|

市場調查報告書

商品編碼

1766164

高壓加工設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測High-Pressure Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

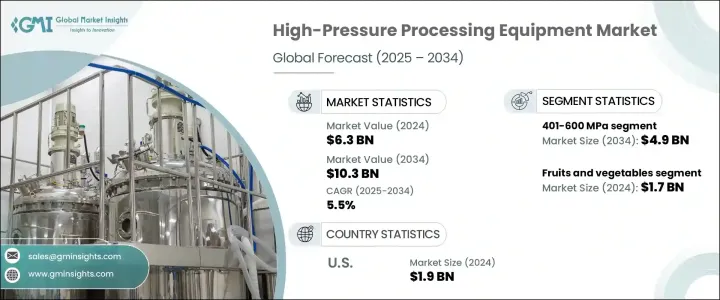

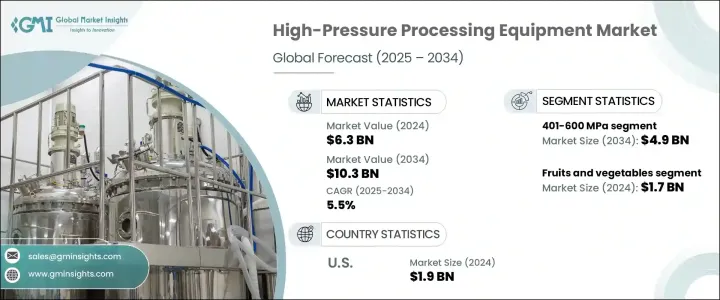

2024年全球高壓加工設備市場規模達63億美元,預計2025年至2034年將以5.5%的複合年成長率成長,達到103億美元。這一成長源於消費者對健康、無防腐劑食品日益成長的偏好,這與對清潔標籤產品日益成長的需求相一致。高壓加工(HPP)技術正擴大被應用於生產無需使用化學防腐劑即可保留其天然風味、質地和營養成分的食品。隨著消費者健康意識的增強,保持產品完整性至關重要,尤其是在果汁、即食食品和熟食肉類等類別中。高壓加工(HPP)技術採用的非熱保存方法,使製造商能夠提供經過少量加工的食品,這些食品在保持營養價值的同時,還能延長保存期限。在競爭激烈、食品安全仍是首要任務的市場中,這種技術尤其具有吸引力。

此外,高壓處理 (HPP) 可有效去活化李斯特菌、沙門氏菌和大腸桿菌等有害病原體,確保食品安全。這些病原體是導致食源性疾病的主要因素。該技術無需使用化學防腐劑或加熱即可實現這一目標,使其成為一種極具價值的非熱食品保鮮方法。透過確保消除這些危險病原體,HPP 可協助食品製造商遵守嚴格的全球食品安全法規,包括美國食品藥物管理局 (FDA)、美國農業部 (USDA) 和其他國際管理機構制定的法規。隨著食品安全持續成為消費者的首要關注點,採用 HPP 的製造商不僅可以保護其產品,還可以提升其信譽和品牌聲譽。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 63億美元 |

| 預測值 | 103億美元 |

| 複合年成長率 | 5.5% |

401-600 MPa 壓力段在 2024 年創造了 31 億美元的市場規模,預計到 2034 年將達到 49 億美元。這項壓力等級實現了安全性和品質的完美平衡,確保有效殺死微生物,同時保留食品的風味、色澤和營養成分。它尤其受到加工肉類、海鮮、乳製品和即食食品等各類產品的加工商的青睞。其多功能性和可擴展性使其成為加工多種食品類別的大型工廠的首選。此壓力範圍完全符合全球病原體控制監管標準,這對食品生產商至關重要,尤其是在美國、歐洲和日本等出口市場。隨著食品安全法規日益嚴格,401-600 MPa 壓力段正成為致力於滿足國際合規要求的加工商的行業標準。

2024年,水果和蔬菜細分市場產值達17億美元,佔27.4%。高壓加工尤其適用於冷壓果汁和冰沙,因為它能夠保留這些易腐產品的天然新鮮度、口感和營養成分,同時延長其保存期限。這一細分市場需求旺盛,尤其是在北美和亞太地區,注重健康的消費者正在推動市場發展。水果和蔬菜極易變質,而傳統的高溫巴氏殺菌方法會破壞其顏色、風味和營養成分。高壓加工 (HPP) 提供了一種非熱解決方案,使其成為優質、有機和清潔標籤產品的關鍵。由於水果和蔬菜的pH值低且水分活度高,它們容易受到污染,而高壓加工可以透過殺死有害微生物來緩解污染。

