|

市場調查報告書

商品編碼

1766168

碳纖維包裹(建築)市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Carbon Fiber Wraps (Construction) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

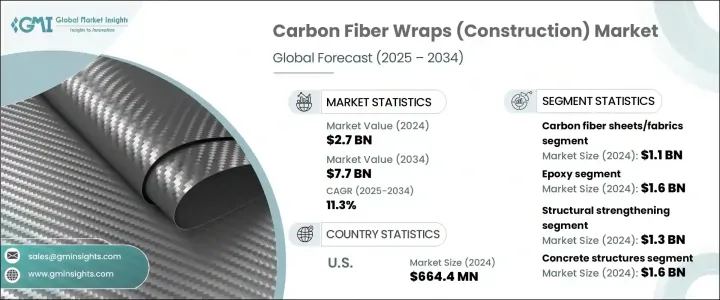

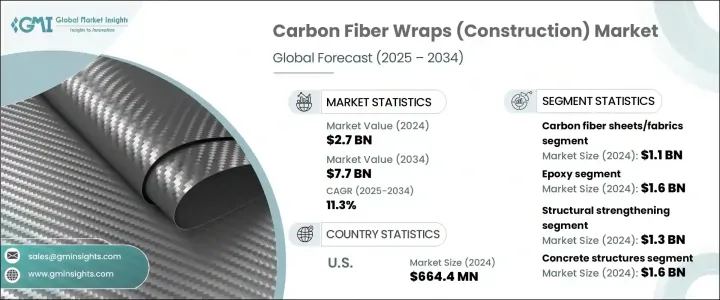

2024年,全球碳纖維纏繞(建築)市場規模達27億美元,預計2034年將以11.3%的複合年成長率成長,達到77億美元。這一強勁成長的動力源自於已開發經濟體和新興經濟體對加固和修復老化基礎設施的迫切需求。隨著無數橋樑、建築和交通網路因年久失修而老化,各國政府和私人開發商擴大選擇碳纖維纏繞,將其作為更實用、破壞性更小的替代方案,而非全面更換。碳纖維纏繞應用更便利、成本更低、週轉更迅速,使其成為結構升級的理想選擇。

碳纖維布重量輕、耐腐蝕,且能夠在不改變原有建築特徵的情況下提供持久的加固,使其特別適用於限制通行或敏感的建築區域。在地震多發地區,隨著監管框架的更新,對防震工作的日益重視進一步推動了其應用。碳纖維包裹層可提高結構的柔韌性和抗剪力,顯著增強其抗災能力。這些因素持續推動穩定的市場需求,尤其是在基礎設施改造和結構修復領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 27億美元 |

| 預測值 | 77億美元 |

| 複合年成長率 | 11.3% |

碳纖維片材和織物市場在2024年創收11億美元,預計2025年至2034年的複合年成長率將達到10.9%。在纖維類型中,這類產品因其易於安裝、強度重量比高以及與各種表面的兼容性而佔據主導地位。它們能夠在複雜的幾何形狀上成型,從而實現均勻的載荷分佈,使其成為加固梁、柱和板的理想選擇。這種形式廣泛應用於公共和私人基礎設施的維修和改造。其多功能性和適應性使其成為結構加固項目的首選解決方案。

環氧樹脂市場規模在2024年達到16億美元,預計在2025-2034年期間的複合年成長率將達到11.6%。環氧樹脂是碳纖維纏繞材料的主要黏合劑,因其高抗張強度、耐化學性和優異的黏合性能而備受青睞。其與多種結構基材的兼容性增強了纏繞材料的性能和長期結構完整性。環氧樹脂在抗震加固、結構加強和修復專案中的可靠性,持續支撐其市場領先地位。同時,聚氨酯和乙烯基酯樹脂在需要更高柔韌性或優異耐腐蝕性的應用中越來越受歡迎。聚氨酯非常適合結構承受變化載荷和熱條件的動態環境。

2024年,美國碳纖維纏繞材料(建築)市值達6.644億美元,預計2034年將以11%的複合年成長率成長。持續的基礎設施更新投資以及對現代安全和耐久性法規的嚴格遵守,推動了需求的激增。聯邦和州政府推出的旨在加固橋樑、公路和公共設施的舉措,也增加了先進材料的採用。此外,新材料在建築改造的應用,以及創新建築公司的湧現,也進一步推動了市場的發展。美國先進的工程技術也促進了碳纖維纏繞材料在新建和修復工程中的使用率不斷上升。

