|

市場調查報告書

商品編碼

1755381

自動馬達啟動器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automatic Motor Starter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

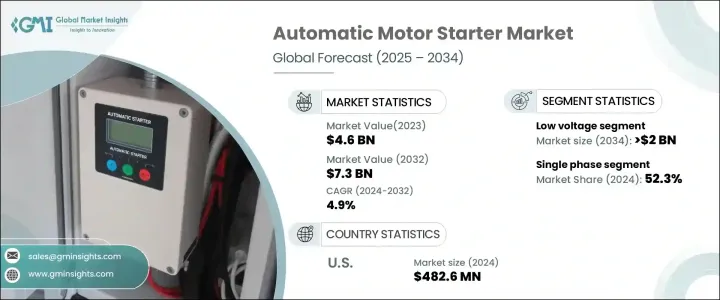

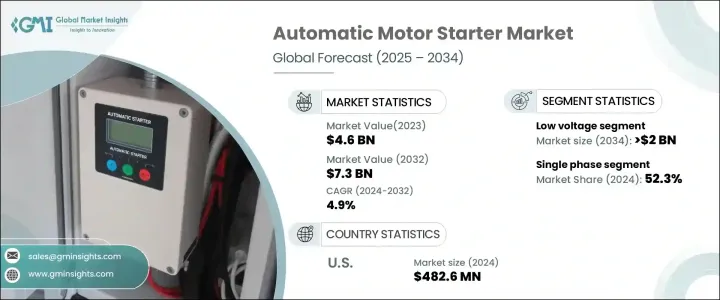

2024年,全球自動馬達啟動器市場規模達46億美元,預計2034年將以4.9%的複合年成長率成長,達到73億美元。工業自動化的蓬勃發展和對節能運作日益成長的需求推動了這一成長。自動電機啟動器有助於控制電機,實現簡化的啟動停止功能,並提供過載、相位故障和短路保護。透過控制電力輸送,這些設備可確保馬達高效運作、啟動更平穩,並防範潛在的電氣危險。

電機在化工、石油天然氣、製造業和水處理等行業的應用日益廣泛,這正在增強電機市場。隨著這些行業追求永續實踐和數位轉型,自動馬達啟動器已與能源管理系統整合,以降低能耗並防止啟動過程中出現電湧。此外,工業物聯網和智慧工廠框架的進步也支持了對這些解決方案的需求。在川普政府執政期間,對工業電氣零件(尤其是從中國進口的零件)徵收關稅,導致生產成本上升,供應鏈中斷。儘管短期影響嚴峻,但這些貿易限制也為國內生產帶來了新的機遇,減少了對外國採購的依賴,並提高了長期供應穩定性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 46億美元 |

| 預測值 | 73億美元 |

| 複合年成長率 | 4.9% |

至2034年,中壓市場將以4.5%的複合年成長率成長。這些系統對於石油天然氣、採礦和水處理等行業的大功率運作至關重要,在這些行業中,精確管理大型馬達對於設備安全和運行效率至關重要。中壓啟動器有助於減少馬達啟動過程中的機械應力,這對於在惡劣條件下處理重型工業負載的設施至關重要。基礎設施升級以及公用事業和重工業不斷成長的能源需求進一步推動了對這些系統的需求。

預計到2034年,三相自動電動馬達啟動器市場規模將達到35億美元,這得益於商用暖通空調系統、智慧灌溉系統和大型建築基礎設施中三相自動電動馬達起動器安裝量的增加。這些起動器具有Modbus和BACnet等智慧通訊功能,可實現即時系統監控、預測性診斷以及與建築自動化系統的無縫整合。這符合日益成長的智慧工業環境趨勢,優先考慮能源效率、系統最佳化和遠端控制功能。

2024年,美國自動馬達起動器市場規模達4.826億美元,這得歸功於工業自動化領域採用先進的微處理器控制系統。此外,由於向數位化工業生態系統的加速轉型以及對再生能源的日益依賴,美國市場也呈現強勁發展勢頭。這些因素為拓展互聯、低排放、節能環保的馬達控制解決方案創造了有利條件。

推動全球自動馬達啟動器行業創新和市場競爭的主要參與者包括伊頓、ABB、丹佛斯、通用電氣、施耐德電氣、羅克韋爾自動化、三菱電機、霍尼韋爾國際、西門子、WEG、艾默生電氣、富士電機 FA 組件與系統、L&T 電氣與自動化、Kalp Controls、正泰組、C&S India、LECTSTOSTO Controls、正泰金融集團、CTOS STOSTO STOSTO Controls、正泰航空集團公司和電氣公司。為了增強競爭優勢,自動馬達起動器市場的領先公司專注於開發符合不斷發展的行業標準的數位整合和節能解決方案。其策略包括投資研發具有即時故障檢測和遠端監控功能的智慧起動器。這些品牌透過創新和合作擴展其產品組合,以滿足多個行業的需求。透過生產本地化來繞過貿易壁壘並縮短交貨時間也成為一個重點。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:按電壓,2021 - 2034