2024年,美國高壓加工設備市場規模達19億美元,預計2034年將以5.2%的複合年成長率成長。憑藉著完善的食品加工基礎設施和日益成長的消費者對清潔標籤產品的需求,美國仍是北美市場的領導者。冷壓果汁、有機嬰兒食品和新鮮酪梨醬等低加工食品日益流行,刺激了對高壓加工技術(HPP)的投資。此外,美國擁有完善的監管框架,美國食品藥物管理局(FDA)和美國農業部(USDA)積極推行食品安全標準。高壓加工技術被公認為一種無需加熱或使用化學物質即可有效殺死病原體的方法,因此對食品製造商而言是一個頗具吸引力的選擇。

全球高壓加工設備市場的領導者包括包頭科發高壓技術有限公司、Avure Technologies(JBT Corporation)、美國巴氏殺菌公司(APC)、Engineered Pressure Systems International(EPSI)和Hiperbaric SA。高壓加工設備市場的公司正致力於提升其系統的多功能性,以滿足從肉類、海鮮到即食食品等各種食品類別的需求。設備設計的創新,以提高效率、可擴展性和食品安全性,是其主要關注點。

許多公司也正在投資擴大其全球業務,與不同地區的食品生產商建立合作夥伴關係,尤其是在北美和歐洲。此外,他們還向製造商宣傳高壓處理 (HPP) 技術的優勢,強調其在延長保存期限和維持營養品質方面的作用。永續性是另一個優先事項,各公司都希望提高其設備的能源效率和環境影響。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業影響力量

- 成長動力

- 消費者對清潔標籤和低加工食品的需求不斷成長

- 增強食品安全和法規遵從性

- 延長保存期限,支持永續發展目標

- 產業陷阱與挑戰

- 高資本投資和營運成本

- 消費者認知度和接受度有限

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依設備類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依設備類型,2021 - 2034 年

- 主要趨勢

- 大量處理設備

- 半連續加工設備

- 連續加工設備

- 輔助設備

- 裝載/卸載系統

- 泵浦和增壓器

- 控制系統

- 傳送帶和自動化套件

- 其他(實驗室/中試系統等)

第6章:市場估計與預測:依壓力範圍,2021 年至 2034 年

- 主要趨勢

- 高達400 MPa

- 401–600兆帕

- 600MPa以上

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 水果和蔬菜

- 肉類和家禽

- 海鮮

- 飲料

- 乳製品

- 即食食品

- 其他(寵物食品等)

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 食品和飲料製造商

- 合約收費服務提供者

- 研究與學術機構

- 製藥和生物技術公司

- 其他(寵物食品製造商等)

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- American Pasteurization Company (APC)

- Avure Technologies (JBT Corporation)

- Bao Tou KeFa High Pressure Technology Co., Ltd.

- Hiperbaric SA

- HPP Italia Srl

- Kobe Steel Ltd.

- Multivac Sepp Haggenmuller SE & Co. KG

- Next HPP

- Pulsemaster

- Quintus Technologies AB

- Stansted Fluid Power Ltd

- Thyssenkrupp AG

- Universal Pure, LLC

The Global High-Pressure Processing Equipment Market was valued at USD 6.3 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 10.3 billion by 2025 - 2034. This growth is driven by a growing consumer preference for healthy, preservative-free foods, which aligns with the increasing demand for clean-label products. HPP technology is increasingly being adopted to produce food that retains its natural taste, texture, and nutritional profile without the use of chemical preservatives. As consumers become more health-conscious, the ability to maintain product integrity, especially in categories like juices, ready-to-eat meals, and deli meats, is vital. The non-thermal preservation method used in HPP allows manufacturers to offer minimally processed foods that have an extended shelf life while maintaining nutritional value. This is particularly appealing in a competitive market where food safety remains a priority.

Additionally, High Pressure Processing (HPP) helps ensure food safety by effectively inactivating harmful pathogens like Listeria, Salmonella, and E. coli, all of which are major contributors to foodborne illnesses. The technology achieves this without the need for chemical preservatives or heat, making it a highly valuable non-thermal food preservation method. By ensuring the elimination of these dangerous pathogens, HPP helps food manufacturers comply with stringent global food safety regulations, including those set by the FDA, USDA, and other international governing bodies. As food safety continues to be a top priority for consumers, manufacturers that utilize HPP can not only protect their products but also enhance their credibility and brand reputation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $10.3 Billion |

| CAGR | 5.5% |

The 401-600 MPa pressure segment generated USD 3.1 billion in 2024 and is expected to reach USD 4.9 billion by 2034. This pressure level offers the right balance of safety and quality, ensuring effective microbial reduction while preserving the taste, color, and nutrients of the food. It is particularly favored by processors working with a variety of products such as meat, seafood, dairy, and ready-to-eat meals. Its versatility and scalability make it the go-to choice for large-scale facilities processing multiple food categories. This pressure range aligns well with global regulatory standards for pathogen control, which is crucial for food producers, particularly in export markets such as the U.S., Europe, and Japan. As food safety regulations become stricter, the 401-600 MPa segment is becoming the industry standard for processors aiming to meet international compliance.