全球碳纖維纏繞(建築)市場的領先公司包括馬貝集團、三菱化學株式會社、西卡股份公司、帝人株式會社和東麗株式會社。為了鞏固其市場地位,碳纖維纏繞(建築)領域的主要參與者正在採用多種策略。該公司正在投資研發,以提高樹脂相容性、增強黏合性能並延長纏繞材料的使用壽命。他們還與建築公司和基礎設施承包商建立策略合作夥伴關係,以加速專案部署並擴大市場範圍。各公司正在擴展其產品線,包括不同的纖維編織和客製化樹脂系統,以滿足不同的結構要求。此外,許多公司正在透過開發環保樹脂和推廣低碳建築實踐來強調永續性。培訓計劃和技術支援服務正在不斷擴展,以幫助最終用戶有效地採用這些系統。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依纖維類型,2021 - 2034 年

- 主要趨勢

- 碳纖維片材/織物

- 碳纖維帶

- 碳纖維棒

- 預固化碳纖維層壓板

- 其他

第6章:市場估計與預測:按樹脂類型,2021 - 2034

- 主要趨勢

- 環氧樹脂

- 聚氨酯

- 乙烯基酯

- 聚酯纖維

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 結構加固

- 抗彎加固

- 剪切強化

- 柱約束

- 軸向強化

- 抗震加固

- 修復和維修

- 腐蝕損傷修復

- 撞擊損傷修復

- 火災損壞修復

- 防爆

- 其他

第8章:市場估計與預測:按結構類型,2021 - 2034 年

- 主要趨勢

- 混凝土結構

- 磚石結構

- 鋼結構

- 木結構

- 其他

第9章:市場估計與預測:依最終用途領域,2021 - 2034 年

- 主要趨勢

- 橋樑和高速公路

- 建築物和構築物

- 商業建築

- 住宅建築

- 工業建築

- 供水和廢水基礎設施

- 海洋結構物

- 歷史和遺產建築

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- Sika AG

- Mapei SpA

- Fyfe Co. LLC (Aegion Corporation)

- Simpson Strong-Tie Company Inc.

- Master Builders Solutions (MBCC Group)

- SGL Carbon SE

- Toray Industries, Inc.

- Mitsubishi Chemical Corporation

- Teijin Limited

- Hexcel Corporation

- Structural Technologies, LLC

- Composite Group Chelyabinsk

- Chomarat Group

- Owens Corning

- Nippon Steel Chemical Co., Ltd.

The Global Carbon Fiber Wraps (Construction) Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 7.7 billion by 2034. This robust growth is driven by the urgent need to strengthen and rehabilitate aging infrastructure across both developed and emerging economies. As countless bridges, buildings, and transportation networks deteriorate due to age, governments and private developers are increasingly turning to carbon fiber wraps as a more practical and less disruptive alternative to full-scale replacements. These wraps offer easier application, lower costs, and quicker turnaround, making them a favorable option for structural upgrades.

Their lightweight nature, corrosion resistance, and ability to deliver durable reinforcement without altering original architectural features make them especially suitable for limited-access or sensitive construction zones. In regions prone to seismic activity, the growing emphasis on earthquake preparedness has further boosted adoption, supported by updated regulatory frameworks. Carbon fiber wraps improve a structure's flexibility and resistance to shear forces, significantly enhancing its disaster resilience capabilities. These factors continue to drive steady market demand, especially in infrastructure retrofitting and structural rehabilitation sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 billion |

| Forecast Value | $7.7 billion |

| CAGR | 11.3% |

The carbon fiber sheets and fabrics segment generated USD 1.1 billion in 2024 and is projected to grow at a CAGR of 10.9% from 2025 to 2034. Within the fiber type category, these products dominate due to their ease of installation, high strength-to-weight ratio, and compatibility with various surfaces. Their ability to mold over complex geometries allows for uniform load distribution, making them ideal for reinforcing beams, columns, and slabs. This form is widely used in repair and retrofitting applications for both public and private infrastructure. Their versatility and adaptability position them as the preferred solution in structural enhancement projects.

