|

市場調查報告書

商品編碼

1755399

乳房植入物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Breast Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

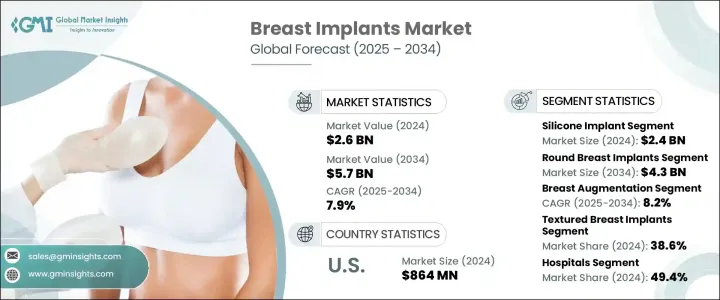

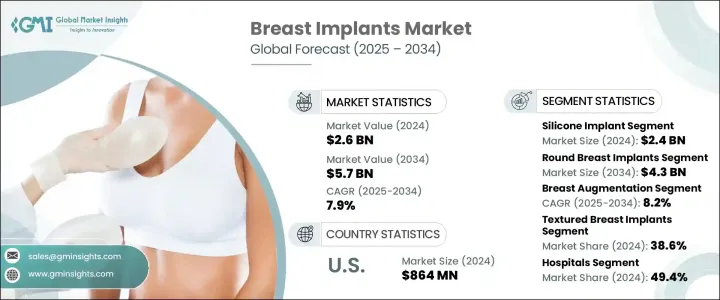

2024年,全球乳房植入物市場規模達26億美元,預計2034年將以7.9%的複合年成長率成長,達到57億美元。這得歸功於隆乳手術數量的成長、植入物設計技術的創新以及人們對外觀的日益關注。隆乳手術因其較高的滿意度、個人化的效果以及相對安全的微創性,已成為一種廣受歡迎的美容手術,尤其是在已開發地區。手術技術的進步,包括更快的恢復時間和更低的併發症風險,也提升了隆乳手術的吸引力。

此外,社會對塑身手術(尤其是以美觀和自信為重點的手術)的接受度日益提高,也推動了隆乳手術的日益普及。越來越多的女性選擇隆乳,這不僅是出於美觀考慮,也是為了解決乳房不對稱等功能性問題,以及乳房切除術或其他疾病後進行乳房重建的需求。隆乳手術能夠根據每個人的體型和美學目標提供個人化解決方案,這極大地推動了需求的成長。此外,包括微創手術在內的外科技術的進步,使這些手術更加安全有效,恢復時間更短,且併發症風險更低。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 57億美元 |

| 複合年成長率 | 7.9% |

2024年,矽膠假體市場規模達24億美元。矽膠假體在隆乳和乳房重建手術(尤其是在乳房切除術後)中的應用日益受到青睞,這主要歸功於其自然的外觀和觸感以及良好的耐用性。矽膠假體深受整形外科醫師的青睞,因為它們不易起皺或起波紋,並且能夠帶來更平滑、更自然的美感。這些假體已獲得美國食品藥物管理局 (FDA) 和歐洲藥品管理局 (EMA) 的批准,可用於隆乳和乳房重建手術。假體尺寸和形狀的日益多樣化也促進了它們的普及,使其適用於更廣泛的患者群體。此外,矽膠假體在修復手術中的應用也日益增多,進一步支撐了市場的成長。

2024年,圓形乳房植入物市場佔據了相當大的佔有率,預計到2034年將成長至43億美元。圓形植入物尤其受歡迎,因為它們能夠提供更挺拔、更圓潤的外觀,並且植入位置靈活。它們可以透過任何類型的切口植入,包括腋下切口,從而減少可見疤痕,使其成為許多患者的首選。此外,圓形植入物在成本效益、手術便利性和更廣泛的尺寸選擇方面具有靈活性,這促使其使用率不斷上升。預計該市場的成長將受到多種選擇的推動,包括鹽水和矽膠材質的植入物,以及植入物技術的持續改進。

2024年,美國乳房植入物市場規模達8.64億美元,隆乳手術數量的成長以及醫療設施的進步推動了市場的成長。主要參與者的加入以及新型先進植入物的開發,為市場擴張提供了支撐。美容手術的接受度不斷提高,加上乳房植入物價格的日益親民,使得更廣泛的人群能夠接受,從而提高了其採用率。

全球乳房植入物產業的主要參與者包括 AbbVie、Euromi、廣州萬和塑膠材料、Sientra、POLYTECH Health & Aesthetics 和 Mentor Worldwide LLC 等。這些公司專注於產品創新,並透過策略夥伴關係和合作擴大市場覆蓋範圍。他們也加大了對研發的投入,以提高植入物品質、提升病患滿意度並降低手術風險。此外,許多公司正在積極開發更廣泛的植入物尺寸、形狀和材料,以滿足不同患者的需求,這有助於增強其在市場上的競爭地位。此外,採用更先進的製造流程使這些公司能夠提供更多客製化、更高品質的植入物,從而進一步提升其市場佔有率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 隆乳手術數量不斷增加

- 乳癌發生率不斷上升

- 技術進步

- 整形外科醫生數量不斷增加

- 產業陷阱與挑戰

- 植入手術費用高昂

- 併發症風險

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 報銷場景

- 定價分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 鹽水植入物

- 矽膠植入物

第6章:市場估計與預測:依形狀,2021 - 2034 年

- 主要趨勢

- 圓形的

- 解剖學

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 隆乳

- 乳房重建

第8章:市場估計與預測:按植入物紋理,2021 - 2034 年

- 主要趨勢

- 光滑的

- 紋理

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 診所

- 其他最終用戶

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 瑞典

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 泰國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 以色列

