|

市場調查報告書

商品編碼

1766163

牙科基質系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Dental Matrix Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

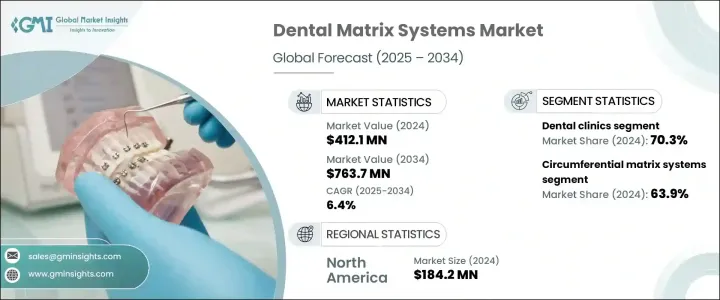

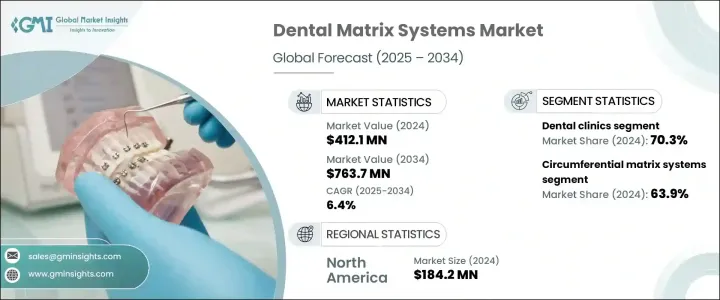

2024年,全球牙科基質系統市場規模達4.121億美元,預計到2034年將以6.4%的複合年成長率成長,達到7.637億美元。人們對美觀和齲齒預防的日益關注,導致美容和修復牙科手術的需求不斷成長。基質系統在實現精準的牙齒輪廓塑造和鄰面接觸修復方面發揮著至關重要的作用。隨著越來越多的患者選擇美容治療,對牙科基質系統的需求激增,以幫助患者獲得更好的臨床療效並提高滿意度。

產品開發的進步,例如預塑形帶、分段式基質環和張緊工具,進一步提升了這些系統的功能性和可預測性,進一步推動了對這些系統的需求。此外,全球合格牙科專業人員數量的成長,尤其是在新興市場,正在推動牙科診所和服務鏈的成長。這反過來又促進了對牙科基質系統的需求成長。微創牙科的採用也不斷增加,因為這些系統有助於盡可能少地去除牙齒結構,同時提供最佳的修復效果。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.121億美元 |

| 預測值 | 7.637億美元 |

| 複合年成長率 | 6.4% |

2024年,環形矩陣系統佔最大佔有率,達63.9%。由於其易於使用且覆蓋範圍廣泛,該系統廣泛應用於兒童牙科和前牙修復。它們在兒科病例中尤其有效,因為兒科病例中,由於病例規模小且患者配合困難,分段系統難以實施。環形矩陣系統簡單、經濟實惠且易於使用,使其在發展中地區和成本敏感型市場尤其受歡迎,因為這些地區的診所通常預算有限。由於其成本低、易於培訓且功能多樣,環形系統的需求依然旺盛,這進一步推動了其成長。

2024年,牙科診所佔據了70.3%的市場佔有率,佔據了市場主導地位。這主要得益於牙齒修復、補牙和齲洞治療的患者就診量不斷成長。隨著患者對高效、精準和多功能矩陣系統的需求不斷成長,牙科診所擴大採用先進的矩陣系統來提高患者吞吐量和治療效果。隨著人們對精準和微創牙科手術的興趣日益濃厚,牙科診所正在利用矩陣系統進行全面修復,以滿足患者的期望和臨床需求。對有效修復方法的需求日益成長,進一步推動了牙科診所對這些系統的需求。

預計到2034年,美國牙科基質系統市場規模將達到3.039億美元。這一成長主要源於消費者對美容牙科服務的強烈偏好,尤其是那些提供與牙色相似且不易察覺的修復體的服務。此外,人口老化、齲齒的高發病率以及對複合材料修復體而非汞合金填充體的需求不斷成長,也進一步推動了美國市場的成長。透過雇主和政府資助計畫提供的牙科保險也擴大了修復治療的可及性,並推動了患者就診,從而增加了牙科基質系統的收入。

全球牙科基質系統市場的主要參與者包括 3M、Bioclear Matrix Systems、Dentsply Sirona、Kerr Dental、Garrison Dental Solutions、Polydentia (Lifco)、Denovo Dental、Clinician's Choice Dental Products、Premier Dental、Trytrix、Water Pental、Clinician's Choice Dental Products、Premier Dental、Trytrix、Water Pental、Clinician.Dental、Suppen、Smot、Mak、Dr.為了鞏固其在牙科基質系統市場中的地位,各公司正專注於持續的產品創新,開發精度更高、更易於使用且能改善患者治療效果的系統。許多公司正在透過提供新型牙科基質系統(例如預成型帶和分段基質環)來擴展其產品組合,以滿足更廣泛的牙科治療需求。此外,各公司正在與牙科診所和醫療保健提供者建立策略合作夥伴關係,以提高產品的可及性,並將其系統融入日常牙科治療中。公司還提供培訓和教育計劃,以確保牙科專業人員充分了解這些先進系統的優勢和應用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 對美容和修復牙科手術的需求不斷成長