The epoxy resin segment reached USD 1.6 billion in 2024 and is expected to grow at a CAGR of 11.6% during 2025-2034. Epoxy resins are the primary bonding agent for carbon fiber wraps, valued for their high tensile strength, chemical resistance, and excellent adhesion properties. Their compatibility with multiple structural substrates enhances the wrap's performance and long-term structural integrity. Epoxy's reliability in seismic retrofitting, structural reinforcement, and restoration projects continues to support its market leadership. Meanwhile, polyurethane and vinyl ester resins are gaining traction in applications that demand higher flexibility or superior corrosion resistance. Polyurethane is well-suited for dynamic environments where structures face variable loading and thermal conditions.

U.S. Carbon Fiber Wraps (Construction) Market was valued at USD 664.4 million in 2024 and is projected to grow at a CAGR of 11% through 2034. The surge in demand is fueled by continued investment in infrastructure renewal and strict compliance with modern safety and durability regulations. Federal and state-level initiatives aimed at strengthening bridges, highways, and public facilities have increased the adoption of advanced materials. Additionally, the integration of new materials in retrofitting and the presence of innovative construction companies further propel the market. The country's advanced engineering landscape also contributes to the rising use of carbon fiber wraps in both new and restoration projects.

Leading companies in the Global Carbon Fiber Wraps (Construction) Market include Mapei S.p.A., Mitsubishi Chemical Corporation, Sika AG, Teijin Limited, and Toray Industries, Inc. To reinforce their market positions, key players in the carbon fiber wraps (construction) sector are employing a combination of strategies. Companies are investing in R&D to improve resin compatibility, enhance bonding performance, and extend the lifespan of wrap materials. Strategic partnerships with construction firms and infrastructure contractors are also being formed to accelerate project deployment and boost market reach. Firms are expanding their product lines to include different fiber weaves and customized resin systems to suit varying structural requirements. In addition, many are emphasizing sustainability by developing environmentally friendly resins and promoting low-carbon construction practices. Training programs and technical support offerings are being expanded to help end-users adopt these systems efficiently.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fiber type

- 2.2.3 Resin type

- 2.2.4 Application

- 2.2.5 Structure type

- 2.2.6 End use sector

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Fiber Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Carbon fiber sheets/fabrics

- 5.3 Carbon fiber tapes

- 5.4 Carbon fiber rods

- 5.5 Pre-cured carbon fiber laminates

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Resin Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Epoxy

- 6.3 Polyurethane

- 6.4 Vinyl ester

- 6.5 Polyester

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Structural strengthening

- 7.2.1 Flexural strengthening

- 7.2.2 Shear strengthening

- 7.2.3 Column confinement

- 7.2.4 Axial strengthening

- 7.3 Seismic retrofitting

- 7.4 Rehabilitation and repair

- 7.4.1 Corrosion damage repair

- 7.4.2 Impact damage repair

- 7.4.3 Fire damage repair

- 7.5 Blast protection

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Structure Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Concrete structures

- 8.3 Masonry structures

- 8.4 Steel structures

- 8.5 Timber structures

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use Sector, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Bridges and highways

- 9.3 Buildings and structures

- 9.3.1 Commercial buildings

- 9.3.2 Residential buildings

- 9.3.3 Industrial buildings

- 9.4 Water and wastewater infrastructure

- 9.5 Marine structures

- 9.6 Historical and heritage structures

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Sika AG

- 11.2 Mapei S.p.A.

- 11.3 Fyfe Co. LLC (Aegion Corporation)

- 11.4 Simpson Strong-Tie Company Inc.

- 11.5 Master Builders Solutions (MBCC Group)

- 11.6 SGL Carbon SE

- 11.7 Toray Industries, Inc.

- 11.8 Mitsubishi Chemical Corporation

- 11.9 Teijin Limited

- 11.10 Hexcel Corporation

- 11.11 Structural Technologies, LLC

- 11.12 Composite Group Chelyabinsk

- 11.13 Chomarat Group

- 11.14 Owens Corning

- 11.15 Nippon Steel Chemical Co., Ltd.