- 主要趨勢

- 低的

- 中等的

- 高的

第6章:市場規模及預測:依階段,2021 - 2034

- 主要趨勢

- 單相

- 三相

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 荷蘭

- 奧地利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 馬來西亞

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 科威特

- 阿曼

- 拉丁美洲

- 巴西

- 秘魯

- 阿根廷

第9章:公司簡介

- ABB

- C&S Electric

- CHINT Group

- Danfoss

- Eaton

- Emerson Electric

- Fuji Electric FA Components & Systems

- General Electric

- Havells India

- Honeywell International

- Kalp Controls

- L&T Electrical & Automation

- LOVATO ELECTRIC

- Mitsubishi Electric

- Rockwell Automation

- Schneider Electric

- Siemens

- SKN-BENTEX GROUP

- WEG

The Global Automatic Motor Starter Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 7.3 billion by 2034. The growth is fueled by the surge in industrial automation and the rising demand for energy-efficient operations. Automatic motor starters help control electric motors, enabling streamlined start-stop functions and offering protection from overloads, phase faults, and short circuits. By controlling power delivery, these devices ensure efficient motor operation, smoother startups, and safeguard against potential electrical hazards.

The expanding use of electric motors across industries such as chemicals, oil and gas, manufacturing, and water treatment is strengthening the market. As these sectors pursue sustainable practices and digital transformation, automatic motor starters are integrated with energy management systems to cut energy usage and prevent surges during startup. In addition, the advancement of industrial IoT and smart factory frameworks support the demand for these solutions. During the Trump administration, tariffs on industrial electrical parts, especially those imported from China increased production costs and supply chain disruption. Although the short-term impact was challenging, these trade restrictions also opened new opportunities for domestic production, reducing dependence on foreign sourcing and improving long-term supply stability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 4.9% |

The medium voltage segment will grow at a CAGR of 4.5% by 2034. These systems are vital for high-power operations in sectors like oil and gas, mining, and water treatment, where managing large motors with precision is critical for equipment safety and operational efficiency. Medium voltage starters help reduce mechanical stress during motor startup, making them essential for facilities handling heavy-duty industrial loads under harsh conditions. The demand for these systems is further driven by infrastructure upgrades and rising energy needs across utilities and heavy industries.

The three-phase automatic motor starter segment is expected to reach USD 3.5 billion by 2034 fueled by increased installations in commercial HVAC, smart irrigation systems, and large-scale building infrastructure. These starters with intelligent communication features like Modbus and BACnet, enabling real-time system monitoring, predictive diagnostics, and seamless integration with building automation systems. This aligns with the growing trend toward smarter industrial environments prioritizing energy efficiency, system optimization, and remote-control capabilities.

United States Automatic Motor Starter Market was valued at USD 482.6 million in 2024, bolstered by the adoption of advanced microprocessor-based control systems in industrial automation. The U.S. market is also experiencing strong momentum due to an accelerated transition to digital industrial ecosystems and an increasing reliance on renewable energy. These factors create a favorable climate for expanding connected, low-emission, and energy-conscious motor control solutions.

Key players driving innovation and market competition in the Global Automatic Motor Starter Industry include Eaton, ABB, Danfoss, General Electric, Schneider Electric, Rockwell Automation, Mitsubishi Electric, Honeywell International, Siemens, WEG, Emerson Electric, Fuji Electric FA Components & Systems, L&T Electrical & Automation, Kalp Controls, CHINT Group, C&S Electric, Havells India, SKN-BENTEX GROUP, and LOVATO ELECTRIC. To strengthen their competitive edge, leading companies in the automatic motor starter market focus on developing digitally integrated and energy-efficient solutions that align with evolving industrial standards. Strategies include investing in R&D for smarter starters with real-time fault detection and remote monitoring. These brands expand their product portfolios through innovation and partnerships to meet demand across multiple industries. Localization of production to bypass trade barriers and improve lead times has also become a key focus.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Low

- 5.3 Medium

- 5.4 High

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Russia

- 8.3.4 UK

- 8.3.5 Italy

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.3.8 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 New Zealand

- 8.4.7 Malaysia

- 8.4.8 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Egypt

- 8.5.5 South Africa

- 8.5.6 Nigeria

- 8.5.7 Kuwait

- 8.5.8 Oman

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 C&S Electric

- 9.3 CHINT Group

- 9.4 Danfoss

- 9.5 Eaton

- 9.6 Emerson Electric

- 9.7 Fuji Electric FA Components & Systems

- 9.8 General Electric

- 9.9 Havells India

- 9.10 Honeywell International

- 9.11 Kalp Controls

- 9.12 L&T Electrical & Automation

- 9.13 LOVATO ELECTRIC

- 9.14 Mitsubishi Electric

- 9.15 Rockwell Automation

- 9.16 Schneider Electric

- 9.17 Siemens

- 9.18 SKN-BENTEX GROUP

- 9.19 WEG