|

市場調查報告書

商品編碼

1766165

廣播切換器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Broadcast Switchers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

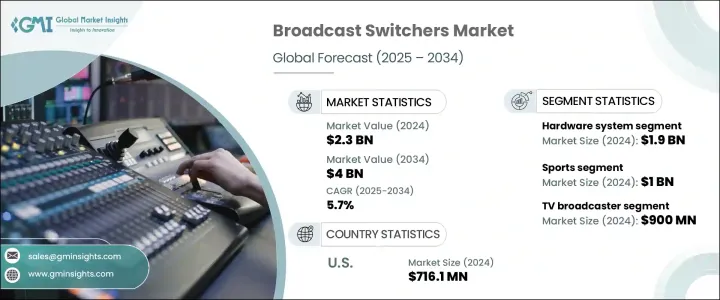

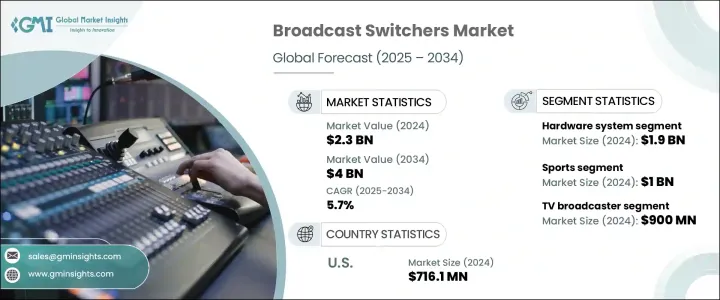

2024年,全球廣播切換器市場規模達23億美元,預計年複合成長率將達5.7%,2034年將達到40億美元。這一成長主要源於媒體消費的轉型,尤其是對直播、高解析度視訊內容和無縫多平台廣播體驗日益成長的需求。隨著數位內容交付的不斷發展,廣播切換器產業正見證著越來越多能夠在不同廣播環境中實現更高效能、靈活性和互通性的技術的採用。

推動市場發展的核心力量之一是影片製作和交付格局的不斷變化。隨著廣播公司適應快速變化的觀眾偏好,他們越來越依賴能夠支援高清格式、遠端製作工作流程和混合環境的切換器。這包括日益成長的雲端整合和基於 IP 的切換系統趨勢,這些系統能夠跨多設備進行即時、可擴展的視訊製作。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 40億美元 |

| 複合年成長率 | 5.7% |

廣播切換台對於簡化多源視訊輸入並提供無縫轉場、特效和直播至關重要,即使在企業網路研討會、線上活動和教育廣播等低階製作中,這些功能也必不可少。對緊湊、節能且方便用戶使用的切換台的需求也在不斷成長,尤其是在行動製作環境和遠端場所。此外,人工智慧驅動的自動化、即時場景識別和直覺的使用者介面等技術進步在提高直播內容製作的效率和準確性方面發揮著關鍵作用。

市場依系統細分為硬體和軟體。 2024年,硬體系統佔據主導地位,價值達19億美元。這種主導地位源於人們對具有高處理能力和耐用性的實體切換器日益成長的偏好,尤其是在戶外廣播和現場活動等高壓環境中。這些系統擴大被客製化以處理4K和8K等超高清格式,以確保與最新視訊標準相容。緊湊、模組化的硬體單元對於行動製作尤其重要,可在轉播車、攝影棚設置和實地拍攝等環境中提供多功能性。此外,人們對硬體切換器的興趣日益濃厚,因為它可以為小型營運(包括宗教活動、學術會議和企業串流媒體需求)提供經濟高效的解決方案。

從應用角度來看,體育賽事成為最大的貢獻者,2024 年的市場規模達到 10 億美元。隨著低延遲、多角度直播需求的日益成長,這一領域正經歷著強勁的發展勢頭。專業運動賽事轉播越來越需要能夠同時處理多台攝影機訊號,並支援 HDR 和 UHD 等格式以實現沉浸式觀看體驗的切換台。高效切換訊號並應用即時圖形和轉場效果的能力已成為滿足現代觀眾期望的關鍵。這些需求促使轉播專業人士投資於能夠提供卓越靈活性、快速反應時間和不間斷輸出的先進切換台。

