|

市場調查報告書

商品編碼

1755376

固定太陽能光電支架系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fixed Solar PV Mounting Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

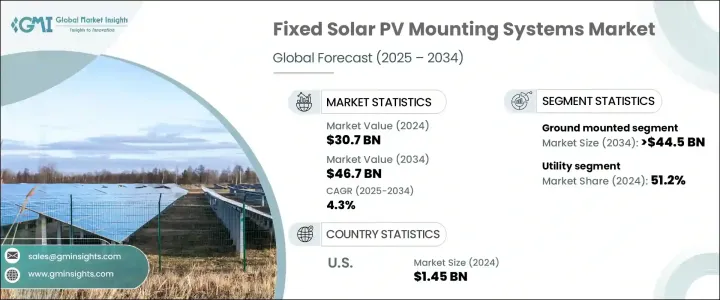

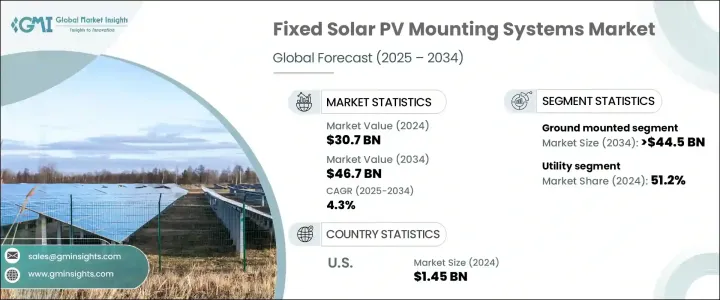

2024 年全球固定太陽能光電支架系統市值為 307 億美元,預計到 2034 年將以 4.3% 的複合年成長率成長,達到 467 億美元,這得益於太陽能板和相關組件成本的下降以及全球向再生能源的轉變。隨著發展中國家在國家政策、激勵措施和上網電價 (FiT) 的支持下擴大採用太陽能光電模組,對支架系統的需求也將上升。對太陽能裝置更高能量產量的需求進一步刺激了對這些系統的需求。太陽能追蹤器因其能夠增加能量產生量並且與更複雜的追蹤系統相比成本相對較低而廣受歡迎。此外,由於其設計更簡單且沒有活動部件,它們對市場擴張做出了重大貢獻。

儘管面臨關稅等挑戰,導致太陽能組件成本上漲,但整體市場前景仍樂觀。儘管關稅上調導致公用事業規模專案成本上升,使太陽能系統成本上漲約30%,但地面太陽能專案中支架系統的採用率仍在持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 307億美元 |

| 預測值 | 467億美元 |

| 複合年成長率 | 4.3% |

預計到2034年,地面安裝太陽能系統市場規模將達到445億美元,這得益於再生能源需求的不斷成長以及大規模太陽能裝置的需求。地面安裝系統具有許多優勢,包括易於安裝和成本效益高,尤其是在土地面積廣闊且價格低廉的地區。這些系統的經濟性和可擴展性使其對公用事業規模的太陽能專案尤其具有吸引力,因為在這些專案中,最大限度地提高能源輸出並最大限度地降低安裝成本至關重要。安裝系統設計、材料和安裝技術的進步顯著降低了這些系統的整體成本,進一步增強了其財務可行性。

2024年,公用事業領域佔比將達到51.2%,反映出人們越來越依賴大型太陽能發電專案來實現再生能源目標並提高能源產量。地面安裝太陽能系統比追蹤系統更簡單、更經濟,在公用事業規模的專案中廣受青睞。不斷變化的金融和政策環境,包括政府激勵措施和支持性法規,持續增強了地面安裝解決方案在太陽能發電領域的吸引力。

受有利的政治法規、財政激勵措施和快速的技術進步推動,美國固定太陽能光電支架系統產業在2024年的價值達到14.5億美元。這些因素正在加速太陽能光電系統的普及,尤其是在公用事業規模項目中。隨著再生能源生產需求的持續成長,預計高效能太陽能支架系統的部署將會增加,從而推動該地區向更永續、更清潔的能源轉型。

全球固定太陽能光電支架系統產業包括 Aerocompact、Arctech、Clenergy、Convert Italia SPA、Esdec、K2 Systems GmbH、Mounting Systems、Schletter Group、UNIRAC、杭州帷盛太陽能有限公司、廈門格瑞斯太陽能新能源科技有限公司等主要參與者。固定太陽能光電支架系統產業的公司實施了多項策略性措施。他們優先考慮設計和技術創新,以滿足日益成長的節能解決方案需求。許多公司正在投資研發,以提高產品性能,包括耐用性和易於安裝性。此外,主要參與者正在擴大其產品組合,以滿足住宅和商業領域的需求,確保他們提供一系列滿足不同客戶需求的系統。與太陽能電池組件製造商和建築公司的策略合作夥伴關係也在不斷增加,使公司能夠簡化營運並擴大市場範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 策略舉措

- 公司標竿分析

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- 地面安裝

- 屋頂

第6章:市場規模及預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業和工業

- 公用事業

第7章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 奧地利

- 挪威

- 丹麥

- 芬蘭

- 法國

- 德國

- 義大利

- 瑞士

- 西班牙

- 瑞典

- 英國

- 亞太地區

- 中國

- 澳洲

- 韓國

- 日本

- 印度

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 約旦

- 阿曼

- 非洲

- 南非

- 以色列

- 摩洛哥

- 拉丁美洲

- 巴西

- 智利

- 阿根廷

第8章:公司簡介

- Aerocompact

- Arctech

- Clenergy

- Convert Italia SPA

- Esdec

- K2 Systems GmbH

- Mounting Systems

- Schletter Group

- UNIRAC

- Versolsolar Hangzhou Co., Ltd.

