|

市場調查報告書

商品編碼

1755401

中壓驅動器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Medium Voltage Drives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

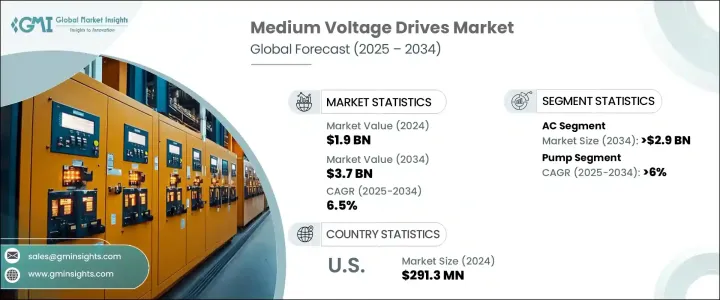

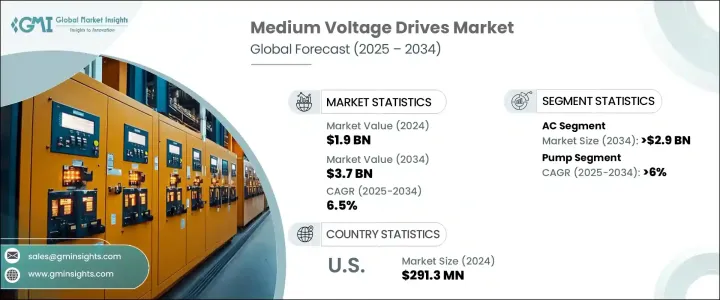

2024年,全球中壓驅動器市場規模達19億美元,預計2034年將以6.5%的複合年成長率成長,達到37億美元。該行業的成長主要受到工業領域對高效能能源解決方案日益成長的需求以及對先進馬達控制系統的需求的影響。這些驅動器透過調節轉速和扭矩,在最佳化馬達性能方面發揮至關重要的作用,從而顯著節省能源、降低營運成本並減少排放。人們對永續性和成本效益的日益關注,正促使這些系統在不同行業中得到更廣泛的部署。

越來越多的資本流入重型機械和能源最佳化需求領域,正在塑造市場的未來。中壓變頻器正成為各種大型機械系統操作中不可或缺的零件。新型工業基礎設施的發展,尤其是那些包含大型暖通空調網路和自動化系統的基礎設施,為市場加速發展奠定了堅實的基礎。此外,製造業和公用事業領域對自動化和智慧技術的日益關注,也進一步推動了需求成長。隨著企業致力於精簡生產流程、提高效率,採用中壓變頻器技術正成為一項策略重點。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 37億美元 |

| 複合年成長率 | 6.5% |

交流中壓驅動市場預計將佔據主導地位,預計2034年將超過29億美元。由於與新興數位技術的兼容性,該領域正在經歷顯著成長。智慧型系統與即時分析的整合,使交流驅動在現代工業應用中越來越具有吸引力。智慧功能的加入可以提高系統響應能力、預測性維護和營運靈活性,這些在當今快速發展的工業環境中至關重要。人們對數位轉型(尤其是在自動化製造領域)的興趣日益濃厚,這進一步增強了對交流驅動系統的需求。

根據應用,中壓驅動器市場細分為泵浦、風扇、傳送帶、壓縮機、擠出機等。其中,泵浦應用預計將佔據最大市場佔有率,預計到2034年將以超過6%的複合年成長率成長。泵浦應用中使用的驅動器有助於顯著提高系統輸出和運作效率。增強的控制機制可實現精確的速度調節,進而提高效能並降低能耗。此功能還可透過最大限度地減少磨損和降低維護要求來延長系統使用壽命。中壓驅動器因其多功能性和在各個工業領域的性能優勢,在泵浦運作中的應用正日益受到青睞。

在美國,中壓驅動器市場持續保持強勁成長動能。預計2022年市場規模為2.62億美元,2023年將達2.761億美元,2024年將達2.913億美元。旨在實現基礎設施現代化和提高能源效率的持續投資在這一上升趨勢中發揮關鍵作用。對可靠馬達控制解決方案的需求以及監管機構對節能技術的日益推崇,進一步推動了市場需求的成長。技術升級和聯邦政府的節能激勵措施也對各行業的採購決策和系統升級產生了影響。