- 口腔健康意識不斷提高

- 牙科工具和材料的技術進步

- 牙科診所擴建

- 產業陷阱與挑戰

- 先進牙基質系統成本高

- 發展中國家缺乏熟練的專業人員

- 市場機會

- 微創修復的需求不斷成長

- 矩陣系統與數位牙科工作流程的整合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 報銷場景

- 報銷政策對市場成長的影響

- 專利態勢

- 消費者行為分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 競爭市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 圓週矩陣系統

- 分段矩陣系統

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 牙醫診所

- 其他最終用途

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Bioclear Matrix Systems

- Clinician's Choice Dental Products

- Denovo Dental

- Dentsply Sirona

- Dr. Walser Dental

- Garrison Dental Solutions

- GoldenDent

- Kerr Dental

- Polydentia (Lifco)

- Premier Dental

- Pro-Matrix Dental

- Safco Dental Supply

- Trycare

- Water Pik

- 3M

The Global Dental Matrix Systems Market was valued at USD 412.1 million in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 763.7 million by 2034. The growing focus on aesthetics and the prevention of tooth decay has led to an increase in demand for both cosmetic and restorative dental procedures. Matrix systems play a vital role in achieving precise tooth contouring and interproximal contact restorations. As more patients opt for cosmetic treatments, there is a surge in demand for dental matrix systems to help achieve better clinical outcomes and improve patient satisfaction.

The demand for these systems is further boosted by advancements in product development, such as pre-contoured bands, sectional matrix rings, and tensioning tools, which enhance the functionality and predictability of these systems. Additionally, the rise in the number of qualified dental professionals globally, especially in emerging markets, is driving the growth of dental practices and service chains. This has, in turn, contributed to the increasing demand for dental matrix systems. The adoption of minimally invasive dentistry is also on the rise, as these systems help remove as little tooth structure as possible while providing optimal restoration results.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $412.1 Million |

| Forecast Value | $763.7 Million |

| CAGR | 6.4% |

The circumferential matrix systems segment accounted for the largest share of 63.9% in 2024. These systems are widely used in pediatric dentistry and anterior tooth restorations due to their ease of use and the holistic coverage they provide. They are particularly beneficial in pediatric cases, where small size and patient cooperation challenges make sectional systems harder to implement. The simplicity, affordability, and ease of use of circumferential matrix systems make them particularly popular in developing regions and cost-sensitive markets, where clinics often operate on limited budgets. The demand for circumferential systems remains high due to their low cost, ease of training, and versatility, which further drive their growth.

The dental clinics segment dominated the market in 2024, with a 70.3% share. This dominance is due to the increasing number of patient visits for dental restorations, fillings, and cavity treatments. As patient demands rise for efficient, precise, and multifunctional matrix systems, dental clinics are increasingly adopting advanced matrix systems to improve patient throughput and treatment outcomes. With the growing interest in precision-based and minimally invasive dental procedures, dental clinics are utilizing matrix systems for complete restorations to meet patient expectations and clinical requirements. The increasing need for effective restoration methods further contributes to the demand for these systems in dental clinics.

U.S. Dental Matrix Systems Market is expected to reach USD 303.9 million by 2034. This growth is driven by a strong consumer preference for cosmetic dental services, particularly those that offer tooth-colored restorations with minimal visibility. Additionally, the aging population, the high prevalence of dental caries, and the increasing demand for composite restorations over amalgam fillings are further contributing to the growth in the U.S. market. The availability of dental insurance, both through employers and government-sponsored programs, is also expanding access to restorative treatments and driving patient visits to dental practices, leading to increased revenue for dental matrix systems.

Key players in the Global Dental Matrix Systems Market include 3M, Bioclear Matrix Systems, Dentsply Sirona, Kerr Dental, Garrison Dental Solutions, Polydentia (Lifco), Denovo Dental, Clinician's Choice Dental Products, Premier Dental, Trycare, Water Pik, Dr. Walser Dental, Safco Dental Supply, GoldenDent, and Pro-Matrix Dental. To enhance their position in the dental matrix systems market, companies are focusing on continuous product innovation, developing systems that offer greater precision, ease of use, and improved patient outcomes. Many companies are expanding their portfolios by offering new variations of dental matrix systems, such as pre-contoured bands and sectional matrix rings, to cater to a broader range of procedures. Additionally, companies are forming strategic partnerships with dental practices and healthcare providers to improve product accessibility and integrate their systems into everyday dental procedures. Training and educational programs are being offered to ensure that dental professionals fully understand the benefits and applications of these advanced systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for aesthetic and restorative dental procedures

- 3.2.1.2 Rising awareness about oral health

- 3.2.1.3 Technological advancements in dental tools and materials

- 3.2.1.4 Expansion of dental clinics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced dental matrix systems

- 3.2.2.2 Lack of skilled professionals in developing countries

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing demand for minimally invasive restorations

- 3.2.3.2 Integration of matrix systems with digital dentistry workflows

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Price trends

- 3.5.1 By region

- 3.5.2 By product type

- 3.6 Future market trends

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Reimbursement scenario

- 3.8.1 Impact of reimbursement policies on market growth

- 3.9 Patent Landscape

- 3.10 Consumer behaviour analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Circumferential matrix systems

- 5.3 Sectional matrix systems

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Dental clinics

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Bioclear Matrix Systems

- 8.2 Clinician's Choice Dental Products

- 8.3 Denovo Dental

- 8.4 Dentsply Sirona

- 8.5 Dr. Walser Dental

- 8.6 Garrison Dental Solutions

- 8.7 GoldenDent

- 8.8 Kerr Dental

- 8.9 Polydentia (Lifco)

- 8.10 Premier Dental

- 8.11 Pro-Matrix Dental

- 8.12 Safco Dental Supply

- 8.13 Trycare

- 8.14 Water Pik

- 8.15 3M