The fruits and vegetables segment generated USD 1.7 billion and held a 27.4% share in 2024. High-pressure processing is particularly well-suited for cold-pressed juices and smoothies, as it preserves the natural freshness, texture, and nutrition of these perishable products while extending their shelf life. This segment has experienced significant demand, especially in North America and Asia Pacific, where health-conscious consumers are driving the market. Fruits and vegetables are highly susceptible to spoilage, and traditional thermal pasteurization methods can damage their color, flavor, and nutritional content. HPP provides a non-thermal solution, making it essential for premium, organic, and clean-label products. Given their low pH and high water activity, fruits and vegetables are vulnerable to contamination, which HPP helps mitigate by killing harmful microorganisms.

U.S. High-Pressure Processing Equipment Market was valued at USD 1.9 billion in 2024 and is projected to grow at a CAGR of 5.2% through 2034. The U.S. remains the leader in North America due to its well-established food processing infrastructure and growing consumer demand for clean-label products. The increasing popularity of minimally processed foods like cold-pressed juices, organic baby foods, and fresh guacamole has spurred investments in HPP technology. Additionally, the U.S. benefits from a robust regulatory framework, with the FDA and USDA actively promoting food safety standards. HPP technology is recognized as an effective method for eliminating pathogens without using heat or chemicals, making it an attractive option for food manufacturers.

Leading players in the Global High-Pressure Processing Equipment Market include Bao Tou KeFa High-Pressure Technology Co., Ltd., Avure Technologies (JBT Corporation), American Pasteurization Company (APC), Engineered Pressure Systems International (EPSI), and Hiperbaric S.A. Companies in the high-pressure processing equipment market are focusing on enhancing the versatility of their systems to cater to various food categories, from meat and seafood to ready-to-eat meals. Innovation in equipment design to improve efficiency, scalability, and food safety is a primary focus.

Many companies are also investing in the expansion of their global footprint by establishing partnerships with food producers across regions, particularly in North America and Europe. In addition, they are promoting the benefits of HPP technology to manufacturers by emphasizing its role in extending shelf life and maintaining nutritional quality. Sustainability is another priority, with companies looking to improve the energy efficiency and environmental impact of their equipment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Pressure range

- 2.2.4 Application

- 2.2.5 End User

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for clean-label and minimally processed foods

- 3.2.1.2 Enhanced food safety and regulatory compliance

- 3.2.1.3 Extended shelf life supporting sustainability goals

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment and operational costs

- 3.2.2.2 Limited consumer awareness and acceptance

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Batch processing equipment

- 5.3 Semi-continuous processing equipment

- 5.4 Continuous processing equipment

- 5.5 Ancillary equipment

- 5.5.1 Loading/unloading systems

- 5.5.2 Pumps and intensifiers

- 5.5.3 Control systems

- 5.5.4 Conveyors and automation kits

- 5.6 Others (Laboratory/Pilot Systems, etc.)

Chapter 6 Market Estimates & Forecast, By Pressure Range, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Up to 400 MPa

- 6.3 401– 600 MPa

- 6.4 Above 600 MPa

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Fruits and vegetables

- 7.3 Meat and poultry

- 7.4 Seafood

- 7.5 Beverages

- 7.6 Dairy products

- 7.7 Ready-to-eat Meals

- 7.8 Others (Pet Food, etc.)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & Beverage manufacturers

- 8.3 Contract tolling service providers

- 8.4 Research & Academic institutions

- 8.5 Pharmaceutical & Biotech firms

- 8.6 Others (Pet Food Manufacturers, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 American Pasteurization Company (APC)

- 11.2 Avure Technologies (JBT Corporation)

- 11.3 Bao Tou KeFa High Pressure Technology Co., Ltd.

- 11.4 Hiperbaric S.A.

- 11.5 HPP Italia S.r.l.

- 11.6 Kobe Steel Ltd.

- 11.7 Multivac Sepp Haggenmuller SE & Co. KG

- 11.8 Next HPP

- 11.9 Pulsemaster

- 11.10 Quintus Technologies AB

- 11.11 Stansted Fluid Power Ltd

- 11.12 Thyssenkrupp AG

- 11.13 Universal Pure, LLC