復領域的公司正致力於擴大產品供應,並開發創新解決方案,以滿足周邊神經損傷患者不斷變化的需求。許多公司正在投資研發,以改善神經修復產品的功能和性能,重點是增強組織整合和神經再生的生物材料。此外,與醫院和醫療保健提供者的策略合作夥伴關係以及與學術機構的合作正在幫助公司提升其技術能力和臨床知識。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 周邊神經損傷發生率上升

- 生物材料的進展

- 臨床越來越傾向於選擇保留神經的替代方案

- 支持性監管批准

- 產業陷阱與挑戰

- 產品成本高

- 缺乏長期療效的臨床證據

- 市場機會

- 下一代生物工程移植物的成長

- 癌症切除和牙科手術的增加

- 成長動力

- 成長潛力分析

- 專利分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 定價分析

- 依產品類型

- 按地區

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 神經導管

- 神經包裹

- 神經移植

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 天然材質

- 合成材料

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 周邊神經修復

- 牙科應用

- 中樞神經修復

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 學術研究機構

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Axogen

- Axolotl Biologix

- BioCircuit Technologies

- Checkpoint Surgical

- Collagen Matrix

- Cook Group

- Integra LifeSciences

- KeriMedical

- Medovent

- Newrotex

- Orthocell

- Polyganics

- Stryker Corporation

- Synovis

- Toyobo

The Global Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 2.9 billion by 2034. This market is driven by a growing number of peripheral nerve injuries, advances in biomaterials, an increasing preference for nerve-sparing solutions, and regulatory support for medical devices used in nerve repair. Peripheral nerve injuries, which occur outside of the brain and spinal cord, are on the rise due to factors such as accidents, trauma, surgeries, and an aging population. These injuries commonly affect the upper limbs and often lead to loss of motor or sensory function, pain, and long-term psychosocial impacts.

The growing frequency of road traffic accidents, workplace injuries, sports-related accidents, and penetrating trauma has significantly amplified the demand for surgical interventions involving nerve conduits, wraps, and grafts. These injuries often result in extensive damage to peripheral nerves, particularly in the limbs, where direct suturing becomes challenging due to the size or location of the nerve gap. In such cases, nerve repair products like conduits, wraps, and grafts offer an essential solution for restoring functionality and promoting nerve regeneration. Road traffic accidents have become a major contributor to peripheral nerve injuries, as the force of impact often leads to severe trauma in critical nerve pathways. Similarly, workplace injuries, including those in high-risk environments such as factories or construction sites, continue to be a leading cause of nerve damage, especially among manual laborers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 9% |

The nerve conduit segment held the largest share of 47.3% in 2024. Conduits are favored in clinical settings for their ease of use and ability to repair small to moderate nerve gaps. These devices provide a less invasive, tension-free alternative to autografts, which are more complex and often lead to complications at the donor site. Nerve conduits serve as channels that guide axons through nerve gaps, ensuring proper nerve regeneration. The growing adoption of conduits, especially for nerve gaps that are too small for grafts, has significantly driven market expansion.

The natural materials segment generated USD 783.2 million in 2024, driven by their superior compatibility with biological systems and their ability to enhance tissue integration. These materials play a critical role in facilitating optimal nerve regeneration, as they closely mimic the body's natural structure, promoting more effective healing than synthetic alternatives. Natural materials like collagen, decellularized extracellular matrices (ECM), and processed human allografts are preferred for their ability to create a conducive microenvironment for axonal growth.

U.S. Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market was valued at USD 461.1 million in 2024, driven by the high incidence of nerve injuries resulting from trauma care, plastic and reconstructive surgeries, orthopedic procedures, and road traffic accidents. The availability of FDA-approved nerve grafts, conduits, and wraps, coupled with favorable reimbursement policies for nerve repair, has helped drive the adoption of these products in hospitals and outpatient clinics across the country.

Leading companies in the Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market include Axogen, Axolotl Biologix, BioCircuit Technologies, Checkpoint Surgical, Collagen Matrix, Cook Group, Integra LifeSciences, KeriMedical, Medovent, Newrotex, Orthocell, Polyganics, Stryker Corporation, Synovis, and Toyobo. To strengthen their market position, companies in the nerve conduit, nerve wrap, and nerve graft repair sectors are focusing on expanding their product offerings and developing innovative solutions that cater to the evolving needs of patients with peripheral nerve injuries. Many companies are investing in research and development to improve the functionality and performance of nerve repair products, with an emphasis on biomaterials that enhance tissue integration and nerve regeneration. Additionally, strategic partnerships with hospitals and healthcare providers, along with collaborations with academic institutions, are helping companies advance their technological capabilities and clinical knowledge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Treatment

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of peripheral nerve injuries

- 3.2.1.2 Advancements in biomaterials

- 3.2.1.3 Growing clinical preference for nerve-sparing alternatives

- 3.2.1.4 Supportive regulatory approvals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of product

- 3.2.2.2 Lack of clinical evidence for long term outcomes

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in next-generation bioengineered grafts

- 3.2.3.2 Rise in post-cancer resection and dental surgery

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis

- 3.7.1 By Product type

- 3.7.2 By Region

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Nerve conduit

- 5.3 Nerve wrap

- 5.4 Nerve grafts

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Natural materials

- 6.3 Synthetic materials

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Peripheral nerve repair

- 7.3 Dental applications

- 7.4 Central nerve repair

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Academic research institutions

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Axogen

- 10.2 Axolotl Biologix

- 10.3 BioCircuit Technologies

- 10.4 Checkpoint Surgical

- 10.5 Collagen Matrix

- 10.6 Cook Group

- 10.7 Integra LifeSciences

- 10.8 KeriMedical

- 10.9 Medovent

- 10.10 Newrotex

- 10.11 Orthocell

- 10.12 Polyganics

- 10.13 Stryker Corporation

- 10.14 Synovis

- 10.15 Toyobo