|

市場調查報告書

商品編碼

1755391

船用往復式引擎市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Marine Reciprocating Engine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

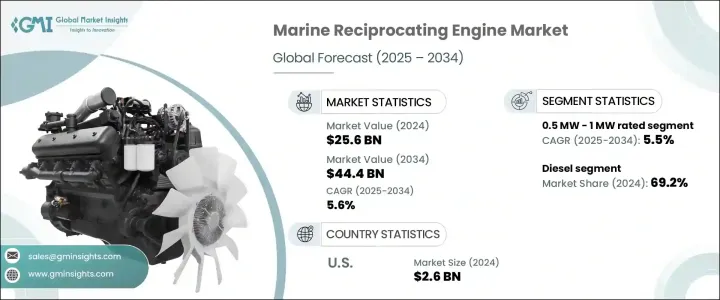

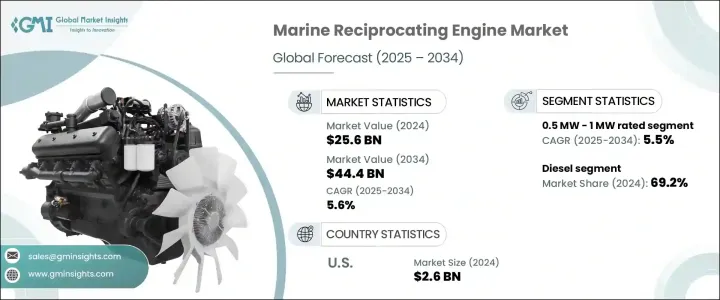

2024年,全球船用往復式引擎市場規模達256億美元,預計到2034年將以5.6%的複合年成長率成長,達到444億美元。推動這一成長的因素包括全球排放法規趨於嚴格,以及市場對可根據成本和供應情況靈活切換燃料類型的燃料靈活系統的需求不斷成長。船東和營運商正在升級其引擎系統,以滿足環保要求並降低燃料消耗,這進一步推動了市場成長。

此外,發展中國家港口基礎設施的不斷擴張也促進了海上交通的繁榮,加劇了對高效環保電力解決方案的需求。即時監控和診斷能力的技術進步也使營運商能夠追蹤關鍵效能指標,防止意外故障,並提高系統可靠性和正常運行時間。製造商正致力於設計更緊湊的引擎,以滿足小型船舶、近海支援船和空間有限的船舶應用的需求,從而提升其在細分領域的應用。國際海事組織 Tier III 標準等監管框架持續推動引擎精度和最佳化的提高,促使製造商快速創新,以在不斷變化的海洋能源格局中保持競爭力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 256億美元 |

| 預測值 | 444億美元 |

| 複合年成長率 | 5.6% |

預計到2034年,額定功率為0.5兆瓦至1兆瓦的船用往復式引擎市場將以5.5%的複合年成長率成長,這得益於中型船舶對緊湊高效推進系統日益成長的需求。這些引擎在尺寸、功率和營運成本之間實現了理想的平衡,使其成為各種注重機動性和燃油經濟性的應用的首選。沿海保安船、客渡輪和小型貨船的部署日益增多,加速了它們的普及。此外,這些引擎更易於維護,並可整合到有限的船上空間,這對於希望在不犧牲性能或合規性的情況下最佳化船舶佈局的營運商來說極具吸引力。

預計到2034年,燃氣驅動的船用往復式引擎市場將以6.5%的複合年成長率成長。這一成長與全球排放標準的日益嚴格以及整個航運業對永續發展的高度重視密切相關。隨著監管機構強制推行清潔的海上作業,船舶營運商紛紛轉向燃氣引擎,因為燃氣引擎的溫室氣體排放量和含硫量顯著降低。這些引擎不僅符合國際法規要求,還能透過使用更清潔、通常更經濟的燃料來源,帶來長期成本效益,尤其是在排放控制區域。