中壓變頻器市場的領先製造商憑藉持續創新和穩健的全球營運保持競爭優勢。他們憑藉在提供針對工業環境的整合電力系統和能源解決方案方面的專業知識,成為產業關鍵參與者。這些公司透過提供與自動化流程和智慧製造環境相容的先進客製化驅動系統,持續滿足不斷變化的客戶需求。

與原始設備製造商 (OEM)、公用事業公司和工業終端用戶建立策略合作關係對市場參與者至關重要。透過專注於技術改進並使其產品與現代自動化趨勢保持一致,製造商能夠更有效率地滿足市場需求。他們還透過與整個供應鏈中的利害關係人緊密合作,擴大業務範圍並提高產品可用性。透過有針對性的研發投入,他們正在提供下一代驅動器,以滿足日益成長的能源性能期望以及與數位工業生態系統的無縫整合。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 策略舉措

- 競爭基準測試

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依功率範圍,2021-2034

- 主要趨勢

- ≤1兆瓦

- 1兆瓦-3兆瓦

- 3兆瓦-7兆瓦

- > 7 兆瓦

第6章:市場規模及預測:按驅動力,2021-2034

- 主要趨勢

- 交流電

- 直流

- 伺服

第7章:市場規模及預測:依銷售管道,2021-2034 年

- 主要趨勢

- 直接用於最終用途

- 直接面向機器製造商

- 直接聯繫系統整合商

- 分銷/合作夥伴

第 8 章:市場規模與預測:按應用,2021 - 2034 年,

- 主要趨勢

- 泵浦

- 扇子

- 起重機和升降機

- 輸送帶

- 壓縮機

- 擠出機

- 其他

第9章:市場規模及預測:依最終用途,2021-2034

- 主要趨勢

- 石油和天然氣

- 發電

- 採礦和金屬

- 紙漿和造紙

- 海洋

- 其他

第 10 章:市場規模與預測:按地區,2021-2034 年,

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 泰國

- 新加坡

- 馬來西亞

- 越南

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第 11 章:公司簡介

- ABB

- CG Power & Industrial Solutions

- Danfoss

- Delta Electronics

- Eaton

- Fuji Electric

- General Electric

- Hitachi Hi-Rel Power Electronics

- Ingeteam Power Technology

- Johnson Controls

- Nidec Industrial Solutions

- Rockwell Automation

- Schneider Electric

- Siemens

- TECO-Westinghouse

- TMEIC

- WEG

- Yaskawa Electric

The Global Medium Voltage Drives Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 3.7 billion by 2034. Growth in the industry is largely influenced by increasing industrial demand for high-efficiency energy solutions and the need for sophisticated motor control systems. These drives play a crucial role in optimizing motor performance by adjusting speed and torque, leading to considerable energy savings, reduced operational expenses, and lower emissions. This growing focus on sustainability and cost-effectiveness is encouraging more widespread deployment of these systems across different industries.

Rising capital inflow into sectors that require heavy-duty machinery and energy optimization is shaping the future of the market. Medium voltage drives are becoming essential components in various operations involving large-scale mechanical systems. The development of new industrial infrastructure, particularly those incorporating large HVAC networks and automated systems, is providing a solid foundation for market acceleration. Additionally, the increased focus on automation and smart technologies in manufacturing and utilities is further propelling demand. As companies aim to streamline production and boost efficiency, the adoption of medium voltage drive technologies is becoming a strategic priority.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.7 Billion |

| CAGR | 6.5% |

The AC medium voltage drive segment is expected to dominate the market landscape and is forecasted to exceed USD 2.9 billion by 2034. This segment is experiencing notable growth due to its compatibility with emerging digital technologies. The integration of intelligent systems and real-time analytics is making AC drives increasingly attractive for modern industrial applications. The incorporation of smart features allows for better system responsiveness, predictive maintenance, and operational flexibility, which are critical in today's fast-evolving industrial environments. Growing interest in digital transformation, especially in automated manufacturing, is reinforcing the demand for AC-based systems.