- 土耳其

第 11 章:公司簡介

- AbbVie

- Establishment Labs

- Euromi

- GC Aesthetics

- Groupe Sebbin

- Guangzhou Wanhe Plastic Material

- Hansbiomed

- IDEAL Implant

- Laboratoires Arion

- Mentor Worldwide LLC (Johnson & Johnson)

- POLYTECH Health & Aesthetics

- Prayasta 3D Inventions

- Shanghai Kangning Medical Device

- Sientra

The Global Breast Implants Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 5.7 billion by 2034, driven by the rise in breast augmentation surgeries, technological innovations in implant designs, and an increasing focus on physical appearance. Breast augmentation has become a widely sought-after cosmetic procedure, particularly in developed regions, due to its high satisfaction rate, personalized results, and relatively safe, minimally invasive procedures. Advances in surgical techniques, including quicker recovery times and reduced complication risks, have also contributed to the procedure's appeal.

Additionally, the increasing societal acceptance of body-enhancing procedures, particularly those focused on aesthetics and self-confidence, has contributed to the growing popularity of breast implants. Women are increasingly opting for breast augmentation not just for cosmetic reasons but also to address functional issues like asymmetry and the need for breast reconstruction following mastectomies or other medical conditions. The ability of breast implants to offer customized solutions tailored to everyone's body shape and aesthetic goals has significantly driven demand. Moreover, advances in surgical techniques, including minimally invasive methods, have made these procedures safer and more effective, with faster recovery times and reduced risk of complications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 7.9% |

The silicone implant segment generated USD 2.4 billion in 2024. The increasing preference for silicone implants for breast augmentation and reconstruction, especially after mastectomy, is largely due to their natural look and feel, as well as their durability. Silicone implants are highly favored by plastic surgeons because they are less prone to wrinkles or rippling and provide a smoother, more natural aesthetic. These implants are approved by both the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) for both augmentation and reconstruction procedures. The growing variety of implant sizes and profiles has also contributed to their popularity, making them suitable for a broad range of patients. Moreover, silicone implants are increasingly used for revision surgeries, further supporting market growth.

The round breast implants segment accounted for a substantial share in 2024 and is expected to grow to USD 4.3 billion by 2034. Round implants are particularly popular due to their ability to provide a more lifted, rounder appearance and flexibility in placement. They can be inserted through any type of incision, including underarm incisions, which reduces visible scarring, making them a preferred choice for many patients. Furthermore, round implants offer flexibility based on cost-effectiveness, surgical ease, and a wider range of size options, contributing to their increasing usage. The growth of this segment is expected to be bolstered by the availability of diverse options, including both saline and silicone versions, and the continued development of improved implant technologies.

United States Breast Implants Market generated USD 864 million in 2024, with an increase in breast augmentation procedures and advancements in healthcare facilities driving market growth. The presence of major players and the development of new, advanced implant products support this market expansion. The growing acceptance of aesthetic surgery, as well as the increasing affordability of breast implants, has made them more accessible to a broader demographic, resulting in higher adoption rates.

Key players in the Global Breast Implants Industry include AbbVie, Euromi, Guangzhou Wanhe Plastic Material, Sientra, POLYTECH Health & Aesthetics, and Mentor Worldwide LLC, among others. These companies focus on product innovation and expanding their market reach through strategic partnerships and collaborations. They are also increasingly investing in research and development to improve implant quality, enhance patient satisfaction, and reduce surgical risks. Furthermore, many of these companies are actively working to develop a wider range of implant sizes, shapes, and materials to cater to diverse patient needs, which helps strengthen their competitive position in the market. Additionally, adopting more advanced manufacturing processes has enabled these companies to offer more customized, higher-quality implants, further boosting their market share.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.1.3 Base year calculation

- 1.1.4 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.1.5 Primary sources

- 1.1.6 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of breast augmentation procedures

- 3.2.1.2 Growing breast cancer incidence

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing number of plastic surgeons

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of implantation procedure

- 3.2.2.2 Risk of complications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technological landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 GAP analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Saline implant

- 5.3 Silicone implant

Chapter 6 Market Estimates and Forecast, By Shape, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Round

- 6.3 Anatomical

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Breast augmentation

- 7.3 Breast reconstruction

Chapter 8 Market Estimates and Forecast, By Implant Texture, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Smooth

- 8.3 Textured

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Clinics

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Sweden

- 10.3.7 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Thailand

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Columbia

- 10.5.5 Chile

- 10.5.6 Peru

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Israel

- 10.6.5 Turkey

Chapter 11 Company Profiles

- 11.1 AbbVie

- 11.2 Establishment Labs

- 11.3 Euromi

- 11.4 GC Aesthetics

- 11.5 Groupe Sebbin

- 11.6 Guangzhou Wanhe Plastic Material

- 11.7 Hansbiomed

- 11.8 IDEAL Implant

- 11.9 Laboratoires Arion

- 11.10 Mentor Worldwide LLC (Johnson & Johnson)

- 11.11 POLYTECH Health & Aesthetics

- 11.12 Prayasta 3D Inventions

- 11.13 Shanghai Kangning Medical Device

- 11.14 Sientra