- Xiamen Grace Solar New Energy Technology Co., Ltd.

The Global Fixed Solar PV Mounting Systems Market was valued at USD 30.7 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 46.7 billion by 2034, driven by the decreasing costs of solar panels and related components, along with the global shift toward renewable energy sources. As developing nations increase their adoption of solar PV modules, supported by state-level policies, incentives, and feed-in tariffs (FiTs), the demand for mounting systems is also set to rise. The need for higher energy yields from solar installations further boosts the demand for these systems. Solar trackers have gained popularity due to their ability to increase energy generation and their relatively lower cost compared to more complex tracking systems. Additionally, with their simpler design and lack of moving parts, they have contributed significantly to the market's expansion.

Despite challenges such as tariffs that have increased the cost of solar modules, the overall market outlook remains positive. While tariff increases have led to higher costs for utility-scale projects, driving up the expense of solar systems by roughly 30%, the adoption of mounting systems in ground-mounted solar projects continues to grow.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.7 Billion |

| Forecast Value | $46.7 Billion |

| CAGR | 4.3% |

The ground-mounted solar systems segment is anticipated to reach USD 44.5 billion by 2034, driven by increasing demand for renewable energy and the need for large-scale solar installations. Ground-mounted systems offer several advantages, including ease of installation and cost-effectiveness, especially in regions with large, inexpensive land areas. The affordability and scalability of these systems make them particularly attractive for utility-scale solar projects, where maximizing energy output while minimizing installation costs is critical. Technological advancements in mounting system design, materials, and installation techniques have significantly lowered the overall cost of these systems, further boosting their financial viability.

The utility segment accounted for 51.2% in 2024, reflecting the growing reliance on large-scale solar power projects to meet renewable energy targets and increase energy production. Ground-mounted solar systems, simpler and more affordable to deploy than tracking systems, are widely favored for utility-scale installations. The evolving financial and policy landscape, including government incentives and supportive regulations, continues to enhance the attractiveness of ground-mounted solutions in solar energy generation.

United States Fixed Solar PV Mounting Systems Industry was valued at USD 1.45 billion in 2024 driven by favorable political regulations, financial incentives, and rapid technological advancements. These factors are accelerating the adoption of solar PV systems, particularly for utility-scale projects. As the demand for renewable energy production continues to rise, deploying efficient solar mounting systems is expected to grow, contributing to the region's shift toward more sustainable and cleaner energy sources.

The Global Fixed Solar PV Mounting Systems Industry includes key players such as Aerocompact, Arctech, Clenergy, Convert Italia SPA, Esdec, K2 Systems GmbH, Mounting Systems, Schletter Group, UNIRAC, Versolsolar Hangzhou Co., Ltd., Xiamen Grace Solar New Energy Technology Co., Ltd. Companies in the fixed solar PV mounting systems industry implement several strategic initiatives. They prioritize innovation in design and technology to meet the growing demand for energy-efficient solutions. Many are investing in R&D to enhance product performance, including durability and ease of installation. Additionally, key players are expanding their product portfolios to cater to residential and commercial segments, ensuring they offer a range of systems that meet diverse customer needs. Strategic partnerships with solar module manufacturers and construction firms are also rising, enabling companies to streamline operations and expand market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic initiatives

- 4.4 Company benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Ground mounted

- 5.3 Rooftop

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial & Industrial

- 6.4 Utility

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Austria

- 7.3.2 Norway

- 7.3.3 Denmark

- 7.3.4 Finland

- 7.3.5 France

- 7.3.6 Germany

- 7.3.7 Italy

- 7.3.8 Switzerland

- 7.3.9 Spain

- 7.3.10 Sweden

- 7.3.11 UK

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 South Korea

- 7.4.4 Japan

- 7.4.5 India

- 7.5 Middle East

- 7.5.1 Israel

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.5.4 Jordan

- 7.5.5 Oman

- 7.6 Africa

- 7.6.1 South Africa

- 7.6.2 Israel

- 7.6.3 Morocco

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Chile

- 7.7.3 Argentina

Chapter 8 Company Profiles

- 8.1 Aerocompact

- 8.2 Arctech

- 8.3 Clenergy

- 8.4 Convert Italia SPA

- 8.5 Esdec

- 8.6 K2 Systems GmbH

- 8.7 Mounting Systems

- 8.8 Schletter Group

- 8.9 UNIRAC

- 8.10 Versolsolar Hangzhou Co., Ltd.

- 8.11 Xiamen Grace Solar New Energy Technology Co., Ltd.