以終端用戶分類,電視廣播公司在2024年領先市場,估值達9億美元。這一領先地位源於向高清和超高清內容交付標準的廣泛轉變。為了保持與數位平台的競爭力,廣播公司面臨更新其製作基礎設施的壓力,這促使他們加大對支援高品質即時視訊處理的切換台的投資。自動切換系統的部署也在增加,這減少了對手動操作的依賴,並縮短了新聞、天氣和脫口秀等直播內容的回應時間。先進的切換台如今已成為創建動態多源節目的核心,使廣播公司能夠提升製作質量,同時滿足日益成長的消費者期望。

從地理來看,美國在2024年以7.161億美元的收入領先全球市場。該國的主導地位得益於其對廣播基礎設施的大量投資以及先進製作工具的廣泛採用。本地廣播公司和製作公司高度重視提升視訊品質、速度和操作靈活性,這推動了對能夠跨平台和解析度運行的下一代切換器的需求。這些工具還有助於管理多樣化的內容輸出,確保為傳統觀眾和數位觀眾提供一致的品質。

廣播切換台市場的競爭格局由老牌產業領導者和新興企業組成。 Grass Valley、索尼集團、Blackmagic Design Pty. Ltd. 和 Ross Video Ltd. 這四大公司在 2024 年共佔據全球約 40% 的市場佔有率。這些公司正在積極開發 IP 原生和軟體定義的切換台,以滿足可擴展和遠端管理工作流程的需求。

這些市場領導者專注於低延遲 8K 切換、AI 驅動的製作工具和多平台輸出功能等創新技術。此外,製造商正在整合即時元資料標記、場景識別和模組化 I/O 配置等功能,以滿足演播室、新聞編輯室和現場製作環境中專業人士的多樣化需求。觸控螢幕控制介面、雲端同步和 AR 支援等功能正在成為許多產品線的標配,從而實現更智慧、更具互動性的影片製作體驗。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 直播和串流媒體需求不斷成長

- 基於雲端的廣播解決方案的採用日益增多

- OTT平台的擴展

- 增加對廣播基礎設施的投資

- 電子競技和遊戲廣播的興起

- 產業陷阱與挑戰

- 初期投資成本高

- 快速的技術變革

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按系統,2021 年至 2034 年

- 主要趨勢

- 硬體

- 軟體

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 運動的

- 訊息

- 現場娛樂

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 電視廣播員

- 有線和衛星電視提供商

- 製片公司

- 現場活動組織者

- 教育機構

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Blackmagic Design Pty. Ltd.

- Broadcast Pix Inc.

- Crestron Electronics, Inc.

- Datavideo

- FOR-A Company Limited.

- Grass Valley

- Panasonic Holdings Corporation

- PureLink

- Roland Corporation

- Ross Video LTD.

- Sony Group Corporation

- tvONE

The Global Broadcast Switchers Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 4 billion by 2034. This growth is largely driven by the transformation in media consumption, particularly the rising demand for live, high-resolution video content and seamless multi-platform broadcasting experiences. As digital content delivery continues to evolve, the broadcast switchers industry is witnessing increased adoption of technologies that allow for higher performance, flexibility, and interoperability across diverse broadcasting environments.

One of the central forces propelling the market forward is the changing landscape of video production and delivery. As broadcasters adapt to fast-evolving viewer preferences, they are increasingly relying on switchers capable of supporting high-definition formats, remote production workflows, and hybrid environments. This includes the growing trend of cloud integration and IP-based switching systems that enable real-time, scalable video production across multiple devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 5.7% |

Broadcast switchers are essential in streamlining multi-source video inputs and delivering seamless transitions, effects, and live feeds, which are now expected even in lower-tier productions such as corporate webinars, online events, and educational broadcasts. The demand for compact, energy-efficient, and user-friendly switchers is also on the rise, particularly in mobile production setups and remote locations. Additionally, advancements such as AI-driven automation, real-time scene recognition, and intuitive user interfaces are playing a key role in enhancing the efficiency and accuracy of live content production.