2024年,美國船用往復式引擎市場規模達26億美元。這一成長源自於國際航運量的穩定成長、海上石油和風能基礎設施的持續投資,以及休閒遊艇活動的強勁成長。美國完善的港口系統和支援性的監管環境進一步促進了先進船舶推進技術的普及。這種良好的生態系統鼓勵商業和休閒船舶營運商投資於符合現代性能和環保標準的更新、更有效率的引擎。

市場的主要參與者包括Caterpillar、瓦錫蘭、珀金斯引擎、IHI 公司、MAN 能源解決方案、洋馬控股、通用電氣、百力通、川崎重工、康明斯、雅馬哈引擎、斯堪尼亞、沃爾沃遍達、Rehlko、久保田公司、三菱重工、勞斯萊斯、JC Bamford Guas、美國能源汽車和本田汽車。為提升市場地位,各公司利用投資研發等策略來開發符合法規要求的低排放、省油的引擎。許多公司專注於混合動力和燃氣引擎技術,以順應脫碳趨勢。與造船廠和船隊營運商的合作有助於確保長期供應協議,而在新興沿海經濟體的地理擴張則開闢了新的收入來源。先進的數位監控系統正在被納入其中,以提供預測性維護和即時診斷。各大品牌擴展服務網路以改善售後支持,確保長期客戶參與度和性能關鍵型應用的可靠性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:按燃料,2021 - 2034

- 主要趨勢

- 柴油引擎

- 氣體

- 其他

第6章:市場規模及預測:依額定功率,2021 - 2034

- 主要趨勢

- 0.5 兆瓦 - 1 兆瓦

- > 1 兆瓦 - 2 兆瓦

- > 2 兆瓦 - 3.5 兆瓦

- > 3.5 兆瓦 - 5 兆瓦

- > 5 兆瓦 - 7.5 兆瓦

- > 7.5 兆瓦

第7章:市場規模及預測:依汽缸配置,2021 - 2034 年

- 主要趨勢

- 排隊

- V型

- 徑向

- 對置活塞

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 義大利

- 西班牙

- 荷蘭

- 丹麥

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 泰國

- 新加坡

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 阿曼

- 科威特

- 埃及

- 土耳其

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第9章:公司簡介

- AB Volvo Penta

- American Honda Motor

- Briggs & Stratton

- Caterpillar

- Cummins

- General Electric

- Guascor Energy

- IHI Corporation

- JC Bamford Excavators

- Kawasaki Heavy Industries

- KUBOTA Corporation

- MAN Energy Solutions

- MITSUBISHI HEAVY INDUSTRIES

- Perkins Engines

- Rehlko

- Rolls-Royce

- Scania

- Wartsilä

- Yamaha Motor

- Yanmar HOLDINGS

The Global Marine Reciprocating Engine Market was valued at USD 25.6 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 44.4 billion by 2034. The growth is driven by the stricter global emission regulations, combined with rising demand for fuel-flexible systems that can shift between fuel types based on cost and availability. Ship owners and operators are upgrading their engine systems to meet environmental requirements and reduce fuel consumption, further fueling market growth.

In addition, expanding port infrastructure across developing nations is boosting marine traffic, intensifying the need for efficient and environmentally compliant power solutions. Technological improvements in real-time monitoring and diagnostic capabilities also allow operators to track key performance indicators prevent unexpected failures and raise system reliability and uptime. Manufacturers are focusing on designing more compact engines to meet the needs of smaller vessels, offshore support crafts, and limited-space marine applications, enhancing adoption across niche sectors. Regulatory frameworks such as the International Maritime Organization's Tier III standards continue to push for higher engine precision and optimization, prompting manufacturers to innovate rapidly to stay competitive in the evolving marine energy landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.6 Billion |

| Forecast Value | $44.4 Billion |

| CAGR | 5.6% |

The 0.5 MW to 1 MW rated marine reciprocating engine segment is projected to grow at a CAGR of 5.5% through 2034, fueled by rising demand for compact and efficient propulsion systems in medium-duty vessels. These engines offer the ideal balance between size, power, and operational cost, making them a preferred choice for various applications where maneuverability and fuel economy are essential. Increasing deployment in coastal security vessels, passenger ferries, and small cargo ships accelerates their adoption. Additionally, these engines are easier to maintain and integrate into limited space on board, which appeals to operators looking to optimize vessel layout without sacrificing performance or compliance.