By application, the medium voltage drives market is segmented into pump, fan, conveyor, compressor, extruder, and others. Among these, the pump application is poised to secure the largest market share and is projected to expand at a CAGR of over 6% through 2034. Drives used in pump applications contribute significantly to improving system output and operational efficiency. Enhanced control mechanisms allow precise speed regulation, leading to better performance and reduced energy use. This capability also supports system longevity by minimizing wear and tear and lowering maintenance requirements. The adoption of medium voltage drives in pump operations is gaining traction due to their versatility and performance benefits across diverse industrial sectors.

In the United States, the medium voltage drives market continues to witness strong momentum. The market was assessed at USD 262 million in 2022, followed by USD 276.1 million in 2023 and USD 291.3 million in 2024. Ongoing investments aimed at modernizing infrastructure and enhancing energy efficiency are playing a pivotal role in this upward trend. Demand is further supported by the need for reliable motor control solutions and an increasing push from regulatory bodies for the adoption of energy-efficient technologies. Technological upgrades and federal incentives targeting energy conservation are also making an impact on purchasing decisions and system upgrades in various sectors.

Leading manufacturers in the medium voltage drive market maintain their competitive edge through consistent innovation and robust global operations. Their expertise in delivering integrated power systems and energy solutions tailored for industrial settings positions them as key players. These companies continue to adapt to evolving customer requirements by offering advanced and customized drive systems that are compatible with automated processes and smart manufacturing environments.

Strategic collaborations and partnerships with OEMs, utilities, and industrial end-users are becoming essential for market players. By focusing on technological enhancements and aligning their offerings with modern automation trends, manufacturers are addressing market demands more efficiently. They are also expanding their reach and improving product availability by working closely with stakeholders across the supply chain. Through targeted R&D investments, they are delivering next-generation drives that meet the rising expectations for energy performance and seamless integration into digital industrial ecosystems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Range, 2021 - 2034, (USD Million, Units)

- 5.1 Key trends

- 5.2 ≤ 1 MW

- 5.3 1 MW - 3 MW

- 5.4 3 MW - 7 MW

- 5.5 > 7 MW

Chapter 6 Market Size and Forecast, By Drive, 2021 - 2034, (USD Million, Units)

- 6.1 Key trends

- 6.2 AC

- 6.3 DC

- 6.4 Servo

Chapter 7 Market Size and Forecast, By Sales Channel, 2021 - 2034, (USD Million, Units)

- 7.1 Key trends

- 7.2 Direct to end use

- 7.3 Direct to machine builder

- 7.4 Direct to systems integrator

- 7.5 Distribution/partner

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034, (USD Million, Units)

- 8.1 Key trends

- 8.2 Pump

- 8.3 Fan

- 8.4 Cranes & hoists

- 8.5 Conveyor

- 8.6 Compressor

- 8.7 Extruder

- 8.8 Others

Chapter 9 Market Size and Forecast, By End use, 2021 - 2034, (USD Million, Units)

- 9.1 Key trends

- 9.2 Oil & gas

- 9.3 Power generation

- 9.4 Mining & metals

- 9.5 Pulp and paper

- 9.6 Marine

- 9.7 Others

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034, (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Thailand

- 10.4.7 Singapore

- 10.4.8 Malaysia

- 10.4.9 Vietnam

- 10.4.10 Indonesia

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 South Africa

- 10.5.4 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 CG Power & Industrial Solutions

- 11.3 Danfoss

- 11.4 Delta Electronics

- 11.5 Eaton

- 11.6 Fuji Electric

- 11.7 General Electric

- 11.8 Hitachi Hi-Rel Power Electronics

- 11.9 Ingeteam Power Technology

- 11.10 Johnson Controls

- 11.11 Nidec Industrial Solutions

- 11.12 Rockwell Automation

- 11.13 Schneider Electric

- 11.14 Siemens

- 11.15 TECO-Westinghouse

- 11.16 TMEIC

- 11.17 WEG

- 11.18 Yaskawa Electric