The market is segmented by system into hardware and software. In 2024, hardware systems dominated the segment with a value of USD 1.9 billion. This dominance stems from the increasing preference for physical switchers that offer high processing power and durability, especially in high-pressure environments like outdoor broadcasts and live events. These systems are increasingly tailored to handle ultra-high-definition formats such as 4K and 8K, ensuring compatibility with the latest video standards. Compact, modular hardware units are becoming particularly important for on-the-go production, offering versatility in environments like OB vans, studio setups, and field shoots. Moreover, there's growing interest in hardware switchers that provide cost-effective solutions for small-scale operations, including religious events, academic sessions, and corporate streaming needs.

When examined by application, the sports category emerged as the largest contributor, accounting for USD 1 billion in 2024. This segment is experiencing significant momentum as demand intensifies for low-latency, multi-angle live broadcasts. Professional sports broadcasting increasingly requires switchers capable of handling multiple camera feeds simultaneously while supporting formats such as HDR and UHD for immersive viewing. The ability to switch between feeds efficiently and apply real-time graphics and transitions has become essential to meet modern audience expectations. These needs are pushing broadcast professionals to invest in advanced switchers that provide superior flexibility, quick response times, and uninterrupted output.

By end user, TV broadcasters led the market in 2024, with a valuation of USD 900 million. This leadership is due to the widespread shift toward high-definition and ultra-HD content delivery standards. Broadcasters are under pressure to modernize their production infrastructure to stay competitive against digital platforms, prompting greater investment in switchers that allow high-quality, real-time video manipulation. The deployment of automated switching systems is also rising, reducing reliance on manual operations and improving response times for live content such as news, weather, and talk shows. Advanced switchers are now central to creating dynamic, multi-source programming, enabling broadcasters to elevate production quality while catering to growing consumer expectations.

Geographically, the United States led the global market with USD 716.1 million in revenue in 2024. The country's dominance is fueled by high investments in broadcast infrastructure and the widespread adoption of advanced production tools. Local broadcasters and production companies are heavily focused on enhancing video quality, speed, and operational flexibility, driving demand for next-generation switchers that can operate across various platforms and resolutions. These tools are also instrumental in managing diverse content outputs, ensuring consistent quality for both traditional and digital audiences.

The competitive landscape of the broadcast switchers market is marked by a mix of established industry leaders and emerging players. The top four companies-Grass Valley, Sony Group Corporation, Blackmagic Design Pty. Ltd., and Ross Video Ltd.-collectively held around 40% of the global market share in 2024. These companies are actively developing IP-native and software-defined switchers to meet the demand for scalable and remotely managed workflows.

Investment in innovations like low-latency 8K switching, AI-powered production tools, and multi-platform output capabilities is a key focus for these market leaders. Additionally, manufacturers are integrating features such as real-time metadata tagging, scene recognition, and modular I/O configurations to cater to the diverse needs of professionals operating in studios, newsrooms, and live production settings. Features like touchscreen control surfaces, cloud sync, and AR support are becoming standard across many product lines to enable smarter and more interactive video production experiences.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for live broadcasting & streaming

- 3.3.1.2 Growing adoption of cloud-based broadcast solutions

- 3.3.1.3 Expansion of OTT platforms

- 3.3.1.4 Increasing investments in broadcast infrastructure

- 3.3.1.5 Rise of esports and gaming broadcasting

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment cost

- 3.3.2.2 Rapid technological changes

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By System, 2021 – 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Sports

- 6.3 News

- 6.4 Live entertainment

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Tv broadcasters

- 7.3 Cable & satellite providers

- 7.4 Production houses

- 7.5 Live event organizers

- 7.6 Educational institutions

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Blackmagic Design Pty. Ltd.

- 9.2 Broadcast Pix Inc.

- 9.3 Crestron Electronics, Inc.

- 9.4 Datavideo

- 9.5 FOR-A Company Limited.

- 9.6 Grass Valley

- 9.7 Panasonic Holdings Corporation

- 9.8 PureLink

- 9.9 Roland Corporation

- 9.10 Ross Video LTD.

- 9.11 Sony Group Corporation

- 9.12 tvONE