The gas-powered marine reciprocating engine segment is expected to grow at a CAGR of 6.5% through 2034. This growth is closely linked to the tightening of global emissions standards and a heightened focus on sustainability across the marine industry. As regulators enforce cleaner maritime operations, vessel operators shift toward gas-fueled engines due to their significantly lower greenhouse gas emissions and reduced sulfur content. These engines not only support compliance with international mandates but also offer long-term cost benefits by using cleaner, often more economical fuel sources, especially in emission-controlled areas.

United States Marine Reciprocating Engine Market was valued at USD 2.6 billion in 2024. This growth stems from the steady rise in international shipping traffic, continued investment in offshore oil and wind energy infrastructure, and a robust increase in leisure boating activities. The country's well-developed port systems and supportive regulatory environment further enhance the uptake of advanced marine propulsion technologies. This favorable ecosystem encourages commercial and recreational marine operators to invest in newer, more efficient engines that meet modern performance and environmental standards.

Key players in the market include Caterpillar, Wartsila, Perkins Engines, IHI Corporation, MAN Energy Solutions, Yanmar HOLDINGS, General Electric, Briggs & Stratton, Kawasaki Heavy Industries, Cummins, Yamaha Motor, Scania, AB Volvo Penta, Rehlko, KUBOTA Corporation, MITSUBISHI HEAVY INDUSTRIES, Rolls-Royce, J C Bamford Excavators, American Honda Motor, and Guascor Energy. To enhance their market standing, companies leverage strategies such as investing in R&D to develop low-emission, fuel-efficient engines tailored for regulatory compliance. Many focus on hybrid and gas engine technologies to align with decarbonization trends. Partnerships with shipbuilders and fleet operators help secure long-term supply agreements, while geographic expansion in emerging coastal economies opens new revenue streams. Advanced digital monitoring systems are being incorporated to offer predictive maintenance and real-time diagnostics. Brands expand service networks to improve aftersales support, ensuring long-term customer engagement and reliability in performance-critical applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Diesel

- 5.3 Gas

- 5.4 Others

Chapter 6 Market Size and Forecast, By Rated Power, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 0.5 MW - 1 MW

- 6.3 > 1 MW - 2 MW

- 6.4 > 2 MW - 3.5 MW

- 6.5 > 3.5 MW - 5 MW

- 6.6 > 5 MW - 7.5 MW

- 6.7 > 7.5 MW

Chapter 7 Market Size and Forecast, By Cylinder Configuration, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Inline

- 7.3 V-Type

- 7.4 Radial

- 7.5 Opposed piston

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.3.8 Denmark

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Thailand

- 8.4.7 Singapore

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 Qatar

- 8.5.4 Oman

- 8.5.5 Kuwait

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 AB Volvo Penta

- 9.2 American Honda Motor

- 9.3 Briggs & Stratton

- 9.4 Caterpillar

- 9.5 Cummins

- 9.6 General Electric

- 9.7 Guascor Energy

- 9.8 IHI Corporation

- 9.9 J C Bamford Excavators

- 9.10 Kawasaki Heavy Industries

- 9.11 KUBOTA Corporation

- 9.12 MAN Energy Solutions

- 9.13 MITSUBISHI HEAVY INDUSTRIES

- 9.14 Perkins Engines

- 9.15 Rehlko

- 9.16 Rolls-Royce

- 9.17 Scania

- 9.18 Wartsilä

- 9.19 Yamaha Motor

- 9.20 Yanmar HOLDINGS